MakerDAO's Savings Account

A globally accessible savings account that anyone can use

TLDR:

MakerDAO look after the Maker protocol and have their own stablecoin called DAI, which is over-collateralised and pegged to 1 DAI = 1 USD.

Maker have their own Dai Savings Rate (DSR) that’s set by the DAO. Currently it’s at 5% and anyone can access it and earn 5% per year on their DAI with low risks.

DSR can be accessed via SummerFi as shown below. Minting sDAI (Savings DAI) allows you to earn savings rewards via sDAI’s price appreciation.

Happy new year, I hope everyone’s had a good start to 2024!

With the Bitcoin ETF around the corner and the Bitcoin Halving in a few months the crypto bull market is fast approaching.

But speculation isn’t the only way to make money in crypto and it’s important to keep some of your money in low-risk plays. So today I wanted to cover one way to keep your crypto as low risk as possible and still earning money for you!

MakerDAO and DAI

MakerDAO is a DAO (Decentralise Autonomous Organisation) created in 2014 by the Maker Foundation to manage the Maker Protocol. The core elements of the Maker Protocol are it’s DAI stablecoin, their collateral vaults, oracles and voting systems. The MKR governance token exists to help stabilise DAI and give voting rights for people in the MakerDAO.

DAI is a decentralised stablecoin managed entirely through smart contracts with a peg such that 1 DAI = 1 USD. The way it works is quite deep and involved, but you can just imagine that people can lock-up ETH (or other stablecoins) on-chain through the Maker Protocol vaults and receive equivalent amounts of DAI in return.

DAI is over-collateralised so if people want to sell their DAI back to the protocol and pull out the underlying collateral they can. Over-collateralising protects DAI from dropping below its $1 peg, and you can see these statistics on daistats.com showing a collateralisation ratio of 259%, more than double the total DAI in circulation!

Owning stablecoins like DAI are obviously more risky than owning USD in a bank, as these protocols do not carry the same guarantees as the US banking system. Yet you can consider stablecoins to be low risk assets in crypto as they are usually pegged to the USD and are therefore less prone to price volatility than most other crypto assets.

When you buy DAI you can do more than just hold it though, you can still make that money work for you like you would by putting your USD into a savings account! And we’ll cover this below.

It’s worth noting that there are other major stablecoins out there like USDT and USDC, and at some point I’ll write a longer post about stablecoins themselves.

DAI Savings Rate

The Dai Savings Rate (DSR) allows any DAI holder to earn savings automatically and natively by locking their DAI into the DSR contract in the Maker Protocol.

It’s free to use, has no minimum requirements, and can be accessed from anywhere in the world. It’s a genuinely great example of how blockchain technology can create financial inclusion globally. No single bank in the world can give a savings account that literally anyone can access without restrictions, but Maker do just that!

The DSR is paid out by the Maker protocol through the fees it earns from the users using it’s vaults. It’s a pretty important part of balancing out the DAI system, so as long as DAI exists so will the DSR.

Today the DSR = 5%, this means that you’ll annually earn $5 for every $100 you put into the protocol, which is better than most banks will currently offer!

It’s worth noting though that there’s no guarantee on how long the DSR will stay at 5% though as it can be changed through MakerDAO governance.

When you deposit DAI into the Maker DSR you can either just leave the tokens in there and pull them out later along with your savings rewards, or mint the sDAI (Savings DAI) token.

The sDAI token automatically updates it’s price based on continually applying the DSR. Therefore, sDAI has a moving exchange rate against DAI to accompany its rebasing. As of writing:

Over time sDAI will continue trending up against DAI, as savings rewards accumulate.

SummerFi

The DSR can be easily accessed through SummerFi or SparkFi protocols, for this tutorial I’ll make use of SummerFi.

First of all you need to have some DAI, if you don’t already you can get it easily by swapping another token for it on Uniswap. Now take your DAI over to SummerFi, open up the Dai Savings Rate, connect up your wallet, and you’ll see the following:

You can see at the top right that the DSR today is 5%. Here you have the option of creating a proxy vault or minting sDAI directly. The simplest and most convenient option is to mint sDAI.

So select the “Mint Savings DAI” box then transact to “Set Allowance” of how much DAI you want to save, and then “Deposit” your DAI! On singing these two transactions you’ll see the following screen showing how much sDAI you now have.

And it’s as simple as that!

Your sDAI will earn your DSR rewards automatically for you, and you can then just convert that sDAI back to DAI with the convert button on the same page.

Alternatives

I’ve ran through how MakerDAO’s Savings Rate works for their DAI stablecoin, but there are plenty of alternative ways to make low-risk return on stablecoins too.

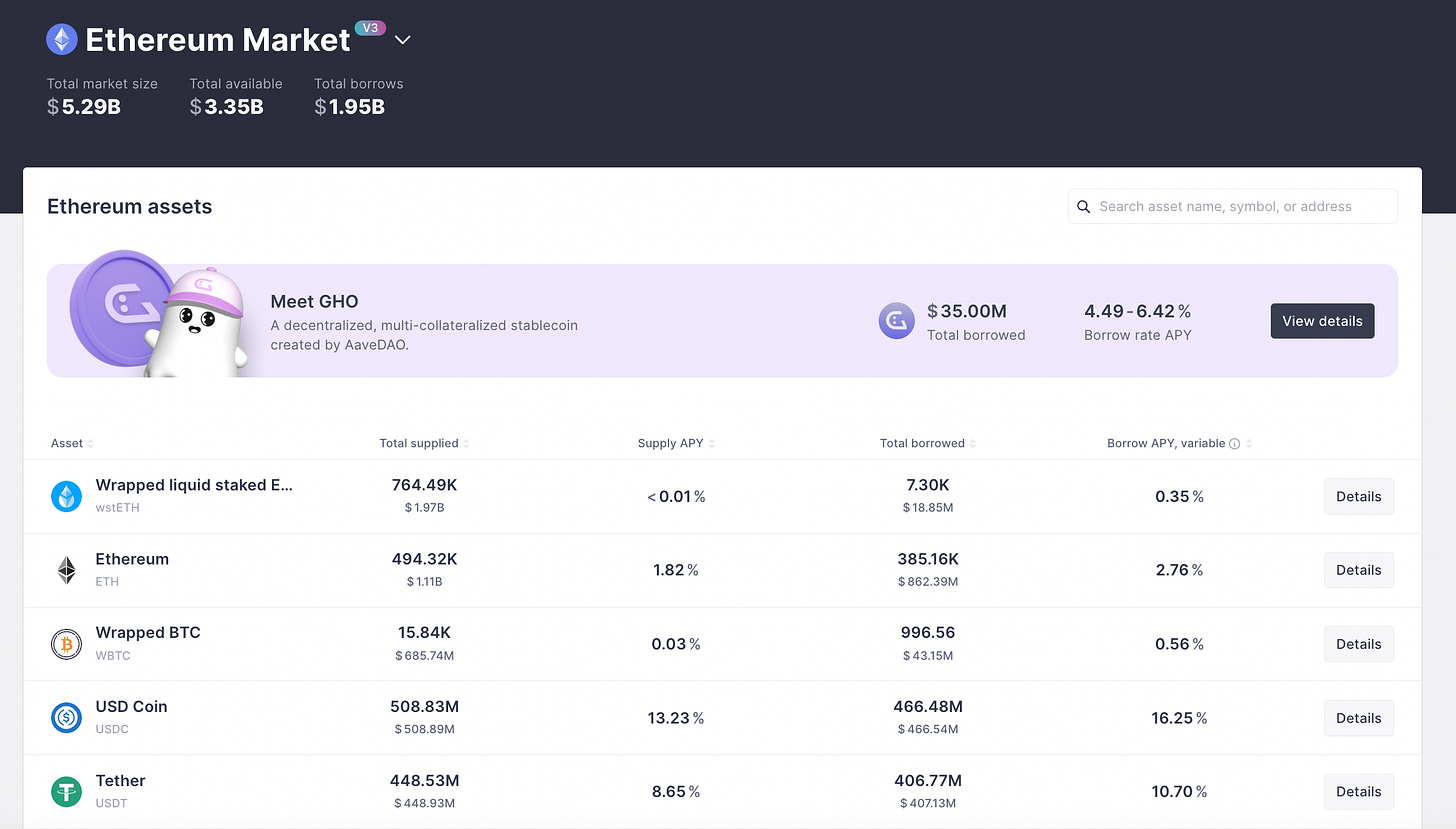

The Aave and Compound lending platforms are the most popular for this. Neither offer such a competitive rate for DAI on Ethereum, but they both offer higher rates on other chains like Polygon and for other stablecoins like USDC and USDT.

Aave V3 alone is offering 13% on USDC and 8% on USDT on the Ethereum market, which are much better rates than the DSR’s current 5%.

Nonetheless, neither of these lending protocols can provide a guarantee on these APYs. As more people flock to them the rates will drop and may go below the DSR, which is set through MakerDAO’s governance rather than market forces.

Yet they are still a great way to get low-risk yield on your crypto and I will dive deeper into them in a separate post.

Importantly though you now know how to leverage the DSR as one of the lowest risk ways to earn money in crypto. Crypto is a highly volatile market so it’s important to keep some of your money outside of the speculative game, and while doing so why not earn yourself a return too!