Bitcoin's hit $100k, what comes next?

Predictions for Bitcoin and Crypto prices in 2025 and beyond

TLDR:

BTC hit $100k on Wednesday 4th December 2024. It took 15 years to hit the $100k price mark, with over 600m (ie. 7%) of the world having interacted with crypto.

Only now are we moving out of the early-adopter phase with true use-cases and patterns emerging. The 4 year cycle is an example of a regular market pattern.

My prediction is this cycle we get to between $200k-$300k BTC, overtaking all the main companies in market cap, and crypto overall hits $8tn-$10tn market cap.

Looking further ahead, I also predict $1M BTC in 5-7 years, with over 1.2bn (ie. 14%) of the world using crypto. Plus more exponential innovation in the space.

BTC surpassed $100k last week. This is an incredibly significant mark and has left me reflective about both the past and the future of the space.

So today I decided to have a brief look at crypto’s past, present, and future, with my own personal perspective and expectations for what may come.

Importantly, none of this is financial advice. Crypto assets are highly volatile so you should do your own research and not risk more than you can afford to lose.

Read on to learn more, and if you want to continue the conversation then jump in here: beginners.tokenpage.xyz.

Watch the Video version of this Post

Bitcoin $100k

Bitcoin hit $100k for the first time last Wednesday the 4th December 2024!

This is a hugely historic and significant milestone, especially when you stop to think that BTC was literally worth $0 just 15 years ago in Jan 2009 when it was first released.

Bitcoin’s decimal milestones against the US Dollar have been as follows:

$1 (= 1 BTC) on 10th February 2011.

$10 (= 1 BTC) on 3rd June 2011.

$100 (= 1 BTC) on 2nd April 2013.

$1,000 (= 1 BTC) on 9th November 2013.

$10,000 (= 1 BTC) on 2nd December 2017.

$100,000 (= 1 BTC) on 4th December 2024.

I personally got involved in crypto in early 2016 tumbling down the rabbit hole, and falling so deep that I’ve dedicated my working life to the space ever since.

Back then BTC was hovering around $400, but that was almost 9 years ago now!

So much has happened in the space since, and I’ve personally lived through 2 full crypto cycles and am living through my 3rd one now.

The $100k milestone made me reflective and so I decided to look at the past, present and potential future predictions of the space. Naturally there’s way too much to cover in both directions of the timeline, so I’ve tried to keep it relatively brief.

The Past

At this point most people know the origin tale of Bitcoin and crypto space, nonetheless, the Bitcoin whitepaper was released in 2008 by the pseudonymous figure Satoshi Nakamoto, who then released the official Bitcoin network implementation on 9th January 2009.

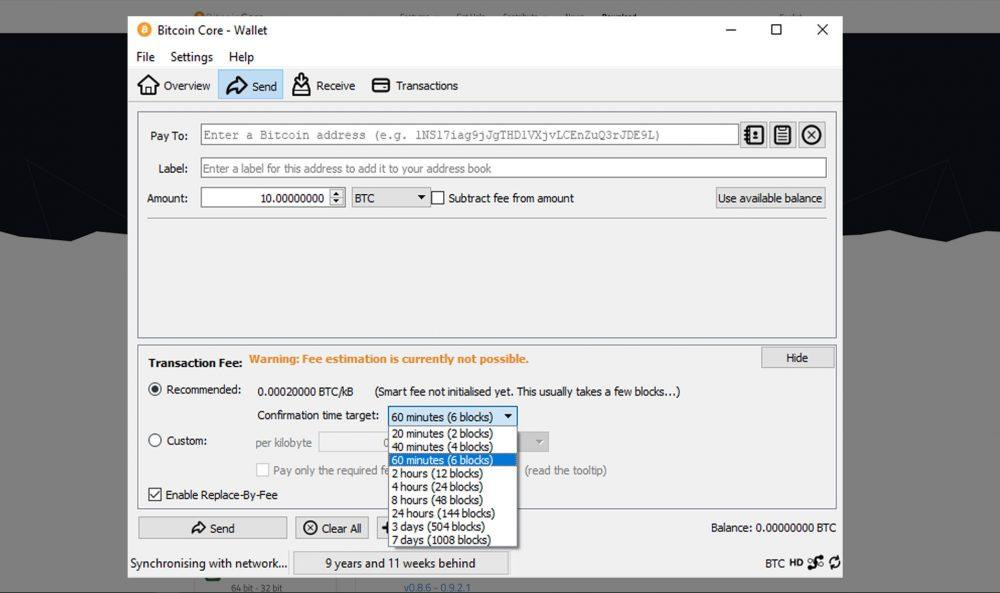

Back then it was an incredibly niche invention with only a few people on certain cypherpunk email lists and forums that even knew about it. It was also incredibly awkward to use, requiring users to download Bitcoin Core, that was a wallet, miner, validating node, and everything else, all wrapped up into a single piece of software.

Since then countless innovations have come. Bitcoin Core was split into it’s separate components. Seed Phrases simplified private keys. Hardware wallets were created. Countless Bitcoin clones generated. Smart contract blockchains like Ethereum introduced. And now new tokens and NFTs are being launched literally every second.

It’s been an incredible journey to say the very least, and one could certainly argue that we’ve only just about gotten started, as the true use-cases for the technology and patterns for working with it are finally emerging.

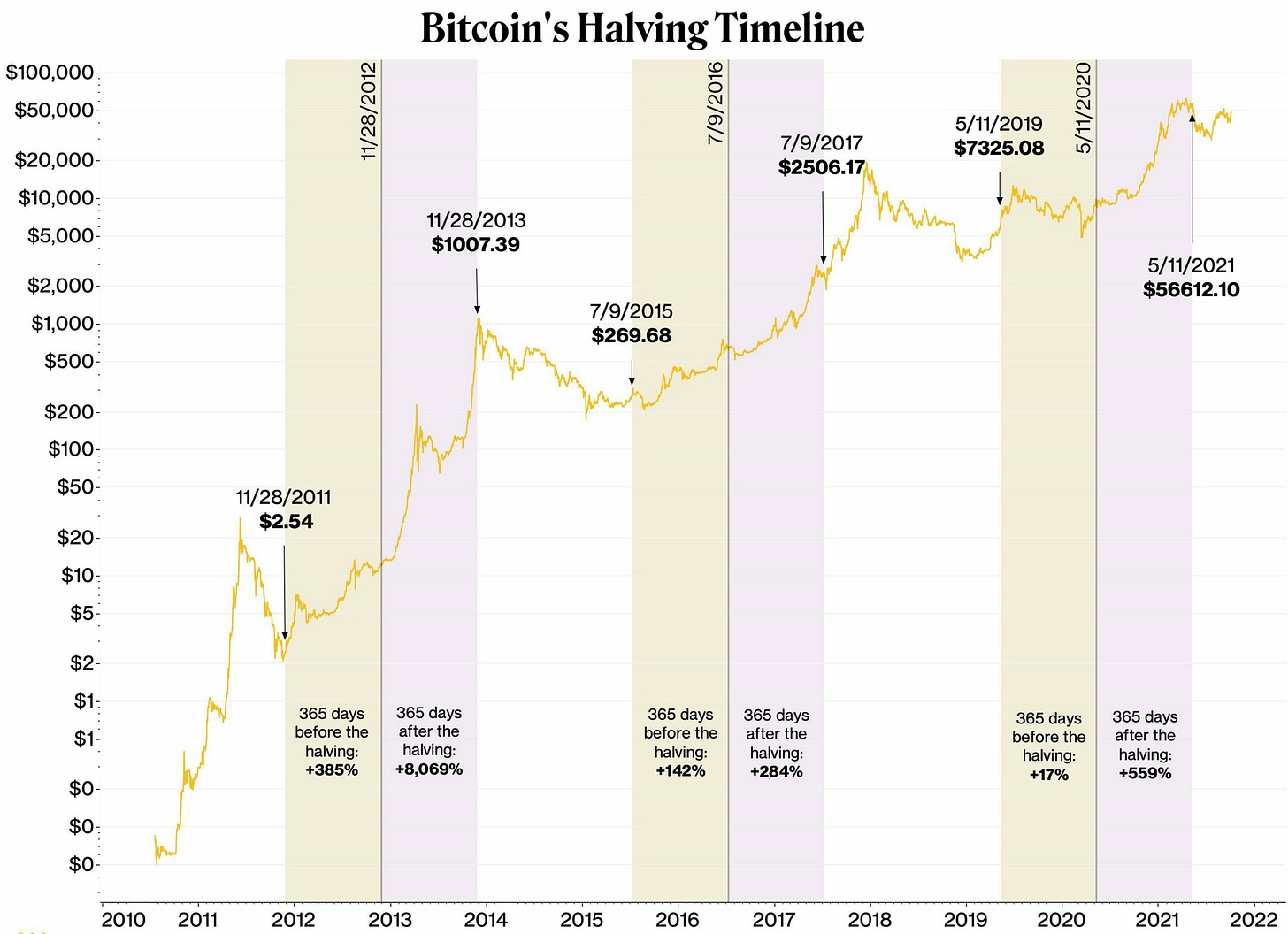

A key pattern that’s emerged for example has been the 4 year market cycles. This curious pattern seems strongly correlated with a simple decision of Satoshi’s to have Bitcoin mining rewards halve every 4 years.

Shortly after these halving events we’ve regularly seen the market repeat a structure where Bitcoin’s price shoots up, driving mania and euphoria among all the coins and tokens in the space, before it eventually dies down dragging everything with it, then slowly climbs back up over the next couple of years, and the cycle repeats itself.

Each cycle’s had a different crowdfunding and token release mechanism drive the mania:

13-14 - Bitcoin Forks (ie. clones of Bitcoin)

17-18 - Ethereum ICOs (ie. new tokens released on Ethereum)

21-22 - NFTs (non-fungible token releases)

25-26 - yet to be decided?

Although these periods of mania and market cycles have come and gone, with token valuations both rising and falling, the technological growth in the space has kept marching onwards and growing from strength to strength.

Hundreds of thousands of coins and tokens have come and gone, but Bitcoin has continued it’s slow and steady march upward, with continuous development around it and in the space, and now it finally hit this key $100k price milestone.

The Present

The 4th major mania cycle got under way this year some 6 months or so after the 4th halving, just like clockwork.

We needed a catalyst and that catalyst was Trump being re-elected as president, and surrounding himself with pro-crypto people. The market patterns are remarkably similar to what’s come before, and this catalyst was just the push we neeeded for Bitcoin to hit $100k!

It’s been an incredible year for Bitcoin just as I predicted in my post earlier this year when Bitcoin’s price ATH was hit after the Bitcoin ETFs were launched.

Assuming we are presently in the 4th major mania cycle in crypto, and assuming that the market structures somewhat repeat themselves like before, I anticipate a lot of excitement up until around Q3 next year.

What could this mean for Bitcoin and Crypto prices overall?

Well, Plan B the creator of the famous stock-to-flow model for BTC’s price and one of the most bullish people in the space, accurately predicted we’d hit $100k BTC this year and he now predicts $250k as a minimum next year.

To me $250k doesn’t seem unrealistic given how these cycles have played out and the exponential nature of Bitcoin and crypto prices. I’m not sure if we do hit that milestone and I personally don’t think we’ll get anywhere close to $500k in 2025, but I personally think we could see between $200k-$300k as the upper bound this cycle.

If BTC does indeed reach $250k this cycle then it’s market capitalisation would surpass every company in the world, as it would hit around a $5tn market-cap, and the only challenger left for Bitcoin’s absolute dominance would be Gold at $18.5tn.

Moreover, assuming the cycle trend does indeed continue then we’ll likely see mania-fuelled growth in all the other tokens as well.

The crypto industry is at around $3.5tn today. If BTC alone jumps to $250k and gets to $5tn, then assuming BTC keeps it’s 50%-60% dominance of the entire market, we’ll likely get close to $8tn-$10tn for the entire crypto space!

Importantly, that would generate a huge price jump for many other tokens too, with the likes of ETH, SOL and other major tokens growing at least double from here.

During these cycles of mania, all the more successful tokens and coins tend to outperform BTC. However, as soon as the cycle ends, they also drop harder and faster than BTC. So it can be a tough game to play to ensure that you outperform BTC over the long-run.

In my experience the exuberrance always lasts longer than you can imagine, but also comes to an immediate end and drops off more sharply too. In that very moment it appears just like normal price drawdown, but instead of climbing back up, prices continue to trend downwards after that until the cycle begins again.

For now though, it’s great to surf this present wave of excitement. Let’s see just how high BTC price can go and take the market up with it, and if it will indeed keep going until Q3 next year.

The Future

Bitcoin’s hit the $100k mark, and according to the latest a16z “State of Crypto Report 2024” report we’re now at around 600m global crypto users worldwide, that’s around 7% of the world who own or have used crypto.

The interesting thing about exponential technologies with strong network effects, like Bitcoin and crypto, is that they tend to grow faster over time, not slower!

Just think of the Internet itself, it took a good while to be understood and get mainstream use, but once it did, it took over everything. In the 90s being on the Internet was a more niche and nerdy pursuit. However, today, the unusual people are those who don’t make use of the Internet on a regular basis.

So if it’s taken 15 years to get to 7% of the population into crypto, I tend to believe it’ll be approximately half the time to get to 14% - that would be around 1.2bn people. And what happens when more people adopt Bitcoin? It's price goes up!

Adam Back, one of the oldest and most prolific Bitcoiners seems to agree. In a recent X post he quoted Hal Finney, one of the early Bitcoiners (and even a potential candidate for the real Satoshi), in saying that adoption and hence growth in price could move faster now rather than slower.

We have huge buyers like Microstrategy who already own 2% of all BTC, while the Bitcoin ETFs hold more than 1M of all BTC (4.5%). Plus with the chance of the USA building its own strategic Bitcoin Reserve (as Senator Lummis is pushing), we might see a rush for other huge companies and nation states to buy up BTC too.

So, my prediction?

I think 1 BTC will hit $1m even faster than we can imagine. BTC did it’s last 10x over 7 years from 2017-2024. My prediction now is that BTC hits the next 10x and reaches $1m in the next 5-7 years.

At this point BTC would have a market capitalisation of around $20tn, and the whole of the crypto market could be worth as much as $40tn.

Importantly, as a reminder, this is not financial advice and you should certainly do your own research. This is just my educated guess after having been in the space for almost a decade with my computing and economics background.

Future Innovation

This post has primarily focused on price, and I’ve barely touched on the vast innovations that have arisen thanks to Bitcoin and Crypto. The sheer technological and financial innovation and trial & error that we see regulary in the space is insane.

I used to think that crypto would become more “mature” over time, and less wild, but time has shown me the opposite to be true. The longer I’ve been in the space the more wacky it has become around the edges!

So if we experience all this exponential price action in the coming 5-7 years, then I predict we’ll have similar exponential innovations in the space, with the long-game being that the entire financial apparatus of the real world economy eventually becomes tokenised and moves on-chain.

In terms of wacky innovations, we’ve recently seen AI agents roaming around “crypto-twitter” and influencing people’s decisions. Truth Terminal started this, becoming the first AI agent multi-millionaire with the $GOAT memecoin.

But with new platforms like Virtuals, we’ve already got new AI influencers like aixbt, who’s in a matter of weeks become one of the most influential personalities in crypto (at some point soon I’ll write a longer post about this!).

AI’s having crypto and influencing human decisions is the first glimpses of the machine economy coming to life. And my prediction here is that crypto will be the main driver for the machine economy, and we’ll continue to see these types of technological innovations getting even *crazier* and more sci-fi.

Meanwhile Google’s just announced their first quantum computing chip “Willow” this past week. Quantum computing (like AI) used to be just a pipe dream, but Google are already busy turning it into a reality.

And assuming we get mainstream quantum computing in the next 5 years or so, it may just become the single largest technological leap of this century. Computations that take millions of years on top supercomputers today would be done in minutes!

Computers with this magnitude of processing power will affect all aspects of human life, in particular it’ll affect all of our current cryptography. Imagine if a computer that previously required a billion years to figure out your private keys could now do it in minutes?

Cryptography is everywhere, from protecting military equipment, to our conversations, to our passwords, to our databases, to of course our cryptocurrency networks. Quantum computers are a very real threat to our current systems. Bitcoin and other crypto networks will have to adapt to become truly “quantum resistant”.

So another big prediction of mine is that we’ll see some significant changes to major blockchains like Bitcoin, Ethereum, and Solana to make them survive potential quantum computer attacks and adapt to a future where quantum computing becomes available.

AI and quantum computing are the two largest technological leaps of our time from my perspective. However, I’ve just barely scratched the surface on the a myriad of exciting future innovations in this brief final section, undoubtedly many more yet uncertain innovations will sprout out from this rich space.

One thing seems certain though, Bitcoin will keep producing its blocks, and the importance (and therefore price) of Bitcoin and crypto will keep growing and growing.

Whenever you’re ready, these are the main ways I can help you:

FREE access beginners.tokenpage.xyz - Get a free video guide on how to set up your first wallet and buy your first crypto. Plus a 1-on-1 call with me for free, and $1,990+ of bonus course material.

VIP access beginners-vip.tokenpage.xyz - Get VIP access with me as I show you how to navigate crypto’s. Includes weekly Q&A calls where you can ask me anything, and our proprietary DeFi portfolio software.

Web3 software development at tokenpage.xyz - Get your Web3 products and ideas built out by us, we’ve built for the likes of Zeneca, Seedphrase, Creepz and more.