TLDR:

Bitcoin hit it’s previous ATH of $69k on Tuesday 5th March, briefly passing the previous record set on 7th November 2021, then dropped back down.

Reaching the ATH before the Halving, 45 days from now, is unprecedented and likely due to the demand surge from Bitcoin ETFs.

After the Halving there will be a supply shock, coupled with the high demand from ETFs we’re likely to see parabolic growth in a short space of time.

This earlier than expected high growth could also mean an end to the bull market earlier than expected, perhaps in early 2025 rather than late 2025.

Bitcoin’s price hit it’s previous all time high of $69k!

Although it was short-lived as it has dropped back down, Bitcoin already hit this milestone and we haven’t even gotten to the halving yet.

This is unprecedented and a historic moment in itself for Bitcoin and the wider crypto space, so let’s analyse this a bit and see what may come next.

Note: Let’s be clear that anything here is NFA (not financial advice) and you should DYOR (do your own research).

Bitcoin’s ATH

On Tuesday 5th March ‘24 we saw Bitcoin’s price pass it’s previous all time high (ATH) of $69k set on the 7th November ‘21! Although it was incredibly short-lived as it crashed right back down to $58k and settled at around $64k a couple of hours later.

Bitcoin’s previous ATH was reached at the height of the last bull market when Bitcoin was on everyone’s lips and it seemed like it was going to keep rising forever - as it always does in a bull market.

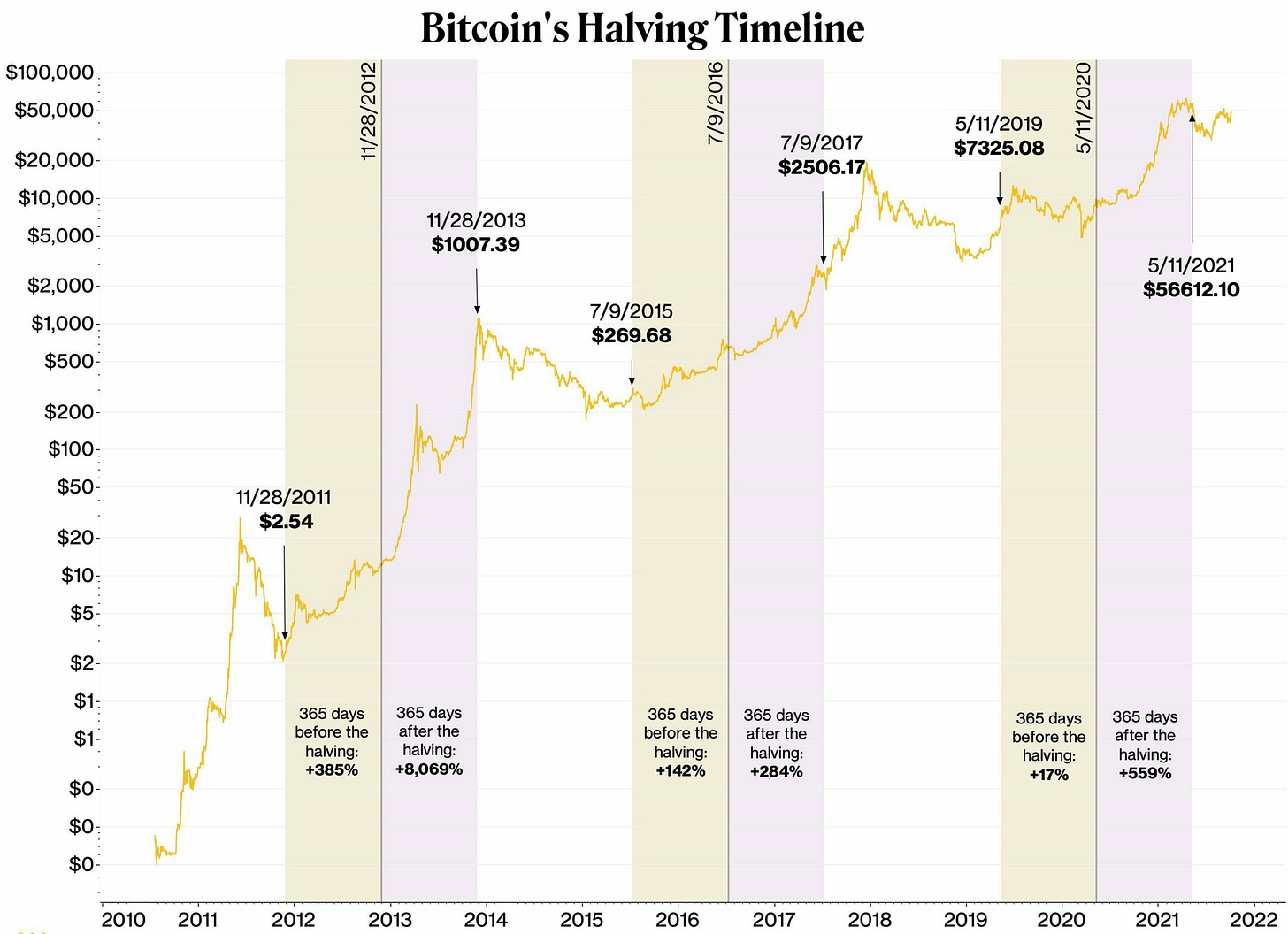

In the graph above you can see ATH peaks of around $1,200 in 2013, $19k in 2017 and $69k in 2021. Each of these peaks fit into Bitcoin’s 4 year cycles, which I’ve covered in depth in a previous post.

Now we’re once again in the bull market phase of a new cycle and Bitcoin is in the process of blasting past it’s old peak and ready to enter price discovery mode to settle high above at a new ATH.

However, what’s different this time is that it has surpassed it’s previous ATH before the Bitcoin Halving, which is still around 45 days away!

As shown in the graph above, in all the previous cycles Bitcoin went through this aggressive climb upwards some months after the Halving not before.

The Halving

Historically it’s always been the Halving that’s been the main driver to push BTC price upwards past the old ATH and into the price discovery phase to find a new ATH.

There’s a lot of complex market dynamics in play that cause this, but the most prominent reason is literally that the halving leads to a 50% drop in new supply of BTC per block, which immediately shifts the demand and supply equilibrium.

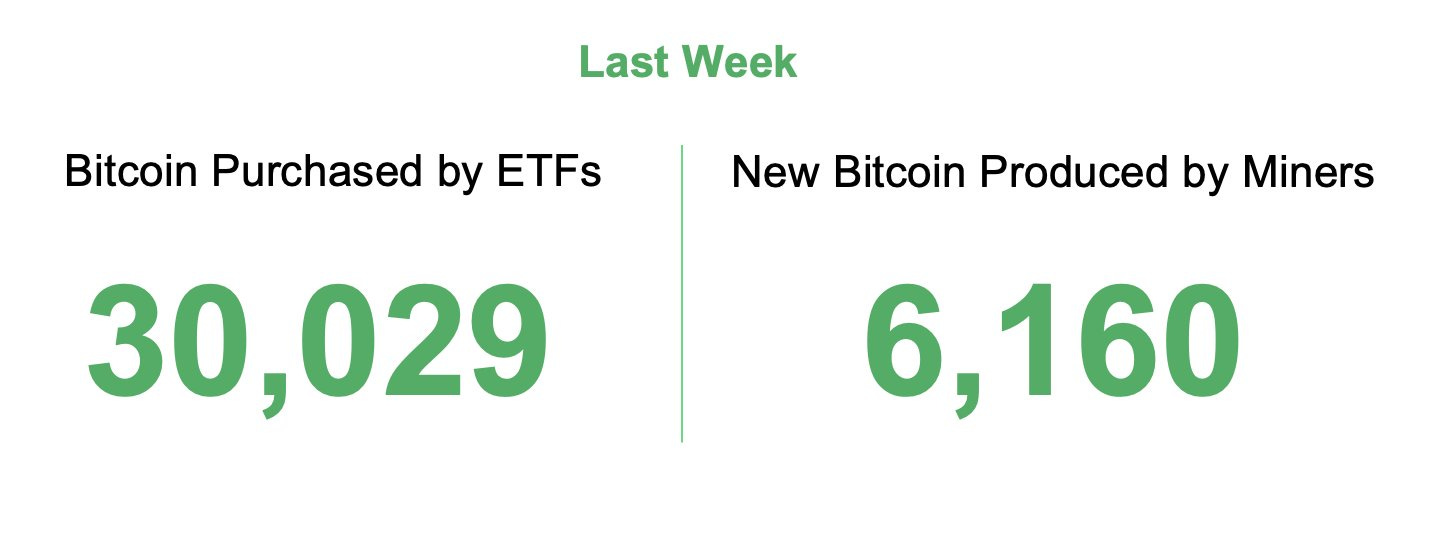

The most likely reason things are different this time around is because of the Bitcoin ETFs that were released in January that have created huge demand for BTC that’s outstripped supply. As you can see below the amount of BTC being purchased by ETFs last week was 5x the amount produced by miners!

In some 45 days we’ll have another halving, then the amount of BTC mined per block will drop from 6.25 BTC to 3.125 BTC, that’s a drop from approximately 900 BTC to 450 BTC per day or 6k to 3k BTC per week!

Just as the Bitcoin ETF has led to a big growth in demand, the halving will lead to a big drop in supply. And Bitcoin will go through another unprecedented moment handling both this large demand and supply shock at the same time!

What could happen next

Put simply, both the ETF’s demand surge and Halving’s supply drop in such short succession will likely make the Bitcoin price sky rocket.

In the past when Bitcoin broke a previous ATH it took as little 10-18 days to reach double that price on 3 separate occasions.

With the conditions we’re seeing right now it’s very possible Bitcoin once again goes through a parabolic period of growth, which will push up the entire market along too.

If we saw this doubling then Bitcoin would reach a price of around $140k by the middle of the year!

Of course, it’s impossible to be certain if we’ll see Bitcoin price double in such a short time again, but either way it’s highly likely that we see a large surge in price growth.

Looking further forward, Bitcoin’s 4 year cycles have historically had 3 years of upward motion followed by 1 year down. We’ve already had approximately 1 year down since the LUNA crash in 2022 and 1 year upwards in 2023, so we can expect around 2 more years of upward motion left in this cycle.

Under normal circumstances we’d expect the bull period of 3 years to come to an end some time around Q4 of 2025.

Yet, the fact we’ve hit the ATH before the halving, have this upcoming scenario of demand and supply shock that’ll push price upwards, and there’s easier access in and out of crypto than ever before, means things could behave differently.

I imagine that we could see something like the following: the euphoric phase of the bull market arrives much earlier, the peak BTC ATH also comes sooner, and therefore the unescapable troth and fall comes earlier too in say Q1-Q2 2025.

However, as I said at the start, this is NFA, I don’t have a crystal ball, anything can happen. The only thing we can be sure is to strap in as this will be a spectacular year!