Understanding Crypto's 4-Year Cycles

Why do we have crypto summer and crypto winter?

TLDR:

Hype cycles exist in all emerging technologies, in Crypto these are exaggerated.

Crypto cycles follow Bitcoin’s regular 4-year halvings. Peak mania kicks in 6-12 months after a Bitcoin halving and lasts approximately 1-2 years.

Every cycle has a new speculative focus: '12-'13 was Bitcoin forks, '16-'17 was ICOs, '20-'21 was NFTs, what will '24-'25 be?

The future is impossible to predict but it’s highly likely these cycles will persist, builders in the bear market will reap the fruits of their labour in the bull market.

Having been in the crypto space for close to 7 years I’ve seen and learned a lot about crypto and its quirks. The evolution of the technology and its impact has been astounding even in such a short space of time when considering Bitcoin was created in 2008 less than 15 years ago. Just within my time in crypto so many new areas have emerged such as DeFi and NFTs.

However, one pattern has been a lot more consistent than I could have imagined and seems to repeat itself like clockwork.

Anyone who tells you they “know” what will happen in the future is lying, ultimately the future is a massive game of chaos and chance. Nonetheless, I’d say there’s a high chance of this pattern repeating itself again since its happened 3 clear times in the space’s short history.

I’m referring to crypto’s 4-year cycles of boom and bust. The cycles that generate so much good press in the bull market and so much FUD (fear, uncertainty, and doubt) in the bear market. Today I want to dive deeper into these cycles to give more insight for people who are still new to the space.

Gartner Hype Cycle

Last week I wrote about how the Web3 space is still in its early stages, essentially like the Internet in the 90s. Much like the early Internet people are still more excited about the technology than any particular product or use-case. We’re still figuring out all the possibilities and innovators are pushing the boundaries trying new and different ideas out.

Almost all major emerging technologies go through a period like this. They begin generating all sorts of interest and hype at the start before people realise it will take some time for them to deliver on their promises, and soon disappointment kicks in and people move onto focus on the next trending technology.

Right now AI is the technology of the moment with the huge strides made by OpenAI launching ChatGPT, which hit a never before seen 100m users in just 90 days! All sorts of incredible use-cases will emerge out of this remarkable technology but you can be sure that this will take time and this short-term buzz will fade soon.

The Gartner hype cycle characterises this well. Created by an American firm called Gartner it splits the maturity, adoption, and application of new tech into 5 phases.

First a new technology emerges with a “technology trigger” and breakthrough, which leads to “inflated expectations” and excitement. Interest wanes and the “trough of disillusionment” comes as those expectations are not immediately met. Many people stop paying attention and focus shifts elsewhere, meanwhile there’s a “slope of enlightenment” as genuine use-cases emerge from the builders who stuck around. Soon you get a “plateau of productivity” as mainstream adoption begins to take off and continues to grow, and people’s expectations are kept in check.

However, in crypto it’s not that simple.

The 2 ways in which crypto is different

Crypto also goes through these Gartner hype cycles, in fact it experiences them very clearly and in an even more exaggerated form. And there’s two very clear reasons for why this happens. The first reason is that the very technology that underpins this space creates “digital scarcity”, which is one of the most significant innovations in this technology and is a huge part of where its magic lies.

Before Bitcoin and the blockchain it wasn’t possible to have purely digital scarce assets. Importantly, scarcity (along with utility) sit at the base of economic value and since crypto creates scarce assets in ironically not-very-scarce quantities, the space is rife for economic speculation!

Gartner’s infamous hype cycle is therefore exaggerated by the speculation of the assets that are created through the very technology itself! This is very peculiar and something that happens in literally no other technology. For example with AI you may generate new text, images, or similar, but you can’t speculate on these outputs, only on perhaps the companies behind them. In crypto every single new token in a sea of hundreds of millions of tokens is a new opportunity for speculation and every hype cycle is an opportunity for new individuals to generate significant financial gain.

The second important reason lies within the codebase of the grandfather of the space itself - namely Bitcoin. It’s always important to remember that the entire space has grown out of Bitcoin. Satoshi created Bitcoin, which created blockchain, consensus algorithms, and all the rest of the technologies that compose this space.

A metaphor that I often use is that Bitcoin is the Sun, and all other cryptocurrency ecosystems are planets or satellites that orbit around it. In time this may change, especially with the growth of Ethereum that may one day grow so large that it acts as its own Sun and breaks away from Bitcoin. But at least for now this is not the case. Most financial and intellectual capital and attention rests within Bitcoin. Bitcoin still sits in the centre of the space and its price fluctuations impact the entire space.

Importantly, Bitcoin has a very peculiar behaviour encoded deep within its codebase known as the “halving”. Every time a block is mined on Bitcoin it will create new coins in what’s known as the coinbase transaction rewarding the miner for their work. Satoshi programmed in that after every 210,000 blocks mined the number of Bitcoins rewarded in the coinbase transaction is halved. This is known as the halving and happens approximately every 4 years, creating a logarithmic graph for BTC emissions.

Bitcoin began creating 50 BTC per block back in 2009. This dropped to 25 BTC in 2012, then to 12.5 BTC in 2016 and is now at 6.25 BTC per block after the 3rd halving in 2020. It’s expected that by 2140 all 21 million Bitcoins will have been mined.

Bitcoin Halvings and Crypto Cycles

Bitcoin therefore has an important 4 year trend where the emissions of coins drops dramatically every 4 years, which has a hugely significant impact on the space and on crypto’s economic cycles.

If I told you I knew the exact reason why the halvings have this impact on cyclically driving prices up and down I’d be lying to you. Important figures in the space have offered up many explanations for price fluctuation. One that’s been most widely accepted is by Plan B who came up with the Stock-to-flow (S2F) model.

The core concept behind the S2F model is based on dividing the total supply (ie. stock) by the amount of Bitcoins produced annually (ie. flow). As new BTC in the system reduces yet demand keeps growing we can expect a jump in price, and at every halving there is significant upward pressure in price, pushing towards a new higher price equilibrium. This model views Bitcoin a lot like other scarce physical commodities like gold and silver. The model appears to map price relatively well historically.

Whatever the exact reason behind Bitcoin’s price trends - history doesn’t lie. And history has shown that after every halving there’s a build up in price and after a short 3-12 month lag we see the space go into a euphoric “crypto summer” for somewhere between 1-2 years. This is followed by a full collapse with companies imploding and many scammers being revealed or running away entering what most refer to as a “crypto winter”, until we repeat again with the next halving.

In the crypto summer you see huge amounts of market euphoria. The price of most coins and tokens shoot up and everyone begins speculating hoping they are going to buy into the next big thing. Scammers and opportunists suddenly appear to sell all types of snake-oil. Since everything is going up its hard to tell what’s legitimate or not. The current fad takes over and entirely new sub-spaces within the wider crypto space are formed. All this market activity drives a lot of adoption with people entering the market when they hear stories of people making life changing money. Everything is pushed up by a growing Bitcoin price.

In the crypto winter we experience the opposite. Projects that seemed legitimate begin to topple over, in some extreme cases like FTX with hugely fraudulent and illegal behaviour. Assets in the space experience huge draw downs, with the great majority of tokens trending towards zero and only a few standouts really separating themselves from the crowd. Life savings are literally eradicated and so many people exit the market and say they will never touch this space again. Bitcoins price drops significantly and takes everything down. However, some hardcore believers who came in the bull market stay, and they become the builders and growers for the next cycle.

This cycle of crypto bull and bear markets has already repeated itself very neatly over the past 3 halvings and although you can never be certain about the future there’s no obvious reason to believe it won’t happen again with the next halving.

Learning from the past

Looking back at the 3 major cycles individually we can see the trends.

The 2012 halving led to a bull-run in '13-'14 with Bitcoin forks being the major thing. The few participants in the space were technical, they would take the Bitcoin codebase, switch up some important variables and create a new coin. Coins like Dogecoin were created during this period with its 1 minute block times vs Bitcoin’s 10m, and infinite coin emissions with a constant 10,000 DOGE mined per block. The technology was very limited at this time but people like Vitalik Butterin had greater plans and created one of the first ICOs (ICO = Initial Coin Offering, a play on IPO) raising $18.3m in 31,500 BTC at the time for his new project Ethereum.

After the halving of 2016 we had an explosion of euphoria in '16-'17 known as the ICO boom. Ethereum had created the possibility for people to create new fungible tokens, which was much simpler than creating a coin that required cloning the entire Bitcoin network. Many opportunists launched ICOs raising millions for their projects but the vast majority disappeared and faded in the ensuing crypto winter. The few that survived have potential to be important parts of of the space such as Polkadot from Gavin Wood, who was one of the original Ethereum founders.

After the 2020 halving we had a small boom known as “DeFi Summer”, where the emerging decentralised finance space garnered attention. But the real star of the show were NFTs in '20-'21 another entirely new sub-space within crypto. New NFT collections were minted every day raising millions and driving speculation. NFTs brought in a whole new type of person into crypto, the creatives. Artists and musicians got drawn into crypto (now named Web3) through the potential to monetise their art through NFTs, something that had not been possible before with the tech.

In all 3 cases the collapse came with Bitcoin price trending downwards bringing the whole market down with it, and some significant industry players imploding. In the first cycle it was MtGox, the biggest centralised exchange at the time was hacked and funds were lost. In the second cycle hacks like Coincheck kicked off 2018 and prices spiralled down. And in the third cycle we saw Terra-Luna imploding as its economic model fell through after their USDT coin lost its peg to USD. In all cases multiple other major players also consequently collapsed as the harsh crypto winter kicked in.

Looking to the future

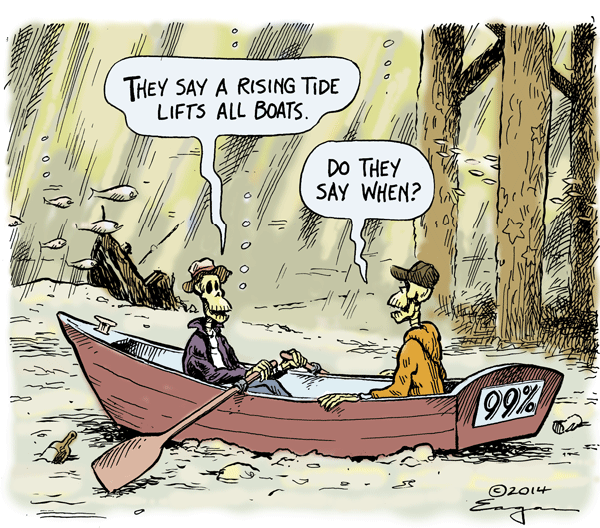

The similarities between each cycle are astounding. Things always begin with a Bitcoin halving and its price being slowly driven up. As Bitcoin trends upwards it lifts the whole market with it and speculation begins. A new funding mechanism is found, from forks, to ICOs, to NFT mints, that fuels the speculative buying further. We see huge adoption and euphoria, with projects in the space appearing in the media and all sorts of famous people seemingly jumping in the bandwagon.

This lasts for 1-2 years as Bitcoin prices begin to dip and the market continues to cling to its euphoric highs until all of a sudden we see a significant player implode, confidence is shaken and the market begins to collapse. People stop talking about crypto and start pointing fingers claiming that the technology has not delivered what it promised. Only the real diehard believers and newly converted stick around.

Whether we like it or not this is a significant and recurring trend in the space. Instead of trying to circumvent it or hope it will change its best to position yourself in a way that you can be best prepared for it.

The focus of each hype cycle is always different, just being in the space when the hype kicks in means you have high chance of riding the waves and trends of the new cycle. It’s commonplace to say that just surviving the bear market puts you ahead of the rest. History suggests that this is true as most significant players such as centralised exchanges like Coinbase and Binance and decentralised protocols like Aave and Uniswap built their foundations in the bear market and reaped the rewards in the bull.

A rising tide lifts all boats.

Following historic patterns we’ll probably see another boom in '24-'25 after the halving of 2024, although it’s impossible to tell what will be the flavour of the month. It’s incredibly likely that what was big in the past cycle will not be big in the next one.

Instead of holding onto old bull-market favourites its best to invest in yourself and build in the space. If you can look beyond the cycles and build something of true longevity regardless of the current market stage you will be well prepared.

Having an idea of how crypto cycles work gives you a strong base to prepare for each stage of the market with your venture in Web3. You can be certain that the underlying technology will evolve regardless of the market cycle and that next time there’ll be new not yet imagined opportunities with more players in the space and more people using the technology, all ready for you to build something incredible for them!

So keep building friend! 🫡