Digital Asset Treasury companies (DATs)

The unexpected rise of crypto treasury companies

TLDR:

Digital Asset Treasury companies (DATs) are one of the most surprising rise in this crypto cycle. They all follow Microstrategy’s strategy of stockpiling crypto.

DATs grow through issuing debt, which they then use to grow their crypto holdings, and people equate their share value to their growing crypto stockpiles.

DATs have formed for all sorts of cryptos, with BTC still being the number one, but many other cryptos like ETH, SOL, BNB, ADA, TRON, DOGE having them.

This has led to growth both in the price of the underlying cryptos and in the DATs themselves, with most companies getting massive share price increases.

However, the “dirty little secret” here is that shareholders have no real ownership in the crypto, so these valuations could one day unravel and collapse the market.

One of this crypto cycle’s biggest winners has come in a very unexpected form through traditional finance stocks! Right now it seems every week there’s a new company that decides to form a crypto treasury and experiences a big jump in its stock price.

So this week I decided to discuss this new phenomenon of “Digital Asset Treasury” companies (or DATs) and dissect it a little further.

These weekly posts are usually sent out on Thursdays, on some occasions on Friday, and on extremely rare occasions like today on Saturday. I had a lot on this week so it took a while to get this post done.

If this post resonates with you and you enjoyed the content then please share it with friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Digital Asset Treasury companies

Digital Asset Treasury companies, also known as DATs, or Crypto Treasury Companies, are a new class of company that has emerged in the traditional stock-market. They all copy Microstrategy’s (now called Strategy) successful model of continuously stockpiling more and more crypto to grow their stock price.

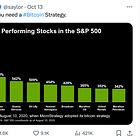

Michael Saylor created this model with Microstrategy over 4 years ago and has continuously repeated the playbook to become one of the fastest growing stocks over this period, that now holds over $70bn worth of Bitcoin, ie. 3% of all BTC! I’ve written in depth about Microstrategy’s model before, which you can check in my post below.

As a summary though, the Saylor playbook is as follows: (1) Saylor sells corporate debt as convertible loans; (2) He uses the money earned to buy BTC; (3) As his BTC holdings go up people view the company as more valuable and buy up the stock; (4) Then as the stock price goes up debt holders convert their loans into stock!

In the end Saylor’s left with more BTC, a higher stock price, and less debt proportional to the BTC!

It’s the ultimate form of leverage because he keeps accumulating more and more BTC, yet his debt obligations don’t follow at the same pace. And due to Saylor’s huge success in this strategy many other companies have more recently decided they want to replicate it too.

At the start there were just a few companies copying Microstrategy, like Metaplanet, however with the Trump administration coming in and the US doing a full U-turn and becoming very pro-crypto, we’ve seen an onslaught of DATs forming.

In previous crypto cycles Wall Street and TradFi stayed mostly out of crypto, but it seems now they can’t get enough as these companies are raising billions of dollars to form crypto treasuries, and these sorts of billions are only possible with their big money.

Bitcoin

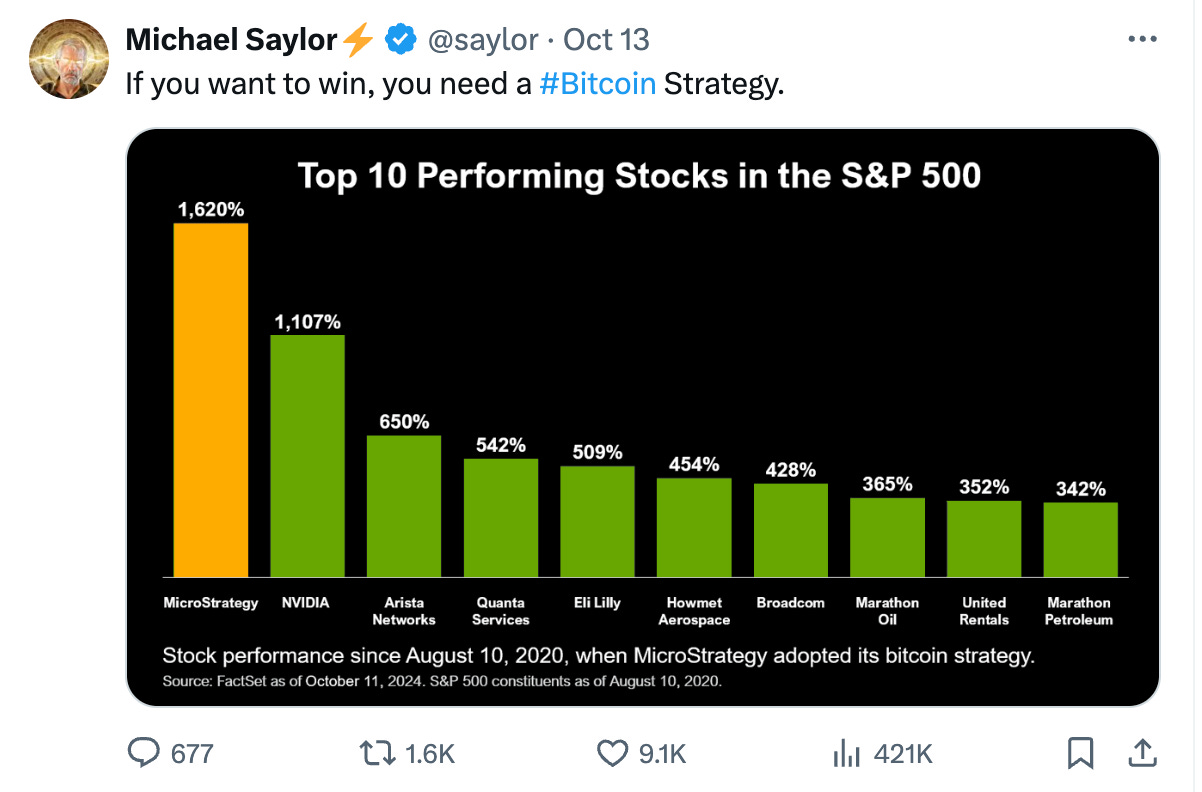

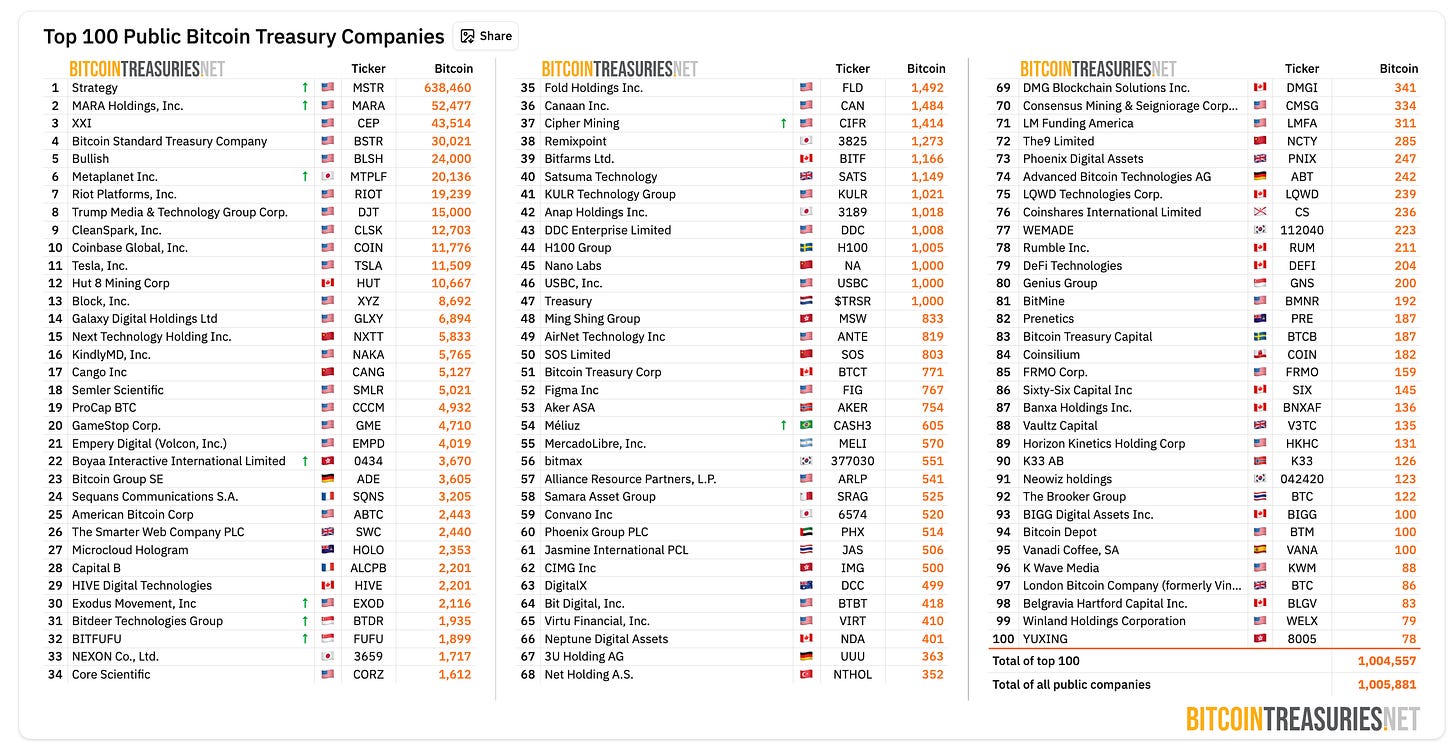

Bitcoin has the most DATs by far with Saylor’s Microstrategy being number one and the originator of the playbook I detailed above. Microtrategy’s accumulated over 3% of all the Bitcoin supply and has even branched into more exotic offerings to raise money, with different options called STRK, STRD, STRC and STRF.

According to bitcointreasuries.net there’s already over 100 companies stacking Bitcoin into their treasuries. However, not all of these companies are following the Saylor playbook of stockpiling BTC through leveraging debt, some are just putting a fraction of their company reserves into BTC.

Some of the more well known DATs stacking Bitcoin include:

Metaplanet over in Japan with Dylan LeClair kicking off the Microstrategy playbook back in July 2024. Metaplanet currently hold over 20,000 BTC.

Twenty One (XXI) led by Strike founder Jack Mallers in collaboration with the Tether team, who’ve already gotten over 43,500 BTC.

ProCap BTC led by Anthony Pompliano, who recently started this DAT a few months ago and now already holds some 5,000 BTC.

Trump Media & Technology Company, and American Bitcoin Corp, who are led by different groups within the Trump family and are also playing the DAT game.

All of these companies are in a race to accumulate as much BTC as possible, and even new terminology has emerged with the concept of “Bitcoin Per Share (BPS)”, where the ultimate goal is to grow a company’s BPS as much as possible.

Microstrategy’s website is a fascinating dashboard to illustrate how they are growing their Bitcoin and BPS:

However, Bitcoin is only one part of the story here, the DAT craze has extended out further into other cryptocurrencies too.

Ethereum and Solana

Two of the largest cryptocurrencies ETH and SOL have also began to see DATs forming that stockpile them.

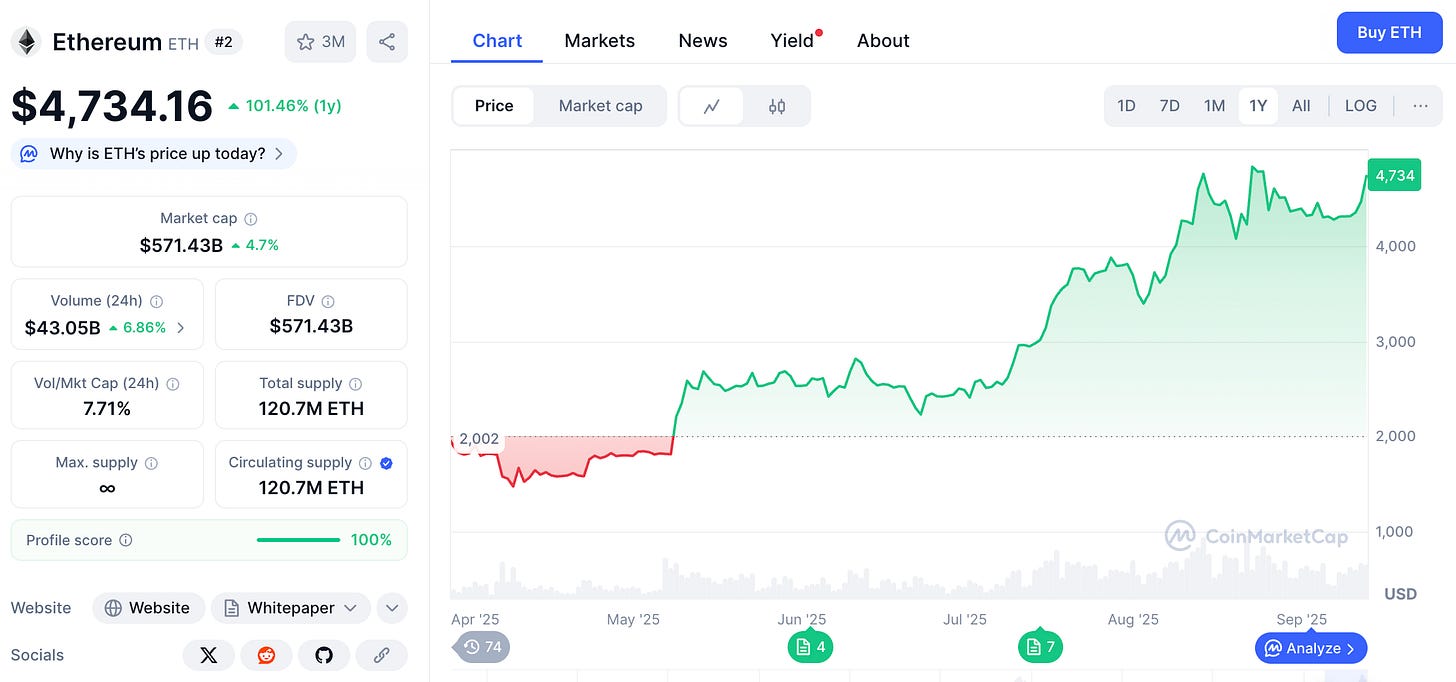

Ethereum in particular has seen the most explosive growth in DATs in recent months with Tom Lee’s BitMine going full throttle and buying as much as $10bn worth of ETH in only around 2 months using Saylor’s strategy - for comparison it took Saylor over 3 years to acheive the same!

You can see the growth in ETH DATs over at www.strategicethreserve.xyz, where you can see that others like SharpLink and Ether Machine have also already stockpiled billions worth of ETH.

And this has no doubt been a big reason for ETH’s recent growth over the past 5-6 months hitting new all-time highs recently and well on its way to break out into new ones in the coming months.

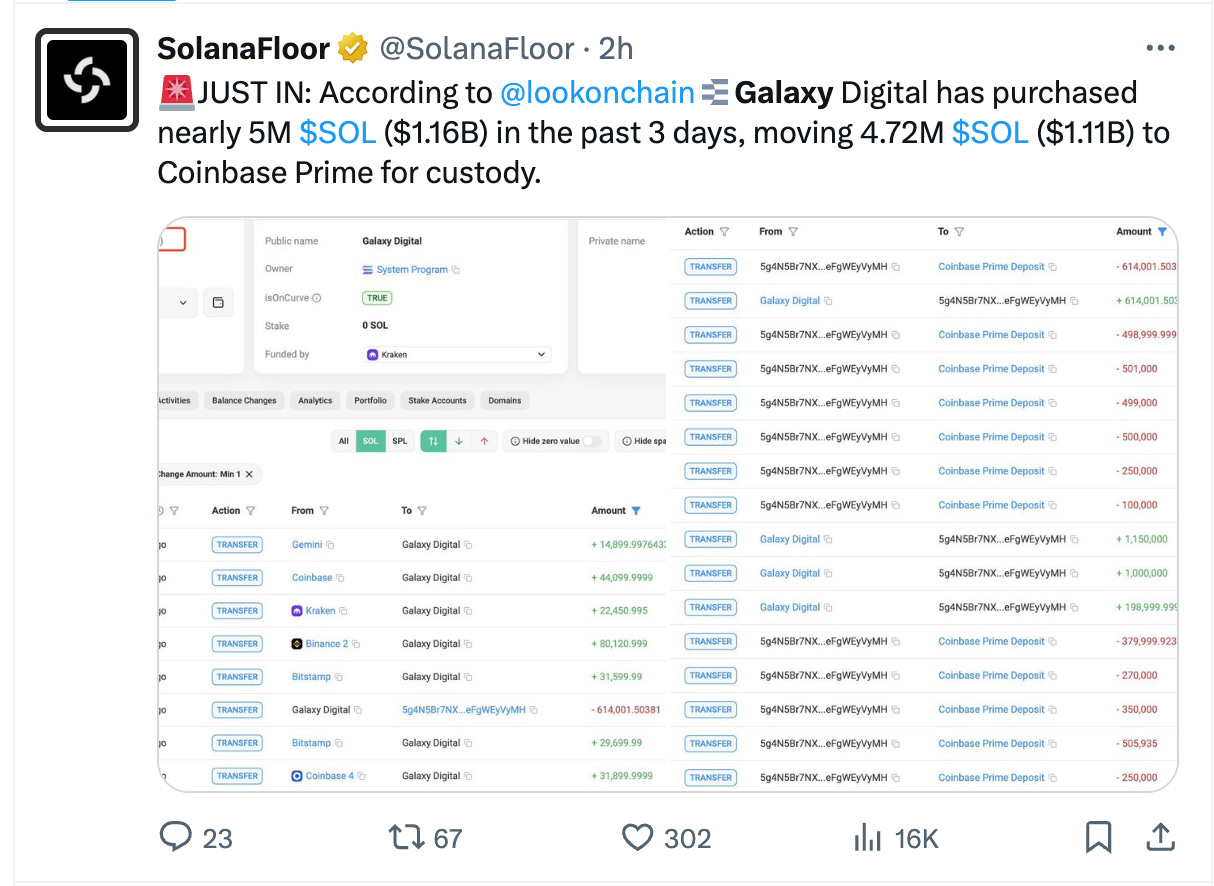

Naturally Solana doesn’t want to be left out either and we’re now seeing big guys like Galaxy Digital, Multicoin & Jump looking to raise $1B for a Solana Treasury. Just this last week Galaxy purchased over $1bn worth of SOL.

Interestingly, since both of these assets allow for certain forms of restaking and other ways to make the asset productive, they might become even more attractive vehicles than Bitcoin DATs because they will be to generate real yield for their shareholders with their underlying assets.

And this is definitely just the start of the story there is no doubt more DATs will form around both of these assets. Not to mention that we’re also seeing it happen with many other large cryptos, with BNB, ADA, and TRON getting their own DATs too.

The Positives

A quick look at these DATs might make you dismiss them as some sort of ponzi scheme built on top of cryptocurrencies. However Microstrategy has at least proven to be incredibly successful so far and its debt obligations are way below all the Bitcoin that its accumulated, so it must be working to some extent.

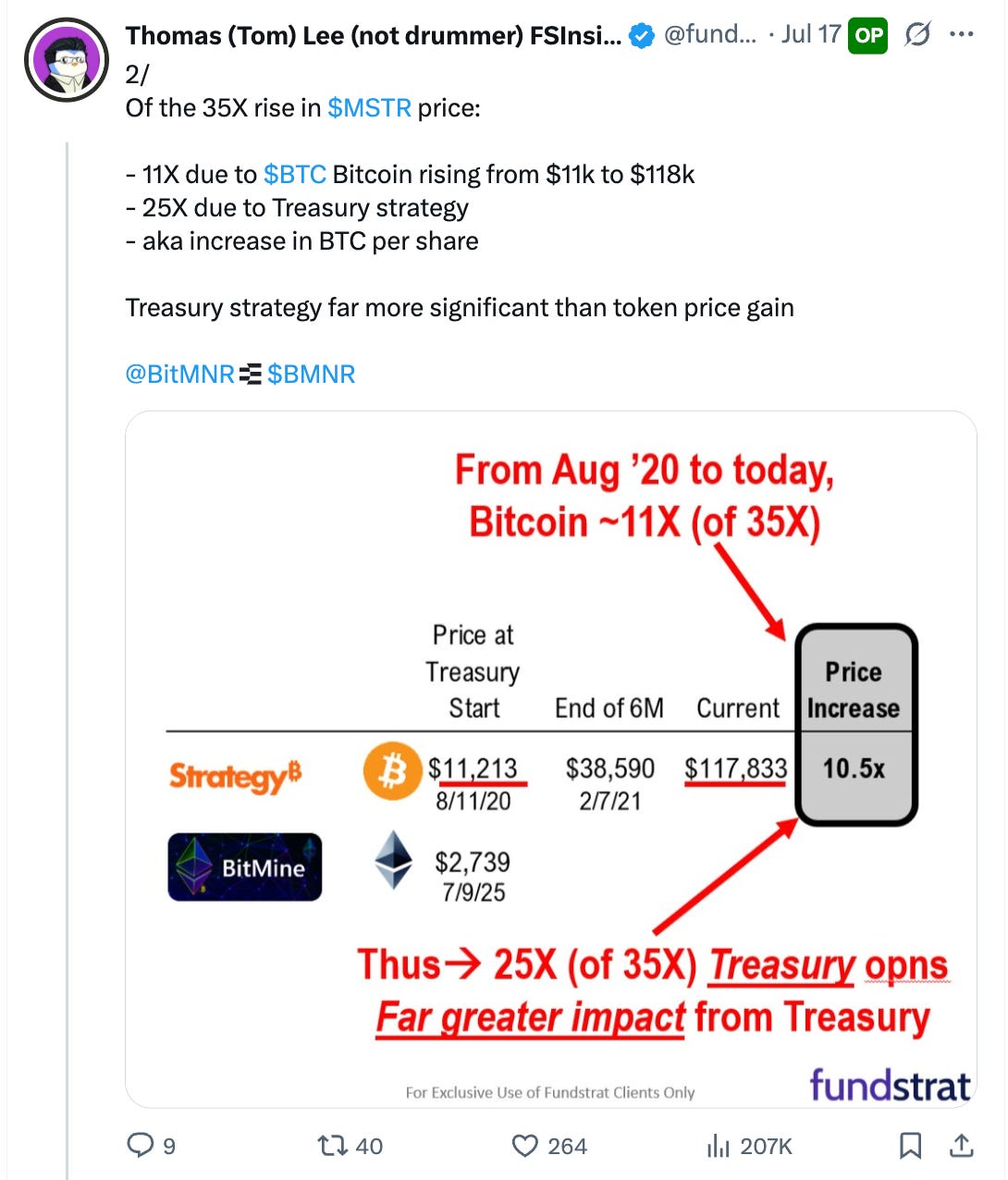

DATs give traditional investors a leveraged vehicle to get hold of the asset that exposes them to potential upside much higher than just buying the asset on its own. As Tom Lee from BitMine highlighted, out of Microstrategy’s 35x growth 11x came from BTC growing and 25x from the BTC accumulation!

This potential upside is really attractive and it ultimately makes these into great vehicles for accumulating and taking the asset’s supply out of the market, which in turn leads to large amounts of price growth of the asset itself, creating a virtuous upwards spiral.

So both crypto holders holding the underlying crypto and the TradFi investors buying these DATs experience their benefits.

The Risks

Naturally all leveraged strategies have risks, and there seems to be a bit of a mania right now with DATs that’s almost certainly overlooking these risks.

Firstly these DATs can lead to a lot of asset concentration in the hands of a few players, which can be bad further down the line. For now its not such a problem, but if some day let’s say Saylor holds 10%+ of the entire BTC he could become a big risk vector for the Bitcoin ecosystem as a whole.

Secondly and more importantly DATs can only work with an asset that genuinely goes up and a strategy that doesn’t put the company under too much leverage.

Microstrategy’s process worked so far because Saylor managed to keep debt obligations really low in comparison to the BTC he accumulated over the years. However, I’m not so sure all the other firms in this game will be as smart and that greed won’t get to them.

Plus there’s many other DATs out there being formed for other coins like DOGE, HYPE and WLD which aren’t as reliable assets as Bitcoin and could easily falter and lose a lot of value imploding the company.

If for example the market has a significant downturn for a prolonged period of time some of these DATs might find their debt obligations higher than their crypto holdings and they may need to sell leading to a downward spiral on the asset forcing others to potentially sell and cascading things further and further down.

What is being built up here is potential leverage that in this case would get flushed out destroying value for shareholders and crypto holders alike.

The Dirty Little Secret

While these DATs have been a huge success so far, especially Microstrategy and now Bitmine, we know there’s risks here since they introduce a lot of leverage into the system.

There’s one fundamental collective belief here though that has the potential to break things apart and cause a cascading downward spiral with these DATs, which I call their “Dirty Little Secret”.

This is namely the belief that shareholders have some sort of say in the underlying crypto that’s been accumulated by these DATs, when in truth they have none.

No shareholder can decide when or how Saylor buys or sells Bitcoin for example, they just need to take his word for it, and if the company blew up for whatever reason then shareholders would have no claims on the underlying Bitcoin either!

The valuations given to these companies are therefore entirely bogus as people value these companies as a multiple of the money held on their balance sheet as if they have some ownership of it, yet they don’t.

So at some point people could very much wake up to this and stop valuing the companies based on the crypto they hold and set in motion a cascading downward spiral.

However, for now, as long as this collective belief holds then these DATs will keep swallowing up their given token supply and the underlying token’s price will go up as well as their stock price, and the party will keep on going.

Let’s just hope we don’t get too much leverage in the system that a potential tumble in the market could destroy these DATs and ultimately cause the next big bear market .

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!