Stablecoins

The least volatile assets in crypto

TLDR:

Stablecoins are cryptos with price pegged to non-crypto assets like the USD. They allow people to move their assets out of volatile cryptos yet remain on-chain.

Centralised stablecoins like USDT and USDC work by issuing coins 1:1 with their reserve collateral. They’re the most successful stablecoins but not very Web3.

Decentralised stablecoins are ran by DAOs and backed by over-collateralised cryptocurrency in smart contracts. They are complex yet follow the Web3 ethos.

Stablecoins already account for around 10% of the crypto market and will continue to grow as a category with the growth of real-world-assets and CBDCs.

A couple of weeks ago I discussed the MakerDAO’s Savings Account earning 5% on DAI, which is a US dollar pegged stablecoin.

In doing so I realised I didn’t yet have a post on stablecoins so I decided I would make one this week, as they’ve become such a key cornerstone of the space.

Stablecoins

Stablecoins are a type of cryptocurrency designed to minimize the price volatility typically associated with major cryptos like Bitcoin and Ether.

Their stability is achieved by pegging their value to a more stable asset, typically a fiat currency like the US dollar (USD), Euro, or a basket of currencies, but it can also include commodities like gold or a combination of different assets.

Stablecoins were created as a way for traders in the space to be able to hedge their bets against the volatility of other cryptos without having to off-ramp their liquidity out of the cryptocurrency ecosystem into fiat currencies every time.

However, they’ve grown to become a large and hugely important part of the space with over $130bn in total market capitalisation between them, almost 10% of today’s entire cryptocurrency market cap!

The most famous and successful stablecoins are based on the USD with USDT, USDC and DAI being the major players in today’s market.

These stablecoins can be split into two main types of centralised vs decentralised (ie. fiat vs crypto collateralised). We’ll cover both below.

Centralised

Centralised stablecoins are very simple to understand as the stablecoin is backed 1:1 with its fiat currency reserve. So if there’s $100 worth of a stablecoin in circulation, then there’ll be $100 worth of USD, or low-risk equivalents to USD like US Treasury bonds, owned by the company issuing the cryptocurrency.

The stablecoin issuer essentially wraps fiat currency into a cryptocurrency for people to access this liquidity on-chain. Of course it all relies on this middle-man keeping their promise of having 1:1 reserves, which goes a little against the whole Web3 ethos.

There are plenty of these centralised stablecoins, but the two most successful and well known ones are USDT by Tether and USDC by Circle, with a market cap today of $95bn and $25bn respectively.

USDT was one of the very first stablecoins, originally launched in 2014 on the Omni protocol that worked over the Bitcoin network. With the growth of Ethereum they soon moved over to EVM smart contracts and have expanded to most major chains.

The Tether team have been marred with conspiracies of inadequate backing of USDT and unlwaful involvement with Bitfinex, as there’s overlapping management between both companies. Consequently they’ve suffered “FUD” (fear, uncertainty and doubt) for years and years, as they’ve literally never provided a full company audit.

However, in August 2023 they released a transparency page on their website that indicated 1:1 backing. Their reports also estimate around $4bn in profits last year from managing their overwhelming reserves, making them one of the most profitable companies in the world per employee!

Despite all the FUD the fact they’ve survived around 10 years in this very volatile space has earned them the position of being the most trusted and used stablecoin.

USDC are the second most successful stablecoin, having been created and launched by Circle in 2018. Unlike Tether, they have focused on US regulatory compliance and provide full audits. For this reason many consider USDC to be a safer option.

Yet others see this compliance with the US government as a risk, because the government could overreach and censor or block people’s assets, which is not possible with most major cryptos like Bitcoin and Ether.

Last year the confidence in USDC was shaken when Silicon Valley Bank collapsed and Circle admitted to having part of their reserves tied up. It led to USDC losing its peg for several days and hence losing confidence and market share against the USDT.

Decentralised

Decentralised stablecoins are more aligned with the Web3 ethos, however this makes them more complex. They are controlled by a DAO and make use of smart contracts to store their reserves.

Here the collateral used to back the issued currency is another cryptocurrency in itself. Since they use a volatile asset to back a less volatile one, they must be over-collateralised and hold more than just a 1:1 backing to ensure they maintain their peg.

DAI is the most famous and successful one. It was launched on Ethereum by Maker in 2017 and is controlled by the MakerDAO and subsquently MKR token holders. All reserve assets are stored in smart contracts and anyone can anonymously add or remove liquidity into these pools.

MakerDAO have several mechanisms to keep DAI’s peg in check, and understanding it fully is quite complex. But the core dynamic stability mechanism is where most of the economic magic happens and it’s based on the fact that the Maker smart contracts can in essence always issue or burn 1 DAI for $1 of collateral.

So hypothetically if DAI drops to $0.90 then any DAI holder can take 1000 DAI (worth $900) and burn it for $1000 worth of ETH (or any other collateralised reserves). The same is possible on the flipside where if DAI went to $1.10 then $1000 of ETH could be collateralised to issue $1100 of DAI!

These incentives are core to keeping the peg stable, as whenever DAI’s price fluctuates someone can swoop in and make money! In practice there are bots that swallow up these arbitrage opportunities and stabilise the price of DAI at $1.

Even with the massive volatility swings in crypto DAI has proven throughout the years that as long as it’s overcollateralised it can keep its peg secure.

Beyond

I’ve only really scratched the surface of stablecoins today.

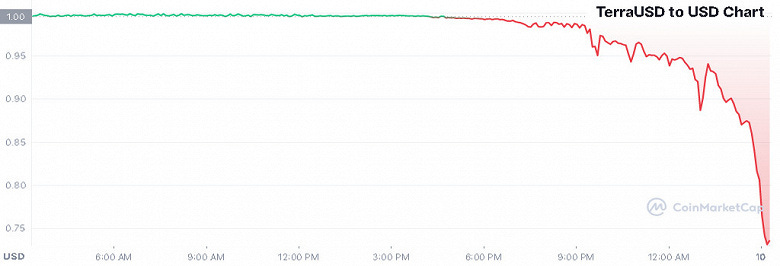

There’s an entire third category known as “algorithmic stablecoins” that are not backed by collateral and aim to keep their value through controlling the supply of the currency. However, none have successfully acheived this, with Terra’s UST being the biggest example of an aglorithmic stablecoin imploding!

Plus there are stablecoins that are not tied to the USD. Tether themselves provide stablecoins for the EUR, CNH and even Gold. Although none in these categories have acheived the same level of usage or populartity.

As an aside, it’s also worth reflecting on the consequences of USD stablecoin’s success. Rather than diminishing the importance of the US dollar on the global market, you could argue that cryptocurrencies have increased USD usage and importance as it’s the only category of fiat pegged stablecoins that has really grown.

You could even argue that although Bitcoin and blockchains provide an alternative to the traditional financial system (which the US has continuously tried to hinder), they’ve actually helped to grow and strengthen the USD’s financial dominance.

Stablecoins are an exciting and important category in cryptocurrency. As tokenisation of real world assets and centrally-backed digital currencies (CBDCs) begins to grow, there will certainly be more growth in stablecoins. So watch this space!