State of DeFi in Q2 2025

Analysing the state of DeFi in Q2 2025 with DeFi Llama

TLDR:

DeFi is a rapidly growing segment of Web3. The best place to keep up with it is DeFi Llama which aggregates all the DeFi data out there.

This post gives a summary of the current state of DeFi in Q2 2025. I did a similar post last year in Q1 2024, today’s is a refresh of how the market’s changed since.

DeFi TVL is still only 3.3% of the total $2.8tn crypto market, while stablecoins are at 8.3%. Clearly there’s a lot of room for DeFi to grow.

DeFi Llama is a treasure trove of data. Plus it even has great tools like for swapping, checking your portfolio, streaming payments, and a DeFi news site.

In early 2024 I made a post looking through DeFi Llama and analysing the state of DeFi at that time. Today I wanted to look through the state of DeFi to see how things have evolved.

For aggregated data in DeFi the best place to go is DeFi Llama, so this post is as much an analysis on the current state of DeFi as it is showing what DeFi Llama can do.

If this post resonates with you and you want to continue the conversation then jump in here: beginners.tokenpage.xyz.

This newsletter goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Watch the Video version of this Post

DeFi

Decentralised Finance (DeFi) is used as a comparison to Traditional Finance (TradFi) and is already a huge segment of Web3 that’s growing exponentially. DeFi’s goal is strongly aligned with a term we hear a lot in crypto of “banking the unbanked”.

The promise of global financial services without the need for banks is a lofty goal, and where I personally think a lot of the magic of Web3 comes from.

Since things are moving so fast it’s incredibly hard to keep up with everything happening in DeFi with all the new chains, protocols, yield opportunities, airdrops, and more - and that’s where DeFi Llama comes in!

DeFi Llama, aggregates all this different data into a single place, making it easier for people to track everything that’s going on. It really is a one-stop shop for all things DeFi and by far the best tool out there today.

I wrote a post last year analysing the state of DeFi in Q1 2024 with the help of DeFi Llama that you can see here below:

Today we’ll go through and analyse all the same points as last time, with an updated look now in Q2 2025 to see how things have evolved over the past year.

Overview of DeFi

Opening up DeFi Llama you get a great overview of the DeFi space.

We can note a few key things immediately:

Total Value Locked (TVL) at $94.6bn - Between all the DeFi protocols out there we have a lot of money locked in DeFi. But considering the entire crypto space is around $2.8tn right now, this is still only around 3.3% so there’s plenty of space to grow. Since last year TVL has grown by around 1.5x, as it was around $65.4bn, but as a % of the crypto space it’s remained quite stable since it represented 3.5%.

Historical graph starting in June 2018 - 2018 is less than 7 years ago, this shows just how nascent DeFi is. Yet, we had an even higher DeFi TVL peak of $176bn in November 2021. We’re still waiting for TVL to hit that peak again.

Aave and Lido TVL at $35.6bn - Over 37% of todays DeFi TVL is ETH staked in Aave and Lido! That shows just how dominant both Aave and Lido are, last year Lido was leading the charge but Aave has since taken over. Also most of DeFi is happening in Ethereum as it continues to be the most significant chain.

Stablecoins at $236bn - We can see Stablecoins they are at over 8.3% of the $2.8tn crypto market, and more than double the full amount staked in DeFi. Stablecoins continues to outpace DeFi TVL, showing how they’ve hit real product market fit.

There’s so much more data in DeFi Llama that it’s hard to even know where to start. But let’s explore some of these categories further with a few bullet points each.

Top Chains

Ethereum is still by far the most dominant player in DeFi with 52% of TVL, however that’s a reduction from last year where it represented 58.3%. Solana’s become a strong second contender with 8% of TVL yet it’s still more than 6x smaller than Ethereum.

Solana and BSC have replaced Tron as 2nd and 3rd chains respectively, pushing Tron from 2nd to 4th. All 3 of these have active addresses that far surpass Ethereum, with Solana alone having over 4.3m addresses and Ethereum only 442k.

Ethereum has by far the most DeFi protocols on it, with 1320+ protocols, up from 960+ protocols last year.

Bitcoin has 58 recorded DeFi protocols, up from 12 protocols last year. When considering it was never intended for smart contracts, it does impressively have over 4% of all DeFi TVL with $3.8bn.

Top Protocols

Aave is unsurprisingly the top Lending protocol in several EVM chains like Ethereum, Sonic, Avalanche and Arbitrum, however Morpho dominates on Base.

Most chains tend to have their own Lending and Stablecoin projects. Restaking is also growing with many major chains having a protocol, the biggest player here Eigen Layer but Pell Network appears on the widest variety of chains.

Stargate is the dominant cross-chain protocol in TVL across several chains.

Protocols on Ethereum dominate among their peers by the sheer volume that Ethereum DeFi commands.

Protocol Categories

Lending, Bridges and Liquid Staking all have the largest TVLs, with the difference between them being relatively small between $42bn - $37bn. Last year Liquid Staking was ahead by a huge margin but that’s been reduced and Lending and Bridges have overtaken.

Aave represents 44% of all Lending, while Lido represents 43% of all Liquid Staking, these are by far the two largest protocols by TVL in the whole of DeFi.

DEXs hold a lot less TVL at around $18bn and the leaders are Uniswap, Curve and PancakeSwap, each operating on over 9+ EVM chains. Even with the lower TVL this is the most lucrative segment with $5.9m made in fees over the past 24h. Its no surprise then that there are over 1600 DEX protocols in total!

Bridges category is dominated by wrapped Bitcoin equivalents like WBTC and Binance Bitcoin.

Foundations and Treasuries

Ethereum Foundation holds a little over half the Treasury size that it did 1 year ago, it’s seen a significant drop. Mantle meanwhile have a huge Treasury but it’s mostly denominated in their own token.

Several Ethereum related projects also dominate by total treasury eg. Aave, ENS, Lido, Sky. Yet they too are mostly holding their own token.

Excluding own token the rankings are more mixed. But very few treasuries are mainly in stablecoins so they are mostly subject to market volatility.

Yields

Lido is where most park their cash for yield, probably because most people are confident in ETH as a long-term place to store value, and Lido dominates its liquid staking. Other liquid staking protocols on ETH also dominate the charts like ether.fi and Binance staked ETH.

JitoSOL is giving a surprisingly high yield of 7.75% on staked SOL outperforming all the other top yield offerings. Marinade and Jupiter offer even higher APYs for SOL though around the 9% mark.

Sky Lending is the top low-risk stablecoin option by TVL, with over $2.5bn in SUSDS stablecoins earning a 4.5% return.

There are over 15,000 liquidity pools being tracked by DeFi Llama across 468 protocols on 104 chains.

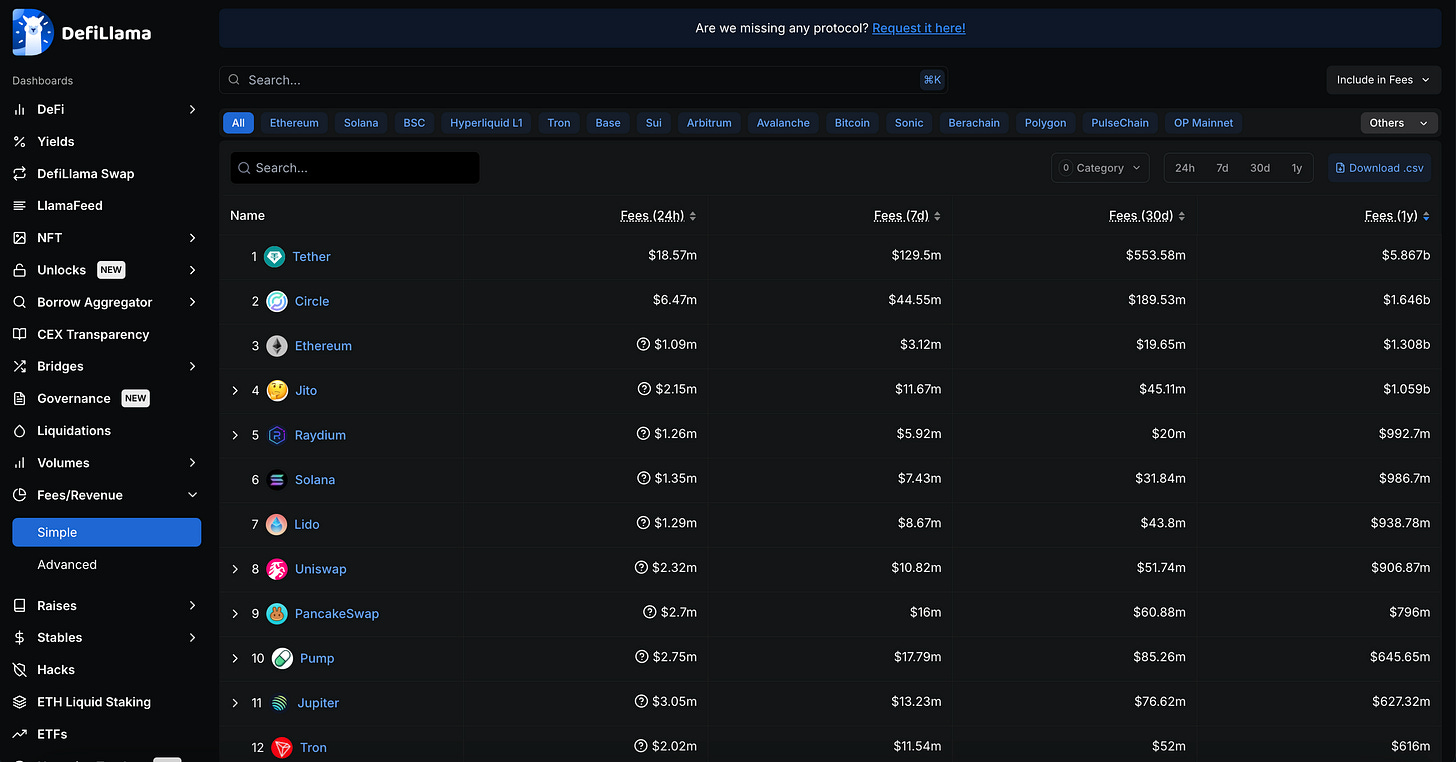

Fees

Tether and Circle’s respective stablecoins are by far the largest fee generating businesses in crypto. Tether alone has generated over $5.8bn in the past year!

Gas on Ethereum is still one of the largest ways that fees get spent when looking across the past year, and the total fees are not too far from Circle with $1.3bn and $1.6bn respectively. However, fees on Ethereum are dropping fast, with Ethereum over the past 30 days not even appearing in the top 15. Ethereum based protocols Lido and Uniswap continue to earn high fees though.

Solana’s fee ecosystem has grown the most over the past year with Jito, Raydium, and Pump.fun all raking in huge fees. This is likely to be driven predominantly by the huge rise of memecoins on Solana.

Bitcoin fees have dropped by about half since last year, and with the growth of many other competitors on the fee market they’ve dropped from 2nd in the chart to 14th.

Stablecoins

Stablecoin total market cap has almost doubled up from $136bn last year to $235bn now. However USDT and USDC still dominate with 62% and 26% respectively, for a total of 88% of the entire market.

The biggest proportionate growth has been Ethena’s USDe, as they didn’t exist 1 year ago and now represent the 3rd largest stablecoin with 2% of the market.

Sky created the USDS token, fragmenting the dominance they had with DAI. However merging both DAI and USDS market caps they have 3.5% of the total market share, essentially still being the 3rd largest player.

USDT, USDC, DAI/USDS, and USDe together account for around 93% of the total stablecoin market with over $220bn in market capitalisation.

Blackrock represent a new entry here with their BUIDL fund, showing that TradFi also want a piece of this market.

Raises

We’ve reached over $113bn worth of investment raised in DeFi, with 6129 funding rounds captures by DeFi Llama in total.

Investments were highest in late 2021 to early 2022, but they seem to be growing fast now reaching over $3.5bn last month alone.

FTX and Celsius were some of the largest raises with $900m and $750m respectively, and also some of the largest failures in the space. The same could be argued for EOS with it’s $4bn raise that barely delivered.

Hacks

Over $11.2bn has been hacked in DeFi, with 25% coming from bridges and the rest from other DeFi companies and protocols.

ByBit’s hack this February was the single largest hack in crypto history with over $1.4bn lost. While the second largest hack was on the Ronin network for $624m back in 2022.

North Korean group Lazarus were responsible for both of these hacks making them the single largest hacking group in the entirety of crypto.

Most of the largest hacks happened in the Ethereum ecosystem, probably because it’s where most of the liquidity is in DeFi.

Overview

On the whole though it’s clear that DeFi volumes are still predominantly dominated by Ethereum and its EVM ecosystem (with its many L2s), where DeFi originated.

We also saw that the Solana is playing catch up having grown massively this past year, and Bitcoin is surprisingly starting to grow its own DeFi ecosystem even though it’s not intended as a smart contract platform. The Tron ecosystem seems to have lost a lot of ground to others but it’s still a strong hub for Stablecoin activity.

As a final note, I’ve just scratched the surface on what DeFi Llama offers. Between it’s Llama Swap, Llama Pay, Llama Feed, and Llama University, DeFi Llama is a treasure trove of DeFi information, you can really lose hours just pouring through all this information.

Have fun hunting around all the different graphs and data, and let’s see what the future holds for DeFi!

Whenever you’re ready, these are the main ways I can help you:

FREE access beginners.tokenpage.xyz - Get yourself started in crypto, setting up your first wallet and buying your first crypto. Includes a 1-on-1 call with me for free, and $1,990+ of bonus course material.

VIP access beginners-vip.tokenpage.xyz - Learn to build real lasting wealth in crypto. Includes weekly Q&A calls where you can ask me anything, and our proprietary DeFi portfolio software.

Web3 software development at tokenpage.xyz - Get your Web3 products and ideas built out by us, we’ve built for the likes of Zeneca, Seedphrase, Creepz and more.