Bitcoin as Digital Gold

A brief look at the thesis that underpins Bitcoin's ever rising price

TLDR:

Bitcoin’s been compared to gold since its early days. As Bitcoin’s price continues to appreciate this comparison seems ever more relevant.

Four of the main similarities lie in both being: scarce, durable, fungible, and divisible. These properties help them to be excellent stores of value.

Four of the main differences include: portability, security and ownership, price volatility, and verification. Here we can see where each has its pros and cons.

Most importantly, due to these properties, both have a similar investment narrative of being a hedge against economic uncertainty.

Industry experts like Michael Saylor argue that getting into Bitcoin is equivalent to getting into today’s gold rush - but only time will tell if this becomes true.

Today I wanted to look at the very common thesis used to describe Bitcoin’s value, essentially that’s it’s a form of “digital gold”.

This topic is huge so I’m only touching the tip of the iceberg. But it’s a worthwhile topic as we see Bitcoin’s price enter a seemingly new inflection point of growth.

For most people that have been in the space for a little while this is mainly a refresher, but for newcomers it’s a fundamental concept to understand that underpins a lot of the growth in Bitcoin and Crypto.

Digital Gold

Bitcoiners have always made the comparison of BTC to gold since the early days of Bitcoin. Thought leaders like Andreas Antonopolous have videos that date back to 2013 making the comparion.

One of the main texts that formalised this concept though was the “The Bitcoin Standard: The Decentralized Alternative to Central Banking” by Saifedean Ammous released in 2018. In this book Saifedean really solidified the arguments for this comparison and we’ll cover some of the important concepts below.

This topic is naturally too large and complex for a single blog post, so we’ll only cover the tip of the iceberg. However, the central ideas covered here are the fundamentals that posit Bitcoin’s ever growing valuation.

When discussing what is money there’s 3 central properties that we usually discuss:

Unit of Account - A measure used to price goods and services, allowing people to compare values easily.

Medium of Exchange - Something that’s widely accepted as payment for goods and services that facilitates trade.

Store of Value - An asset that maintains its value over time, allowing wealth to be saved and retrieved in the future without significant loss of purchasing power.

Historically gold has fit the profile for all 3 key properties of money, and therefore has been one of the main types of money for the past few millenia. I’ll undoubtedly write another post covering the history and evolution of money, but for now the most interesting property to look at in this comparison is the 3rd, namely “store of value”.

Due to gold’s great capacity in being a store of value it has become the single most valuable asset in the world by market cap. If you added up all the known gold quantities mined, estimated at 244,000 metric tons, and multiplied by the value of 1 ounce at around $2700, then you’d get to a market-cap of around $18 trillion today!

As we’ll discuss below, Bitcoin also has many similar properties to gold that allow it to be an incredibly good “store of value” too, and is where the thesis of Bitcoin being the digital version of gold comes from.

Hardcore Bitcoiners will argue in fact that BTC the better store of value and will one day surpass the total value of gold - but only time will tell. For now gold is worth approximately 15x more than BTC, so BTC has a long road ahead to surpass it.

Bitcoin’s similarities with Gold

So we’re aware of the comparison, but what are the similar properties that make these two assets comparable?

Scarcity

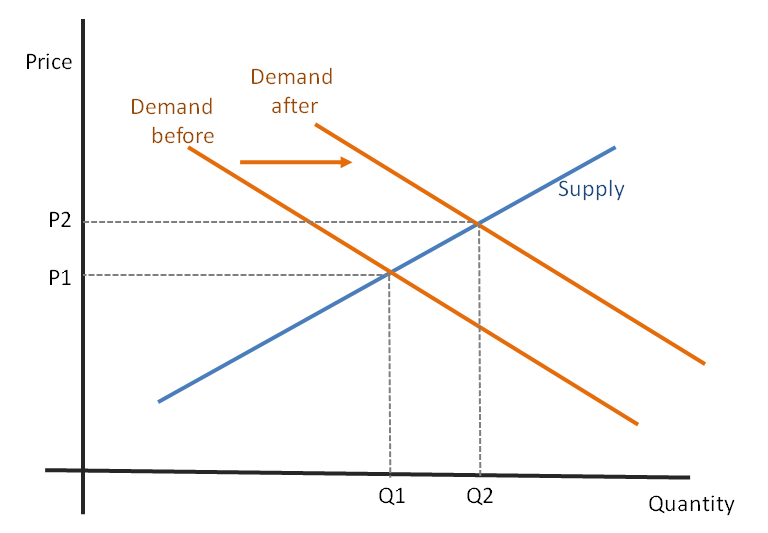

The first and most important point is the well-defined scarcity of both assets. Price is ultimately a function of demand and supply, and if you assume a fixed scarce supply then an ever growing demand will continue to push the price ever higher and higher.

Historically gold has been one of the best stores of value because we have no known way to create gold other than to mine it, and there’s a limited supply of gold on planet Earth. We may indeed find further deposits of gold on the planet some day, but for now there’s a fixed limit of approximately 244,000 metric tons that have been mined.

Similarly Bitcoin has a hard-coded limit of 21 million BTC that can ever be mined - as I’ve discussed before in my Bitcoin Halving post. Bitcoin’s scarcity constraints are in fact even stronger than gold’s because the code enforces a hard limit of 21 million BTC, yet with gold we may still find further deposits that’ll push up its supply.

Durability

Gold is very hard to destroy. It’s common to melt gold into bars, coins and jewellery. However, left on its own gold does not rust or corrode, and it resists acids that would degrade other metals. To destroy it you need extreme processes like nuclear reactions. This is important because if gold decayed over time it wouldn’t be a very good store of value since people would literally see their own savings erode away!

Bitcoin, just like gold, cannot be easily destroyed. It’s stored securely on the blockchain, which thanks to it’s decentralised nature will live on for as long as the Internet exists. You’d need to literally destroy all the computers on the planet to destroy the Internet and Bitcoin, which is practically is impossible.

Fungibility

An item is said to be fungible if it can be swapped for another without any noticeable difference in value. For example $1 dollar bill can be swapped for another without any of the people involved noticing any practical difference value-wise. Both gold and BTC are fungible.

This is an incredibly important property for a good store of value, imagine if gold and Bitcoin were like apples where 1kg of apples may be worth more than a separate 1kg of apples from a different brand, it wouldn’t make for a very good store of value!

It’s worth noting that gold is slightly better on this front, because when melted down you cannot tell the difference between two pieces of gold. Whereas BTC can be traced back with their history, and therefore certain fractions can be assigned different values, as we’ve seen with the growth of Ordinals and Rare Sats.

Divisibility

Money needs to be easily divisible so that you can partake in small transactions as well as large ones, because if we could only ever transact in 1 BTC sizes or 1 ounce of gold sizes, it would limit the types of transactions we could do hence it wouldn’t be particularly useful form of money.

Both gold and Bitcoin can be divided into ever smaller units. Gold can be melted down to small lightweight jewellery or coins, while 1 BTC can be slipt into 100 million satoshis, which is the smallest divisible unit of Bitcoin.

Although both share this property, Bitcoin is certainly more easily divisible than gold because melting down gold requires specialised knowledge and equipment, while splitting Bitcoin into satoshis is trivial.

Bitcoin’s differences with Gold

We’ve looked at some of the similarties to gold, but naturally there are plenty of differences too, especially since gold is physical and Bitcoin is natively digital.

Portability

This is an example of where Bitcoin is incomparably better. Since it’s digital, it doesn’t matter where you are in the world, you can both access and transfer it almost instantenously to other people who can also be anywhere else in the world.

This makes Bitcoin far superior to gold, which is heavy and cumbersome, and therefore hard to transfer in large quantities. Transferring $1bn in Bitcoin is trivial and fast, meanwhile to do the same with gold would require you to have several armoured trucks to even get started.

Security and Ownership

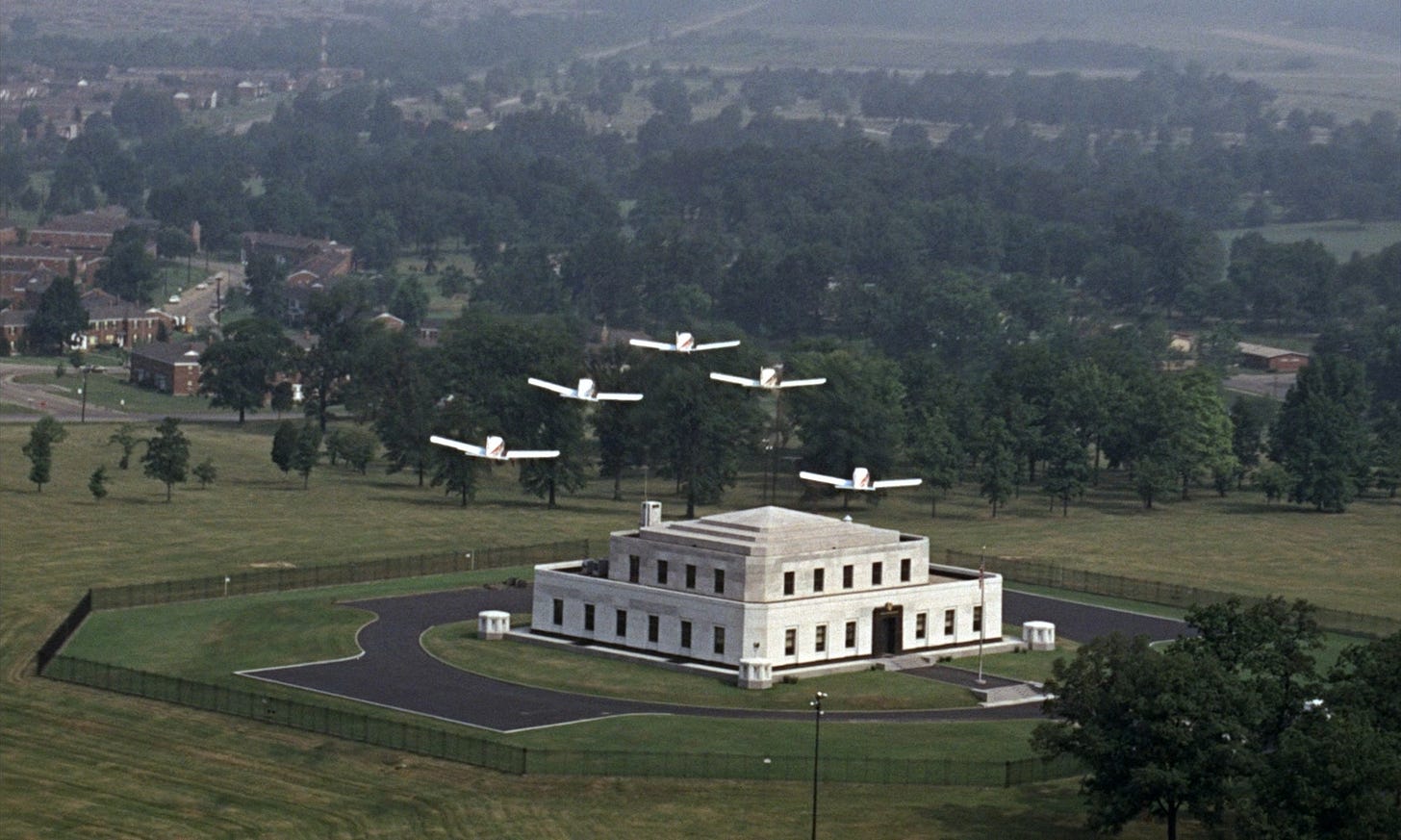

Following on from the above point. For similar reasons gold is expensive and difficult to store. Sure smaller amounts of gold can be stored in vaults in a home, however larger quantities require bunkers and complex security. Think how much is spent just to keep Fort Knox secure on an annual basis?

Bitcoin on the other hand can just be stored by simply writing a seed phrase on a piece of paper! Or in an even more extreme case, you can just memorise a seed phrase and you’ll still have access to your funds wherever you are in the world.

Naturally, larger volumes of Bitcoin do tend to use more complex security measures, and in some case even complex bunkers and vaults similar to gold - such as with Coinbase’s custodial storage of Bitcoin ETFs. Nonetheless, these setups are logistically a lot simpler than storing large quantities of gold.

Verification

Once again, while both can be verified, it’s trivial to verify the validity of Bitcoin, whereas gold is expensive and requires special equipment. To the untrained eye two bars of gold may look identical, even if one is fake or has a lower density of gold. Only specialists can definitively grade gold and verify its purity and value.

Meanwhile Bitcoin cannot be counterfeited. If it’s stored on the Bitcoin blockchain then it’s BTC and you can easily verify your ownership of it by signing with your private keys.

Price Volatility

This is where you can argue that gold makes for a far better store of value. Due to the nature of BTC being new, portable and tradable 24/7, it’s always changing in price and experiences volatility that make it harder to be confident in it’s price appreciation in the short-term. It’s this volatility that also makes it a terrible unit of account.

However, in its short existence Bitcoin’s price has massively outperformed gold, with Bitcoin going up 14,000% in the past decade while gold only 110%!

In thise sense one could argue that if you hold onto each asset for a long enough amount of time, then Bitcoin has served and will likely continue to serve as a much better store of value than gold.

Hedge against Economic Uncertainty

Most importantly perhaps, both Gold and Bitcoin fundamentally hold the same investment narrative.

The nature of gold having the aformentioned properties and being easily stored at home means that it’s ultimately a great way to step out of the traditional financial system and a great financial hedge against global economic uncertainty.

A helpful anecdote to visualise this is that if you lived in Venezuela over the past few years where they’ve had hyperinflation, with inflation that’s gone as high as 130,000% in 2018, any savings you kept in the bank would have lost value at an incredible speed.

But if you had bought gold bars and kept them in your bedroom, you’d have found that even through the economic turmoil you would have still protected yourself financially.

In times of economic difficulty government backed currency has the risk of losing value to inflation, stocks and shares tend to fall, and even real estate struggles as people have less money to buy property. But both Gold and Bitcoin provide an alternative to secure yourself, as they share the same set of properties that make them a good store of value that we discussed above.

Today as the global scenario has become ever more complex, with wars and conflict growing around the world, and central banks having to print more and more money to finance their debts, investors have turned more and more to scarce assets like Gold and Bitcoin to protect their savings from the increasing economic uncertainty.

Larry Fink, the founder and CEO of Blackrock, the largest asset manager in the world, has come on camera himself to argue this very point that he sees Bitcoin as “digital gold” and a hedge against the world’s economic challenges.

The Future

We’ve only just touched the tip of the iceberg in this post but you can see that the comparisons between Bitcoin and gold are plentiful!

The future is impossible to predict. Gold has literally thousands of years of human civilisation behind it that’s pushed it to become the number one asset in the world, meanwhile Bitcoin is only around 15 years old.

Nonetheless, for an asset that’s only 15 years old to already be a top 10 asset in the world, and with the world becoming ever more digital and people ever more educated on Bitcoin and the need for it, we may indeed see greater adoption and growth.

Michael Saylor, one of the most vocal Bitcoin bulls in the world, argues that we’re living in a new gold rush, where people are beginning to wisen up to Bitcoin’s importance and rushing to secure themselves a piece of the action.

Only time will tell if Bitcoin truly lives up to the digital gold narrative, but as Satoshi Nakamoto said: “It might make sense just to get some in case it catches on.”.

Whenever you’re ready, these are the main ways I can help you:

All our latest content is FREE at beginners.tokenpage.xyz - Join an ever growing community of people learning about Bitcoin, Crypto and Web3 together.

Bitcoin & Crypto 101 course - The perfect course for newcomers in the space to level up from beginner to intermediate in under 2 hours.

VIP access beginners-vip.tokenpage.xyz - For those who want direct access to me and to get on regular calls with myself and other likeminded people.

Web3 Software development at tokenpage.xyz - We’ve been building in the space for years, and can develop Web3 solutions for you.