Fear and Greed

2025 has been a case study on how emotions rule markets

TLDR:

Markets are a natural phenomenon that arise as an expression of human behaviour, and are strongly driven by our emotions of “fear” and “greed”.

This year has been a great example so far as we’ve seen Trump’s wielding of tariffs incite both extreme fear and extreme greed in the markets.

Consequently we’ve seen huge market volatility with asset prices dropping massively only to bounce back at incredible speeds.

Manipulation of emotions is rife in markets, and having strong conviction together with a solid hypothesis and strategy is the best way to avoid falling prey.

Both crypto and traditional markets have had a rocky year so far with high volatility in prices, and we’ve seen a great example of how markets are driven by fear and greed.

So today I decided to take a look at these fundamental forces that influence markets by analysing what’s happened so far in 2025.

If this post resonates with you and you want to continue the conversation then you can join my free beginner community here.

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Watch the Video version of this Post

Fear and Greed

When people begin learning about how markets work they think that there’s an exact science to it, especially since economists in the news always seem so certain about what they are saying. However, economics is a study of human behaviour and is therefore a “social science” not an exact science like physics or chemistry.

Economists try to fit predictable numbers around unpredictable human emotions, so their mathematical models are naturally flawed and are at best approximations while at worst totally off and unreliable.

Markets are a natural phenomenon that arise as an expression of human behaviour, with two of the most important emotions that drive markets being “fear” and “greed”. And this year we’ve had front-row seats of these emotions in action, as both crypto markets and traditional markets have seen huge volatility in prices.

The S&P500, which tracks the 500 most important companies in the US stock market, suffered a huge drop at the start of the year, but just this past month it was up over 19% experiencing one of the greatest comebacks in stock market history.

The crypto market followed similar patterns. At the start of April BTC’s price had dropped as far down as $76k, but since then it shot back up and just last week it broke a new ATH (all-time-high) of over $111k!

So why did we get all of this price volatility?

Trump’s Market

The US is the largest and most important economy in the world so a change in its leadership is always a big deal, especially for its own stock market. Nonetheless Trump seems to have tried particularly hard to be the single most important factor in market dynamics for the past half year or so.

When Trump won the US election late last year in November markets got excited. Trump is a business man and so there was an anticipation that his presidency would be more pro-business, and therefore market participants greedily bought up stocks and crypto in anticipation of this growth, driving prices up!

Bitcoin even hit a significant mark of $100k in December last year leaving everyone in anticipation of what would come next.

However as soon as Trump got into power in February he began to make use of something that he’d been mentioning plenty of in his campaign trail - tariffs.

And as soon as Trump started wielding tariffs as a geopolitical and economic weapon, the markets quickly became fearful, because tariffs increase the cost of doing business and so businesses generally suffer from them, which went counter to the pior sentiment that the market had of Trump’s administration being pro-business.

On Trump’s now infamous “Liberation Day” on April 2nd, he declared tariffs on literally all the countries around the world, with some countries seemingly being given really high tariffs, like China at 67% and Vietnam at 90%.

The last time a US President had declared such high tariffs like this was as far back as the 1930s with the Smoot-Hawley Tariff Act by President Hoover during the height of the Great Depression, and so this association with that period terrified the markets.

Fear ensued and the markets retreated massively. Bitcoin which was already dropping amidst all the tariff talks fell as low as $76k while the S&P500 plunged over 12% in just a few days - while 12% might not sound like a lot in crypto, it is a huge amount for traditional markets.

Right before enacting these sweeping tariffs though Trump decided to do a 90-day pause on them to negotiate deals with each country. And that pause gave markets hope that these tariffs were more just talk than real action.

Since then the markets have become optimistic and greedy once again as they seemingly remembered their earlier insight that the most powerful man in the US is a pro-business dealmaker who wants to bring business to the country and grow its economy.

Volatility

If there’s one thing markets hate it’s uncertainty, so Trump’s seemingly erratic behaviour has led to huge swings in market sentiment and consequently we’ve seen huge volatility in the market.

Several “fear and greed” indices exist that try to gauge the market’s sentiment by pulling together a bunch of data points like sentiment surveys, the ratio between shorts vs longs by margin traders, along with other economic indicators.

In the past months headlines suggesting we were potentially heading into the next Great Depression incited so much fear in the market that at one point the gauge on feargreedmeter.com hit 20/100 for both stocks and crypto indicating “extreme fear”!

However, as soon as Trump postponed the Liberation Day tariffs and then struck a deal with China to bring tariffs down to 30% on China and 10% on the US, we saw this sentiment reverse course. All the fear dissipate and greed began to take over, and just last week we were back above 80/100 on the “extreme greed” side of the counter!

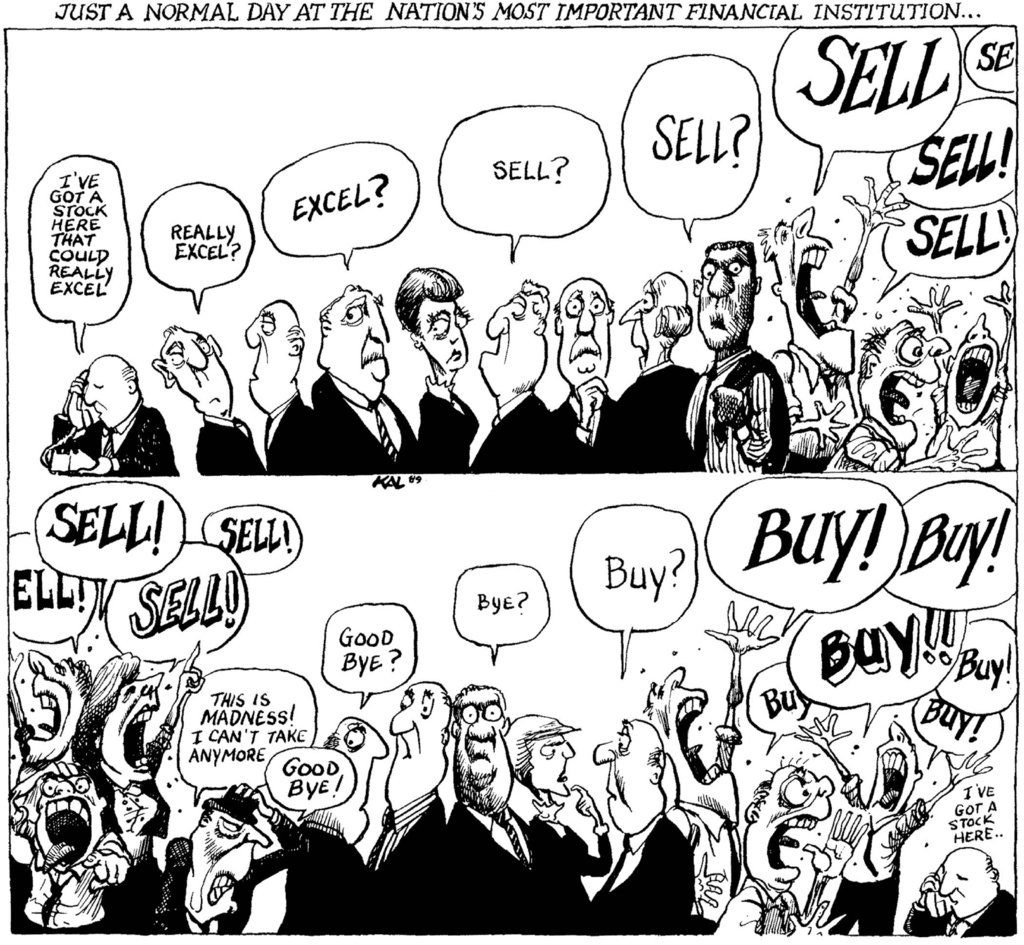

This entire situation is reminiscent of this classic cartoon shown below of fear and greed, which shows that sentiment can easily balloon into either depressive fear or euphoric greed very quickly. Remember that markets are a natural phenomenon driven by human behaviour and emotions can often make us act irrationally.

All of this extreme fear and greed has translated to huge volatility with the VIX index that measures market volatility hitting some of the highest levels it’s ever hit, and indeed the highest in the last 5 years.

Manipulation

Now there is some truth that parts of today’s economic data show some pretty alarming numbers. For example, governments around the world are in extreme levels of debt, so much so that the US is now paying more in interest on its debt than its own national security.

Moreover Japan, who has the single largest debt of them all at over 230% vs their GDP, is now claiming that their situation is as bad as Greece since their interest repayments are becoming unsustainable just like the US.

However, global markets are incredibly complex and there’s plenty of positive data out there too and so it’s important to be aware of the wider interests at play. Most ordinary investors are small fish in an ocean full of whales and are therefore highly susceptible to manipulation from the larger interests that truly move the markets.

Although most markets are regulated to try and avoid manipulation it’s still somewhat inevitable, this is because, as I’ve already said, markets are not an exact science and humans can be manipulated by their emotions.

For example, most mainstream media is completely against Trump, this is just plain and simple, and so part of the manipulation investors face is purely political as these news outlets attack his methods and strategy to try to weaken him politically.

The suggestion that we could have been heading into the next Great Depression for example was pure fear-mongering given that Trump could just as quickly switch off his tariffs if he did begin to see this any sort of disaster unfold. Even entertaining this idea therefore just seemed ridiculous but there it was all over the news.

And now that its mainly clear that he’s using tariffs to negotiate with trading partners, we’ve not seen any praise from news outlets for the huge reversal in the market either, highlighting their bias and consequently their emotional manipulation.

You’re not only susceptible to manipulation from political interests though. There are plenty market participants who love volatility because they can profit off of it!

For example “market makers” literally live off this, and are known to some times sell off assets heavily to push prices down and scare people out of their positions, only to go on and buy back up those assets at lower prices a couple of days later.

Banks for example also make a lot money off of trading, and in the first quarter of this year 5 of the biggest banks saw record breaking revenue from trading fees as shown below.

Volatility is good business for these guys.

I could go on here with countless examples of larger interests at play, the key thing to take away though is that there’s manipulation everywhere that can make investors slip up and get swallowed up.

Conviction

If fear and greed are the ocean waves that try to sink your ship, then conviction is the antidote which turns you into an unmovable rock that’s able to weather the storm.

Conviction comes from truly understanding the assets you are investing in: why they exist, what purpose they serve, and how they work. And from there forming both a hypothesis on what will make them become more valuable over time, and a personal strategy on how you will invest in these assets and when you should exit them.

While business and life often requires a lot of short-term thinking, most successful investors need to learn to ignore the noise and view things on a long-term horizon. It’s this perspective that will allow you to avoid falling for the vagrancies of the market that’ll try to push and pull at your decision making.

For example, someone with strong conviction on Bitcoin would have seen this recent drop as a moment of market irrationality and seized the opportunity to “buy the dip”. Warren Buffet, the greatest investor alive, has an important quote that says: "Be fearful when others are greedy, and be greedy when others are fearful".

However, by conviction I don’t mean just blind faith. Markets can behave irrationally for longer than you can be liquid so you also need to understand your own personal financial situation, and revisit the basis of your investment hypothesis from time to time to see if they have been invalidated for some reason or not.

Plus in crypto it’s important to understand the 4-year cycles and not get yourself caught out with the latest exciting narrative. A solid strategy based on your own personal financial situation and grounded in a solid analysis is the best way to do this.

All of this is easier said than done of course, especially in crypto, which is a fast moving and highly speculative space. Everyone who’s been in crypto long enough will have stories of how if they’d bought Bitcoin or some other crypto when they started and sold at the right time or just held on they would now have a lot more money.

So remember that just like the tides of the ocean, if you can learn to weather the storm of market volatility caused by fear and greed, and stay steadfast with strong conviction and smart strategies into the long-term, then you’ll become a great investor!

Whenever you’re ready, these are the main ways I can help you:

FREE access beginners.tokenpage.xyz - Get yourself started in crypto, setting up your first wallet and buying your first crypto. Includes a 1-on-1 call with me for free, and $1,990+ of bonus course material.

VIP access beginners-vip.tokenpage.xyz - Learn to build real lasting wealth in crypto. Includes weekly Q&A calls where you can ask me anything, and our proprietary DeFi portfolio software.

Web3 software development at tokenpage.xyz - Get your Web3 products and ideas built out by us, we’ve built for the likes of Zeneca, Seedphrase, Creepz and more.