The End of Crypto's 4-Year Cycles?

Thoughts on crypto's historic market trend

TLDR:

The 4-year cycles are a trend that have repeated in crypto markets from the beginning, where we get 3 years of upward price action followed by 1 year down.

This cycle has shared similarities with past ones in that its got new focal points like memecoins and DATs, and after 3 years rising up BTC has began to drop.

Yet, there’s also been a lot of differences like a lack of Alt Seasons, institutions getting involved, less retail interest, and direct support from the US government.

Given the new setup where institutions dominate, we could see cycles begin to follow the macro scenario more closely and break away from the 4-year cycle.

Right now its impossible to know what’ll happen, but the next few months will be crucial to see if this historic 4-year cycle trend continues or not.

Happy New Year all!

For 2026’s first post I wanted to discuss crypto’s historic 4-year cycles. It’s still too early to know whether the 4-year cycles will continue to play out or not but there’s plenty to suggest that they may be coming to an end.

So this week I decided to reflect on one of the key trends that has defined crypto markets since their inception and how this trend may play out in the future.

If this post resonates with you and you enjoy the content then please share it with a friend and get rewarded for doing so!

This blog goes out weekly to some 20,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

The 4-Year Cycle

I’ve been writing 1 post per week for 3 years now with 150+ weeks of content on my blog, and one of my very first posts back in early 2023 was on this well documented theory of crypto’s 4-year cycles.

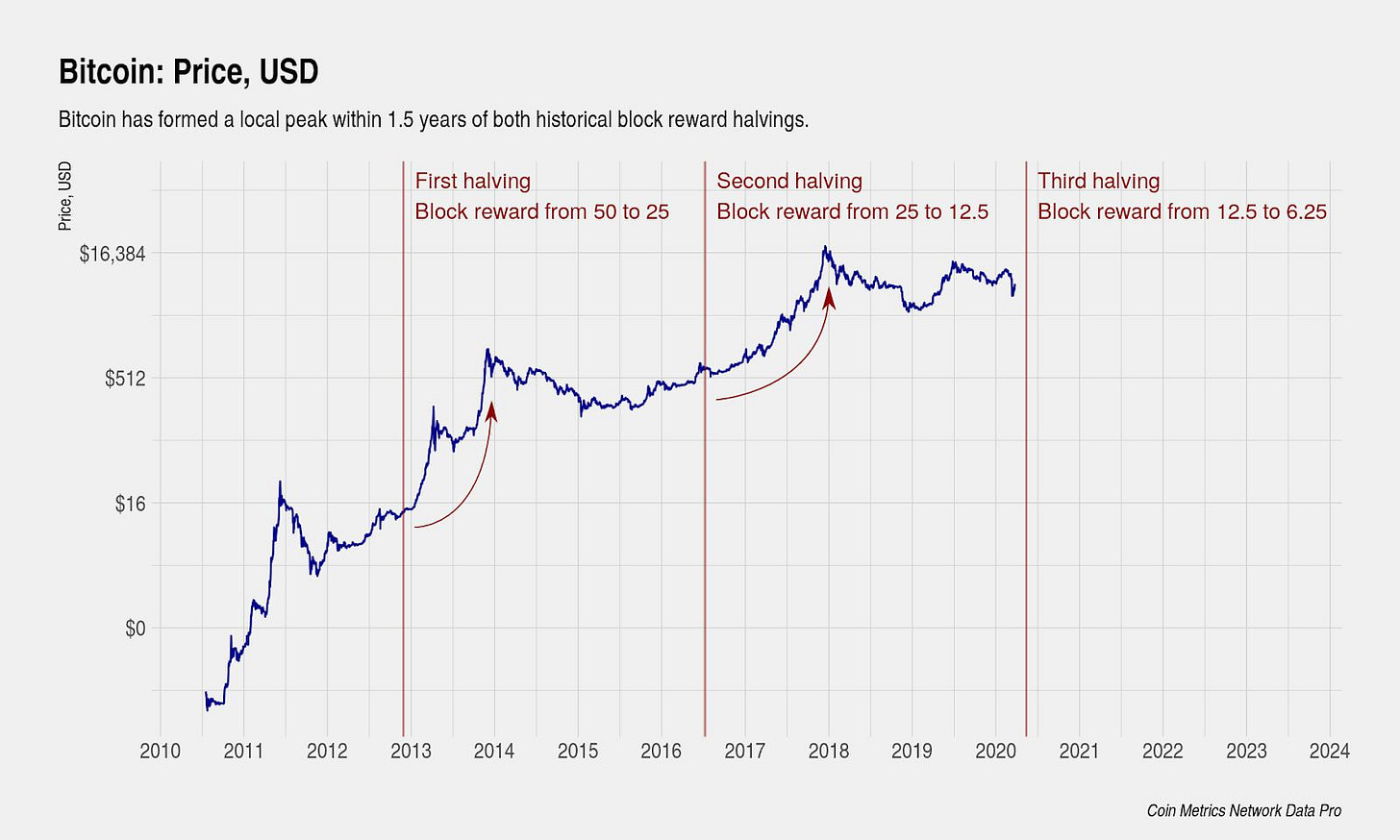

Essentially the theory is that crypto markets follow a 4-year cyclical pattern with 3 years of up-trend followed by 1 year of down-trend, with these 4-year patterns having been observed all the way since people began trading BTC back in 2010.

This trend is strongly suspected to be correlated with Bitcoin’s halvings. This is because every 4 years Bitcoin’s newly mined supply halves, causing demand to outstrip supply and driving growth in BTC’s price, which then attracts more demand pushing price up further and creating an upward spiral.

Eventually this demand and supply reach a new equilibrium and we see a lull in excitement where demand begins to drop and price drops too, all before a new halving occurs and the cycle repeats itself again.

Since Bitcoin is the centre of gravity in crypto and all of the largest cryptos are paired against it, this push-pull in BTC’s price then affects the price of the rest of the coins and so we’ve historically seen the entire crypto market roughly follow this 4-year cycle.

In particular we often get what’s known as “Altcoin Season” (or Alt Season) part way through these cycles where coins other than BTC grow faster than BTC as the money trickles down into the rest of the market generating outsized returns for these smaller coins.

This pattern has repeated like clockwork for some 16 years, but it may now be breaking down - it’s too early to be certain either way but it’s still worth discussing.

Every cycle is different

There’s a famous saying that goes “history doesn’t repeat itself, but it often rhymes” and in crypto this very much holds true. Each crypto cycle has been unique in its own way with the focal point for each cycle shifting to different areas each time, yet each cycle also had some key similarities.

In 13-14 we had many Bitcoin forks take off, 17-18 we saw the ICO boom, and in 21-22 NFTs blew up. While each focal point was different, in every cycle we saw the regular beat of Bitcoin creeping up, pulling Altcoins up with Alt Seasons, and finally after a period of euphoria Bitcoin began to drop bringing the market down with it.

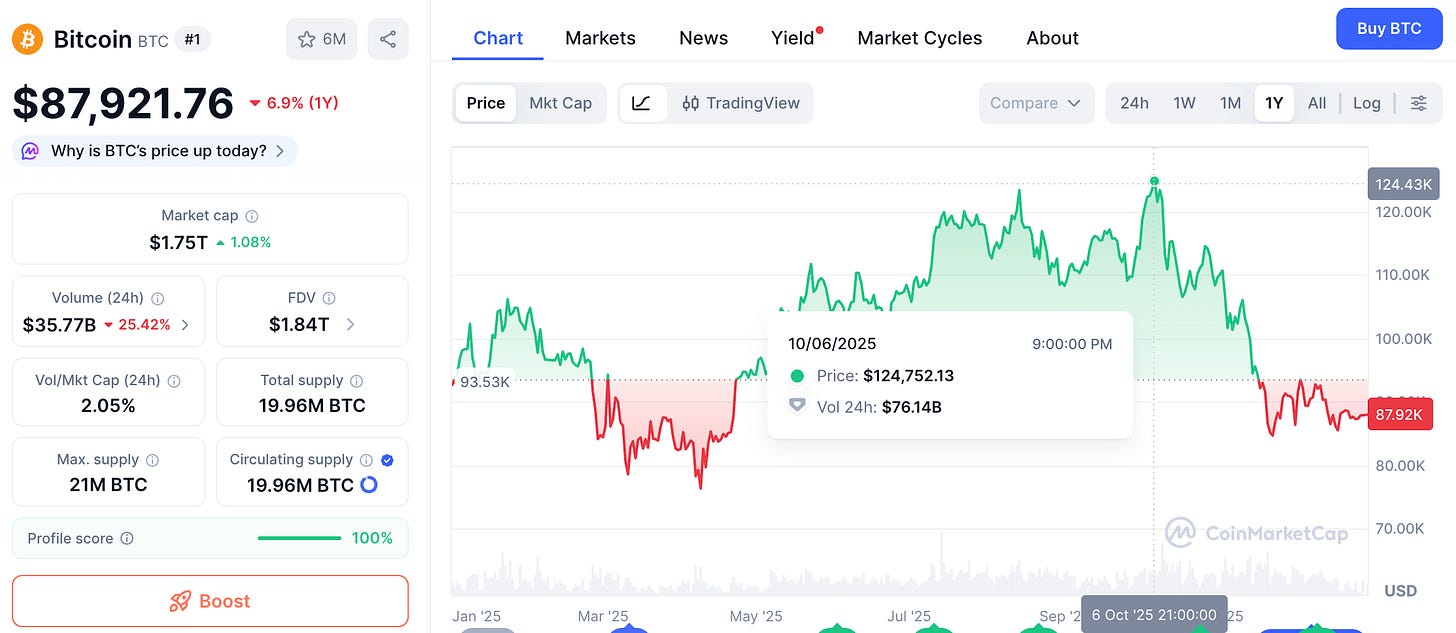

This most recent cycle from 2022 up to now has also seen similar continual growth in Bitcoin with a recent peak in Oct ‘25 and a drop since. We could easily point to memecoins and DATs like Microstrategy as the focal points for this cycle, with both memecoins and DATs peaking in interest and rising to crazy high valuations.

However, many of the similarities end there, since we never really got a proper Alt Season with very few major coins tracking the market up, in particular coins like ETH got completely left in the dirt as it barely broke through the ATH it set in the last cycle.

In the past BTC gains would flow down to Altcoins and the rising tide would lift all boats. Yet, in today’s crypto market there are just too many coins out there for them to rise together, and all the attention and money that would have flown into Alts has appeared to go into the memecoin and perpetuals casino instead.

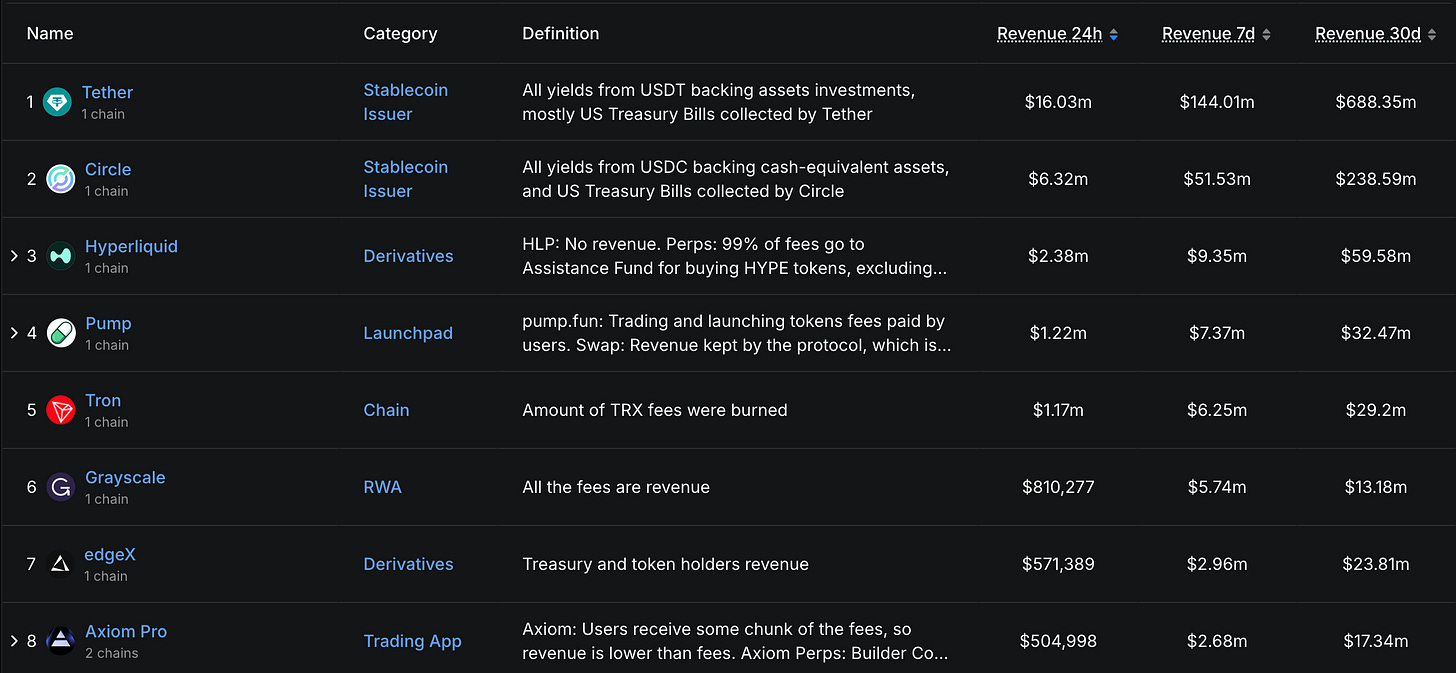

This is clear from the incredible revenues that projects like Hyperliquid and Pump.fun have been posting, a quick look at DeFiLlama will show you revenues of around $60m and $30m respectively in the past 30 days, and we’ve seen this high revenue pattern now for much of this cycle.

Crypto markets are certainly shifting, and one of the key reasons for this is the recent growth in institutional participation in the space.

The Institutions have arrived

Since pretty much the creation of crypto markets people have said that one day the traditional institutions would come in to “buy up their bags”, and it seems like after many years of waiting TradFi has finally arrived during this cycle, but perhaps not as everyone had hoped it would happen.

The creation of the Bitcoin ETF back at the start of last year was probably the key moment for this trend to begin, as institutions were finally given a fully regulated vehicle to trade Bitcoin.

However, a major shift really happened when the new Trump-led US administration took over in early 2025 and the SEC went from being incredibly hostile to crypto, to incredibly pro-crypto.

We went from an administration that seemed hell-bent on criminalising and destroying crypto, to one where the sitting US president has several crypto projects associated with him and his family, including his own memecoin!

With this shift in leadership everything rapidly changed in crypto as many major companies and projects like Coinbase and Aave who had pending SEC disputes had their cases dropped. Plus numerous traditional companies began to form their own DAT strategy, copying Microstrategy, and the DAT space became a free for all.

And most interestingly perhaps big banks like Blackrock and JP Morgan have began to push their own crypto-related projects worlwide as they sell their own ETFs and have even started to tokenise their own funds on the Ethereum blockchain.

There’s been growing consensus that Bitcoin could indeed represent “digital gold” and we’ve seen people like Larry Fink from Blackrock try to push this narrative into the market.

Microstrategy in particular has led this push for mainstream adoption of Bitcoin from the front. Although their stock MSTR has dropped recently, they reached 1000% growth in stock price, and went from having 0 BTC to owning over 3% of the entire BTC supply in just a few years!

There has also been huge growth in Coinbase and Robinhood stocks as they’ve become some of the largest US companies driving crypto adoption, and are juggernauts in their own right. Not to mention crypto mining companies like Core Scientific and Hut8 that have also shot up in valuation.

But that’s not what crypto token holders wanted to see!

Crypto owners wanted institutions to buy up their Altcoin bags, not these publicly traded stocks that they don’t own!

Therefore the entry of institutions into crypto has been lackluster for retail adoption with the value being mainly captured by those in TradFi.

Where’s retail?

Previous cycles were largely driven by retail investors and crypto funds without such stringent regulations as TradFi.

But where’s retail now that the institutions are finally here?

Judging by mentions of Bitcoin and Crypto on Google it would seem that retail never even arrived this cycle. We can see that mentions of these keyword haven’t hit new ATHs, with their peaks still being in the previous 2 cycle peaks of 17-18 and 21-22.

Although crypto is now more mainstream than ever it doesn’t seem to have the same retail appeal as before. Perhaps retail has been burned too many times from crypto in the past and don’t want to take part again, or perhaps their attention has shifted to other opportunities in the market like AI.

Either way it would appear that the space is acheiving a new level of maturity where we’re going beyond retail-led speculative mania and and shifting towards more serious valuable projects taking centre stage.

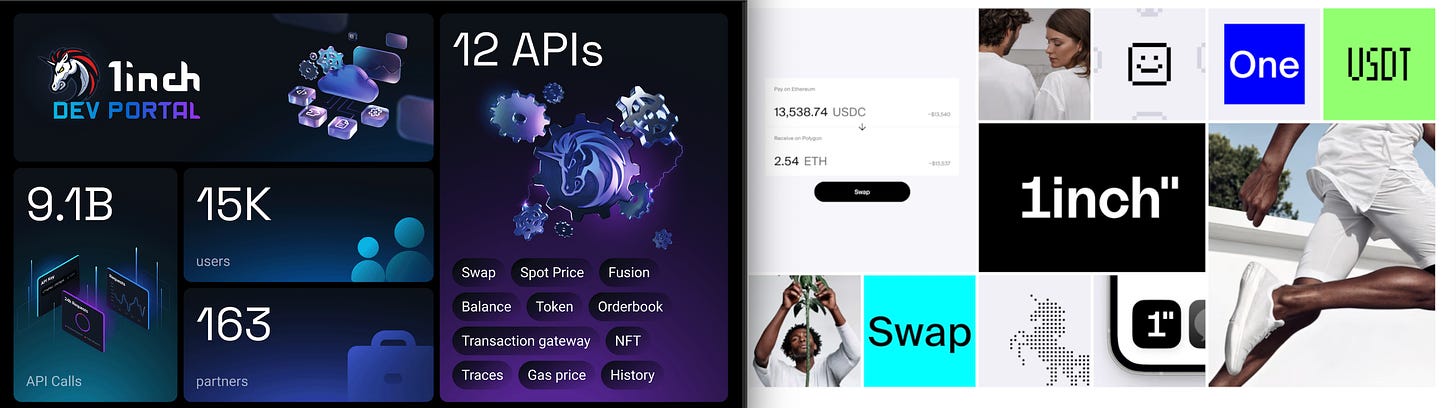

This is very visible in how many brands of mainstay projects in the space that used to be goofy and fun are now becoming a lot more serious. As a simple example, look at how 1inch.com used to look before versus what they look like now.

The original brand was more colourful and playful with a metal unicorn as their logo, while the new brand is a lot more accessible and looks a lot more like a typical FinTech app.

Plus with the White House now actively drafting up laws to make it easier for companies to provide crypto solutions to retail there are massive tailwinds for crypto.

And we’re already seeing crypto going mainstream through stablecoin adoption. PayPal have PYUSD, Stripe are releasing their own stablecoin powered blockchain, and there are numerous mainstream players looking into stablecoins as they’ve all seen Circle and Tether’s success and want a piece of the action too.

So with crypto now reaching this next level of maturity will the 4-year cycles continue?

Have the cycles broken down?

Bitcoin and the overall crypto market peaked in around October ‘25 with Bitcoin hitting around $125k. Since then Bitcoin has dropped down to around $88k and the market has come down with it.

This price drop has tracked the 4-year trend surprisingly well and it’s therefore very possible that crypto continues on a down trend for the coming year and we only come out of this stagnation some time late next year. In which case the 4-year cycle will still hold.

However, its also possible that crypto is in a whole new phase now where we won’t see the 4-year cycles play out like before.

For starters, institutions are now a significant player and they tend to follow macro business cycles rather than Bitcoin’s quirky 4-year halving cycles. Traditional markets are very bullish right now with the S&P500 hitting constant new ATHs, and precious metals like Gold and Silver having had a massive year in 2025.

We also have a whole new class of insitution with DATs like Microstrategy and Bitmine buying the dips aggressively on BTC and ETH respectively, these guys certanly don’t care about cycle theory they just want to keep growing shareholder value.

Plus as we saw above its also clear that the Alt Seasons of the past may be over thanks to hundreds of new memecoins being created daily.

And as we’ve already noted, crypto adoption is accelerating thanks to a more friendly US administration, and so its very possible that we’ll experience continued growth in the space in 2026.

As far as I can see there’s in fact no clear reason for next year to be a down-year, I’d actually hazard a guess that we see BTC hit new ATH’s in the year ahead.

The truth is of course that the future is impossible to know, and the next few months will really define what happens. If the 4-year cycle structure continues then we can expect to see price trend down in the coming months, but if we crab sideways or even rise back up then it may be time to re-think the 4-year cycle model.

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!