Pendle

A unique DeFi Yield Derivatives protocol

TLDR:

Pendle lets users tokenise and trade “future yield” from yield-bearing assets, creating a market for them just as with any other asset.

The key innovation is splitting up yield bearing assets like sUSDe into a “Principal Token” and “Yield Token” derivatives called PT and YT tokens.

PT okens then generally provide low-risk yield APYs that keep accruing value up until maturity.

YT tokens on the other hand offer high-risk returns both on claims to yield and airdrop points for the underlying asset, and eventually trend to 0 at maturity.

This week I decided to write about Pendle, which is hands down one of the most innovative products in DeFi building a truly unique set of DeFi primitives.

Pendle get’s very complicated the further you dive into it so I’ve focused this post on just the key concepts you need to understand to be able to use it.

If this post resonates with you and you want to continue the conversation then you can join my my free beginner community here.

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Watch the Video version of this Post

Pendle

Decentralized Finance (DeFi) is being built in a distributed way around the world by entrepreneurs and innovators who continuously experiment with new ideas. For that reason it’s hard to know exactly what ideas will genuinely take off.

Over the years certain projects have already become category defining in DeFi, such as Uniswap for DEXs and Aave for Lending protocols. Many copypcats have come along and replicated these platforms attempting to differentiate themselves by being on a different chain or having a slightly different set of features.

However, in the midst of all these recycled ideas Pendle stands out as a truly unique project that’s built something nobody else had built so far, and it’ll certainly go down as a category creator too just like Uniswap and Aave.

But what exactly does Pendle do?

Well they literally describe themselves as “Liberating Yield” and when you take a further look they claim to acheive this through “Yield Tokenisation”.

The simplest explanation though is that they let users tokenise and trade “future yield” from yield-bearing assets just like any other asset.

So you can actually buy, sell, and lock in your returns ahead of time, effectively turning passive income into a tradable market.

How it Works

At the core of Pendle’s innovation are their “Principal Tokens” and “Yield Tokens”, which they simplify to PT and YT tokens.

Understanding these is best done through an illustration.

In this example Pendle takes Ethena’s yield bearing sUSDe that represents its staked USDe token earning interest, and let’s the user split it into two parts where:

Principal Token (PT) – represents the base asset itself (ie. USDe)

Yield Token (YT) – gives you the rights to the future yield that the underlying (sUSDe) asset generates

This gives users lots more options with their assets, so they can for example sell their future yield now, lock in profits, or speculate on how much yield something will earn further down the line.

These PT and YT assets are derivates and hence come with an expiry date. So for example:

PT sUSDe (30 April 2026):

Here you’re essentially buying $1 that you’ll get back in around 1 year, but at a discount depending on the market. For example, if you buy a PT today for $0.94, you’ll be able to redeem it for $1 in 1 year. This is a locked-in return and in this example it translates to a 6.4% APY. PTs offer no guessing, no volatility, just a fixed yield for holding until maturity.

YT sUSDe (30 April 2026):

Here you're basically buying the variable yield that the underlying asset (like sUSDe) will collect over the next 1 year. Right now, the market might be pricing that yield at around 7%. But if you believe the actual yield will be higher than that, you can buy YT tokens and potentially earn more. It's a bet on future yield and if you're right the upside is all yours.

When a YT reaches maturity, they stop accrueing any further yield and become worthless. They represent the right to receive the yield generated by the underlying asset only up until the maturity date.

Bonus: If there are airdrops happening and the underlying asset qualifies then holding YT tokens can also earn you points toward those airdrops!

YT tokens often have this dual mechanism of both earning you yield and points for potential airdrops, which is where a lot of the magic happens.

Market for Pendle Tokens

Great so you now understand Pendle’s core yield tokenisation innovation, so let’s get practical and look at the market for PT and YT tokens.

As soon as you launch the app you’re shown an incredibly complex dashboard.

The truth is Pendle has way too many different tokens and options to really dive into so we’ll keep it light in this post and just show you the example from the section above with sUSDe.

Having clicked on the sUSDe option you’re taken to the page for its market. You can see here that it says “1 PT sUSDe is equal to 1 USDe staked in Ethena at maturity”.

I can now buy these tokens in one of two ways. Either I can go into the market and buy the PT or YT token at the going rate, or I can mint entirely new ones and sell them into the market.

Buying vs Minting Tokens

Minting takes the sUSDe and creates both the PT and YT tokens that are split out from the sUSDe, as shown below. Note that you can also do a “redeem” operation to merge PT and YT tokens together and get back the original token, in this case sUSDe.

You’ll see that these resulting tokens are numerically equal to the sUSDe you originally minted, ie. 100 sUSDe = $117.28, so it gives 117.28 PT and YT tokens. This means at maturity on the 30th July 2025 they will return $117.28 which is the value originally minted at.

However, the price of buying these PT and YT tokens on the open market varies based on what buyers and sellers are willing to pay. So for example instead of minting PT tokens if I were to buy the exact same 100 sUSDe I would actually get 119.2 PT tokens, which are more tokens because I’m buying them at a slightly discounted rate.

This discunted rate makes sense since the buyer is essentially buying something that’ll only reach maturity 1 year from now. However, it’s worth noting that during that time period I can sell back through the protocol and lose a bit of the profit so I’m not locked to wait 1 year to get my original assets back.

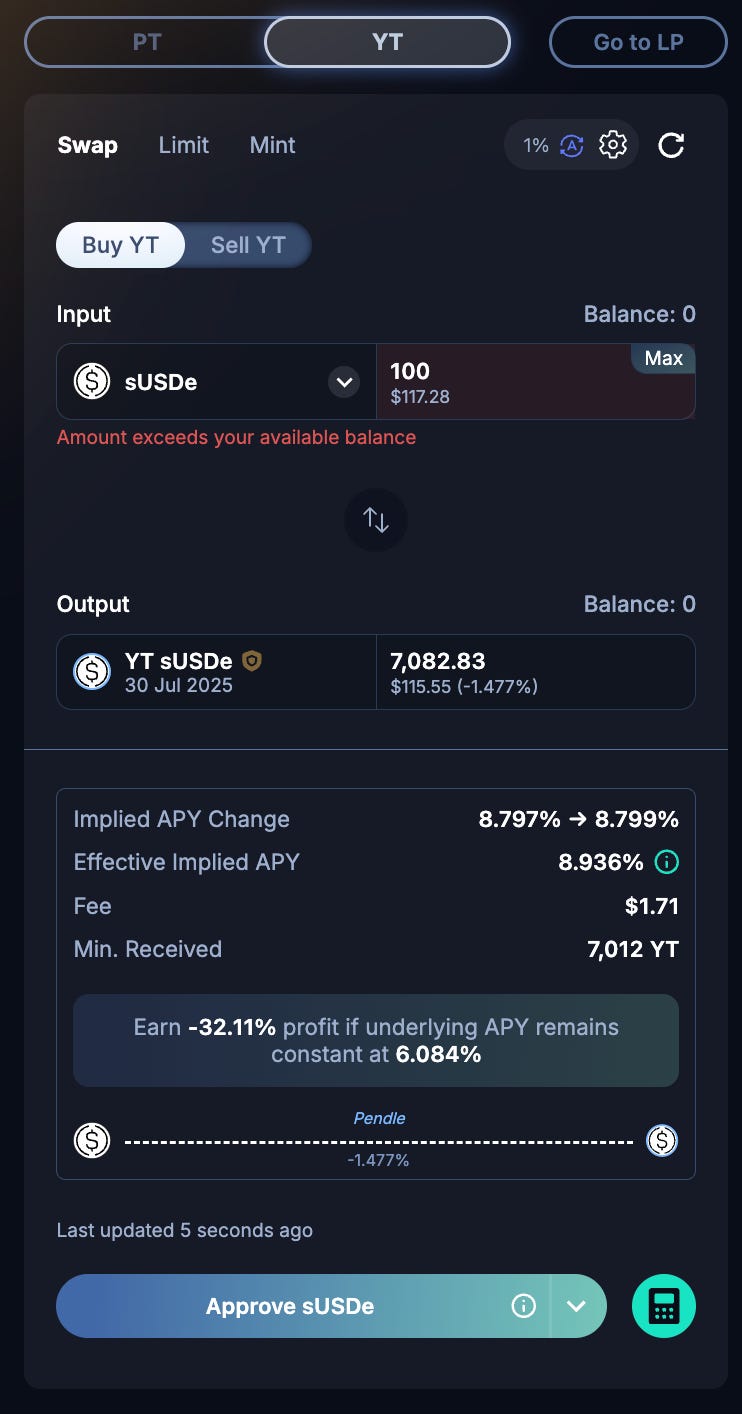

PT tokens are generally low-risk bets that you’ll get a return on your money. The real risk likes with YT tokens, and in this sepcific example of buying 100 sUSDe’s worth of YT tokens you’ll get 7,082.83 YT tokens. Now at today’s APY that actually will lose you money, losing you around -33.6% assuming you keep it until maturity!

However, if you believe that this yield will offset the money you put in and you’re right then you may find yourself making a profit and/or you might farm points and make money through an airdrop.

Since YT tokens stop accruing any further yield and points when they reach maturity they also rapidly devalue the closer they are to maturity, so the market for YT tokens is more complex and varied based on their maturity date.

Points Market

Since Pendle breaks down tokens into its constituent pieces and can offer more points on YT tokens they’ve also created a “Points Market”.

Here you can pick PT or YT tokens specifically to try to earn certain points towards certain airdrops. For example if you select eUSDe here you can see how YT tokens can give you 45x leverage on Ethereal points, while PT tokens forgo points to earn you over 9.8% in APY.

Pendle also have LP tokens that are related to providing liquidity into their DEX, which ends up being a middle ground between going all in on PT or YT tokens and helps Pendle to provide liquidity for the traders of these assets.

The key thing here though is that since Pendle splits out yield from the underlying token, they can create these entirely new markets based on farming points for future airdrops!

Pendle are aware of just how appealing this can be for risk-takers and have a growing points market with many projects running partnerships together with Pendle giving special point bonuses. This can be a win-win for Pendle and the project as both get more liquidity and users.

Dashboard & Fees

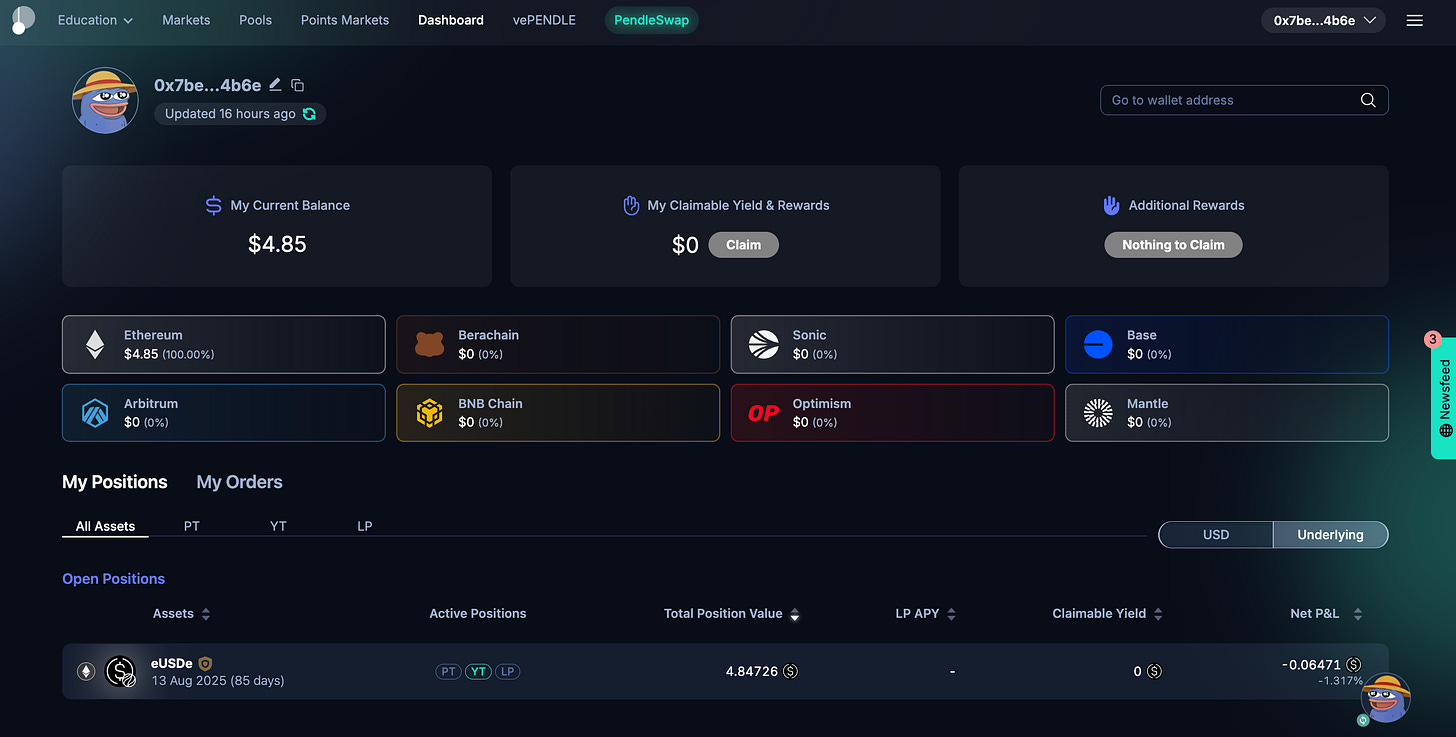

For the sake of this tutorial I bought around $5 worth of the eUSDe YT token so that you could see what it looks like in the dashboard.

This is where you can see all your open Pendle positions, check what chains your assets are on, and your total balance. It’s also easy to find all claimable yield and additional points rewards here just by clicking through the appropriate sections.

The dashboard is a surprisingly clean and easy interface to use given just how complex the rest of the Pendle protocol can be.

As a final note here, Pendle makes it’s money through two sets of fees.

DEX Swap fees - the closer an asset is to expire the lower its DEX fees tend to be, plus there’s a fee for deploying a pool

YT fees - every time yield (and points) are earned Pendle takes a cut of 5%

A chunk of these fees are returned to those who decide to stake their PENDLE token for vePENDLE.

Checking DeFi Llama you’ll see that Pendle generate around $19m in annual revenue placing them in 79th place out of all DeFi projects as of today. This is a lot of money but there a still many larger DeFi protocols out there.

Unique Protocol

Summarising, Pendle’s very innovative and creates a truly unique DeFi primitive. In traditional finance the closest thing you’ll see to this is something called “Bond Stripping” where bond’s principal and coupon payments are separated and traded individually.

You’ve now had a good overview of how Pendle works, although honestly I’ve only just scratched the surface as there’s even more complexity the further you dive into it.

Most importantly today there’s nothing quite like Pendle in the market and it sits as the king of the hill for this type of product. Plus it seems to be growing very fast. As it grows and establishes itself I’m sure new copycats will emerge to try and take some of its market share.

I suggest having a play with Pendle and see if you can earn yourself some points for future airdrops with YT tokens or make some solid low-risk yields through its PT tokens.

Whenever you’re ready, these are the main ways I can help you:

FREE access beginners.tokenpage.xyz - Get yourself started in crypto, setting up your first wallet and buying your first crypto. Includes a 1-on-1 call with me for free, and $1,990+ of bonus course material.

VIP access beginners-vip.tokenpage.xyz - Learn to build real lasting wealth in crypto. Includes weekly Q&A calls where you can ask me anything, and our proprietary DeFi portfolio software.

Web3 software development at tokenpage.xyz - Get your Web3 products and ideas built out by us, we’ve built for the likes of Zeneca, Seedphrase, Creepz and more.