The Dollar Milkshake Theory

The US Dollar gets stronger in times of crisis

TLDR:

The Dollar Milkshake Theory is a theory created by financial strategist Brent Johnson back in 2010 to describe the US dollar’s central role in global liquidity.

It ultimately suggests that since the USD is considered the safest place to leave capital, in times of economic crises its global demand will grow.

The theory is interesting because it counterintuitively suggests that even if an economic crisis is created by the USA, the USD will still stand to benefit.

Brent suggests that when the time comes for an extreme crisis there’ll be a final showdown between the USD and hard assets like Gold (and perhaps Bitcoin).

If you’ve been in crypto long enough you’ll likely have heard about the Dollar Milkshake Theory but you may not know what it is. So with this week’s post I decided to dive into what it is, how it plays out in practice and how it ties into crypto.

If this post resonates with you and you enjoy the content then please share it with a friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Dollar Milkshake Theory

Spend enough time within the crypto space and you’ll eventually hear the term “Dollar Milkshake Theory” (DMT) thrown around, so today I decided to explain it as clearly and succinctly as possible and how it ties into crypto.

The theory was created by financial strategist Brent Johnson back in 2010 and ultimately suggests that global economic instability leads to a strengthening of the US dollar as investors seek safety in it, sucking up global liquidity and strengthening the US economy relative to other countries.

You can watch Brent describing the Dollar Milkshake Theory in the 21 minute video below or just carry on reading and you’ll get a faster and more succinct explanation.

When describing the DMT in his presentations Brent references a few movies, in particular the “milkshake” analogy in the name is a reference to the film “There Will Be Blood” where in one of the final scenes the oil tycoon Daniel Plainview demonstrates himself sucking up his competitors oil with his metaphorical straw.

In this scene Daniel suggests his straw is larger than everyone else’s and he’ll suck up the oil in all the fields with it so that only he can get the oil - this scene also gets a bit gruesome after so just be warned if you decide to watch it.

Extending the metaphor, in the Dollar Milkshake Theory the US dollar acts as this big straw sucking up this tasty milkshake that represents global liquidity drawing it away from other countries and assets.

This is especially true in moments of a global economic crisis as investors run to safety and end up buying more dollars meaning that both the USD and USA benefit from the crisis, even in cases where the USA may have caused the crisis in the first place!

The US dollar is able to do this because it benefits from “world reserve” status, in other words it serves as a global standard for international trade, pricing assets, settling debts, and storing value globally.

It’s held this “world reserve” status since the Bretton Woods system was put in place in 1944 after WW2 where all currencies were pegged against the USD and its managed to keep this status for some 80 years since, even as many other players have seeked to challenge its dominance and de-dollarise.

Inflation & Debt

Over these past 80 years central banks have continuously printed more money and debt driving both inflation up and growing global debts to levels never seen before.

I wrote earlier this year in Mrach about how worldwide debts are at unprecedented levels, and since I released that post the US debt alone has grown from $36tn to over $38tn - that’s some $2tn of additional debt in under 1 year!

This never ending cycle of growing global debt and inflation is an unsustainable cocktail, yet the DMT explains that even as the global financial system gets more stressed the USD will still get more demand due to its special place at the heart of the system.

In particular this global inflation path puts currencies in a race to the bottom with them all continuously inflating and devaluing. And since the USD sits right in the middle, when the USD experiences inflation other currencies are given the breathing room to inflate too, keeping the USD relatively strong against other currencies.

You’ll hear many people in crypto talk about the inevitable incoming collapse of the US dollar, but the DMT posits that the dollar will get stronger before it ever gets weaker as crises strengthen it, and this simple Twitter post below neatly summarises why:

So while its true that there has been some de-dollarisation globally, its also true that its not happening at the rate that fearmongerers suggest it should be happening.

Gold

As part of the Dollar Milk Shake Theory Brent does indeed agree that the current path is unsustainable and that the only truly safe assets are scarce hard assets like Gold and Silver. He’s very much bullish Gold and suggests people should hold it as an insurance policy against the system unfolding.

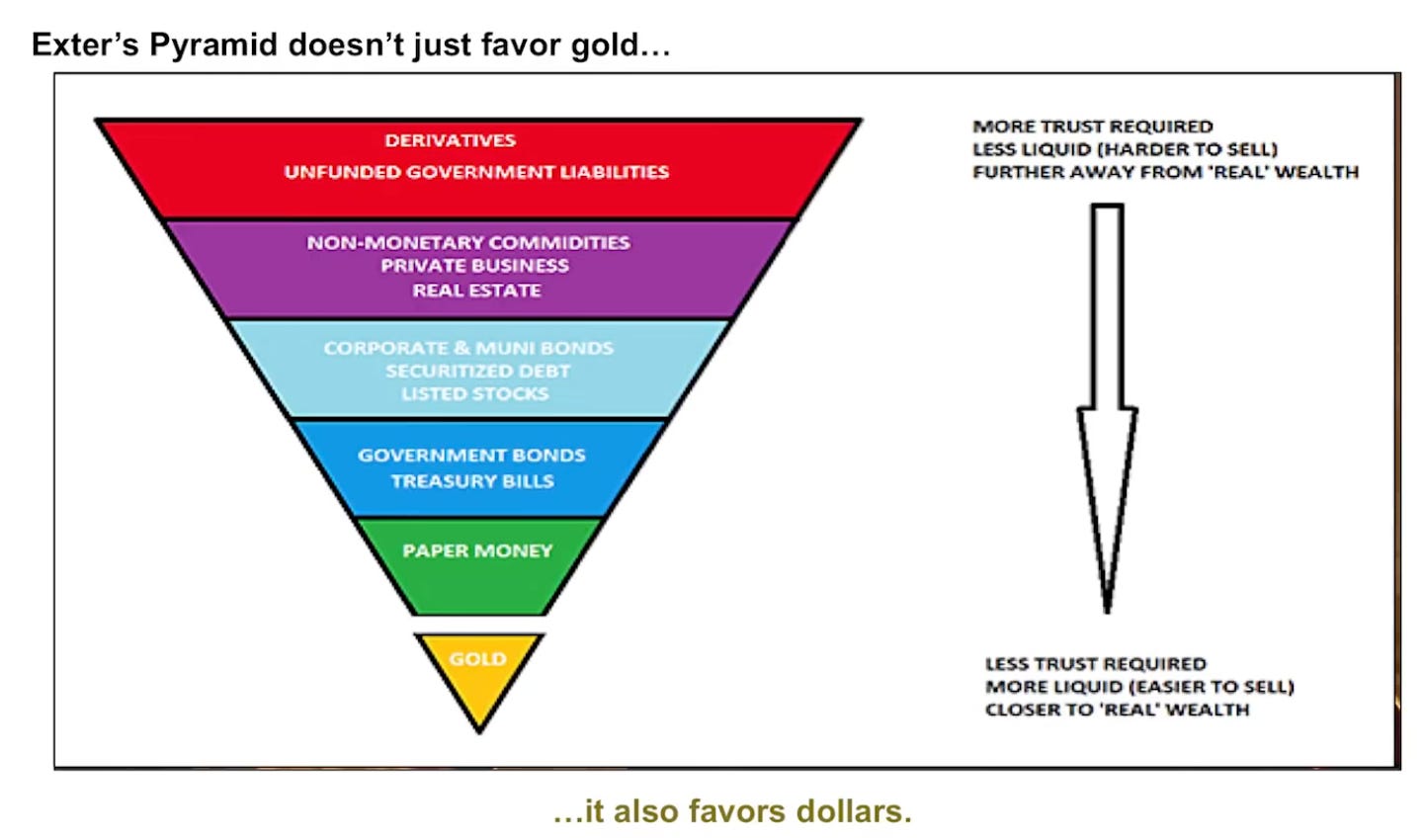

However, he also makes it clear that in a scenario where the system does begin to unfold the US dollar (illustrated by “paper money” in the diagram below) is where liquidity will flow to first before moving into Gold.

So he ironically suggests that the USD is a safe bet even in the scenario where the USD is heading towards its own collapse!

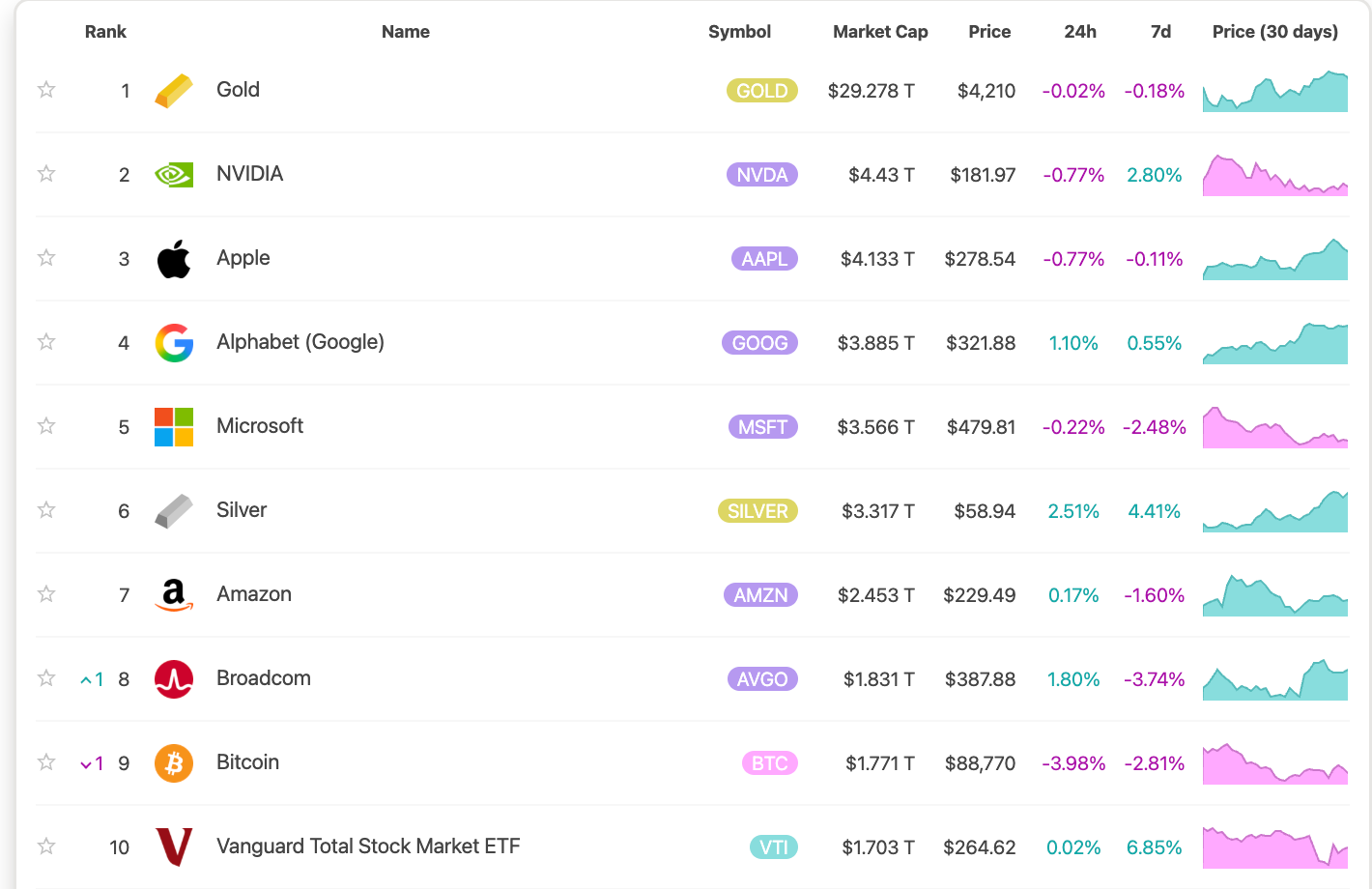

Interestingly, while this year was not a great year for cryptocurrencies with the market down from where it started, we’ve had one of the best years for Gold ever with it peaking at over $4,300 having started at around $2,700 marking a growth of around $60% in a single year!

Gold strongly holds the throne as the single most valuable asset in the world having extended its lead significantly against the rest at an almost $30tn market cap, with a 7x gap to NVIDIA which has grown to become the second most valuable asset with an over $4.4tn market cap.

But where does crypto sit in all of this?

Bitcoin & Crypto

Now I’ve previously explained why Bitcoin is described as “digital gold” in the post highlighted below.

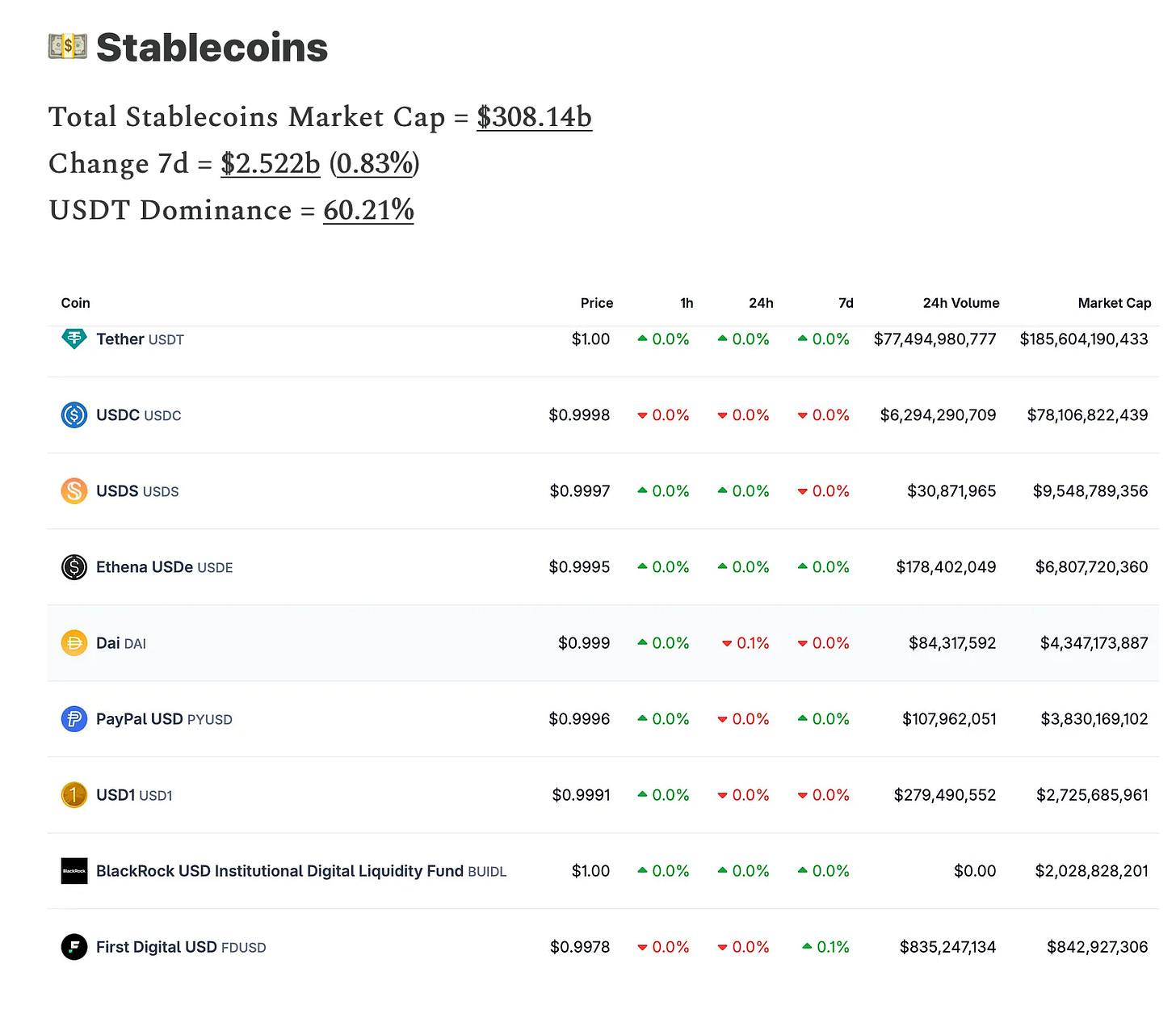

Plus my regular DeFi Daily posts highlight the ongoing growth of Stablecoins, which are now over $308bn in size of which USD based Stablecoins represent over 95%.

Assuming you agree that Bitcoin is equivalent to digital gold and acknowledge the ongoing growth of USD-based stablecoins, then you can see the DMT playing out in a certain sense in crypto too because:

Even in moments of distress in crypto where the overall market size contracts, USD equivalent stablecoins suck up all the liquidity and continue to grow!

Therefore in the crypto-arena this ultimate battle lies between USD stablecoins and Bitcoin (ie. digital gold), just as in the traditional arena it lies between the USD and Gold.

And there you have it!

You now know that the Dollar Milkshake Theory is ultimately just a fancy way of saying that since the US dollar is at the heart of the global financial system, so in moments of economic distress it tends to grow in demand. This happens even as the system has become more precarious and the USA’s debt has reached extreme levels.

Plus you also know that according to the DMT we’ll likely see a growth in demand for dollars before any sort of final showdown happens between it and hard moneys like Gold and Bitcoin.

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!