US Government Debt

Analysis on how US Debt may be impacting the Crypto Market

TLDR:

US Government Debt is at a gigantic $36tn and $9tn of it is going to have to be refinanced in the next 12 months at a higher interest rate.

10-Year Treasury Bonds are a type of US Debt, and it’s the 10-Year Treasury Yield rate on secondary markets that defines the rate most US debt is refinanced at.

Trump is acutely aware of this and one theory suggests that he may be trying to generate chaos in the market partly to bring this rate down.

This is a risky bet because it could cause a recession that could spread. However, reducing government spending and debt will be a huge win if he’s able to.

Crypto is considered a “risk-on” asset-class so it has suffered together with traditional markets. Yet the tailwinds for crypto have never been more positive.

Traditional Markets are tanking and some have been pointing to this Trump Dump being intentional.

This theory relates to US Debt, so this week I’ll explain a little bit more about US Debt, how it works, how this is impacting traditional markets, and consequently how it impacts crypto.

If this post resonates with you and you want to continue the conversation then jump in here: beginners.tokenpage.xyz

This newsletter goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Watch the Video version of this Post

Government Debt

Most people don’t really understand how governments can hold so much debt or how government debt even works. In fact we discussed this topic in my VIP community call last week as it’s pretty hard to get to grips with.

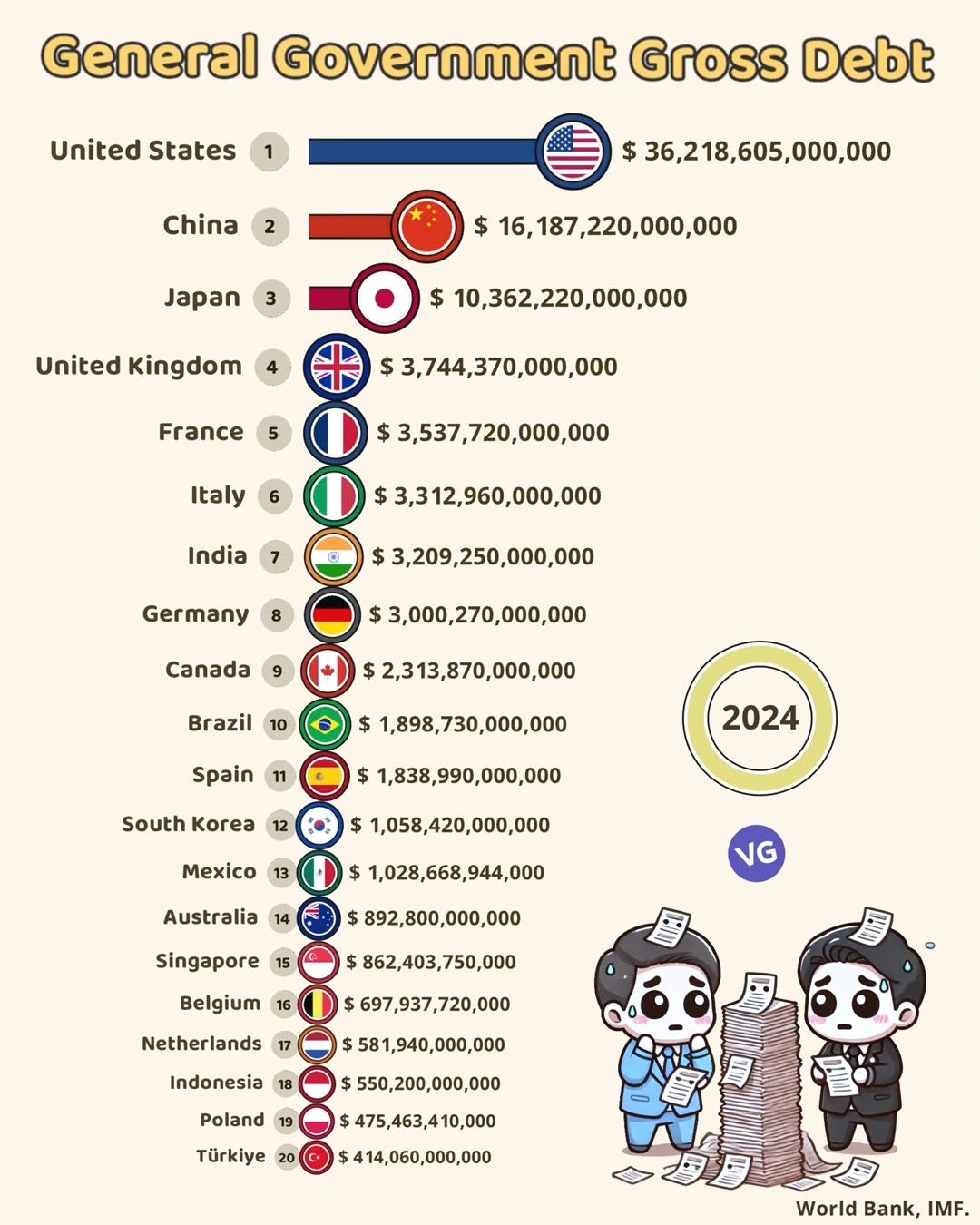

Nations around the world are in insane amounts of debt, global debt is over $320tn and steadily rising, with the US leading the pack with an insane $36tn!

For most ordinary people the word “debt” immediately conjurs up a negative image. We’re generally taught to avoid debt as much as possible and people chronically in debt are seen as financially irresponsible, so why do we allow our governments to be in so much debt?

Well debt isn’t all bad, many people take out multi-decade mortgages to buy houses that they couldn’t afford otherwise. As long as they can make the monthly repayments it can be cheaper than renting and they end up with their own house in the end!

The problem comes when their repayments are higher than their income and they find themselves unable to keep up with them.

In this sense governments are no different.

Government debt can be useful to finance strategic projects that can make the country grow and prosper, generating more income for the government in the long-run. As long as government debt repayments are not too high then they can keep paying them off and push the problem further out into the future.

But what happens when that future catches up to them?

US Debt

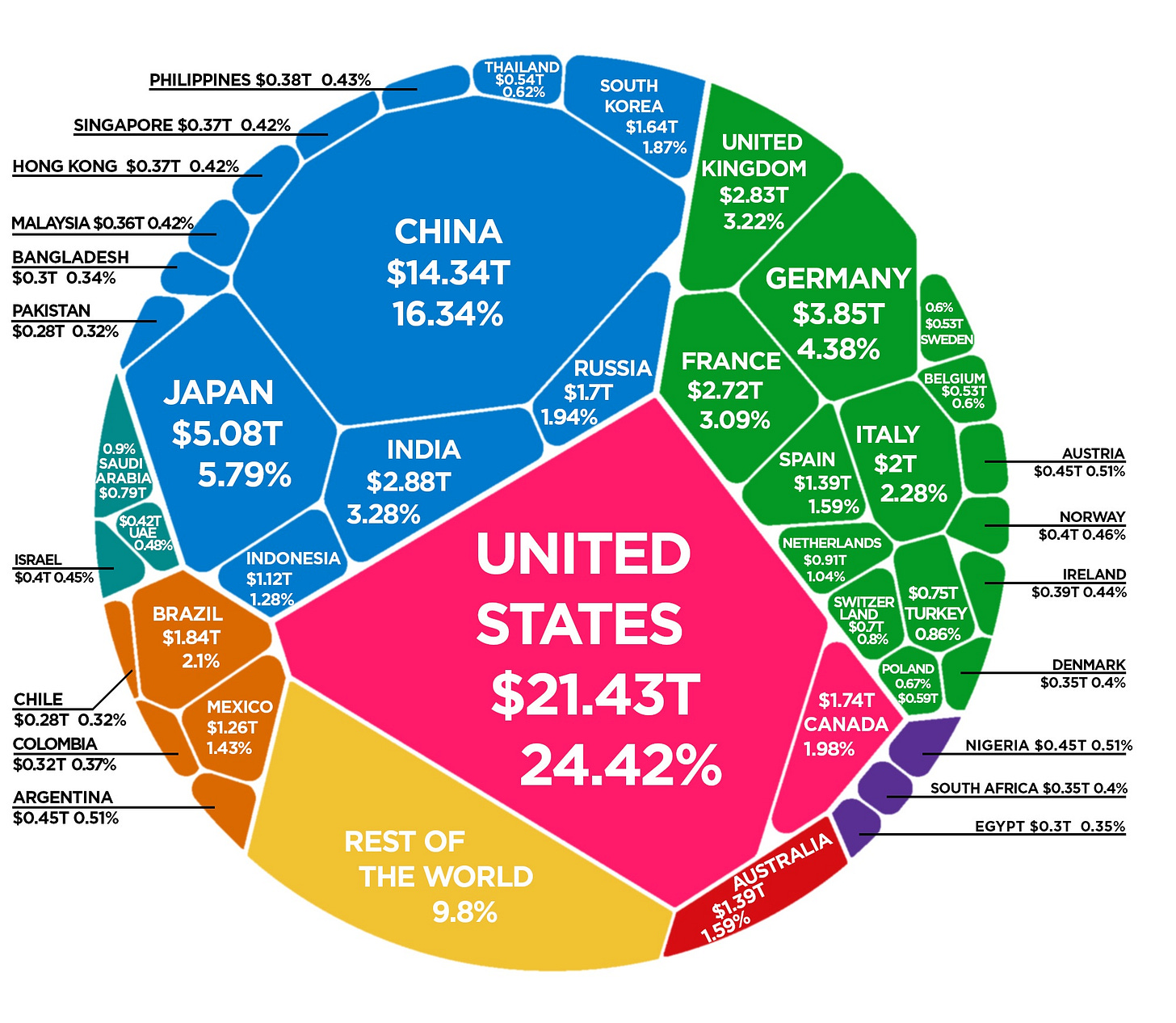

The US economy is the single largest economy in the world and accounts for a whole 25% of global GDP!

Even China’s huge economy is dwarfed by the US, accounting for *just* 16% and the next largest is Japan with *only* around 5.5%.

Therefore the US’s impact on global economics is completely outsized, any decision it makes has huge ripple effects throughout the entire world.

However, although the US have a booming economy, they also have the largest debt of all as we saw above, and their debt is ticking up fast.

Trump’s administration inhereted a government with huge debt and they are fully aware of this and seem intent on dealing with it, regardless of the financial pain it’ll cause or the negative impact it’ll have on the US’s global hegemony.

Large amounts of this debt were sold in the Covid era where interest rates were almost 0%. But now $9tn of debt is close to reaching its maturity date and is going to have to be refinanced in the next 12 months. In practice the debt is paid off (or refinanced) by issuing more debt at a new and more up to date interest rate.

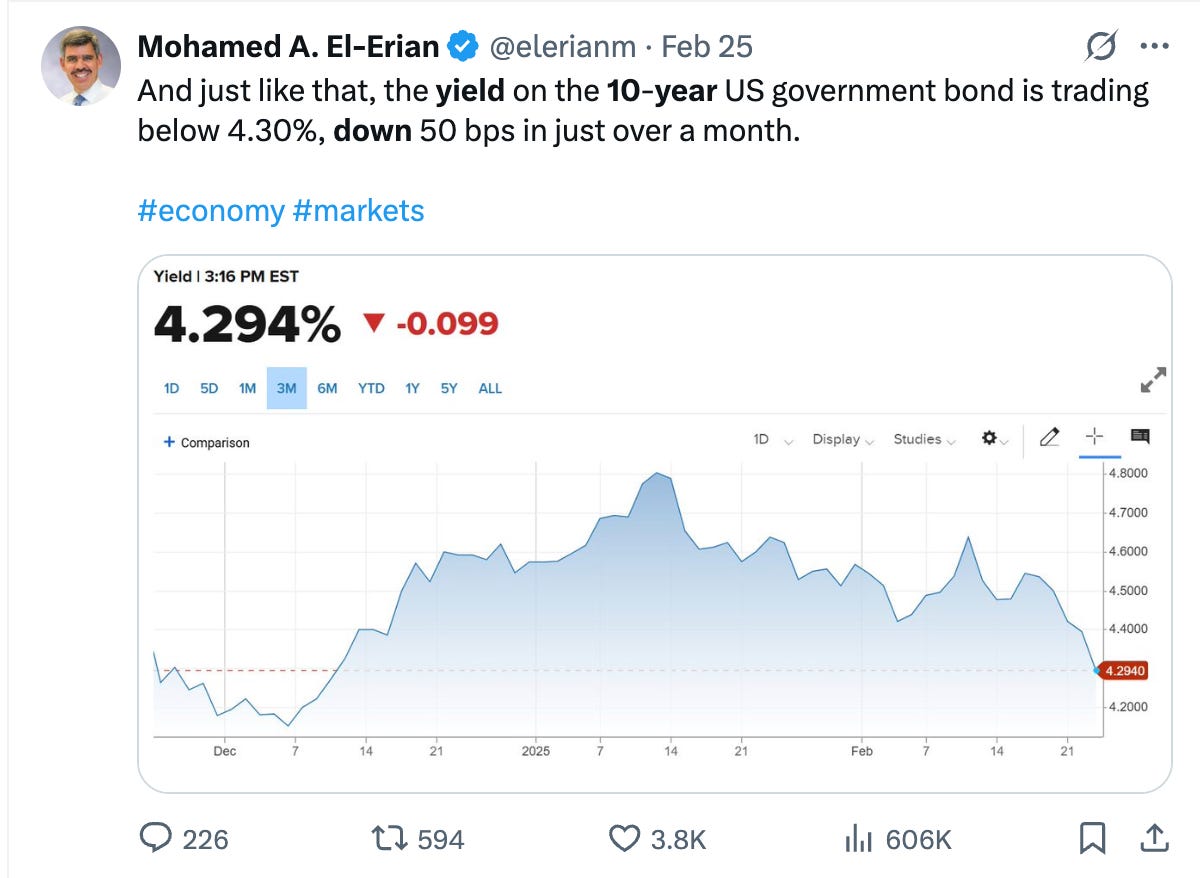

The important rate that matters here for the government is called the 10-Year Treasury Yield, because it’s based on this rate that the new debt will be refinanced at. Currently this is above 4%, so the old debt they were paying close to 0% on is going to suddenly become a lot more costly.

US Treasury Bonds

Before we can understand what 10-Year Treasury Yields are we need to start with Treasury Bonds. Now this part can get quite complicated and I could just skip over it, but I think it’s important for people to understand how governments really work.

When a government cannot pay their incoming bills they issue debt (aka bonds). In the case of the US this debt is called US Treasury Bonds (USTs) and are sold through the US Treasury authorised by the Treasury Secretary - previously under Biden this was Janet Yellen but now under Trump it’s Scott Bessent.

When the US Treasury issues this new debt, they go out to the open market and other governments and big institutions bid against each other to buy it up.

People buy this debt because the US is the most powerful economy in the world and has never “not” paid up it’s debt repayments, so anyone who wants to put their money to work and earn the “safest” interest (aka yield) in the world will buy these bonds.

These UST’s come in different maturation ages - ie. the date they need to be paid off. That then offer different coupon rates - ie. the rate they earn yield at.

The most important USTs and most regularly sold are the 10-Year Treasuries, in other words the ones where the government will need to cough up the money in 10 years from now.

The current yield earned in the secondary market for these 10-Year Treasuries essentially marks the rate that the US will need to pay on refinancing their debt.

10-Year Treasury Yields

The government bond market is complex, but as I said previously USTs are considered the safest place in the world to earn interest. So when world markets are in turmoil people buy up USTs, even if the turmoil is predominantly caused by the US government itself!

As the demand grows for USTs, so does their price through simple demand and supply, and higher price for bonds means lower yield on bonds.

This is often hard to understand, but essentially bonds have an original price and coupon rate that they are given when sold.

So say we have a $1,000 bond for arguments sake with a 3% coupon rate, that means it will return $30 per bond per year. The bond’s holder will earn a steady $30 pay-out from the US government regardless of the price they paid to that bond on the secondary market.

Now when the demand for those bonds drops and people sell their bonds, the price could say drop to say $500 per bond so its yield *rises* to $30/$500 = 6%!

But when demand heats up for bonds pushing their price up, the price could say rise back up to $750 for that same bond, making the yield *drop* down to $30/$750 = 4%

Now Trump has gone on TV to say he wants to reduce the 10-Year Treasury yields, because he knows it’ll influence the rate of the $9tn in debt that needs to be refinanced.

But to reduce this yield he requires growing bond demand, which usually comes from either the FED reducing interest rates and/or people wanting to derisk their money.

People derisk their money when they fear recessions or geopolitical unrest, and Trump’s certainly stoking these fears. Plus the FED will only reduce their interest rate when they see that inflation’s back below their 2% goal, and Trump’s policies appear to be helping this happen too as truflation.com suggests inflation’s down to 1.3%.

And all of this is indeed having the desired effect of growing demand for bonds and reducing 10-Year Treasury yields.

Now am I saying Trump is intentionally causing unrest in the market? Well potentially so, but I can’t read his mind and he seems to flip flop on things all the time.

Risky Bet

If this is indeed what Trump’s attempting, and this is a big *if* as I have no idea, then it is a risky bet to play.

Firstly, the world’s never been more in debt. Sure US debt is at huge levels never seen before, but at least against its GDP it’s “only” 120%, compare that to Japan’s 260%!

In the past we’ve seen scenarios where individual governments were over leveraged but never so many countries at the same time like this before. It’s an unprecedented moment for the world.

If Trump’s administration continues causing this turmoil it could kick off a recession that *could* theoretically kickstart a larger recession around the world. The simple possibility of this being true can help to generate a self-fulfilling prophecy.

However, although the stock-market has been crashing with the S&P down over 7% recently, it’s still up over the last 6 months! And all the other economic indicators seem generally strong with inflation coming down as we mentioned above, and unemployment rate at historic lows of 4.1%.

So the most likely outcome is that there will just be some pain in markets until the US economy gets past this rough patch. And if there is a recession it’ll be a short-lived one.

And if we don’t see a US recession then it could be incredibly good for the US in the middle to long-term. This is because Trump’s administration are cutting costs with Doge, while increasing revenues with tariffs, and generating more internal businesss and investment with lower income and corporate taxes.

The US government has a spending problem, this past month of February alone they spent $603bn while they took in $296bn, so they are spending 2x what they earn! Rebalancing the governments income and expenditure is essential to getting their debt to more manageable levels.

Making the US government more fiscally responsible would in principle be an all round win for the US economy.

And there’s no doubt Trump will want the markets to be strong by his mid-terms 2 years from now, so this pain should pass.

How does this affect Crypto?

Crypto is considered a “risk-on” asset, which means that when people have an appetite for risk the market can do well, but when people are “fearful” the crypto market tends to do badly.

Since traditional markets are having a terrible time, this has spilled over into crypto. There are well known “Fear and Greed” markers that have been stuck at “Extreme Fear” for the past few weeks in traditional markets, bringing the crypto market down with them.

While people were expecting a really bullish entry from Trump, he’s had the opposite effect, at least in the short term.

However, although things look ugly in the short-term it’s important to note that the over-arching Crypto news from the US government has never been more bullish!

The SEC has dropped their ongoing lawsuits against companies like Coinbase, Kraken and Consensys, and last week they announced a Bitcoin Strategic Reserve and the White House even had a crypto event!

For someone’s who accompanied the market for 9 years now I’ve never seen such bullish times in crypto. If you can weather this storm you’ll surely make it out the other side.

Many people connect M2 (ie. global liquidity) to the price of Bitcoin with a lag, and we’ve seen a drop but it’s on it’s way back up - but understanding M2 is a whole different topic for another day.

So if you have a solid DCA strategy and Portfolio management then you should welcome this moment as a great opportunity to “buy the dip” because it too will pass and crypto’s tailwinds have never been stronger.

Whenever you’re ready, these are the main ways I can help you:

FREE access beginners.tokenpage.xyz - Get a free video guide on how to set up your first wallet and buy your first crypto. Plus a 1-on-1 call with me for free, and $1,990+ of bonus course material.

VIP access beginners-vip.tokenpage.xyz - Get VIP access with me as I show you how to navigate crypto’s. Includes weekly Q&A calls where you can ask me anything, and our proprietary DeFi portfolio software.

Web3 software development at tokenpage.xyz - Get your Web3 products and ideas built out by us, we’ve built for the likes of Zeneca, Seedphrase, Creepz and more.