Stablecoin Summer

The recent Circle IPO and GENIUS Act show that stablecoins are going mainstream

TLDR:

Stablecoins are having a boom right now with a lot of major moves happening, including from big players like Stripe, Shopify and JP Morgan.

The largest showcases of the stablecoin excitement though have been Circle’s hugely successful IPO and the GENIUS Act passing the US Senate.

Circle IPO’d at a $6.9bn valuation, already at a 44x multiple, but the market couldn’t get enough of their stock and they’ve done over 7.5x to $52bn!

GENIUS Act will allow more companies to confidently issue stablecoins and Scott Bessent believes they’ll eventually hold over $3.7tn in US Treasuries!

The biggest winners though are us crypto-natives as stablecoins are a genuine use case that can help to onboard the masses into crypto.

Stablecoins are one of the hottest narratives in crypto right now and some people are even calling it “Stablecoin Summer” - myself included!

So this week I decided to dive into the excitement around Stablecoins, looking at the biggest factors causing excitement and who stand to be the winners and losers of it all.

Note that I’ve been on the move this week so I didn’t get a chance to make a video.

If this post resonates with you and you enjoyed the content then please share it with friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Stablecoin Summer

Summer has officially arrived and many people are calling this one “Stablecoin Summer” because the stablecoin narrative in crypto has been heating up a lot and become a huge focal point for the space.

If by chance you’re not aware of what stablecoins are then I suggest reading one of my related posts like the one below. As a summary though it is easiest to think that they’re any traditional non-volatile asset (like a fiat currency) that’s issued as a cryptocurrency, the largest being US dollar equivalents like USDT and USDC.

We’ve been seeing stablecoin adoption moving fast and coming into the mainstream with big players making big moves, some recent examples include:

Stripe buying up Bridge (stablecoin infrastructure) for $1.1bn and Privy (wallet infrastructure) for a large undisclosed sum.

Coinbase creating an integration with Shopify for any ecommerce business on Shopify to accept stablecoin payments.

JP Morgan launching their own JMPD stablecoin for institutional players.

And while these examples above are all big in their own right, they are not even the biggest - I’d argue the biggest are instead Circle’s hugely successful IPO and the recent GENIUS act that has passed the US Senate and is on its way to be accepted by the US government.

These are both truly significant happenings so I decided to dive into them further.

Circle

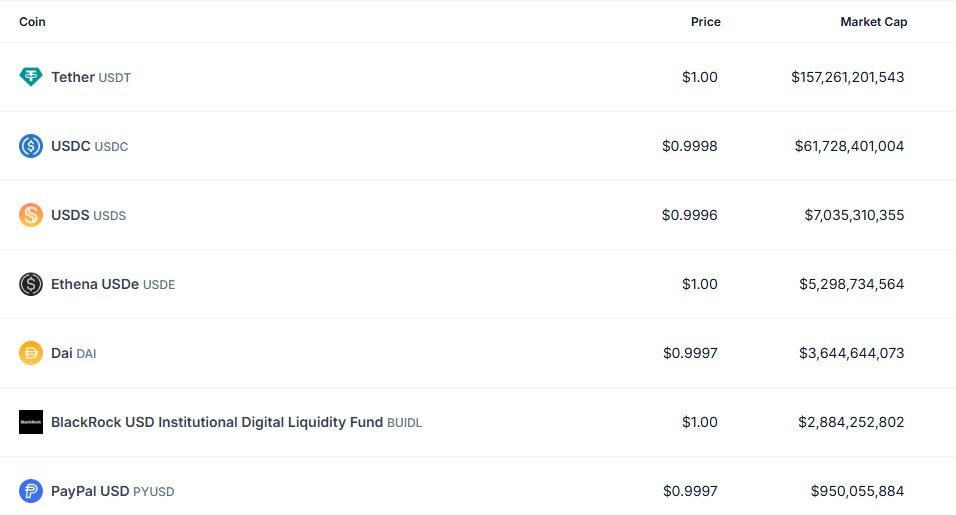

Circle is the creator of USDC, which has a $61bn market cap making it the second largest Stablecoin in the entire crypto space, second only to USDT with its $157bn market cap. Both have 24% and 62% of the entire stablecoin market as of today.

Circle had recently been in discussions to either sell the company or go public in the US stock market, and in the end they decided to go with the latter and IPO’d a few of weeks ago on June 5th at around a $6.9bn valuation.

Considering that in Circle’s IPO filling they showed that they earned around $1.67bn in revenue in 2024 however only had $155m in actual profit, that meant their $6.9bn valuation was already an 44x multiple on their profit.

Companies are often valued through these multiples, with many of the larger tech companies at around 30x multiple of their earnings, so a 44x multiple was already a pretty high place to start for the IPO.

So, what nobody expected was just how successful Circle’s IPO would be, and since then the market’s gone crazy and in just over 2 weeks Circle’s market cap went as high as $60bn, coming back down to around $52bn now, which is a 7.5x increase on their original valuation and puts them at an insane 335x multiple on profit!

Everyone in crypto knows that Circle and Tether with their respective Stablecoins are the biggest and most consistent revenue generating projects in the entire space, but nobody really anticipated the market to give Circle such a high valuation!

Even if Circle’s market cap doesn’t hold up it still speaks to just how much excitement there is in the market around stablecoins right now.

As a side note here if Tether were to have the same multiple applied to them as Circle, then they would be the most valuable company in the world being valued at over $4 trillion dollars, being more valuable than the likes of Nvidia, Microsoft and Apple - which might just suggest that Circle’s a little overvalued.

GENIUS Act

Meanwhile in the US government we’ve also seen a huge piece of legislation pass the Senate, meaning it’s passed the first step towards being signed into law and now it needs to go through the House so it can finally be signed into law by the president, and considering Trump’s a big proponent for crypto he’ll definitely sign it through.

But what does this act do? Well it can be summarised with this post below.

If that’s a little confusing to read then a simple summary of the key points are:

Issuance of stablecoins is permitted by certain entities who follow the rules.

Issuers must maintain 100% reserve backing for stablecoins using U.S. dollars, short-term U.S. Treasuries, or similarly liquid assets, but not BTC.

Issuers and custodians can freeze tokens on lawful order.

States can establish their own stablecoin frameworks.

Stablecoins cannot natively give a return because then they would be classified as a security.

To summarise this even further - there’s now regulatory clarity around stablecoins so big players can begin to get involved!

This will likely be huge for stablecoins as big players like the big banks, which have mostly been sidelined due the lack of regulatory clarity, will begin to get involved and we could see a big explosion in stablecoin growth.

You may also have noticed in the text above that stablecoins need to be backed 1-to-1 by US dollar equivalents like US Treasuries (USTs), and this is where things get very interesting.

US Treasuries

The biggest stablecoin player is Tether who actually created the very first stablecoin and the playbook through which stablecoins make money, which is quite simply that they are backed almost entirely 1-to-1 by USTs, and they make the current UST rate (currently around 4% annually) on those billions!

I’ve already written about this before if you want to dive deeper into it.

I’ve also recently discussed just how complex the situation is right now for the US government (and in fact the world) with regards to debt. And things have been getting worse as the the US goverment is having trouble selling their USTs into the market.

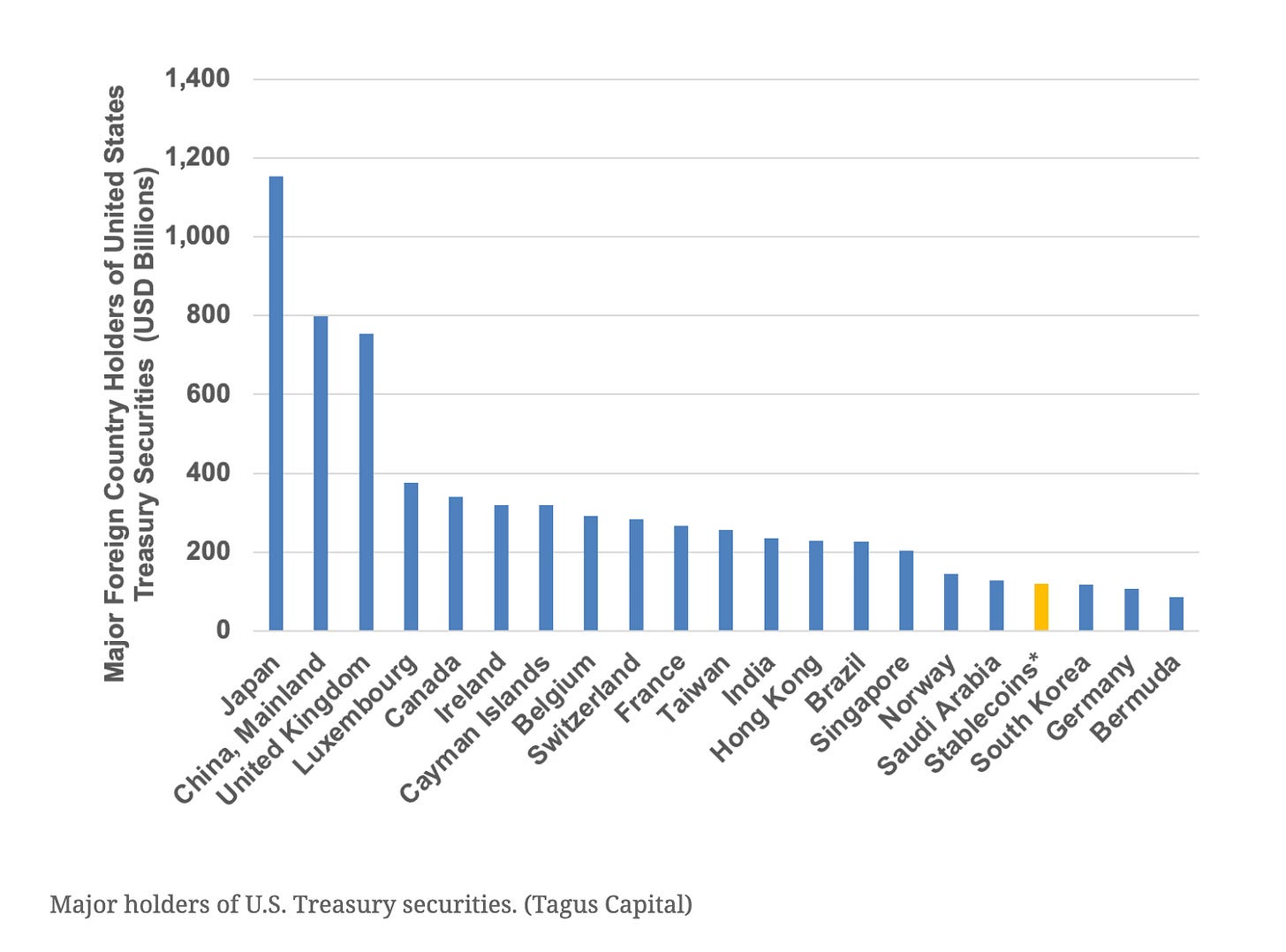

Considering then that the main model for stablecoins to make money is through buying up and holding USTs its pretty impressive to see that Tether’s already the 18th largest UST holder in the world - they hold more USTs than countries like Germany and South Korea!

And it seems Scott Bessent, the current Treasury Secretary, believes this is just going to continue to grow. He’s come out going as far as saying that he believes Stablecoin issuers will buy up as much as $3.7tn worth of USTs - this would lead to over 15x growth on the size of the entire stablecoin market!

Even if the numbers are still a fraction of this it would still be huge for US Debt and the US economy, especially at a time where demand for USTs is drying up in general with other major countries like China trying to reduce their economic reliance on the US due to geopolitical tensions.

Winners and Losers

As you can see from what we’ve covered above “Stablecoin Summer” is as real as it gets, with market euphoria taking over on Circle’s stock price and the US government going as far as suggesting that stablecoin issuers will become some of the biggest buyers of their sovereign debt!

Now, as with everything in life, the growth in stablecoins will create both winners and losers.

The winners here will likely be stablecoin issuers and customers, because stablecoin issuers will finally have the US government’s support, and with more issuers joining the ecosystem customers will get more choice about how to use and store their USD too!

Plus something that most people aren’t even talking about, is that stablecoins make it easier for people around the world to hold US dollars without needing a bank account, which will help grow the US dollar dominance worldwide - making the US government a big winner!

Meanwhile losers will be current payment providers who will see a reduction in their revenues as more people decide to using stablecoins instead. And we may see currencies from weaker governments begin to bleed out as people choose to hold their money in USD stablecoins rather than their local currency.

In a financially successful trade the winners outweigh the losers, and I personally believe this will very much be a winning trade as it ultimately provides more choice and a better experience for customers.

For those of us in crypto who want to see this space grow this is also a huge win because stablecoins will probably act as a great trojan horse for crypto as a whole! In other words us crypto-lovers will be one of the biggest winners.

One of the main arguments levied by the mainstream against crypto is that it has no real world use case, well stablecoins prove the opposite and they are very likely to be the entry gateway into crypto for most ordinary people.

This is because once you hold stablecoins for whatever reason you’lll begin to understand that they are a form of crypto-currency, and start diving down the rabbit hole and learning about other things in the crypto space!

An example may be that you want to earn interest on your stablecoins and so you might come across our very own Yield Seeker agent, which will essentially act as a savings account for your stablecoins earning you interest/yield on autopilot, and consequently you’ll start learning how to use DeFi and crypto further.

So as you can now see, it’s well and truly stablecoin summer right now!

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!

Yup just look or click this link!! #AZOS.FINANCE is going to be doing it join soon ...

#ALPHA ** CODE to use = PSYP3D....

let the team know you hear it from #LADYDAYDAO community member #TYMED