Crypto Portfolio 101 (2026 re-share)

The basics of building an investment portfolio in crypto

TLDR:

Even though crypto is full of financial opportunities, most newcomers lack basic risk management and will often lose more money than they make.

Long-term investors understand that you need to create an investment portfolio focused on both wealth creation and wealth preservation.

In traditional markets the 60:40 portfolio strategy where 60% is in stocks and 40% is in bonds does a good job of balancing wealth creation and preservation.

In crypto a 60:40 portfolio means keeping 60% in Bitcoin and other cryptos, with 40% in Stablecoins earning low-risk yield.

The crypto game is rigged in your favour. Bitcoin trends up over time, don’t let your lack of patience and short-term desires make you lose the game.

Bitcoin and the entire crypto market has been in a bear market since October, and only a couple of weeks ago we saw a sharp drop that brought BTC down 50% from its $126k ATH.

These moments are often when people begin to panic and sell. However if you’ve got a well thought out plan for your portfolio these can be some of the best moments for capital allocators.

So this week I decided to refer back to a post I made around this time last year on portfolio allocation and creating a portfolio in crypto.

You can find the original post from Feb 2025 here.

If this post resonates with you and you enjoy the content then please share it with a friend and get rewarded for doing so!

This blog goes out weekly to over 20,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Portfolio Management

Most people get into the crypto space just by chance, and it’s often because a friend of theirs told them about some money they made buying some cryptocurrency, which means most newcomers haven’t had any formal financial education.

Therefore they tend not to have any idea of risk management or understand their own personal risk tolerances. Which can be a real problem as they can make silly mistakes and end up losing all the money that they made along the way.

You’ve probably heard stories of people who’ve won a million dollars on the lottery and lost it all right? Well this story is also all too common in crypto too where people make significant gains but then “round-trip” all their money back down to zero.

The reason this usually happens is because “wealth creation” and “wealth preservation” are generally two different skillsets.

While making money requires taking risks, preserving money requires reducing risks, and it’s all about figuring out this careful balance between both that makes people into good long-term investors.

So this week I just wanted to run through a very basic 101 on portfolio management. These basic frameworks are actually how some of the wealthiest individuals and hedge funds on the planet think about the money they manage.

While this is by no means a complete course on portfolio management, it’ll at least give you more perspective on how to look at your money, so that you can avoid making big mistakes and be a savvy participant in the market.

What is a Portfolio

A “portfolio” is just a fancy term for a collection of investments owned by an investor, where an investor can be an individual person, or a company or fund.

For example, let’s say we have an individual called Alice who has a $200k home, along with $25k in her bank, and maybe another $25k in the stock market. This means that Alice’s total net worth is $250k and her material wealth can be visualised as a pie-chart like this.

We can then take a peek further into Alice’s stocks and see that she’s put $15k into Apple stock, $5k into Meta, and $5k in Nvidia, so her stocks pie-chart looks like this:

You can see here that both Alice’s over-arching assets and her individual stocks are themselves portfolios since they are each collections of investments owned by Alice.

Most people will aim for some version of this with their own material wealth. Whether they are saving up to buy a house, or instead of stocks they’ve bought a car, a person’s overall portfolio will be generally similar.

A quick note here is that I’ve purposefully simplified Alice’s example without including things like a mortgage or a pension just to get the idea across clearly.

When looking at the portfolios above what we’re interested in here is not how Alice views her overall net worth but rather how she allocates her “stock market” portfolio, which is the riskier side of her net worth.

The reason for this is that it’s not recommended for anyone to have all their net-worth tied up in risky assets like the stock-market or crypto, so you should realistically only risk a portion of your total wealth on crypto that you can afford to lose.

Now, when allocating money in the traditional markets, big hedge funds that manage huge sums of money tend to have somewhat standard formats for their portfolios, and there’s one very common playbook in particular that we’ll look at first.

60:40 Traditional Portfolio

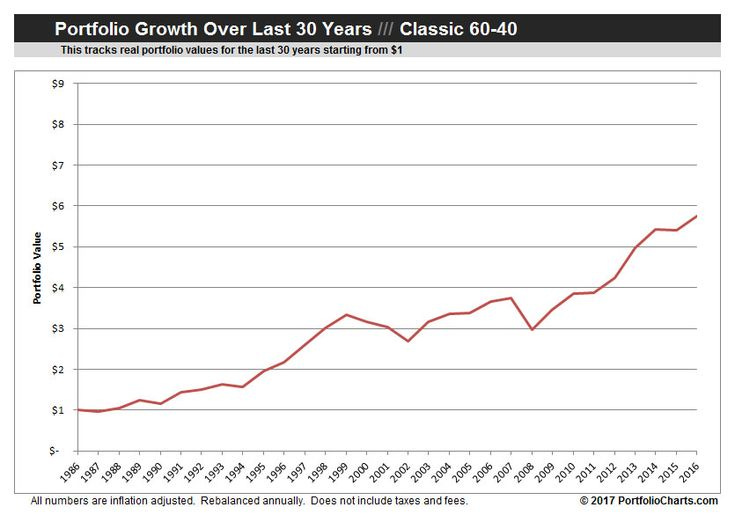

The 60:40 portfolio strategy is probably the most traditional investment strategy out there, where investors allocate 60% of their money into stocks and 40% into bonds.

So why is this such a standard strategy?

Well stocks are generally considered to be more high risk, but have historically provided higher returns over time than other asset classes.

Meanwhile, bonds are considered low risk investments as they are less volatile. Plus, while not all stocks pay dividends, nearly all bonds pay some interest and provide a steady stream of income.

This allocation mix has historically stricken a good balance between the upside from growth in the stock market when things are trending up, together with the stabilising effect of bonds when the market trends down.

When the market drops an investor can use the money from their bond allocation to buy up cheaper stocks. And similarly when the market shoots up, they can sell their overpriced stocks and buy up bonds to protect their profits.

This portfolio therefore has a healthy mix of what I mentioned earlier, namely “wealth creation” and “wealth preservation”.

Now, obviously this is not how every single investor allocates their portfolio, some are more risky while others are more risk-averse. Those on the riskier side may for example shift towards 80% stocks and 20% bonds, while those on the more risk-averse side may shift towards 20% stocks and 80% bonds.

There’s no right answer here, and we’ve simplified this conversation a lot by not even including real estate and commodities like oil and gold, which are also regular appearances in different portfolio management strategies.

Importantly though, this illustrates the basic understanding that successful investors tend to split their money between safer assets that stabilise their portfolio to preserve wealth, and riskier assets that are more volatile to grow wealth!

60:40 Crypto Portfolio

We’ve looked so far at how portfolios are generally constructed in traditional markets, so now let’s turn our attention to crypto markets.

Before we even get started we need to remember that crypto is far more volatile than pretty much any other market out there, which means you can see massive gains, but you can equally experience massive losses all in a very short amont of time!

So the first thing to take into account is that as I said at the top, you should not put all your eggs in one basket, especially the crypto basket, because it’s highly volatile and full of scammers and all your eggs could break!

Now assuming you’ve only put money you’re comfortable risking, the next thing to say about this very volatile market is that the rules of traditional markets don’t apply in quite the same way. Therefore, a more conservative portfolio allocation in crypto is generally recommended.

Some memecoins for example can go from being worth nothing, to tens of millions, and back to nothing, all in a single day! So putting all your money into crazy bets like these is the quickest way to lose it all.

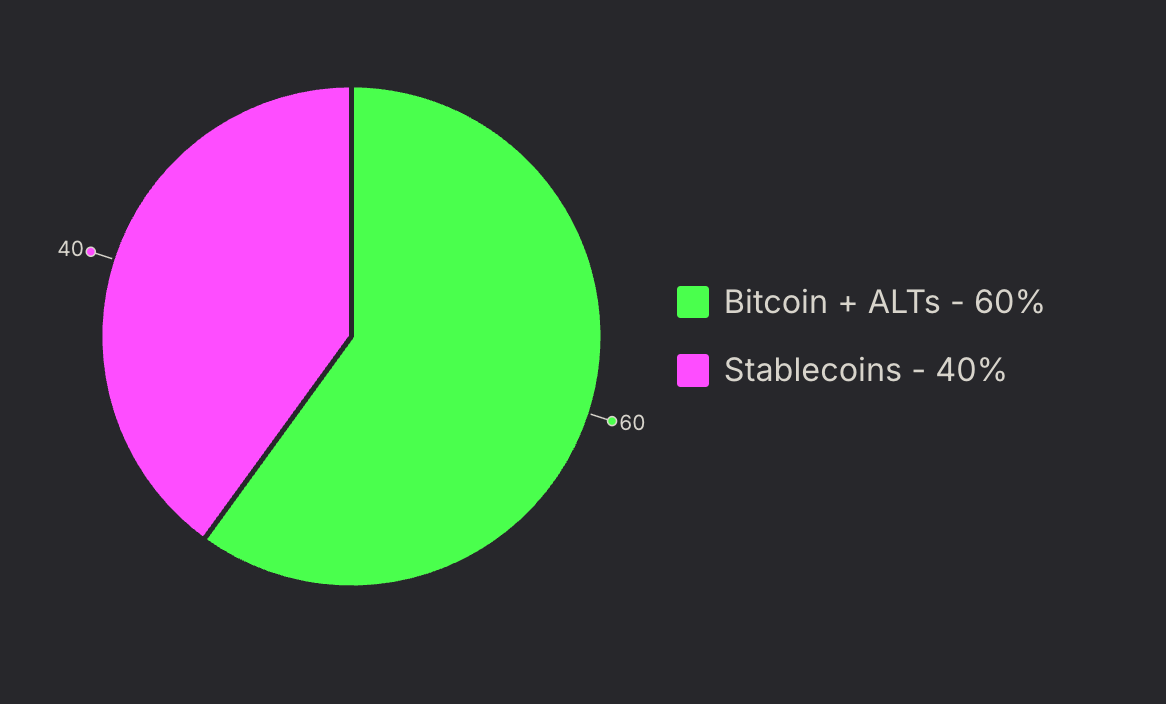

By following a 60:40 crypto portfolio you are replicating the most common strategy for a traditional stock and bond portfolio, but with crypto equivalents.

Here you would hold 60% in volatile crypto assets like Bitcoin and other Altcoins, and keep the remaining 40% in Stablecoins earning low-risk yield for you, perhaps with something like Aave or SparkFi.

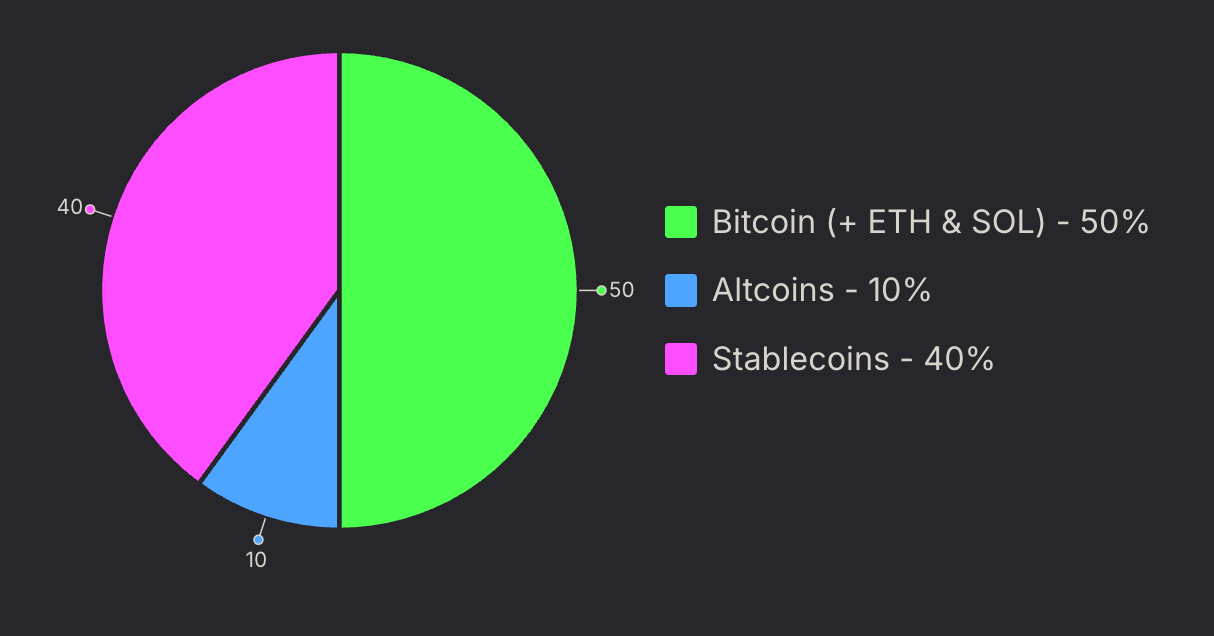

Then by stepping in one layer deeper we can break down the 60% allocation in Bitcoin and Altcoins even further.

Here prolific investors like Raoul Pal would suggest an 80:20 portfolio strategy, where its split such that 80% of your 60% (approximately 50% of your total) is in Bitcoin and perhaps other major coins like Ether and Solana, while at most 20% of your 60% (approximately 10% of your total) is in the rest.

The beauty of this approach is that ultimately Bitcoin is the most solid asset in crypto, as I’ve discussed in previous posts, and it still grows faster than many altcoins. In fact Bitcoin outperformed all but 6 of the top 50 cryptocurrencies in 2024! So by holding a large amount of BTC you’re well positioned to reap the rewards during bullish times.

However, in bull-markets you’ll often see some smaller coins shoot up 10x, 100x or even more! And so having at most 20% of your 60% bucket allocated to a few riskier coins is totally reasonable, considering that if you hit the jackpot with one of them you can truly multiply up your overall net worth.

Most importantly though the 40% you left in stablecoins on the side earning yield can be used to buy up the inevitable dip. Bitcoin has been known to drop 80% between the top and bottom of market cycles, so when the bottom eventually comes in you’ll have stablecoins ready to buy the blood.

An important consideration here though is that you shouldn’t be selling your stablecoins while prices are dropping!

In other words its ok for the 60:40 to become more like 40:60 as BTC and other cryptos fall, you should only begin to rebalance again when the bottom has come in otherwise you’re catching a “falling kinfe” and will get cut up along the way.

It’s obviously impossible to know when the real bottom has come, but an easy approximation is to look at fear & greed gauges and the 200-day moving-average for Bitcoin:

If BTC > 200 SMA and F&G > 30 or so, then its a bullish scenario and you can assume things are probably trending up so its ok to rebalance.

If BTC < 200 SMA for 2 weeks, then its bearish and you should just sit and wait to avoid burning your stablecoins by rebalancing into assets trending down.

These heuristics above do not perfectly define whether things are bullish or bearish, and over time you’ll likely settle on your own ways to read the market, but they give you a great place to start.

Assuming you keep to a 60:40 portfolio, or something similar catered for your own risk-profile, the assymetry of this type of portfolio means that over time you’ll almost certainly win. Most of the difficulty lies in keeping to the plan and not deviating from it in moments of peak market euphoria or depression.

Risk Mangement

When it comes to risk everyone in this market is an individual with different risk tolerances and conviction levels.

If you’re holding onto a coin and you don’t have enough conviction in it, then if it drops 90%, you’ll probably sell at a 90% loss!

However, if you have strong conviction and truly believe that it’s going to do well, you can rebalance using money from the less risky side of your portfolio, and when it comes back up you’ll make even bigger gains!

This is partly why it’s so important to have stablecoins in your portfolio, because they can give the breathing room to buy up riskier assets when the market dips.

Yet, if you’ve lost faith in one of the assets your holding, don’t be afraid to simply accept the loss. If it’s just a memecoin of some passing trend, then it’s probably best to cut your losses rather than double down on them and lose even more money.

Moreover, individuals have different amounts of total wealth. If you’re 18 and all the money in the world you have is just $1,000, then you can afford to play the risky game of putting 100% of your portfolio in the crypto memecoin casino, as you’re young and if you lose it all you’ll make it back quick enough.

However, if you’re a parent who’s got $100k in the market, you have both more money and more responsibility, so you have a lot more to lose. Therefore you should probably be more risk averse and follow something like an 80:20 portfolio strategy.

Imagine having $100k portfolio and putting $90k on a memecoin that goes to 0, you’re now back down to $10k and need to get 10x just to get back to where you started!

There’s generally a simple rule in investing, which is that if you’re waking up in the middle of the night sweating or in the morning scared about the price of a given investment, then you’re taking too much risk.

Make sure you’ve balanced your portfolio in such a way that you can get some sleep. Don’t risk your mental health for money, it’s not worth it.

The Game is Rigged in your Favour

As a final note, this game is rigged in your favour.

There’s no hard and fast rule for how to run your portfolio, and everyone is different with different risk tolerances.

However history has shown that Bitcoin will generally trend up, while most coins hit their all-time-high in one crypto cycle and never get past it again (even ETH and SOL have struggled on this front).

Satoshi Nakamoto made an incredible innovation called Bitcoin that just seems to keep going up in value over time. It’s the gift that keeps on giving, and you can just keep buying more and more with a solid DCA strategy.

Sure there’s a lot of fun that can be had in taking bet on smaller coins, but don’t overdo it.

The game is rigged in your favour, you just need to survive long enough and your wealth will go up as Bitcoin gets wider and wider adoption. We’re still in the early innings of crypto, the total market cap is still less than that of Apple’s market cap! Bitcoin and crypto will inevitably grow further and further.

Be patient, be smart, and don’t let your short term desires make you lose the game.

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yieldseeker!

Love Web3 & AI insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!