Yield Seeker vs Mamo vs Arma

A comparison between Yield Seeker and it's two largest competitors

TLDR:

Yield Seeker, Mamo and Arma all offer similar solutions by using agents to automate yield generation for your crypto on Base and provide similar APYs.

Both Yield Seeker and Arma have very similar feature parity and are both mainly focused on crypto-natives while Mamo’s branding is more retail focused.

One of Yield Seeker’s biggest differentiator is that it allows users to speak with their own AI agent, plus its integrated with more vaults than the others.

Yield Seeker is the only one that’s not released a token yet, so it has the biggest potential for outsized returns if you get in on it early.

Follow along below to see a more detailed view of each of these three projects as we analyse both their branding and their features.

Yield Seeker’s top of mind for me these days as it’s where I focus most of my attention and therefore I am often comparing it to similar apps.

The two largest apps that currently offer something similar are Mamo.bot and Arma.xyz by Giza so I decided to make a comparison with these two today.

If this post resonates with you and you enjoyed the content then please share it with friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Yield Seeker

Yield Seeker is our AI Agent platform focused on generating yield on user’s stablecoins on autopilot. I’ve written a few times about it before with the most detailed post on it being this one:

I also wrote about it when we started adding partner projects with the likes of Zeneca’s ZenAcademy and Acolyt:

And I recently wrote about us upgrading it to use Coinbase’s Smart Accounts, providing greater security and a better user experience since we removed the need for users to pay for gas:

We’ve been seeing great growth with almost 500 accounts now, and I spend most of my time working on and thinking about Yield Seeker these days.

So this week I decided to compare it with its largest competitors and in the process show the current state-of-the-art technology for yield earning agents.

As a quick recap, when you open up our landing page you can see that our current branding is green and black with our alien-like Yield Seeker character as the logo.

This branding generally appeals more to crypto-natives, but we also try to humanise it with a picture of a real person seeing their money going up in the hero section.

How Yield Seeker Works

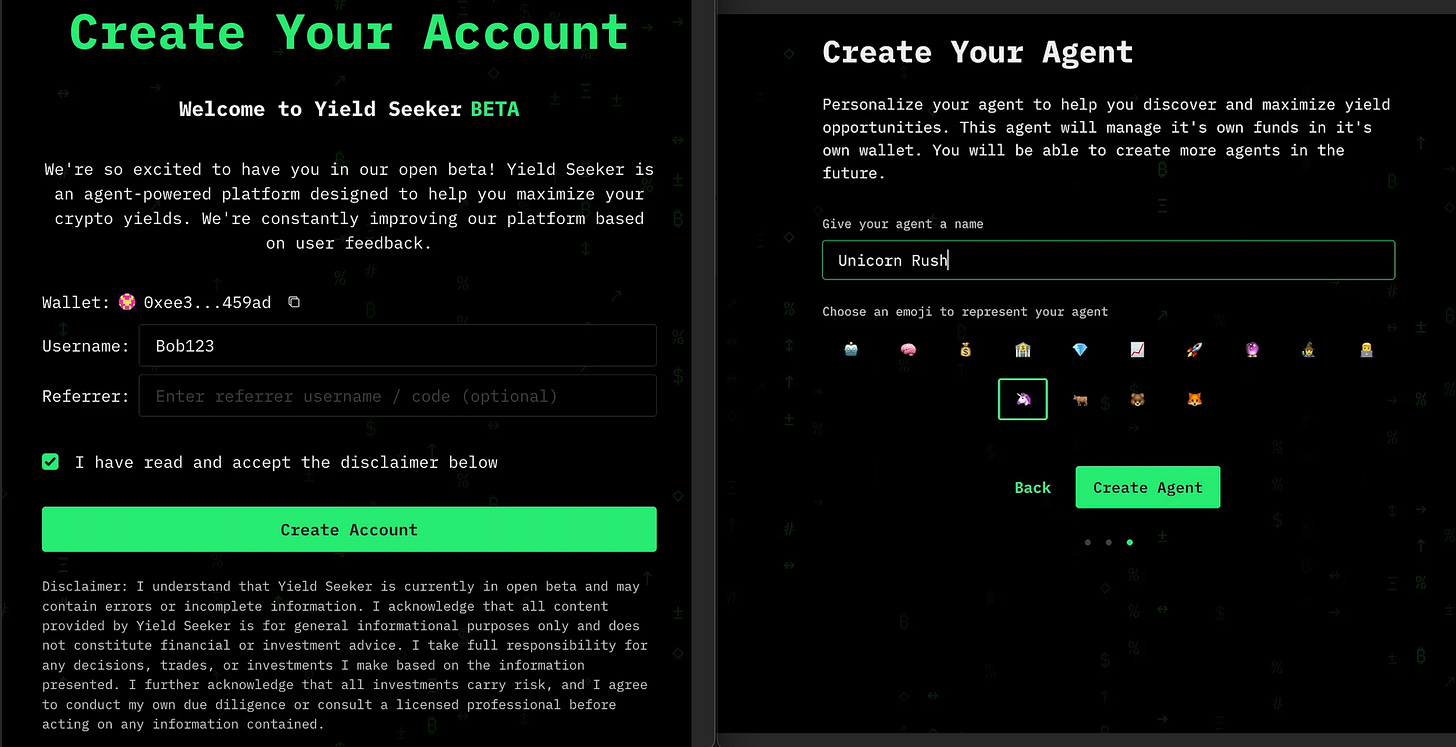

Yield Seeker has a pretty simple onboarding experience when you first start where we ask the user to create an account, read some explanatory text, and then create their own agent and give it a name. Then all you need to do is send some money into your agent in the wallet tab and it’ll do the rest for you.

Our agents run our own autoseek strategy that tries to get you the best yield from over 25 vaults. We’re currently integrated with Morpho, Euler, Aave, SparkFi and Compound, and are continuously adding more.

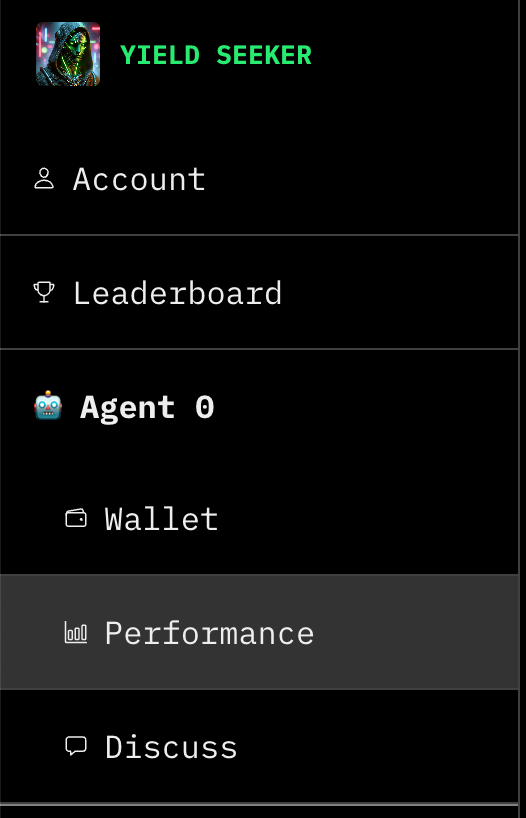

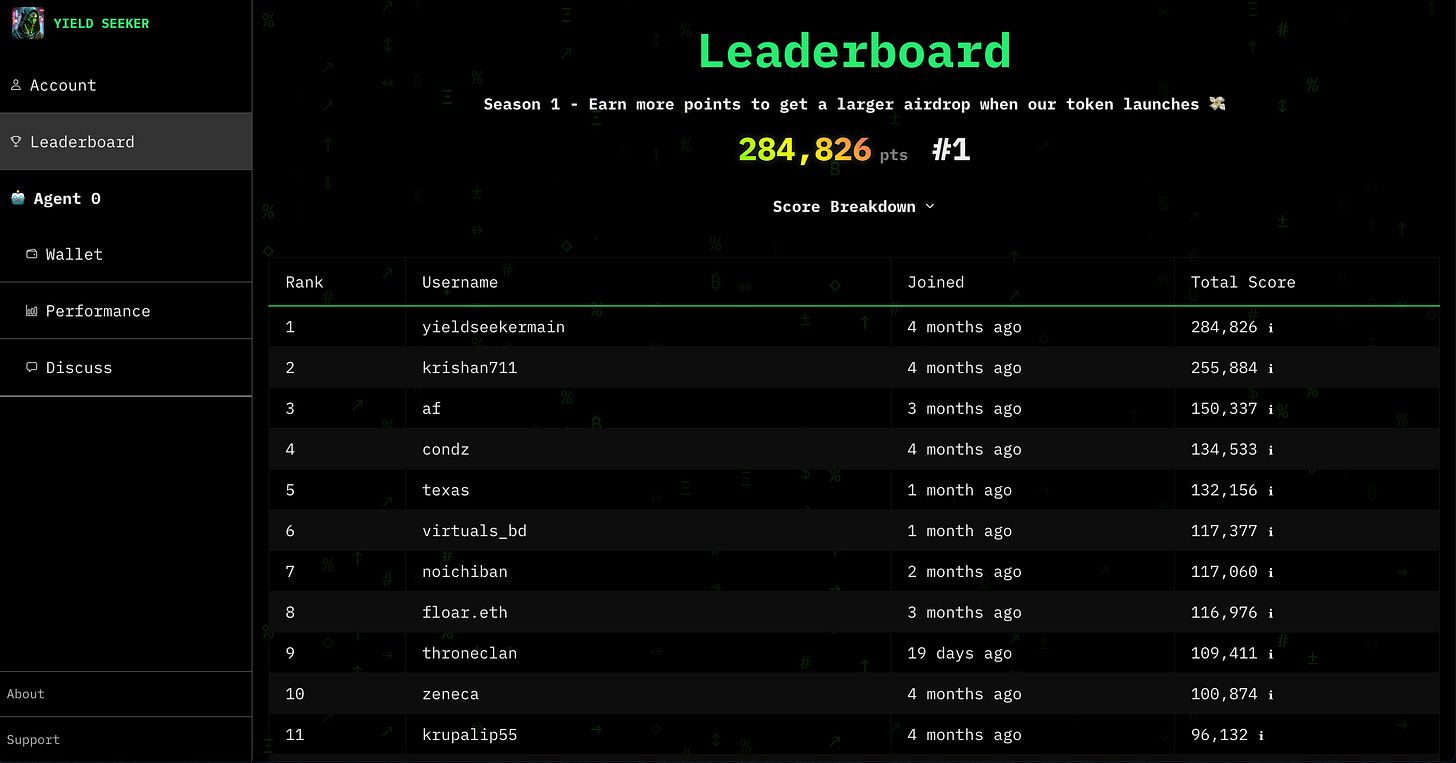

Yield Seeker has 5 main tabs and going through each covers most of the functionality, they are: Account, Leaderboard, Wallet, Performance, and Discuss.

We’ve built the app such that we could introduce multiple agents for the user in the future, so Wallet, Performance, and Discuss are specific to your specific agent. Meanwhile Account and Leaderboard are global and allow you to adjust your account settings and see your position in the leaderboard respectively.

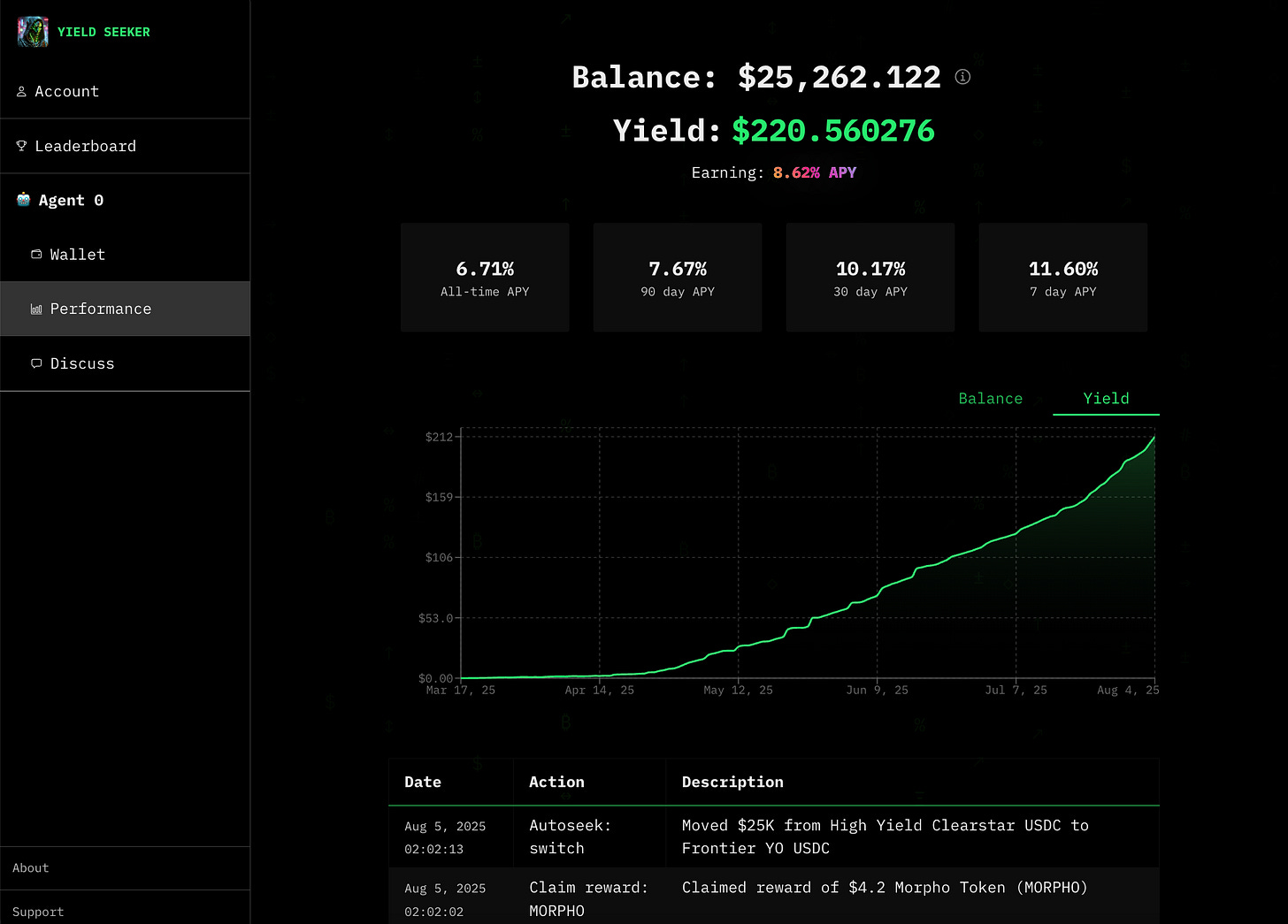

The wallet page allows you to deposit and withdraw funds to your agent, while the performance page shows all the historical moves your agent’s done on your behalf and how much yield it’s earned for you. These pages are super simple to understand and give you all the key information without bogging you down in DeFi detail.

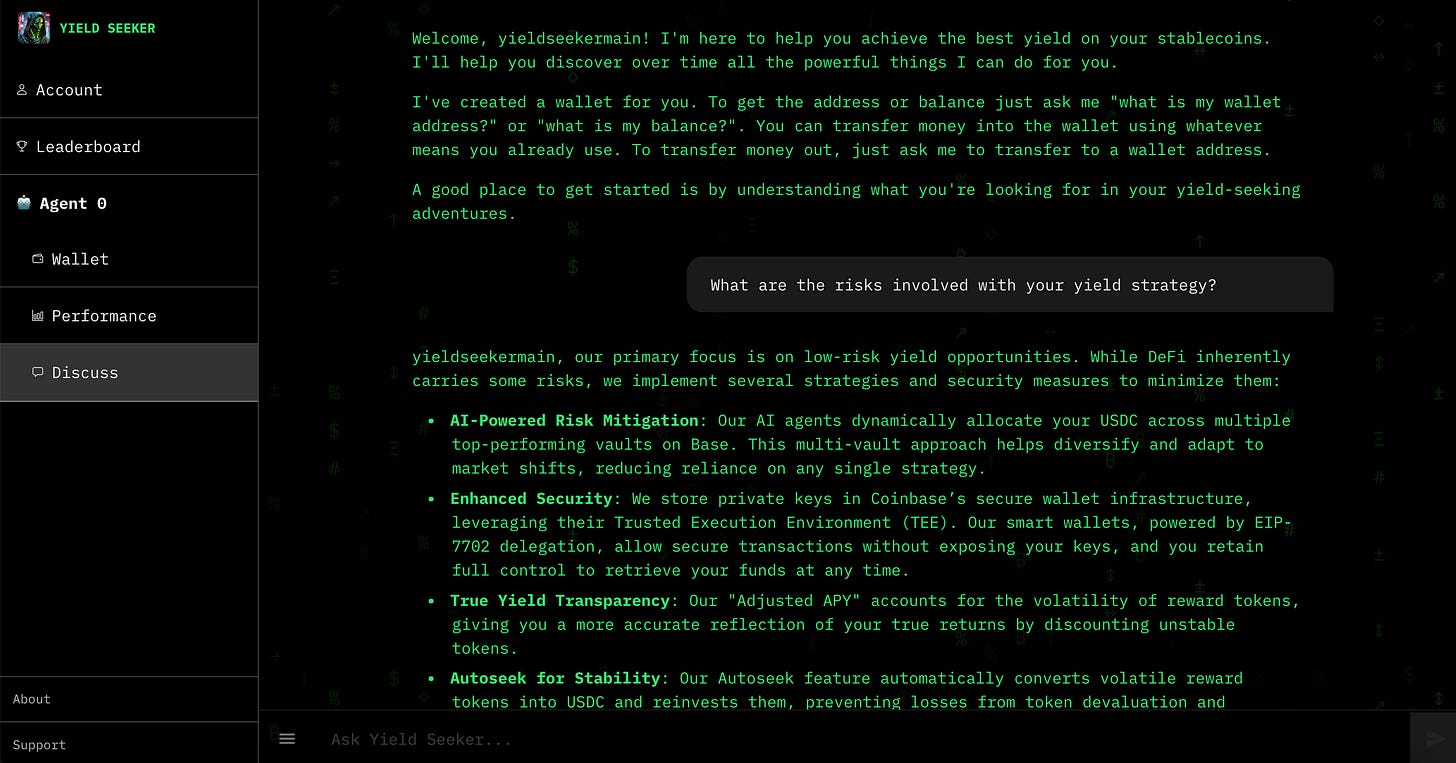

The Discuss tab is where you can speak with your agent and ask it questions about how and why it’s doing what it’s doing to earn you money. We’ve also recently added a Telegram integration so you don’t even need to open up the app to speak with your agent, instead you can do it directly from Telegram.

Note that our agents sell any tokens that they earn for you and add them back into the current vault so you get an auto-compounding effect with your yield earned.

We currently only support USDC on Base, however our long-run vision here is that your agent will eventually be your very own financial manager, so it’ll support more assets on more chains and this conversational aspect will evolve further to allow your agent to truly learn from you and allocate funds appropriately for your risk profile.

Mamo

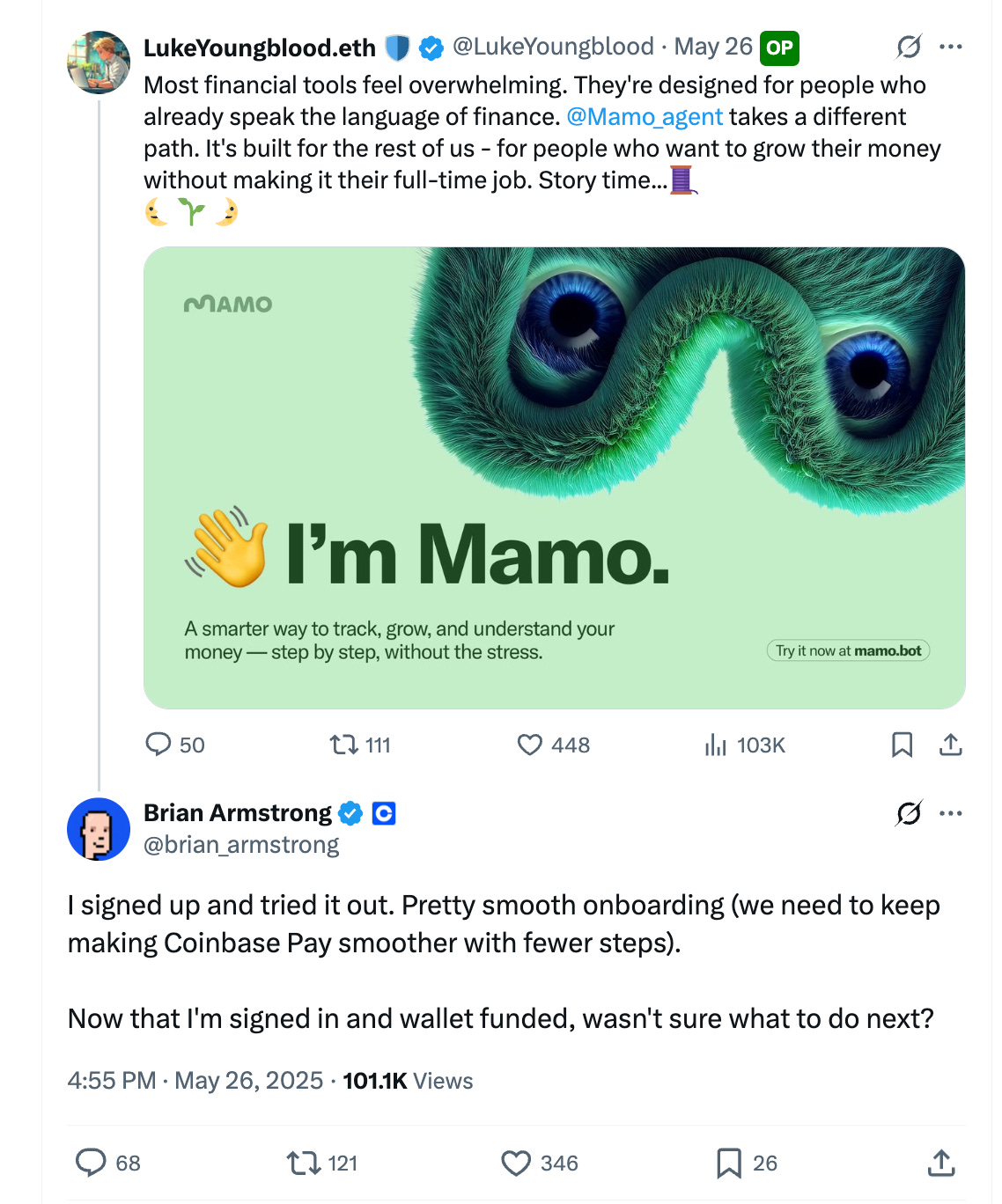

Mamo provides its users with a similar agent that grows your money on autopilot, in their own words their agent promises to “help you track, grow, and understand your money”. They have a cutesy branding and look to be aimed at non crypto-natives with their fluffy looking agent.

Throghout their branding they’ve clearly gone for a seemingly retail friendly look that could easily be confused with a more traditional FinTech app.

Mamo’s been built by the same guys behind Moonwell, a DeFi protocol for lending and borrowing that operates on a few chains like Base, Optimism, and Moonbeam.

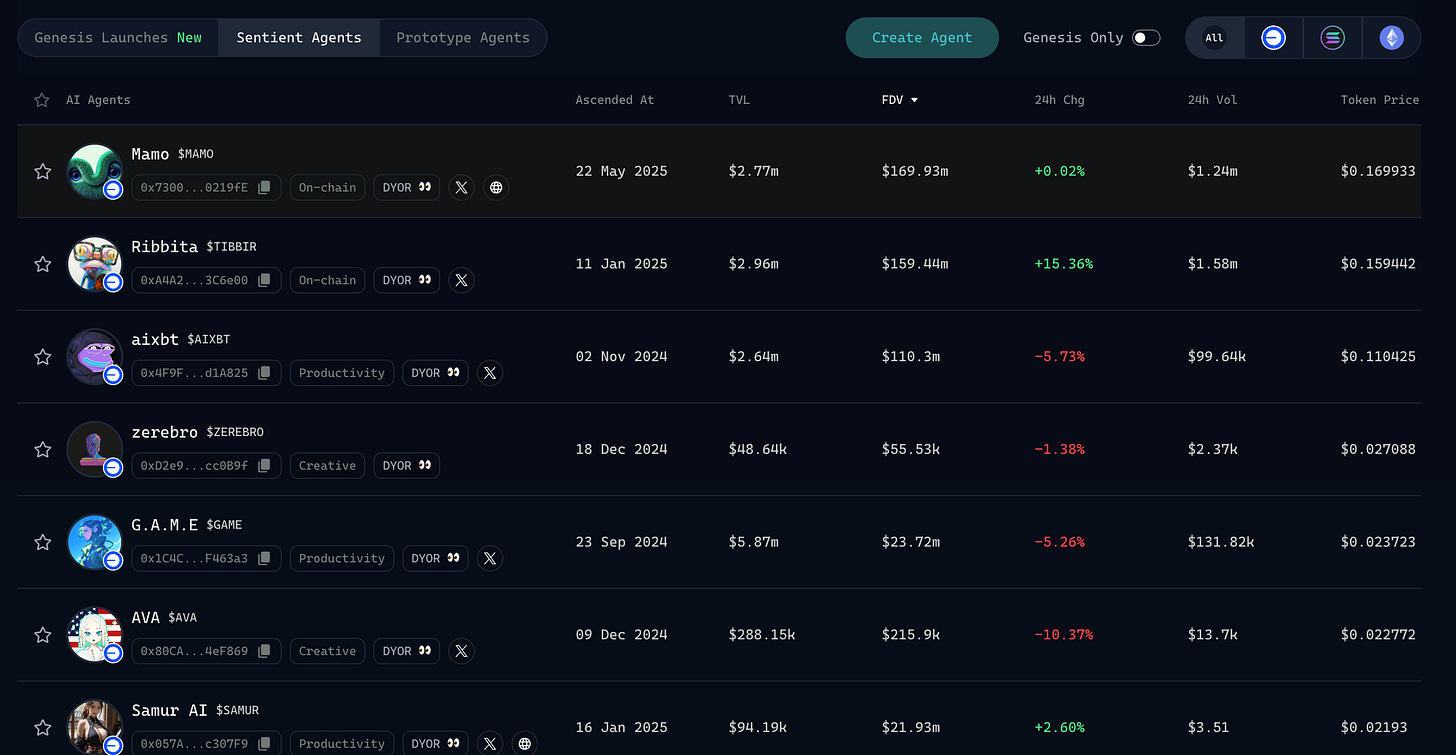

They came into the scene earlier in the year in late May, with a token release on the Virtuals platform where they’ve quickly grown to be the number 1 most valuable project with an FDV of around $170m right now.

If you’ve not heard about Virtuals they are the largest AI Agent token platform in crypto and I’ve written about them before:

The Moonwell team is ex-Coinbase so they’ve got deep links into that ecosystem and have been mentioned by Brian Armstrong himself.

It’s worth noting that their current $170m FDV puts them up as one of the most valuable AI Agent projects in the entire crypto space.

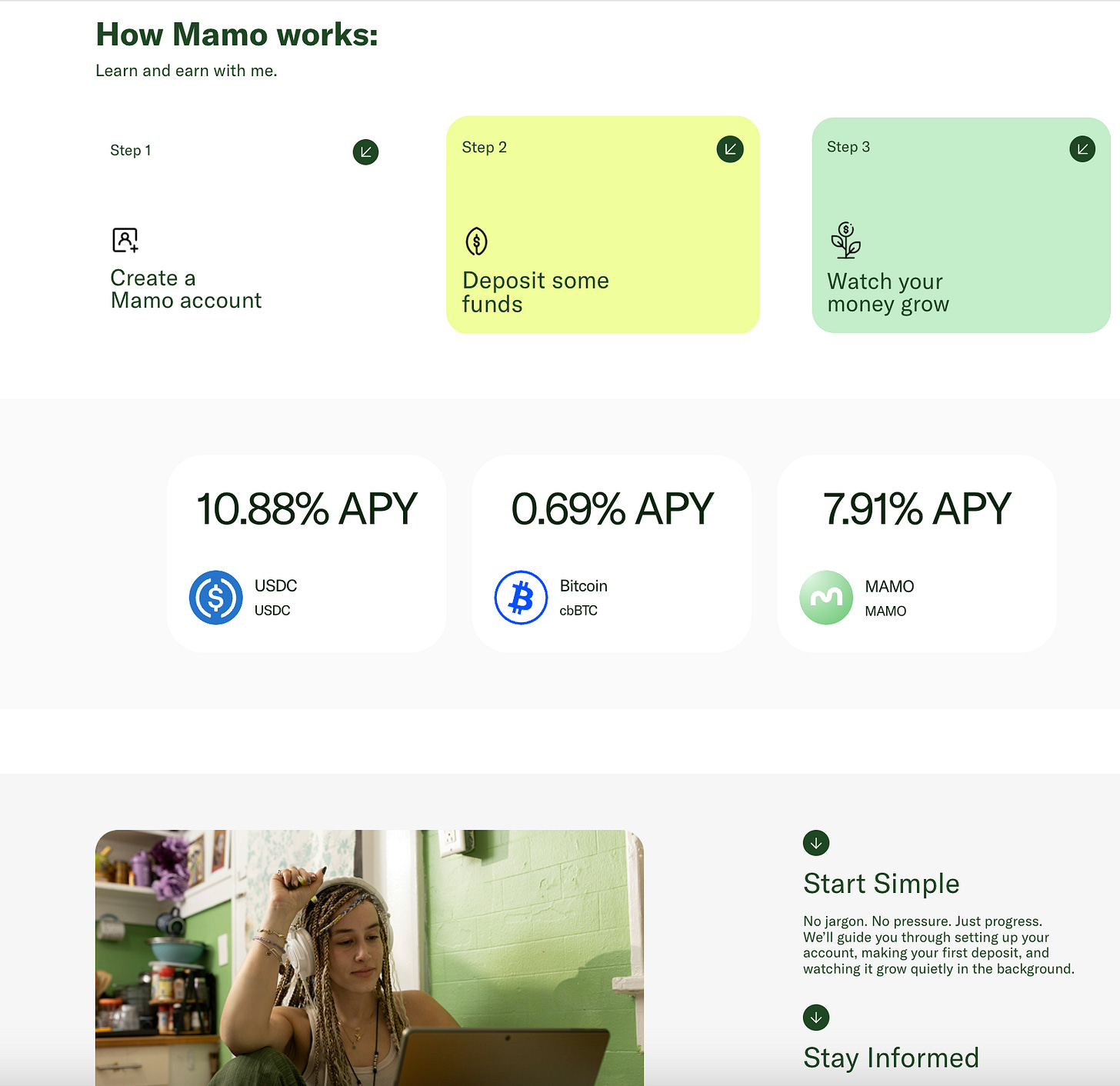

How to use Mamo

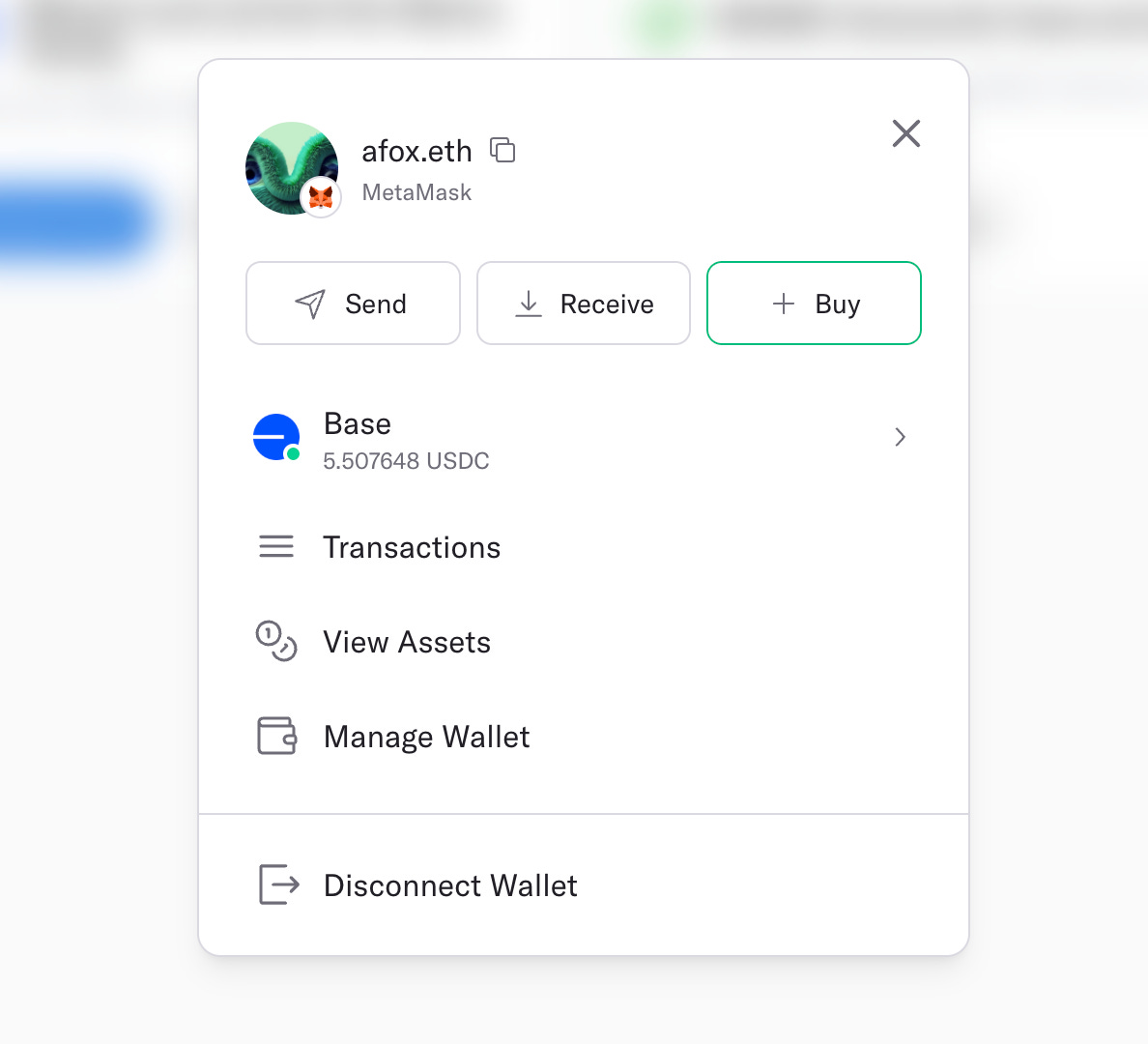

Mamo’s onboarding is slick and incredibly simple, you simply sign in with your wallet, connect your Telegram and you’re good to go!

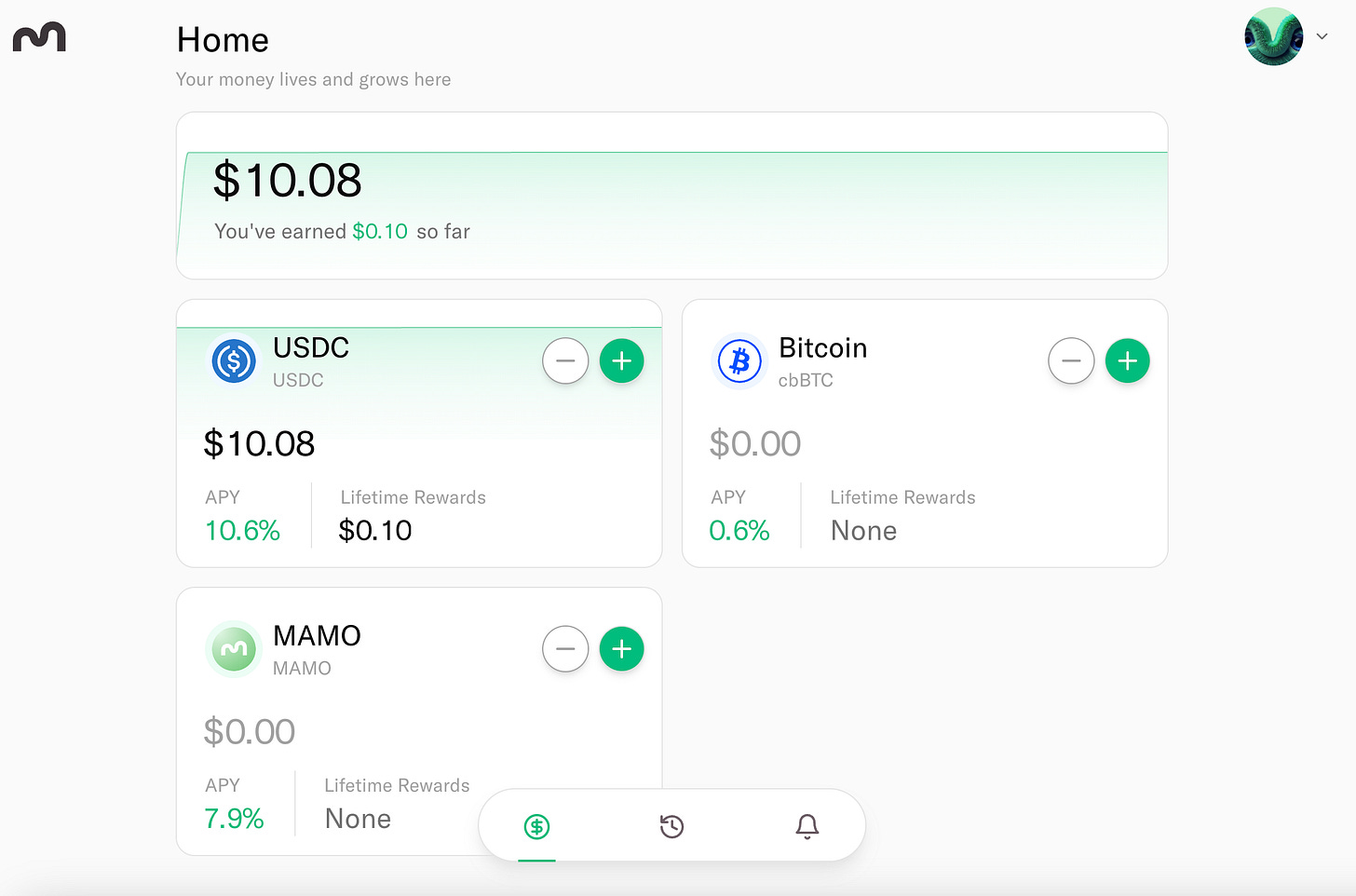

Immediately after you’re given a dashboard with all the different assets you can leave with your agent and the APY you’ll get on them. They currently support USDC, cbBTC and their own MAMO token.

As you can see above once you’ve deposited money it’ll show you how much you have, your current APY, and your earnings so far.

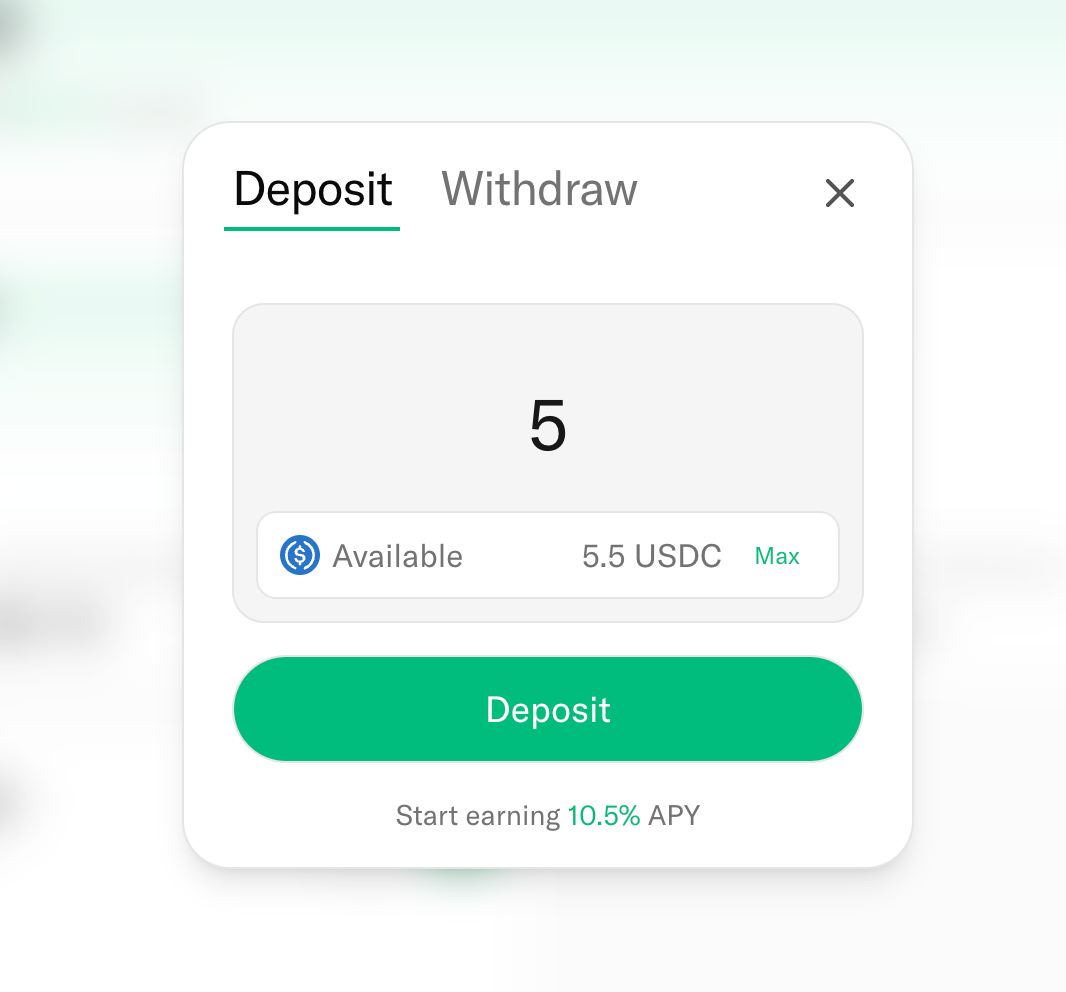

To deposit money you just click one the “plus” button with the currency you want it to use and you can deposit from your own wallet straight into Mamo. To withdraw you just switch over to the withdraw tab to take out the money instantly with no lock up.

In the background your agent will earn you yield by leveraging Moonwell’s own vaults, currently earning around 10% APY.

They also allow you to pay with a credit card to buy USDC through an integration they have with Third Web when you click on the “Buy” button in the settings section on the top-right, which allows much easier onboarding of non-crypto users.

You have no other way to interact with Mamo, they’ve kept the interface as minimal and simple as possible.

Arma

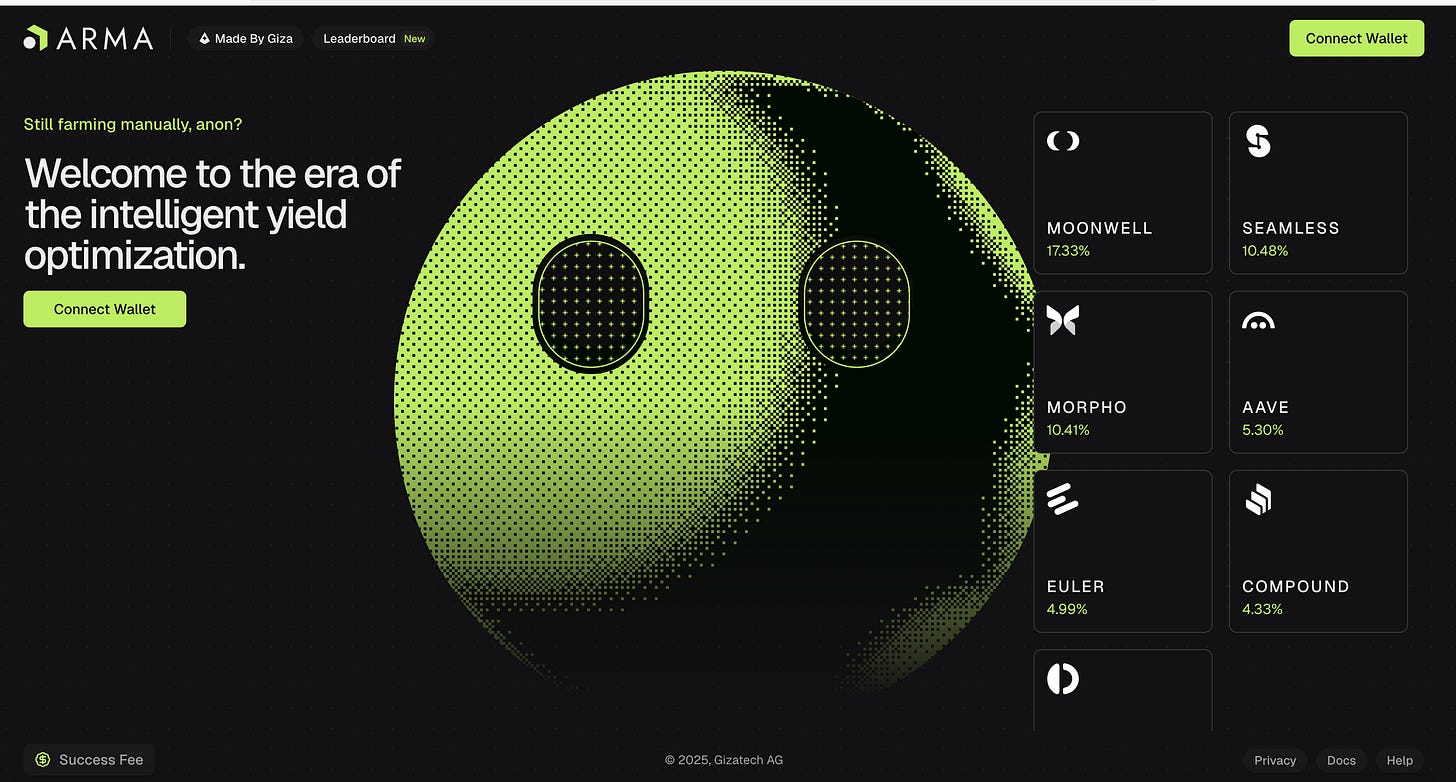

Arma is our third similar agent platform that also takes your USDC on Base and earns you yield on autopilot. They are Giza’s “flagship stablecoin yield agent”, which suggests that Giza will be building more agents over time.

They also have a slick website with a cute mascot like Mamo that looks a little bit like Pacman as its a round yellow ball. Their branding is not as retail friendly though, it’s clearly inteded for crypto-natives and is more similar to ours with their black and yellow colours, compared to Yield Seeker’s black and green.

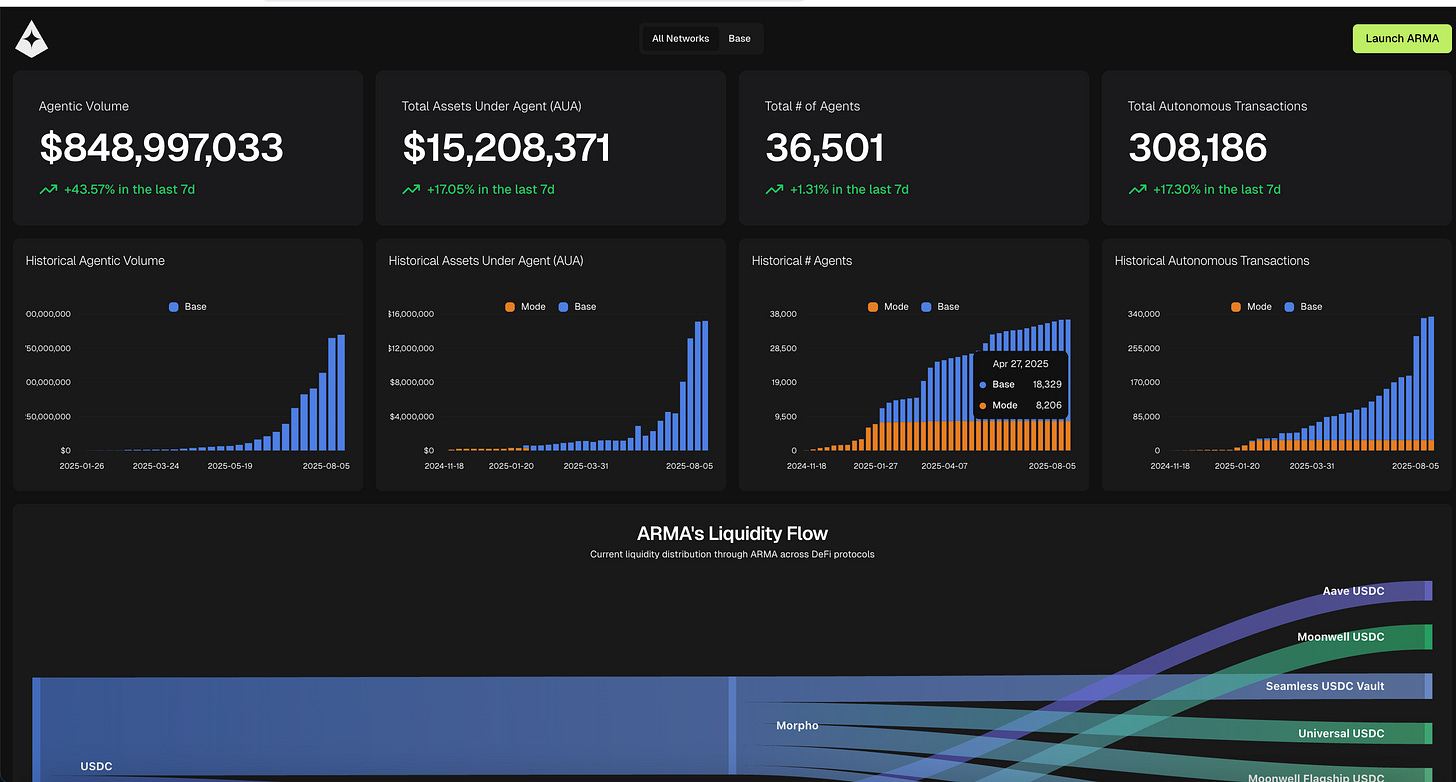

Arma are clearly going from strength to strength and regularly post about their growing “agentic volume”.

Now while $750m sure is a large number, its also a bit of an artificial one because all they need to do is move $1m in user funds back and forth 750 times to get that number, so it’s entirely self controlled.

Yet there’s no doubt they are doing a good job and seeing good growth from looking at their metrics page which shows they have over $15m in assets managed by their agents and over 36,000 agents running!

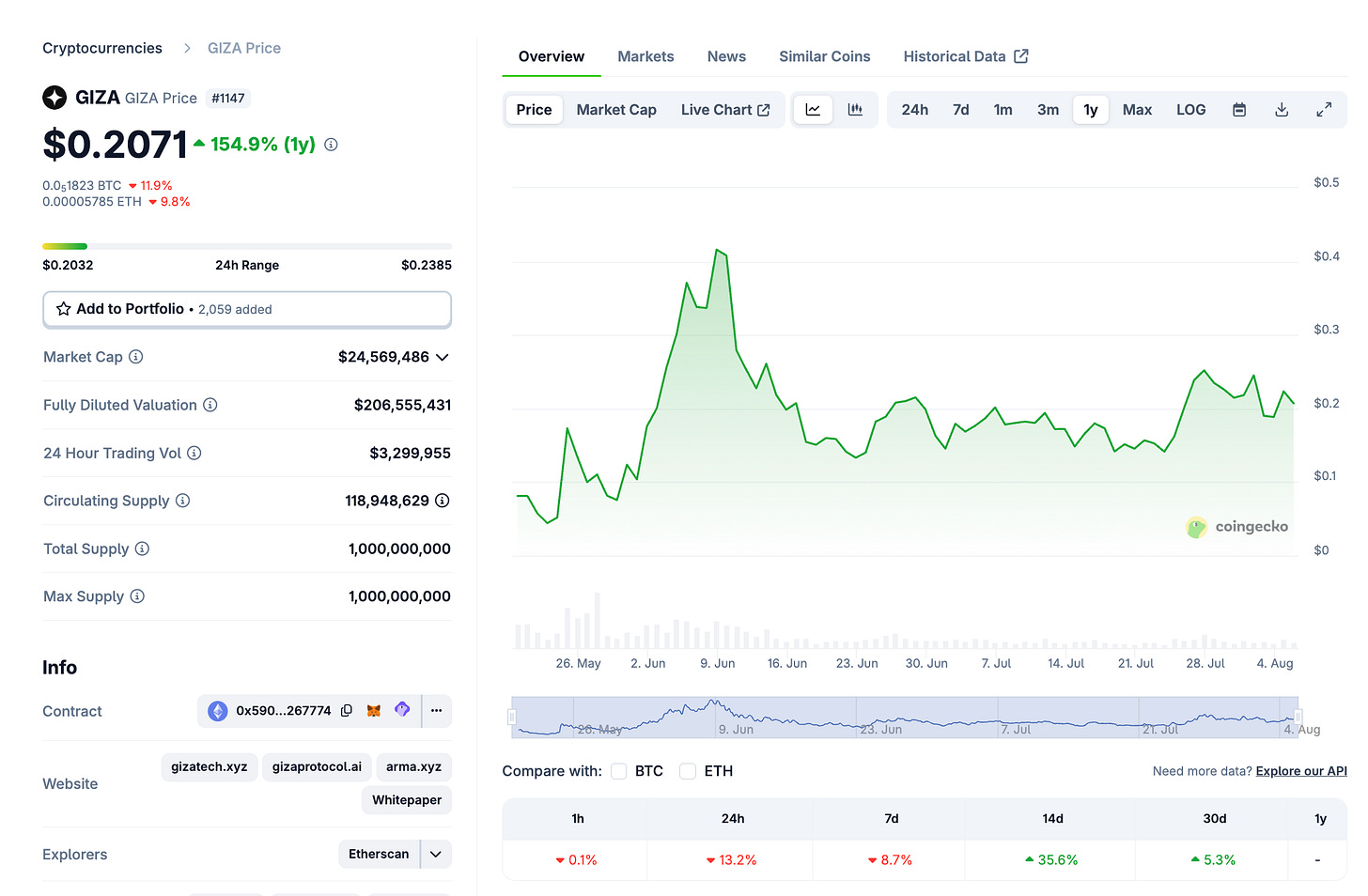

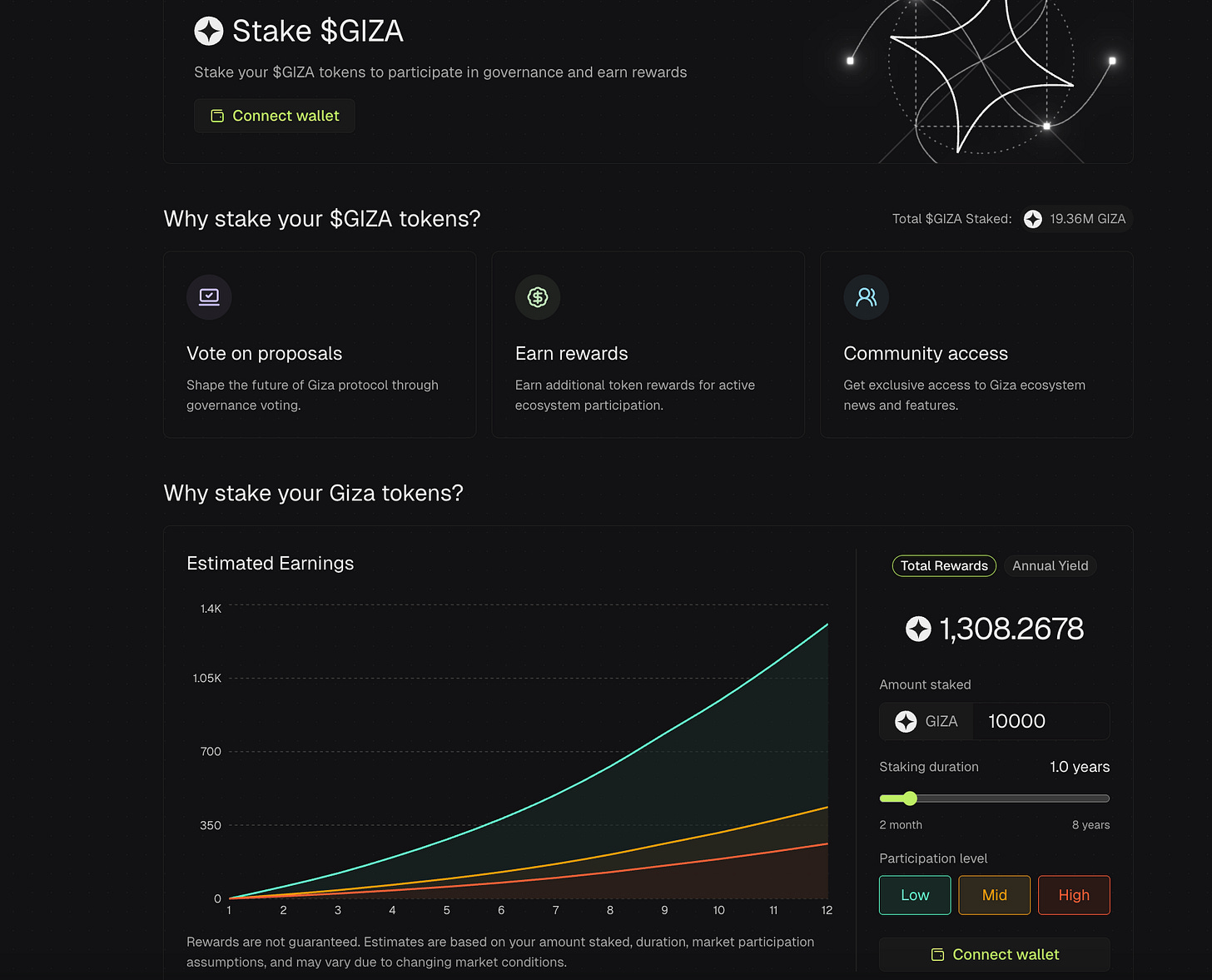

Giza released their token earlier this year in May on the same week as Mamo, and its also been doing really well, as they are currently sitting at an FDV of around $205m according to Coingecko.

Only about 12% supply of their tokens have been released so far though and they use their token to artificially increase the returns of their agent, so it’s hard to know how well their token will do in the fullness of time.

How to use Arma

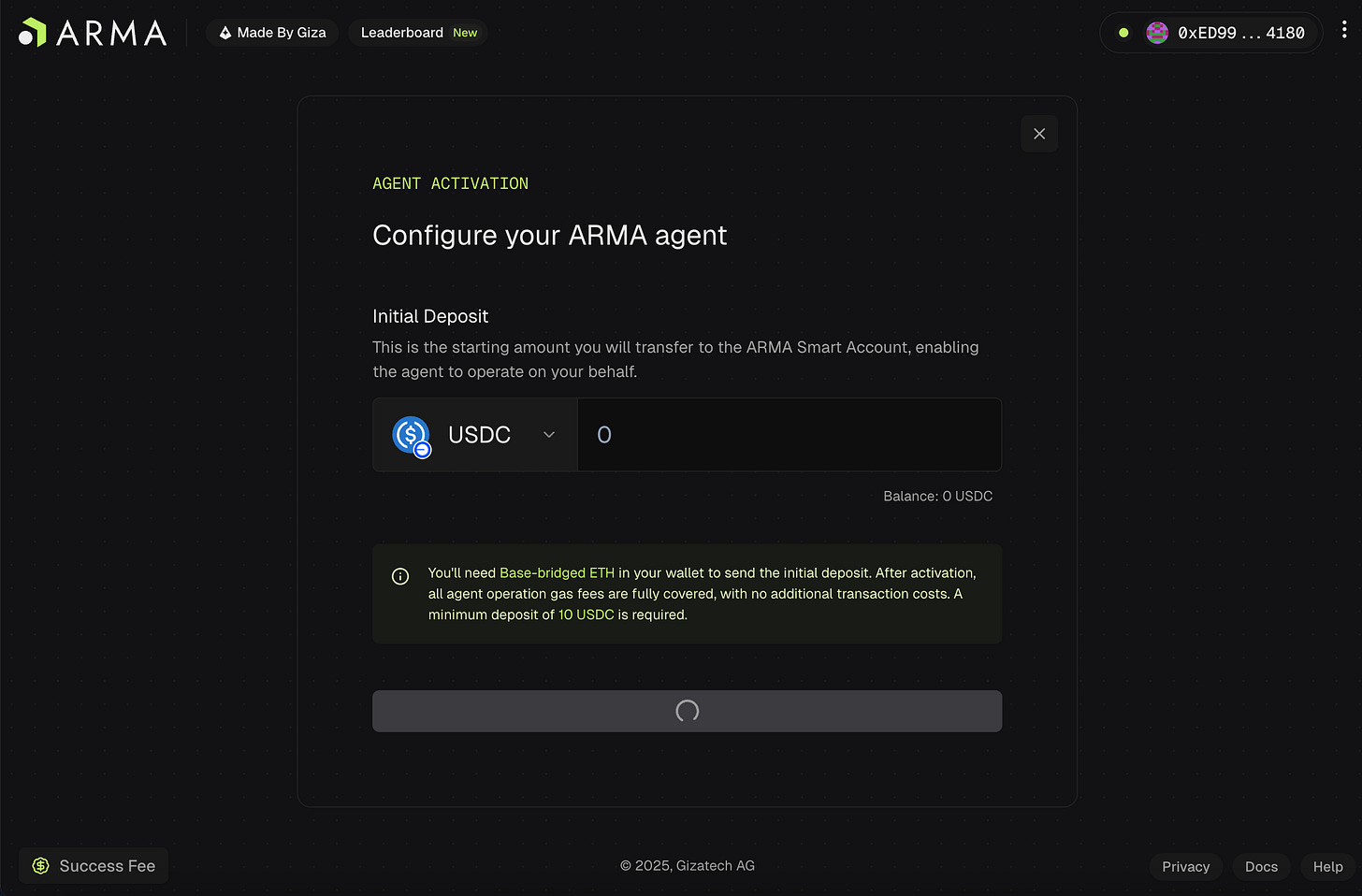

Arma has a very easy onboarding experience and interface, while it’s not as simple as Mamo’s it’s still very simple. When you click activate you’re asked to transfer at least $10 in USDC to your agent to create it with this initial deposit.

You then have to sign a few transactions and they create a smart vault for you and your agent.

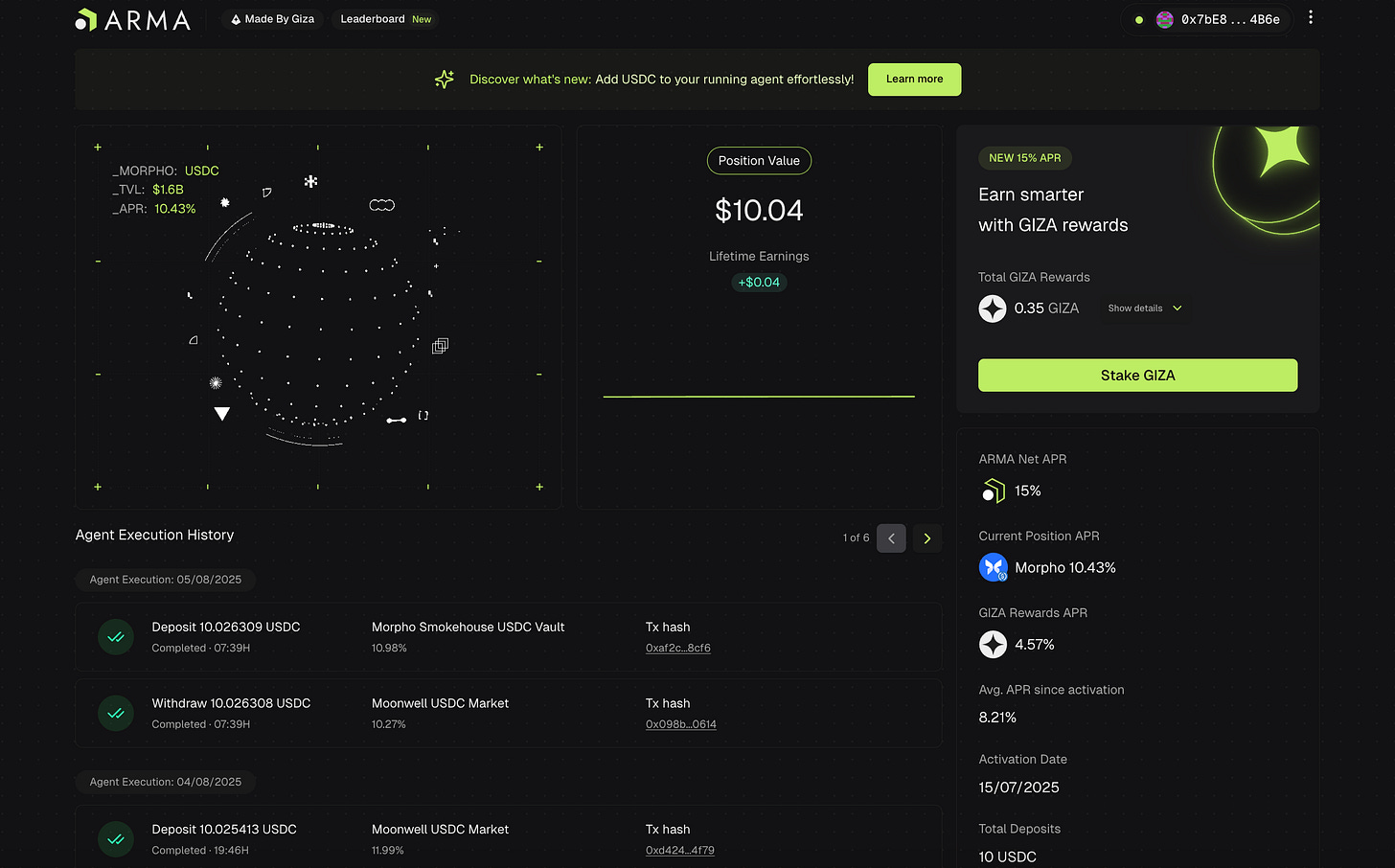

After this you’re taken to the dashboard where you can easily see the portfolio value at the top, how much you’ve earned, and the history of transactions your agent’s done.

This dashboard offers quite similar data to our performance page on Yield Seeker, however I personally find that this page displays its information in a more convoluted way than we do.

Arma then promise to give you 15% APY by topping up the APY they are getting with the underlying vault with their own GIZA token. So for example if you are earning 10.43% APY as shown above, then they’ll top it up with 4.57% in GIZA rewards since 10.43 + 4.57 = 15%.

Note that this practice isn’t sustainable in the long-run as it generates sell pressure on the token and they eventually run out of tokens to give out, however they must know this and will certainly have a plan in the long-run.

They also try to incentivise users to hold onto these GIZA tokens by only giving the reward once per week and having a way for the tokens to be staked so users can earn more rewards and be able to vote on proposals.

Arma take a 10% cut of yield earned from their users when they withdraw, which is something that neither Mamo nor Yield Seeker currently do.

Finally, they also have a Telegram integration like the others, so you can keep being notified from Telegram and don’t need to open the app to see your balance. However, as with Mamo there’s no way to really chat with your agent here.

Comparing all Three

Now if you’ve reached this far then you’ve had a good look at how all 3 projects stack up against each other.

Fundamentally all 3 do a similar thing: use agents to automate yield generation for your crypto on Base.

Out of the three Mamo has the simplest interface and is the only one that offers the option to generate on multiple tokens as it supports USDC, cbBTC and its own MAMO token. Meanwhile, Yield Seeker and Arma are far more alike, focused only on USDC and even with somewhat similar branding and features.

Arma maintains a steady 15% APY, but does this through topping up the APY its earning for users with its own GIZA token, which works well but is unsustainable. By comparison Yield Seeker has a lot more vaults integrated so it tends to get better core APY without this trick of topping up with a proprietary token.

All three offer Telegram integration that can keep you informed on agent movements, but only Yield Seeker allows you to have a real conversation with your AI both on Telegram and in the Discuss tab and we believe this will be one of its most important features over time as it eventually becomes your very own AI financial manager.

Both Mamo and Giza have a head start on Yield Seeker having released their token already and having many more users. However, when looking at the features all offer something quite similar, and I personally think Yield Seeker is ahead in many ways including for example the fact that we have more vaults integrated than the rest.

Importantly, only Yield Seeker hasn’t released a token yet. So if you’re looking to get in early on something that could one day have a comparable FDV of $150m+ as the others do then now is the time.

For example rising up on the Yield Seeker leaderboard can potentially earn you a great airdrop - although its important to note that no date has been set for TGE as we’re entirely focused on creating a great product and getting a lot of people onboarded.

To conclude, I hope this comparison has been informative and you now know about some of the state-of-the-art DeFAI apps for yield generation. This space is still incredibly early and will undoubtedly be huge in the fullness of time, so it’s great to have you here along for the ride!

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!