Bitcoin ETFs

What are they? Why are they important? And how will they change things?

TLDR:

Spot Bitcoin ETFs create a way to trade Bitcoin on a stock exchange without having to custody and hold the BTC asset itself.

Big financial institutions can now get involved, and they have the largest capacity to push the price up and even rewrite the narrative around BTC more positively.

But there are risks, as these institutions can also try to co-opt and control key players in the space like miners and exchanges.

Either way this was an inevitable step in Bitcoin’s evolution. It’s highly likely a lot of capital will slowly flow in making for a bullish next 12-18 months.

This week all eyes were on the SEC’s approval of Spot Bitcoin ETFs in the USA, which went through yesterday Wednesday 10th January '24!

These ETF approvals will likely be a large catalyst for Bitcoin adoption and is a huge moment for Bitcoin and the cryptocurrency industry as a whole.

So this week I’ve written a little about my perspective on the topic.

Bitcoin ETF

ETF stands for “exchange traded fund” and is a very generic financial instrument that can track any regulated asset and be traded on a stock exchange. There are ETFs for almost anything you can imagine, from commodities like oil and gold, to stock market indexes like the S&P 500 and FTSE 100.

This means a Bitcoin ETF is simply a tradable fund on a stock exchange that investors can buy to track the price of Bitcoin without having to own the underlying BTC asset.

A Bitcoin ETF has been on the cards since 2013 when the Winklevoss twins proposed an ETF that would be traded on the Nasdaq stock exchange. Many other ETF proposals have followed for the past decade and been continually rejected by the US’s Securities and Exchange Comission (SEC) due to regulatory concerns.

Grayscale launched their Grayscale Bitcoin Trust (GBTC) in 2013 and it was the closest thing to a US Bitcoin ETF until the SEC accepted Bitcoin Futures in 2021.

Yet neither are the same as a spot Bitcoin ETF. A Trust does not allow for easy redemption of the underlying asset, so it’s price can deviate a lot from Bitcoin’s market price. Meanwhile, Futures are based on tradable contracts related to the price of BTC, so they are even further removed from the asset itself.

But that all changes now with the SEC’s approval of spot Bitcoin ETFs!

Why is a Bitcoin ETF important?

Bitcoin is the original cryptocurrency and commands the highest market-cap valuation. I have an analogy that Bitcoin is like the “sun” in the world of crypto and Web3 as the whole industry rotates around it and is affected by its gravitational pull. As attention and price of Bitcoin rises or falls, so does the rest of the market.

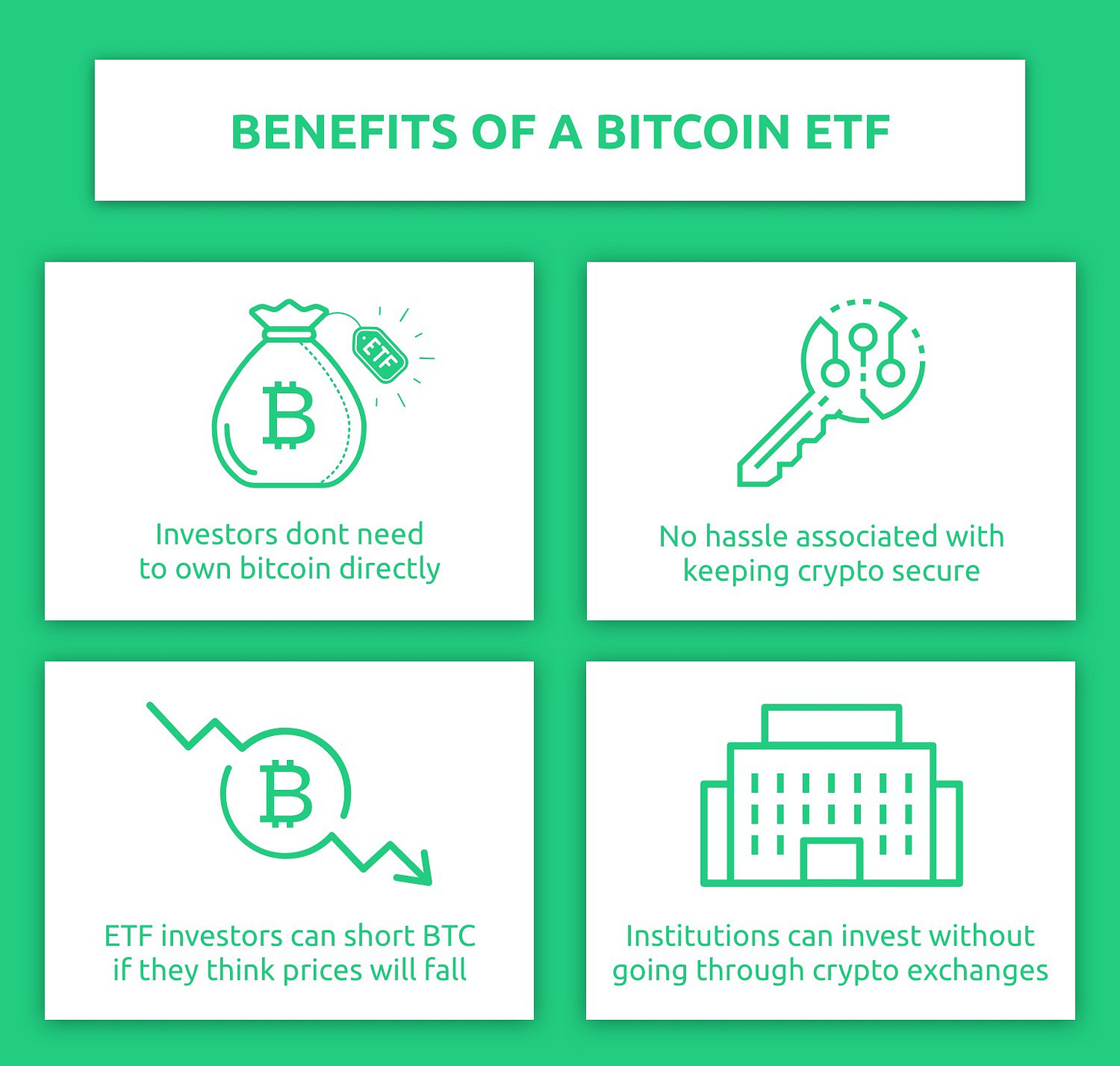

Yet, Bitcoin is very easy to buy and hold, as you can create a wallet in seconds for free and buy some BTC on an exchange. So what’s the real need for a Bitcoin ETF then?

While the average joe can hold $100 worth of Bitcoin on his phone, if he loses it then it’s no big deal. But, that’s not the case for big institutions like banks or funds.

For these institutions custodying large volumes of BTC can be a real challenge, as if you hold millions or even billions of dollars worth of Bitcoin and are hacked or make a single mistake with your private key, you can lose access to all of that money!

Bitcoin ETF’s take away the custody risk and allow large institutions to still buy into the Bitcoin price apprecation. And the more people buy the ETF, the more the ETF’s owners need to buy and hold the underlying BTC asset.

Pros

It has been a meme in crypto from the start that one day “institutions will buy our bags”, ie. they will buy the assets we’ve been buying and holding for years.

Well that day can finally come now with a Bitcoin ETF as big financial institutions are the ones with the real financial muscle to make a significant difference and set off an upward price spiral. The growth in BTC demand pushes price up, and the rising price creates more interest and demand!

We can already see that the ETFs are competing with each other on fees as they fight for market share - shown in the image below. Interestingly the fees are generally really low, with BlackRock at only 0.2%, so you can deduce that they must expect a really large volume of demand and competition for that low fee to be worth it!

Not only will big institutions compete with each other on fees though, you can be certain that they’ll spend millions of USD competing through marketing too! Expect to see a lot more Bitcoin adverts this coming year.

Importantly, in the past Bitcoin has been painted as the currency used by drug dealers and thieves for illicit activities on the dark web. Well that narrative will have to change to convince big institutions to buy these ETFs. So these marketing campaigns will likely shift the entire narrative and storytelling around Bitcoin too.

An example of this can already be seen in a recent article in the Financial Times, who’ve always painted Bitcoin as “dark money”, but now seem to be changing their stance and even suggesting Bitcoin could be ESG friendly!

Furtheremore, ETFs will allow even nation states with their sovereign wealth funds to get hold of Bitcoin! These are some of the biggest capital allocators in the world and even a small % allocation of their capital can have huge shockwaves.

As an example, if the UAE with its 3rd largest sovereign wealth fund in the world put in just 1% of their almost $2tn fund into Bitcoin, that would be around $20bn entering into Bitcoin!

Moreover, it’s important to remember that price changes are not one-to-one, so for every $1 that goes into BTC you don’t just get a $1 price increase. There’s in fact a multiplying affect related to the amount of liquidity and available sellers. So this level of money entering the BTC market would have an outsized impact on BTC’s price.

Cons

Now, while a Bitcoin ETF is certainly exciting for price action, everything has two-sides and large institutional participation in the ecoystem is no different.

Bitcoin has always been about building an alternative to the traditional financial system, so it’s not surprising that most big players have steered clear. For these institutions to be coming in and joining the party they must believe that they now have the ability to somewhat sway and influence the direction of the ecosystem.

Centralisation is what Bitcoiners have often fought against, and it’s exactly what will happen with the ETF as more money get’s pooled into these ETFs and in turn these large financial institutions buy up the underlying asset and hold it themselves.

Now while centralising a huge amount of the BTC asset doesn’t necessarily lead to a centralisation of the network, we’ve already seen big fund managers like BlackRock and Fidelity buy controlling stakes in Bitcoin miners, and that’s where things get a bit more dangerous.

Miners play a crucial role in Bitcoin as they can accept or reject transactions, as well as accept or reject updates to the Bitcoin protocol. When a Bitcoin miner has a large financial institution regulated by the US government as one of it’s main share holders, it’s hard to imagine that they won’t try to steer Bitcoin’s direction.

The same level of influence and pressure will likely be placed on other players in the space like exchanges, hardware manufacturers and even the core developers.

In many ways a Bitcoin ETF is the biggest threat Bitcoin has ever had. However, it was an inevitable challenge Bitcoin would some day have to face as it matured, and now 15+ years since its creation that day has come.

Wen Moon?

While the Bitcoin ETF may be a risk for the core ethos and values that it promotes, it’s still incredibly bullish for the price.

So are we going to see a massive price increase now on approval?

Well at the start it’s anybody’s bet as it takes time for the money to flow in from institutions because by their very nature of safeguarding a lot of capital, they are slow to move and it takes time for them to allocate their assets.

So in the short-run it will be mostly narrative driven with people either buying or shorting the news in the daily PvP trading environment.

However, in the middle to long-run we’ll certainly see institutions moving more money into Bitcoin through the ETF and driving the price up.

When you combine that with Bitcoin’s upcoming halving in April which will reduce the supply of BTC entering the market, we’re likely to be entering a very bullish 12-18 month period!