Tether make $200m per employee

The biggest stablecoin company is one of the biggest success stories in crypto

TLDR:

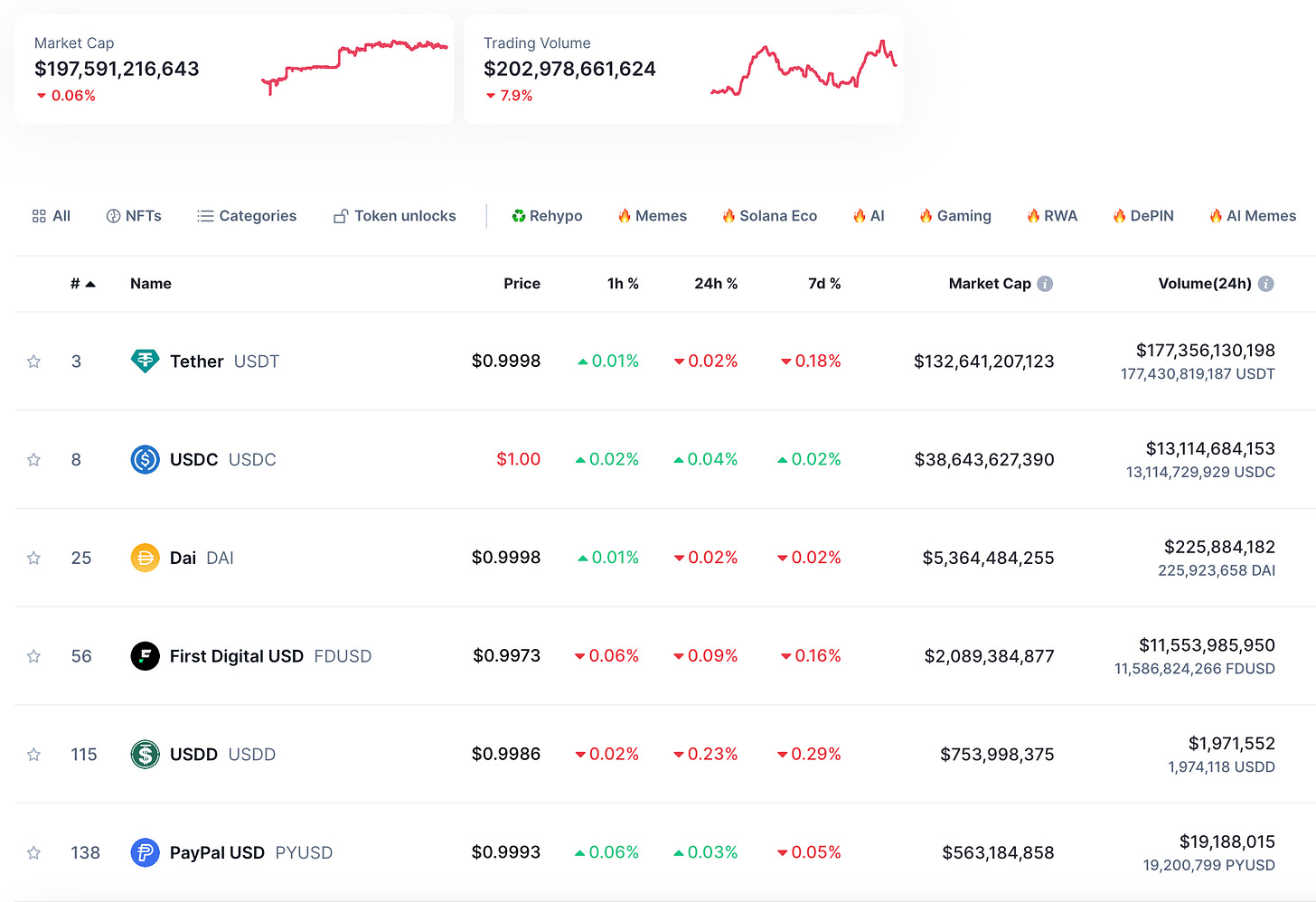

Tether’s USDT is the third most valuable cryptocurrency by market-cap. It’s both the original and largest stablecoin, accounting for ~67% of the stablecoin market.

USDT is a centralised stablecoin, where in principle 1 USDT is backed by $1. Dollars are held as government debt and make Tether a lot of money in interest.

Tether’s been marred by unending FUD in its 10 year existence. However, it’s survived the FUD and harsh crypto-winters, and continues stronger than ever.

Tether’s a huge success story in crypto, with their simple business model they are insanely profitable making ~$200m per employee annually.

Stablecoins have emerged as one of the biggest use-cases for crypto, and the largest and most successful of them all is Tether’s USDT.

So this week I chose to write about Tether, the company behind the largest stablecoin today, how it came to be, and the magnitude of its success.

Read on to learn more, and if you want to continue the conversation then jump in here: beginners.tokenpage.xyz.

Watch the Video version of this Post

Tether’s USDT

Tether’s latest report showed a profit of 7.7bn over the past 3 quarters, if you extend this out it’ll likely be over 10bn for the year. Yet the company say they only have around 50 employees. This means they are set to make $200m ($10bn/50) per employee!

Tether’s current $132bn supply also make it the third largest cryptocurrency by market cap.

But how did the third largest cryptocurrency by market cap, and one of the most profitable companies per head in crypto (in fact, in the world) get started?

Well, it all began in 2014 when a centralised cryptocurrency exchange called Bitfinex realised a clear demand for traders on their platform to trade in-and-out of Bitcoin without needing to actively sell for US Dollars and then send them to a bank account. Bitfinex wanted their customers to keep their funds on the platform.

Having spotted this demand, Bitfinex’s founders span off another company called Tether and created USD Tether (ie. USDT), the very first and original “stablecoin” in the cryptocurrency space.

USDT is a crypto where 1 USDT stays fixed at the price of $1 (1 USD), so it acts as the perfect hedge against other cryptocurrency’s incredibly volatile movments. Traders can easily sell in and out of USDT as other crypto prices trade in and out.

There was a real need for this product and it very quickly it spread to all the other centralised exchanges at the time like Poloniex and Bittrex.

Since then USDT’s evolved massively and grown from strength to strength. It’s had its share of controversy and many still claim that there’s fishy business going on, but it’s stood the test of time and never been knocked over, unlike other stablecoins like Terra which was indeed built on a house of cards and completely collapsed on itself.

And today, USDT alone accounts for ~67% of all stablecoins, and ~4% of the entire crypto market!

How it works

I’ve covered Stablecoins before in a post earlier this year, where I discuess the two largest categories, namely centralised and decentralised stablecoins. But it’s worth having a quick recap below.

Tether is a centralised stablecoin that in principle works by minting 1 USDT for every $1 that it holds. Therefore it essentially wraps fiat currency into a cryptocurrency for people to access this liquidity on-chain.

It originally launched in 2014 on the Omni protocol that was a coloured coin protocol on the Bitcoin network (I’ve discussed coloured coins a bit before here). Then with the growth of smart contracts they soon moved over to Ethereum and have since expanded to many major chains today, including the likes of Solana and Tron.

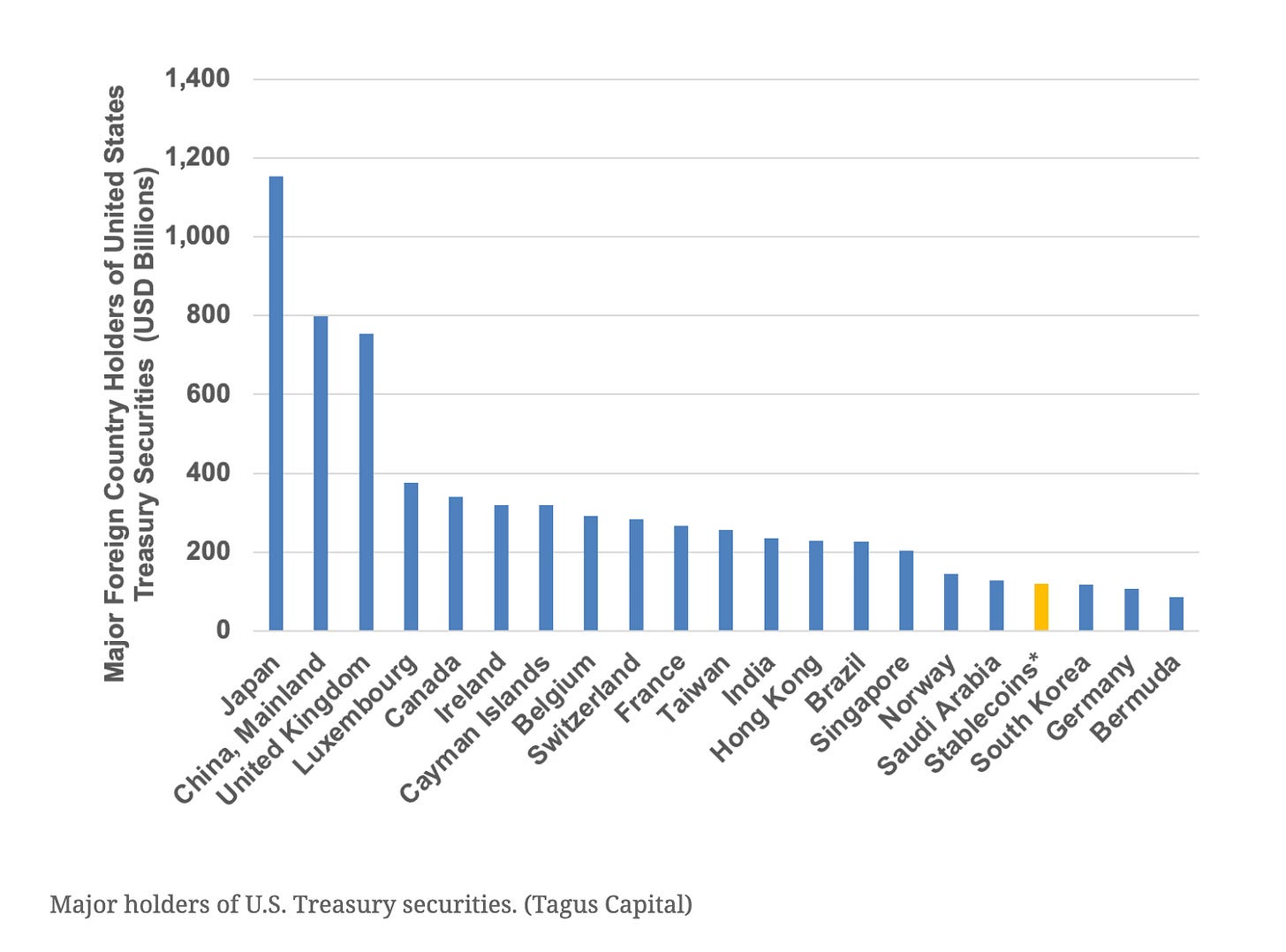

Tether in practice hold their USD fiat reserves in government treasury bonds, and in August 2023 they released a transparency page on their website to indicate this.

As you can see, over 80% of their reserves are stored in US treasury bonds, meaning they are earning a return on all that parked cash, which today is giving above 4%.

Imagine having over $105bn (80% of $132bn) just casually earning you 4% returns? It’s not surprise they’ve become one of the most profitable companies in the world!

As long as these transparency numbers are true and Tether does indeed have enough USD collateral to back the USDT they’ve emitted on-chain. Then even if there’s a bank-rush of sorts with people wanting to redeem their USDT there’s no real chance of Tether not being able to fulfill that demand and USDT losing it’s peg.

This business model is as elegant as it is simple. They provide the ability for people to hold dollars as a cryptocurrency, and in return earn the yield from government treasury bonds!

Tether offer other cryptocurrencies that are backed by GBP, EUR, Gold, and more, but these account for less than 1% of their entire business. The real winner has been their USDT, which is an indication of the USD’s strong demand.

Overcoming Controversy

Tether have survived for over 10 years, which in crypto alone is a pretty incredible feat, however what’s most impressive is just how much FUD (fear, uncertainty and doubt) they’ve had to overcome.

For pretty much as long as Tether has existed there have been voices in the crypto space claiming that printing USDT is propping up Bitcoin and that eventually it’ll unwind and collapse the entire space. One of the most famous voices attacking Tether is the account @Bitfinexed on Twitter that’s been on its FUD campaign since 2017.

Bitfinexed and other critics in the space argue that BTC’s growth is highly tied to Tether printing new USDT and buying more BTC, and that some day this will all unwind and send the price of BTC crashing down.

The critics also say that Tether don’t hold what they said they do as they’ve never provided an official company audit from well recognised auditors, only their own self-administered transparency reports.

Bitfinex was embroiled in complex situation with a hack back in 2016 where 119,756 BTC, worth about US$72 million at the time, was stolen. The US government eventually caught the criminals and seized a portion of the BTC back worth $3.6bn.

However, in this meantime critics say Tether was plundered to fill the gap, since Bitfinex and Tether were owned by the same parent company called iFinex Inc.

Even this past week new FUD has come out about USDT being used to launder money by Mexican cartels.

Honestly, you’ve not been in this space long enough if you’ve not heard any Tether FUD. In fact it’s become such a common occurence that people even poke fun at it, like this “Tether FUD Dice” below where each face has a different common theme for Tether FUD, ranging from them printing money to being banned by China.

Tether can never catch a break!

It’s hard to know just how much of this is fact or fiction, but despite all the FUD, Tether have survived many brutal crypto winters and just grown from strength coming back stronger and stronger.

$200m per Employee

Tether have an incredible story, even with all the hate and knock backs they’ve excelled and become one of the most important companies in crypto and I’d argue one of the most important companies in the world.

USDT’s use-case has evolved from mainly being used for traders to swing in and out of volatile cryptos to today being a way to globally bank the unbanked!

People in all different parts of the world who don’t have bank accounts can simply spin up a new crypto wallet for free and accept USDT for their goods and services. With USDT it’s become trivial to do commerce with anyone anywhere in the world.

I’m personally aware of people in Lebanon and Nigeria, two countries with crippling inflation, who’ve taken to receiving USDT rather than their own currency as it’s easier to receive than traditional money-transfers and protects them against inflation!

The US Dollar already holds the status of “world reserve currency” so it’s considered a financial safe-haven of sorts. And companies like Tether help to further cement this status as it increases the ease-of-access to USD throughout the world.

Tether's in fact becoming such an important pillar of the US Dollar’s story that it’s even become the 18th largest holder of US treasury bonds in the world - Tether hold more US government bonds than countries like Germany and South Korea!

Plus Tether are more profitable per head than mega financial institutions like BlackRock, making $200m per employee as I stated earlier. Few companies in the world are more profitable per head than Tether.

And they’ve recently announced their Hadron platform to tokenise even more traditional financial assets. So we can only expect further growth from them!

However, many lingering questions remain: How long will the US government allow a private company to be a proxy for the USD? Could Tether be swallowed up by the US government at some point? Will the US not want to use a Central-Bank Digital Currency (CBDC) instead? Is there any truth to all the FUD against Tether?

It’s not clear how long Tether will continue to operate in its current format before it becomes too important for the US government to take some action.

For now though Tether are simply one of the most incredible success stories in crypto and continue to be a crucial company in the space.

Whenever you’re ready, these are the main ways I can help you:

FREE access beginners.tokenpage.xyz - Get a free video guide on how to set up your first wallet and buy your first crypto. Plus a 1-on-1 call with me for free, and $1,990+ of bonus course material.

VIP access beginners-vip.tokenpage.xyz - Get VIP access with me as I show you how to navigate crypto’s. Includes weekly Q&A calls where you can ask me anything, and our proprietary DeFi portfolio software.

Web3 software development at tokenpage.xyz - Get your Web3 products and ideas built out by us, we’ve built for the likes of Zeneca, Seedphrase, Creepz and more.