Yield Up

Track top stablecoin yields in DeFi

TLDR:

Yield Up is a super simple and cool little app that highlights some of the best yields available in DeFi for the top stablecoins.

You can browse the different vault options for the major stablecoins by selecting the coins, networks and protocol options available.

They also offer a little Yield Calculator that annualises the APY for the top protocol on any given coin and network.

Yield Up is a super cool little tool that I found recently while working on Yield Seeker, our AI Agent generating stablecoin yield.

So this week I wanted to keep it brief and take a quick look at how this tool does a great job of keeping you on top of some of the best DeFi stablecoin yields out there.

If this post resonates with you and you enjoyed the content then please share it with friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Watch the Video version of this Post

Yield Up

In working on Yield Seeker, our AI Agent that earns you stablecoin yield effortlessly, I recently came across yieldup.ai, which is a great tool for tracking top stablecoin yields that I wanted to run through today.

This tool is super simple to use and understand, so I’ll keep this week’s post very brief.

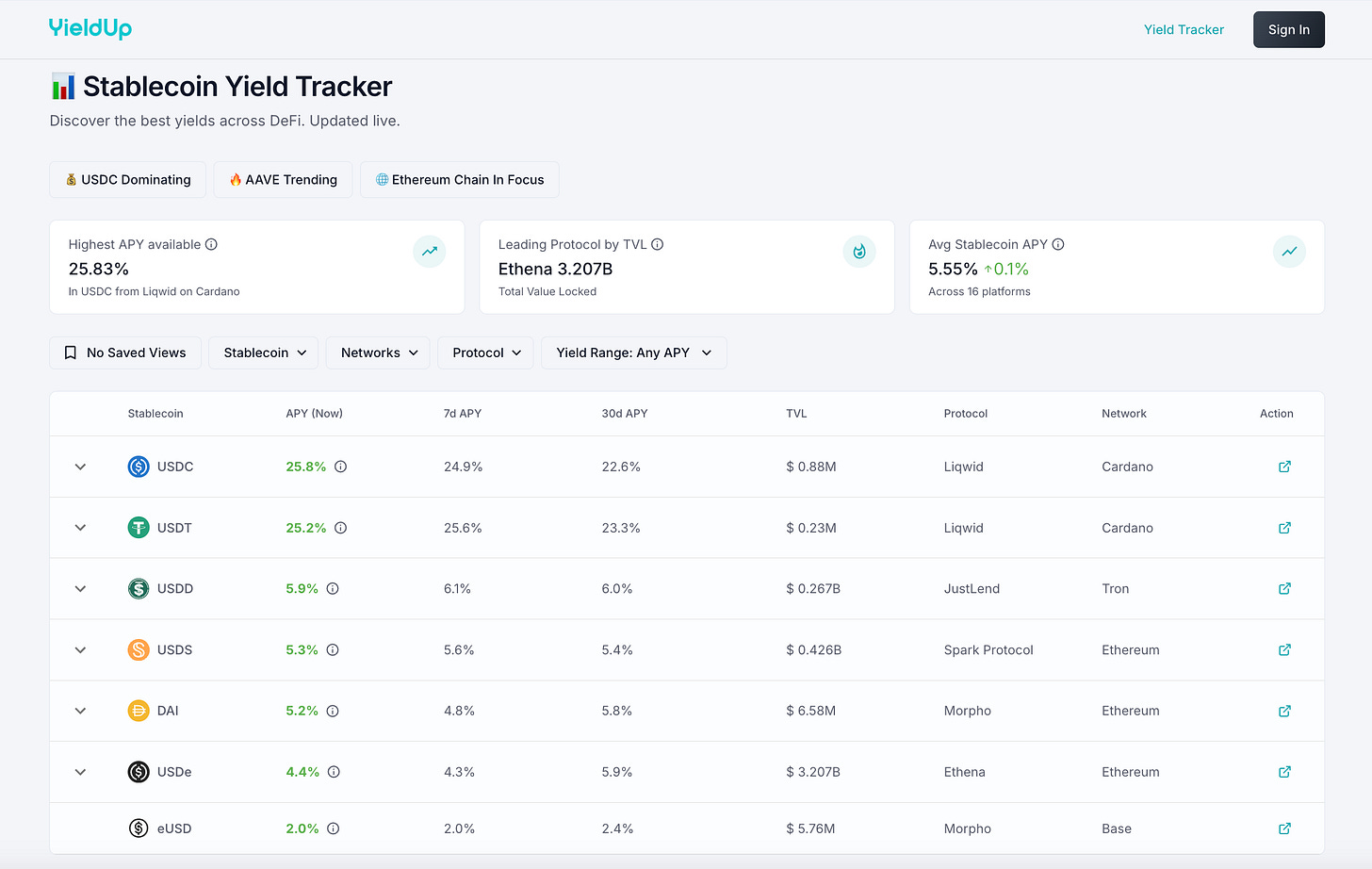

So Yield Up describes itself as a “Stablecoin Yield Tracker”, and does exactly what it says on the tin as it shows some of the top possible yields for any given stablecoin in a very concise and easy to understand format.

As you can see above, the table on their site splits out the largest USD stablecoins and shows the top APY that the site can find for each one.

For example for USDC and USDT there’s a protocol called Liqwid on the Cardano network that’s supposedly giving around 25.8% and 25.2% respectively, however both of these Liqwid vaults have low TVLs with $0.88M and $0.23M respectively suggesting they are higher risk.

By comparison the top USDS and USDe vaults are getting a much more modest 5.6% and 4.3% on Spark and Ethena respectively, but have much higher TVLs measured in the billions and are on the Ethereum network suggesting they are much lower risk.

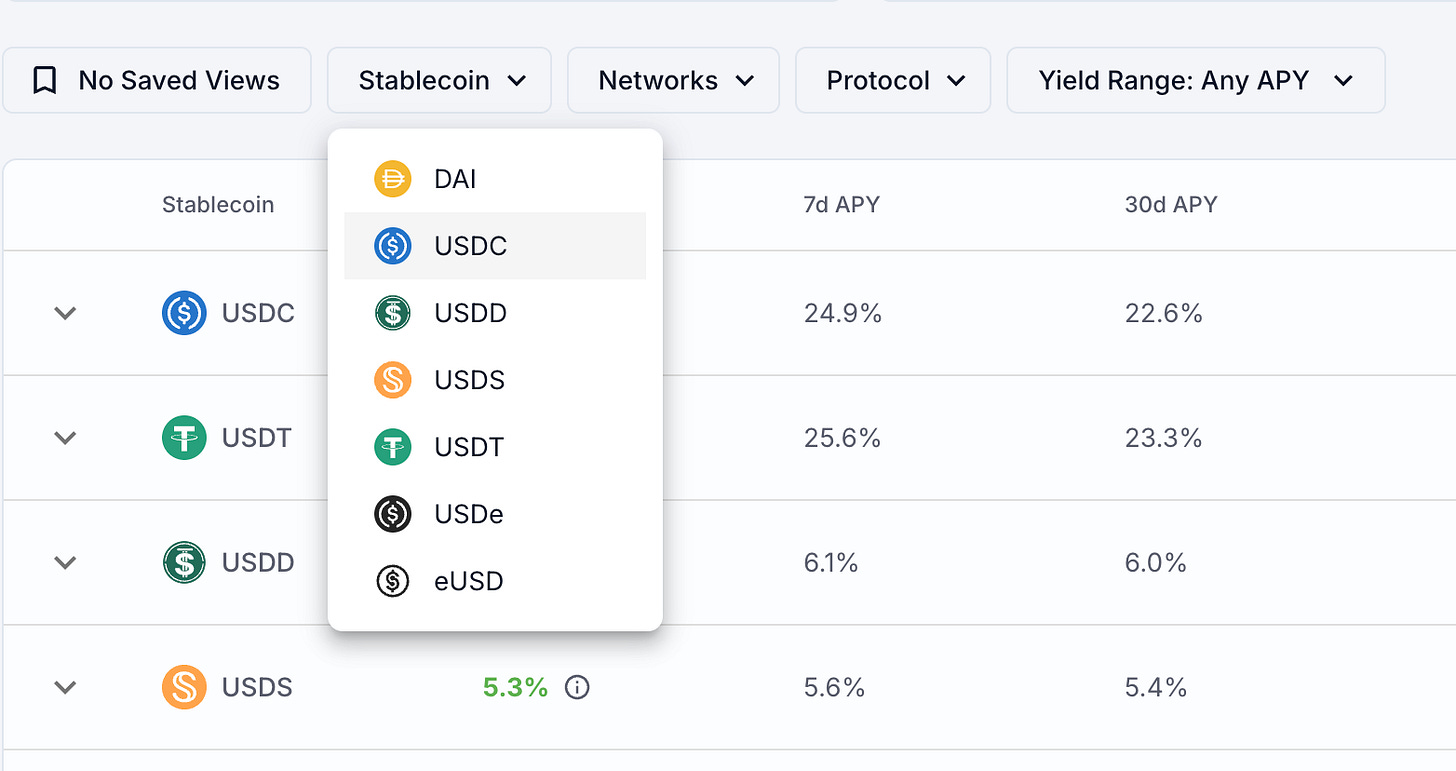

Browsing Yields

Yield up’s interface is really easy to browse around. For example if we want to see what’s available on USDC on Base, then we we can just select the coin and network at the top as such:

Then if you hit the drop down you can see a little list of USDC vaults available on Base that include Morpho, Aave and Compound vaults.

Yield Seeker currently only supports USDC on Base yet it already supports a lot more vaults than Yield Up shows and has been giving returns as high as 14% recently as it continuously finds the best vaults for you.

However, Yield Seeker is not cross-chain yet or cross-asset so it cannot get the same returns as Liqwid is offering on the Cardano network for example.

Importantly though having a tool like Yield Up gives you a great baseline to see what people can earn with their stablecoins out there in DeFi right now and makes you appreciate more clearly the work and effort involved with trying to track and optimise your yield in real time.

Yield Up says all its data comes from DeFi Llama, which is easily one of the best resources for DeFi data and we use it in our daily newsletter A Fox’s DeFi Daily 🦊🗞️. If you want a deeper dive on DeFi Llama then I recommend my previous post below where I ran though the state of DeFi earlier this year.

Yield Calculator

Yield Up also offers a simple yet cool calculator that allows you to get an estimated yearly earnings on your stablecoins, calculating based on 3 different variables: (1) Token; (2) Network; (3) Amount.

So if for example we have $10,000 of USDC on Base right now, then the best vault they are aware of is on Morpho and will give 6.2% APY, which would earn you approximately $620 over the year if it remained the same as shown below.

This is a pretty simple yet neat feature as you can quickly see the best returns available for your given token on the given network.

And that’s pretty much the crux of how Yield Up works!

I said at the start I’d keep it brief this week because this tool is as clean and simple as it gets. Yet I really liked what it offers and it sets a great baseline comparison for the sort of yields we’ve been getting with Yield Seeker.

If you want to see more small tools like Yield Up that I’ve discussed before then check out:

Gas.zip to see how you can send gas for free to any Ethereum L2.

Gas Buddy to track the latest prices on the Ethereum network

SmolRefuel to get your tokens out of addresses with 0 ETH.

And Pocket Universe so you never sign a dodgy Ethereum transaction again!

I promise that I’ll keep finding these little gems and sharing them with you all!

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!