Gold Won 2025

Gold, Silver and other precious metals are on an incredible run

TLDR:

Gold had an incredible run last year with 60% growth while its little brother Silver grew 160%, lifting them to become the number 1 and 2 most valuable global assets.

Growth in precious metals like Gold has been fuelled by geopolitical instability and the weakening credibility of US Treasuries.

Gold is now the number one asset held in central bank reserves surpassing US Treasuries, and has given the same returns as the S&P500 over the past 30 years!

Gold’s outpaced Bitcoin’s returns in recent years, but nothing’s changed in Bitcoin’s core thesis and if anything it just shows there’s more space for it to grow.

We’re super excited to have finally gotten the new branding for Yieldseeker out last week! We’re working tirelessly on some new technical upgrades and on getting the new branding into the app too, this will come soon.

For this week’s post I decided to look at how last year was a great year for precious metals with Gold in particular having one of the best years ever in terms of price appreciation.

If this post resonates with you and you enjoy the content then please share it with a friend and get rewarded for doing so!

This blog goes out weekly to over 20,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Gold

Gold has kept the crown as the most valuable asset in the world for as far back as records stretch but last year in 2025 it managed to extend its lead even further with an incredible 60% growth, which is large by any measure and even more so when you’re already number one!

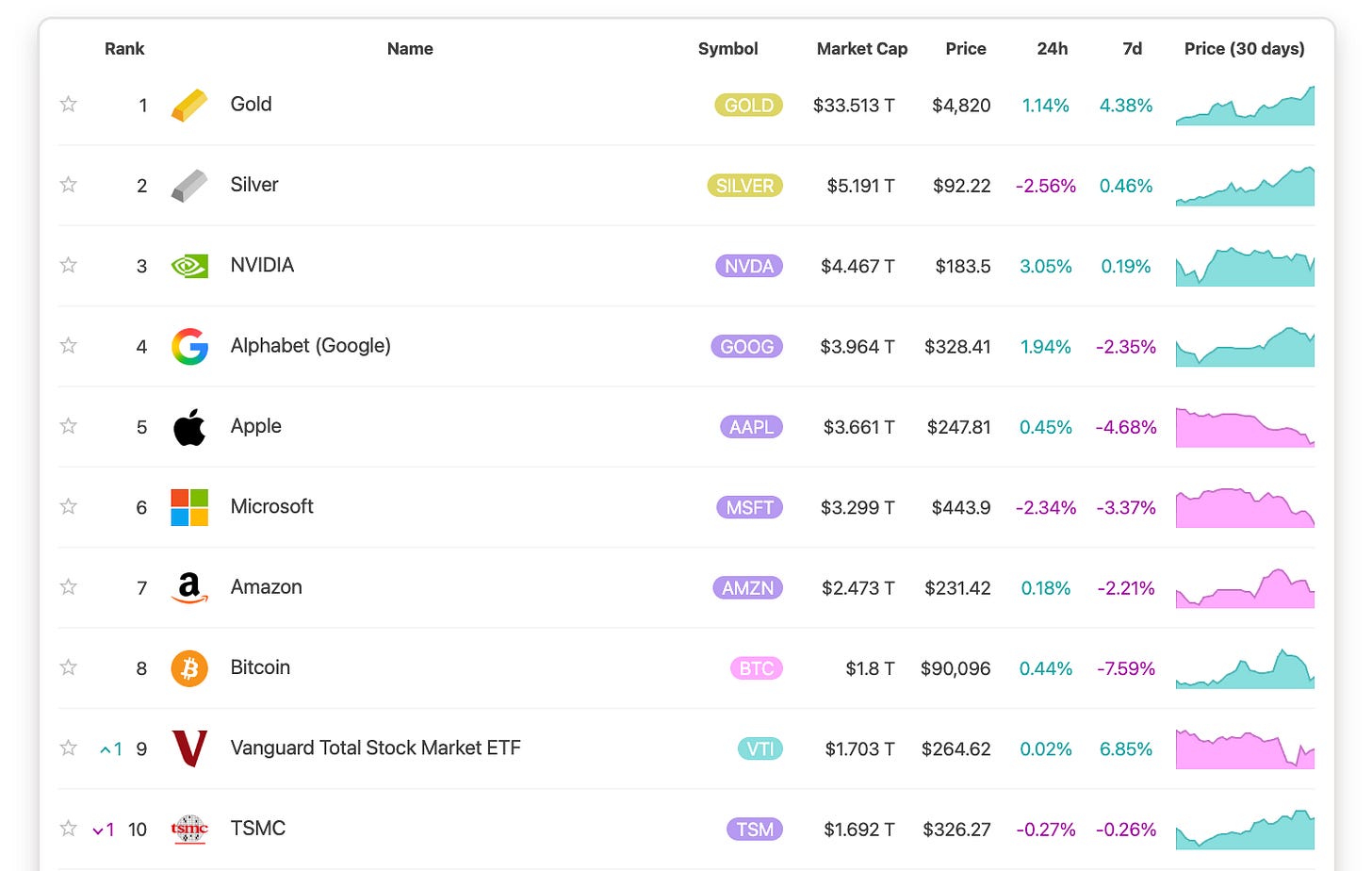

However Gold was not alone in its growth as all the other precious metals also had a very strong year. Take its little brother Silver which jumped up 160% and surpassed all the biggest companies like Nvidia, Google, and Apple, to take second place as the most valuable asset in the world.

Gold and Silver are the top precious metals in terms of their scarcity and perceived value, and they’re now also the top 2 most valuable assets by market cap in the entire world with $33tn and $5tn market caps respectively.

By comparison the market cap of the entire crypto space is around $3tn with Bitcoin accounting for more than half of that.

And last year Bitcoin had a pretty poor year having actually dropped around 6% in a year where all other assets classes in the traditional financial markets experienced a strong bull run.

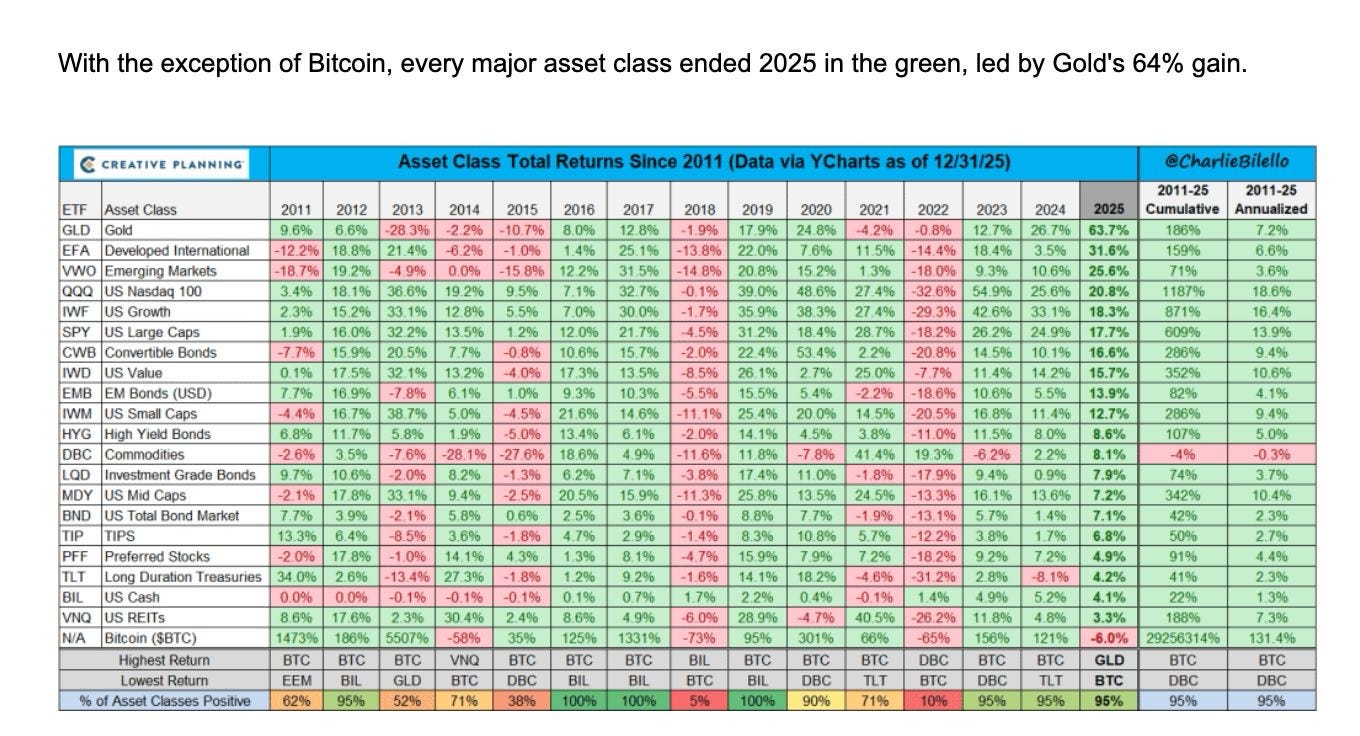

Impressively Gold managed to beat all major asset classes by a mile with its 60% growth being double that of the second place, namely the EFA index for developed markets.

For most people in crypto who don’t usually pay attention to commodity prices it may seem unusual to see precious metals doing so well, however for the gold bugs and other precious metal lovers they think its been a long time coming.

Precious Metals

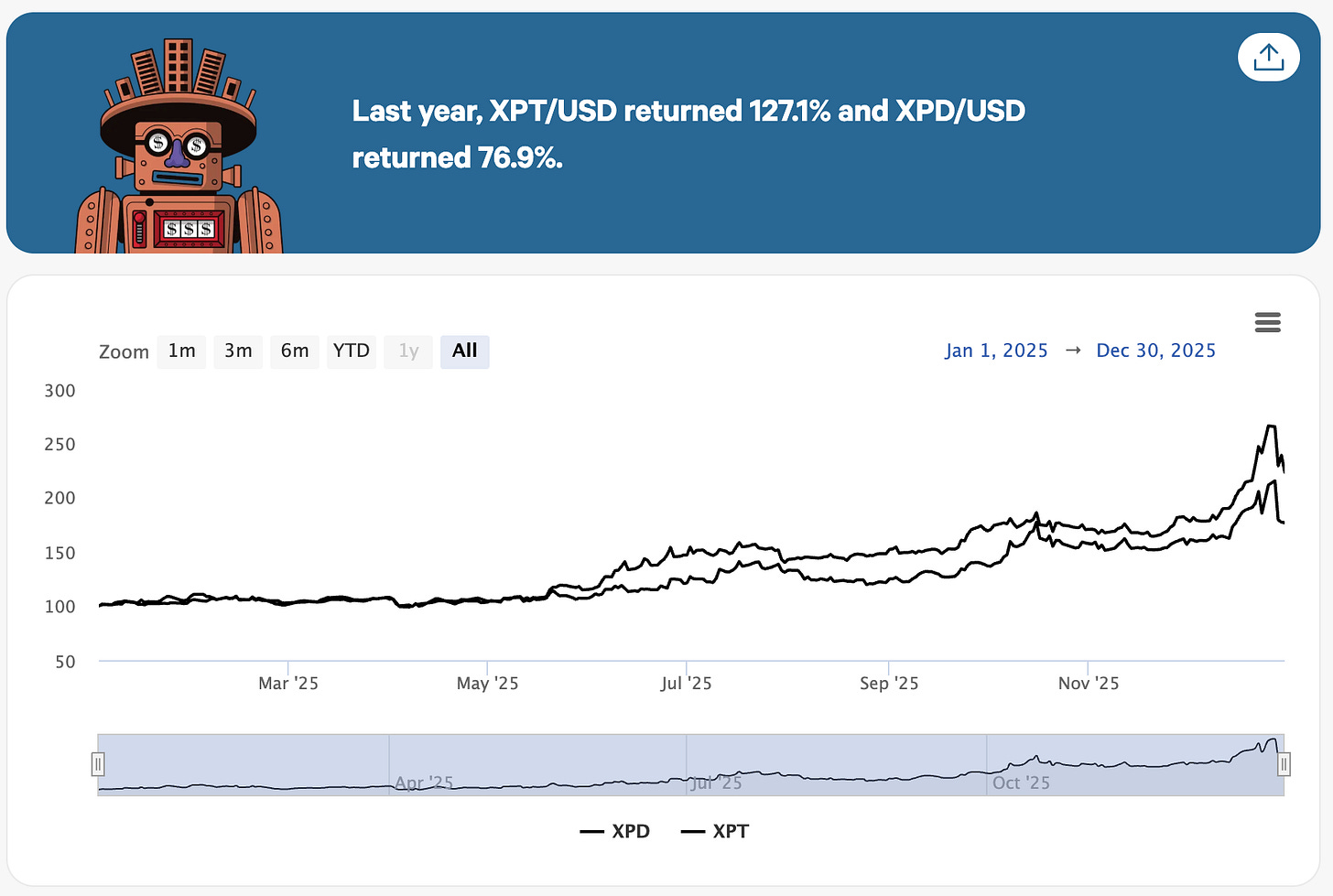

Gold and Silver are the top dogs within the precious metals, but they are not the only ones out there and this past year we also saw big growth in Platinum jumping 127% and Palladium rising 77%.

But why was 2025 so good for precious metals?

Well firstly as I said above, last year was a great year for all markets. There’s been many things driving this growth, among them is the fact that the new US administration has been running the economy hot through deregulation and doing all they can to push the economy higher.

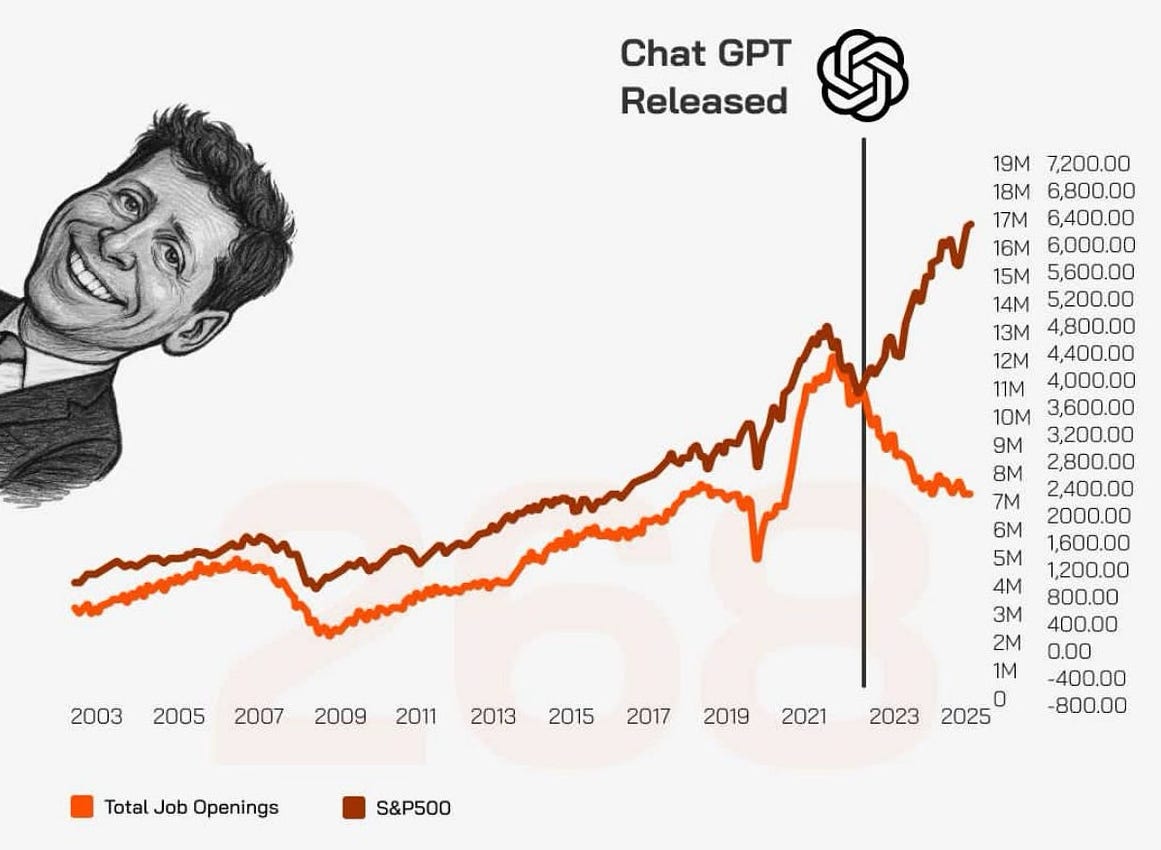

Plus we’ve seen the growth of AI make companies become ever more productive, with most major companies acheiving higher revenues while freezing hiring or even cutting headcount.

However this only explains part of the story as we could easily see markets growing with precious metals having a muted response.

The main reason we’ve also seen a growth in precious metals is more strongly tied to a growth in geopolitical uncertainty. This in fact started before Trump’s second term, with the Russia-Ukraine war bookmarking the start of the US Dollar being used as a weapon of war against Russia hence reducing its credibility as a neutral safe haven.

Since Trump came into power last year he’s upped US geopolitical pressure on both its enemies and allies, which has exacerbated the credibility crisis of US Treasuries and pushed many institutions and central banks to seek alternatives.

This is all happening with the backdrop of the ever growing US national debt, which has been progressively getting worse under every administration for the past 40+ years (which I covered before in the post below).

In times of geopolitical and economic uncertainty Gold has always been seen as the top financial hedge due to its long history as a medium of exchange and its hard money properties of being scarce, durable, fungible and divisible (which I’ve also covered before).

However Gold is not alone in that all other precious metals also have these properties to a certain extent, which is why they’ve also benefited from this rise.

Gold in numbers

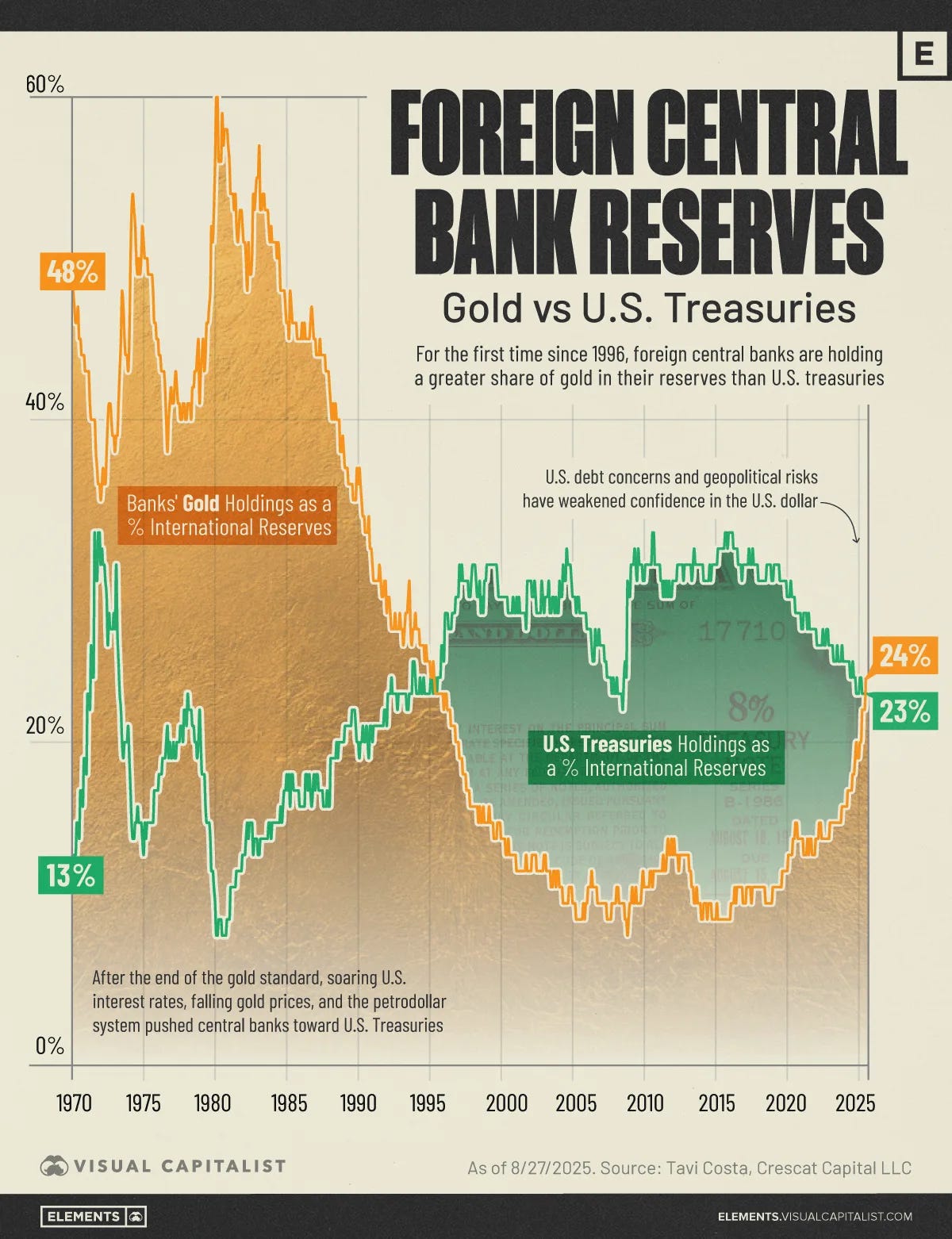

Gold has always been the most historic financial reseve, however after the US broke away from the Gold Standard in 1971 there’s been a steady retreat in the storage of Gold by Central Banks with US Treasuries growing steadily and overtaking Gold in 1996 as the primary reserve.

However, in the past 10 years this trend has reversed and 2025 saw Gold once again overtake US Treasuries as the largest asset held by Central Banks in a trend that seems to be continuing.

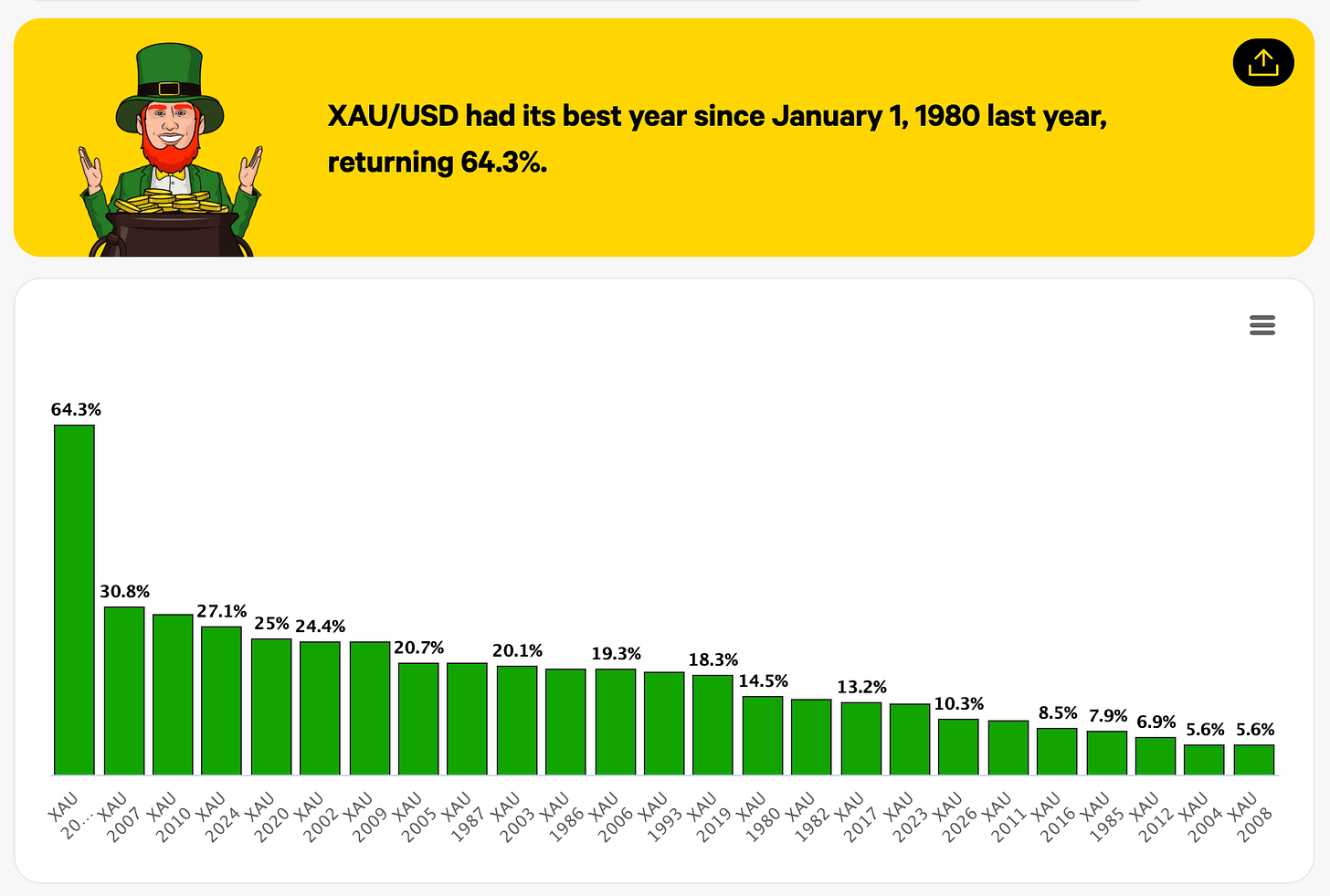

Last year marked best year for Gold since 1980 with the second best in this period being 2007 when Gold return 30%, which is still half of what it acheived last year!

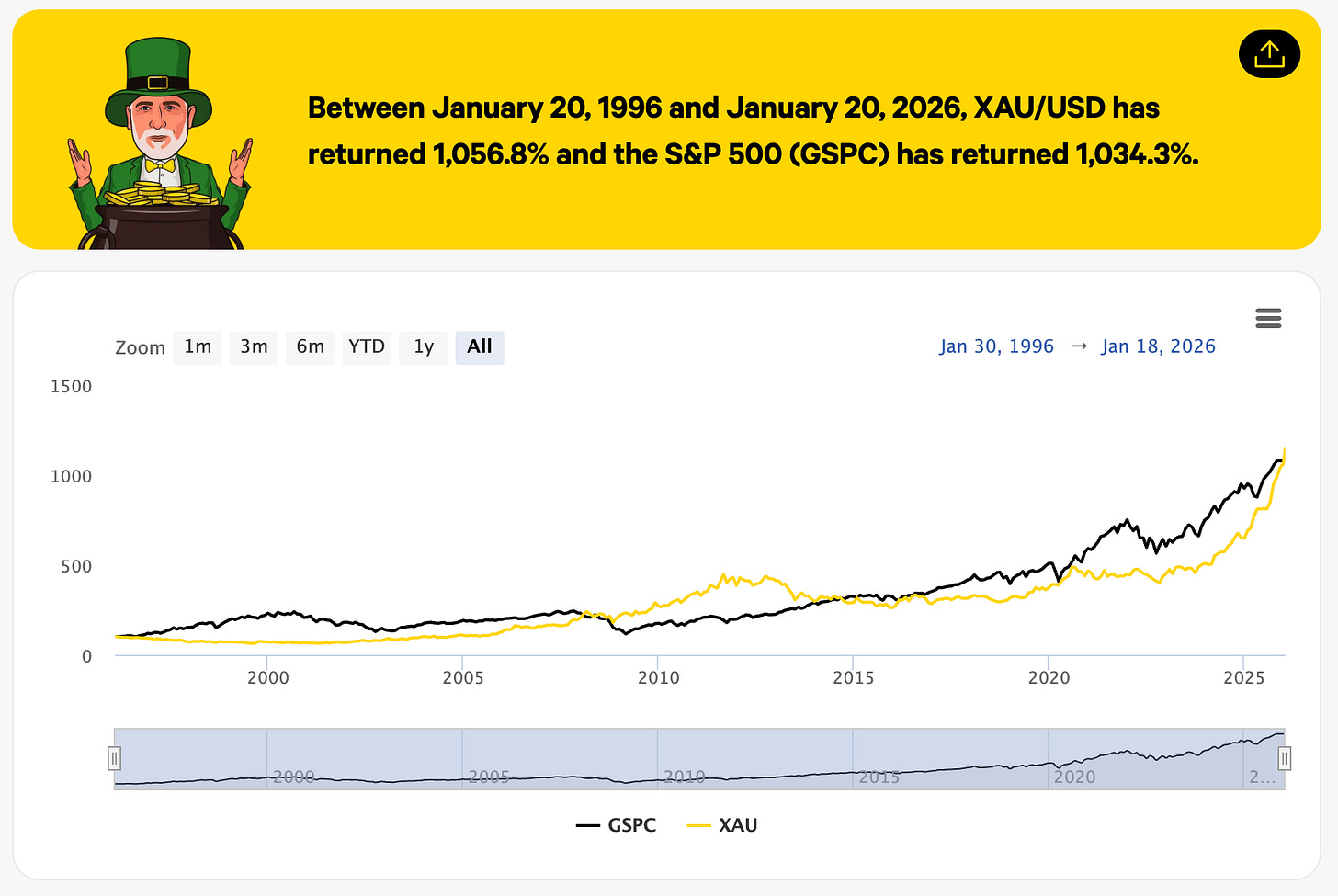

Furthermore, thanks to last year’s growth Gold and the S&P500 have now given pretty much the same return over the past 30 years!

When you begin to make these comparisons you can see that we’re living in a pretty special moment for Gold holders.

But what does this all mean for Bitcoin and Crypto?

Bitcoin & Crypto

As we’ve seen so far there’s no doubt that Gold and its precious metal friends have had a stellar year in 2025, while Bitcoin and Crypto actually dropped this past year. Gold bugs like Peter Schiff have been very vocal about all this and mocked Bitcoin given its poor returns recently.

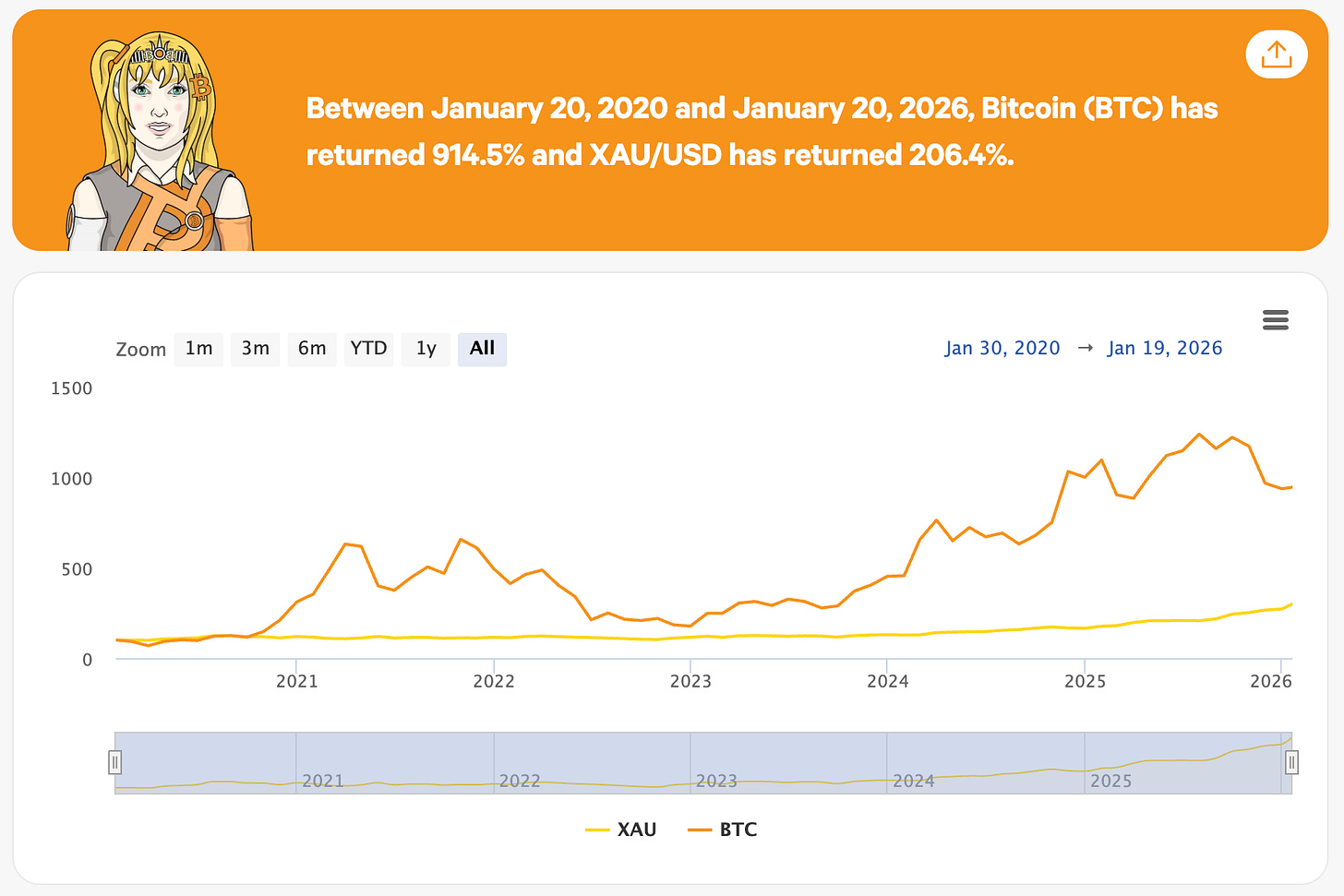

However, you don’t need to extend the line very far back to see that the situation inverts massively. If you look back on a 6-year scale you’ll see that Bitcoin is up over 900% while Gold is only up around 200% in that same time, and if you look even further back the numbers are far more extreme.

There’s no doubt though that the distance between Bitcoin to Gold has certainly grown, while at the start of 2025 a 10x return would make BTC reach Gold’s heights, BTC now needs an 18x return to get there.

Yet, while there are some genuine fears about how Bitcoin could be affected by the apparent growth in Quantum Computing (which I’ll write about in a future post), nothing else has fundamentally changed about the properties of Bitcoin, in fact its now more globally accepted than ever.

BTC ETFs total cummulative flows have surpassed $60bn and continue to grow, we’re seeing more and more banks allowing and even suggesting people should allocate into Bitcoin, and laws are getting passed to accelerate Bitcoin and Crypto adoption worldwide.

Sure it’s been a tough year for those looking just at price as BTC and Gold appear to be getting further apart, but if anything this just gives Bitcoin more room to run to even greater heights and pull the entire Crypto market up with it.

As I said a few weeks ago, I personally think the 4-year cycles are now broken and we could see the entire space reach new heights this year, let’s see how 2026 plays out.

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yieldseeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!