Dollar Cost Averaging into Bitcoin

"Stack Sats" - The best low-effort long-term strategy in crypto

TLDR:

Passive observers are those who want to invest in crypto without being active market participants, and therefore are best served by dollar cost averaging (DCA).

DCA’ing into Bitcoin means simply buying Bitcoin at a regular amount in $USD at a regular interval, eg. buying $100 of BTC every month.

DCA’ing is a superior strategy because you never risk too much, you get the best average BTC price, and will still outperform most traders in the long-run.

DCA’ing into BTC avoids the trap of round-tripping profits on other coins as BTC is the most resilient: it survives every bear-market and comes back stronger.

I often get asked by people who are not full-time in crypto for advice on what they should buy.

The truth is that if you’re not going to dedicate time to crypto then the best long-term proven strategy is to dollar cost average (DCA) into Bitcoin.

Therefore this week’s post is all about DCA’ing so that the next time someone asks me what to buy I can simply send them this post. And if you agree with what I’ve written below then when someone asks you, you can also send this post.

Why did I write this post?

As Bitcoin’s price floats around $70,000 near it’s current all time high and the Bitcoin Halving approaches in about 8 days, there’s a lot of growing interest in crypto.

Rising crypto prices act as growth mechanism attracting more and more people into the space, which is great. Some of these people become deeply interested and decide to stick around, yet the majority only become passive observers.

This post is intended for that majority of passive observers!

These people often want to dip their toes in and get involved with investing in crypto but aren’t looking to become a full-time Web3 participant and spend all their hours learning about different coins, projects and go down the myriad of rabbit holes.

When starting, the passive observer often gets overly excited and buys a bunch of random shitcoins that their friend has told them to, only to find themselves getting burned and losing most of the money they invested.

This is unfortunately a very common path for new people in crypto.

If you don’t want to go through that though and your only goal is to just passively invest and make a profit then you should probably be “dollar cost averaging”.

Dollar Cost Averaging

Dollar cost averaging (DCA) is one of the simplest investment strategies out there and it’s basically where you invest into Bitcoin (or any other asset) at a regular amount at a regular interval.

Most people receive their salary once a month, so usually people will take a regular amount that they are comfortable with, say $100 per month, and put that away to save. To DCA into Bitcoin would be to then take that $100 every month and buy Bitcoin with it, although you can also do it daily, weekly or bi-weekly, whatever you prefer.

Doing this religiously in regular intervals, and increasing that $100 amount further on pay rises, is such a simple yet elegant strategy. It removes all the risk of putting in more money than you can afford to lose and you buy at the average Bitcoin price over time.

DCA’ing into Bitcoin is so simple in fact that most people just don’t believe it can work and will decide not to do it, and instead try something much more complicated that’ll probably lose them money.

Why is DCA a superior strategy

Now you could simply put that $100 in a savings account every month, which is what most people do. However all government money is by definition inflationary, as a small % of inflation is mandated by all Central Banks globally, meaning that over time that same $100 you’ve saved will buy you less.

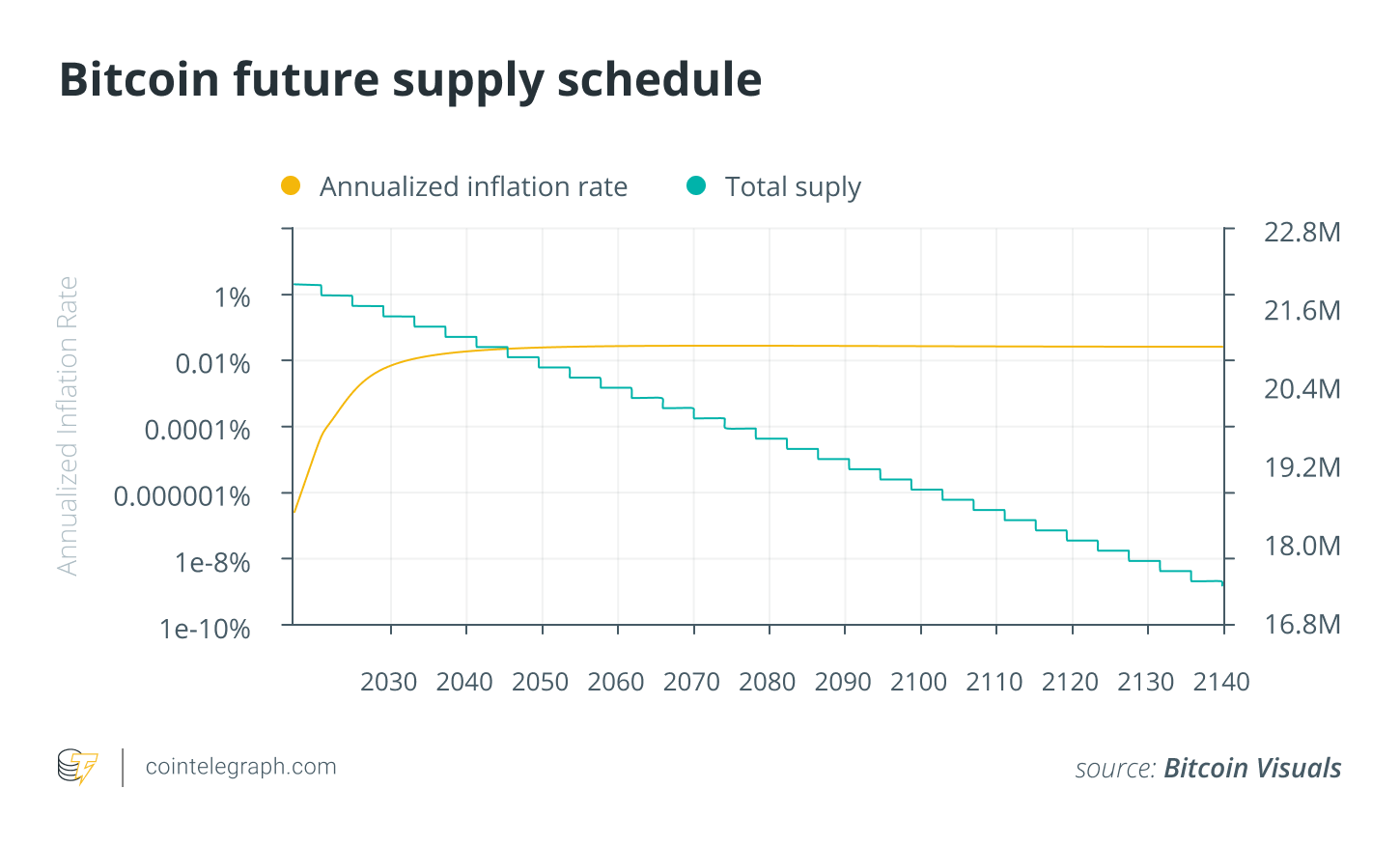

Meanwhile since Bitcoin has a fixed total supply of 21m coins in total, it tends to be deflationary in the long-run. So the very same $100 of Bitcoin you buy today will be worth more over a long enough time window as the price of Bitcoin will tend to go up.

To put this simply Bitcoin is a way to fight against inflation because even though the price is volatile, the fact it has a fixed supply means that as more and more people get into Bitcoin the price trends up.

The next question then is why not just buy as much Bitcoin as possible immediately today?

Well, since Bitcoin’s price is highly volatile, if you buy upfront you might be buying at a local top and end up paying a higher price for the Bitcoin than you need to. By buying a set $USD amount every month you’ll end up paying the average price over the months and years and tend to get a better price. We can illustrate this below.

On the website dcabtc.com you can estimate the returns on different DCA strategies. By default we can see here the results of DCA’ing $10 per week over 3 years would give you a 112.7% on a total of $1570 invested, totalling $3339.

Meanwhille if you had just bought $1570 exactly 3 years ago, rather than DCA’ing $10 weekly, then you would have only made an approximately 20% gain, rather than the 112.7% gain shown above and have approximately $1890 today, far less than $3339.

Importantly, as I discussed in the previous section, if you are DCA’ing a regular amount that doesn’t make a big financial difference to you, then you’ll be able to keep this going for a much longer time. So not only will you get the best average price, but you’ll never be risking too much and you’ll sleep easily as the price fluctuates.

DCA’ing into Bitcoin is so encouraged by Bitcoiners that they even have a term for it called “stacking sats”. Since the smallest divisible unit of a Bitcoin is called a satoshi, or “sat”, if you are regularly DCA’ing then you are regularly stacking up those sats!

Bitcoin is built differently

Most people when I tell them to DCA into Bitcoin will either feel like they’ve missed the boat or like it’s too simplistic a strategy and instead insist that they should buy a bunch of other coins.

As a passive observer this is generally a mistake. The reason being that while many coins can outperform Bitcoin’s price within a bull market, in a bear market they will also lose a lot more and they generally won’t come back to their previous highs.

It’s very common for people to “round-trip” their profits as they buy a coin, see the price shoot up, and then keep holding it even as the bear market kicks in and they see the coin draw down more than Bitcoin. They’ll hold onto that coin hoping that it’ll come back, yet in the end it never does and they lose out versus just holding Bitcoin.

Bitcoin is built differently.

For a number of reasons there’s just more fundamental value attributed to Bitcoin that I can discuss in a future post. Bitcoin’s price tends to be the main driving force of the market both up and down, and despite the fact it does not offer the same % returns as other coins, it will continuously trend upwards even when other coins die out.

Therefore there’s no safer haven than Bitcoin for the passive observer who wants to be invested in crypto but isn’t going to keep paying regular attention to the market.

Although I mainly recommend Bitcoin, today you could say that Ethereum has become a pretty good safe-haven too, and Solana may be getting there. However, I’d still only suggest passive investors to primarily DCA into Bitcoin and if they really want to then they can DCA into Ethereum in second place.

Importantly both of these have a fixed or decreasing supply, which SOL doesn’t. Bitcoin will only ever have 21m coins in circulation and Ethereum is currently actively burning ETH within it’s algorithm so the supply is actively decreasing. This is an essential piece for long-term value accrual - although not enough on it’s own.

Playing Cycles as an active Market Participant

This post has been predominantly directed for the passive observer, but if you are looking to be more than that and take on a full-time role as an active market participant, then DCA'ing into Bitcoin is still a good strategy but perhaps you can do better by taking on a bit more risk.

As mentioned above, most coins and NFTs tend to lose against Bitcoin in the long-run, however in the height of a bull market many can outperform Bitcoin. There’s a still a noticeable challenge of picking the right coins and NFTs in the cycle, yet it can be a smart idea to risk a small % of your capital on the current cycle’s narratives.

For example it’s clear that right now there’s a lot of money to be made in things related to AI, memecoins and Bitcoin’s Ordinals and Runes, so risking a certain amount of money in these narratives can give you outsized returns versus just Bitcoin.

However, the big problem here is that most people don’t understand crypto’s 4 year cycles and will likely round-trip those profits as mentioned before.

So if you are looking to be an active market participant then just make sure to sell your position out of them way before the cycle ends as it’s impossible to predict exactly when it’ll end, but when it does those tokens are not coming back.

Now it’s important to end this post saying that this advice is just my personal perspective as someone who’s been involved and observed the market for 8+ years.

As people often say in crypto, all of this is NFA (not financial advice) and make sure to DYOR (do your own research). In other words take my opinion as just another in a sea of online content, don’t take it to be the gospel truth as I’m sure you won’t. Make sure to read plenty and get well informed yourself before you invest your own money!