Solana Memecoin Season

Create, view and trade solana memecoins

TLDR:

Solana memecoin season has propped up SOL prices despite an overall dip in the market. Last week the memecoin $BOME reached $1bn market-cap in just 3 days!

Crypto degens have thrown around $150m into “pre-sale” memecoin tokens in a week by random people on Twitter! The crypto casino has been in full swing.

Creating your own Solana memecoin is easy with solana.keyglomax.com and the steps to do this are highlighted below.

Viewing and trading memecoins can be done through Dextools, Dexscreener, Birdeye and other tools. Photon seems to be one of the best for fast trading.

Most coins collapsed this past week but Solana has shown some real strength, mainly due to the memecoin season that’s been going on there.

It’s reminiscent to the what happened on Binance Smart Chain’s early on in the last bull run.

But the tools have become more sophisticated this cycle, today I’ll look at how to use these to get involved in the memecoin mania.

Solana Memecoins

Solana memecoin season is in, everyone’s been making their own token, we’ve seen new tokens based on presidents, famous people, animals and even vegetables cropping up every few minutes on Solana.

Last week a memecoin called $BOME reached a market cap of over $1bn in 3 days! Meanwhile, $WIF, which has become *the* Solana dog meme has successfully been funded with over $600k to appear on the Las Vegas sphere!

We’ve been seeing random people on Twitter launch their own token by posting just an address for people to send money for a pre-sale and raising millions of dollars in SOL! Coins like $NAP, $NOS, $SMOLE, and more.

We’re literally seeing cartoon characters on Twitter raising mllions of dollars with no promise other than hopefully “number go up”! ZachXBT noted that $150m was raised like this in just over a week.

One person on crypto-twitter who’s alias is Slerf raised $10m for $SLERF, then proceeded to incorrectly burn the liquidity pool meaning nobody even got their pre-sale tokens! And in the end people actually praised him for turning it around!

It’s all pretty insane behaviour and is clearly part of a local top in the market. Importantly it has led me to believe we’re getting progressively crazier bull markets, not more toned down ones as I’d previously imagined would be the case.

Solana memecoin season may be fizzling out a little now but it’ll definitely come back, below I’ll highlight some tools so that you’re ready when it does.

Creating a Solana Memecoin

I previously covered how to launch a memecoin on Ethereum in 3 minutes. Creating a token on Solana is just as simple.

Solana uses a standard called SPL for its tokens, one of the easiest ways that I know of to create one without any code is using solana.keyglomax.com. The tutorial in this video is a great one to follow in more detail, but I’ll explain the key steps below.

First, you should create an image to represent your memecoin, make it as silly or serious as you want. Below is the $SLERF image just to show you how silly you can be and still get to over $500m market cap.

Next, you must decide on a name, symbol, description and total supply of tokens. You can also add any other links like a website, twitter and telegram if you have them.

Now fill in the details you’ve settled on, upload the image with “Token Image” button, and finish up with “Create SPL Token” button!

It’s this fast and simple! And you’ll end up with a token address like:

AgFnRLUScRD2E4nWQxW73hdbSN7eKEUb2jHX7tx9YTYc

With the token created you’ll then need to revoke the mint authority (meaning the supply is fixed) and revoke freeze authority (so you can’t freeze people’s tokens). This can be done on the same site too.

The next step is to create the Openbook market ID as show on the site. This will cost you around 3 SOL and basically creates an entry into Openbook’s directory pairing your token against SOL, which will get used by the DEX to create a market. Note that this might be slow to do as Solana has been struggling recently under a lot of usage.

The final step now with the Openbook market ID in hand is to create the liquidity pool on something like Raydium. You’ll need to decide a % of tokens to pool against your SOL. The standard is to do something below 50%, as you’ll want to keep some for yourself and for the treasury of the project.

In the future I’ll write a post to explain liquidity and market cap better. But for now it suffices to say that a larger % of tokens and SOL liquidity means less volatility.

Now you’ve created a token, the real work of marketing it begins, although that’s a whole different conversation and not within the scope of this post.

Viewing and Trading memecoins

With your new token out in the wild it will immediately show up in all the main tools as a newly listed token and people and bots will immediately start trading it.

Some of the most popular tools used to track these are Dextools, Dexscreener and Birdeye. They each have a lot of information and can be a little confusing at the start but are easy to get a grasp of over time.

The first thing to do is type the token address (often called CA after contract address) into the search bar at the top and check out the token. Below is an example of $SLERF on Dexscreener:

The most notable thing is the price history graph, but you can learn a lot more about the token here too. For example you can see how much liquidity is available. For liquidity I find Dextools has a great overview, this is what it showed for $SLERF.

Clearly there’s a lot of liquidity available, with 384.7k SOL at the time of this print to be precise, that’s around $70m! Plus there’s 15.9% of $SLERF coins pooled against it.

Remember the more liquidity the less volatile it is, you need large volume of trading to impact the price of a coin like this. Although the trading volumes of SLERF have been huge this week.

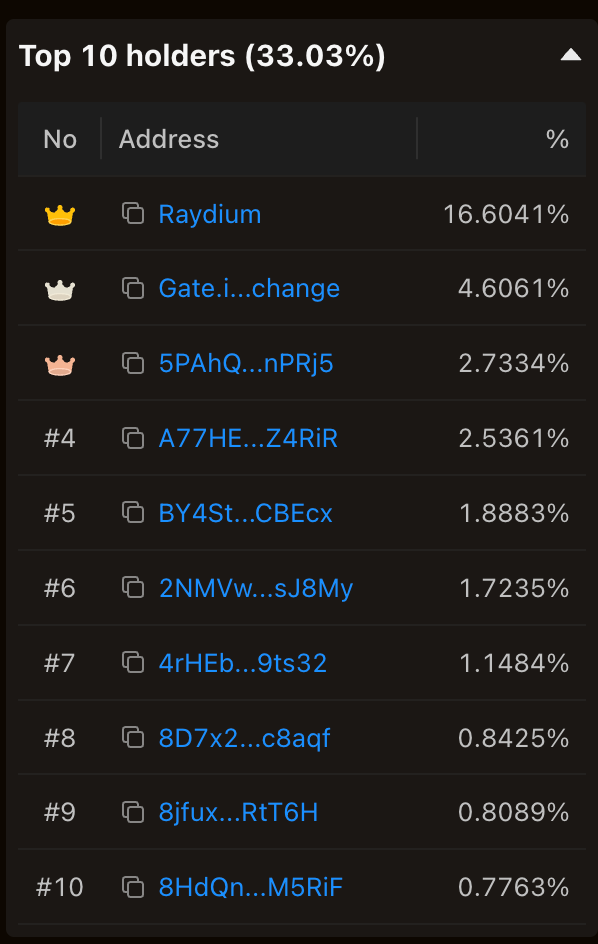

To understand who’s even holding these coins I find a quick glance at Birdeye very helpful to see the top holders at a quick glance.

You can see that 16% of the coins are held on Raydium and 4.6% on Gate.io. The next 5 holders have over 1% but then everyone else has less, meaning there’s no singular large whale who can dump all their coins. I’d be wary of coins where there’s some huge holders as they can cash out and dump the price if they want to.

All of the above tools give great data, and allow you to buy directly, as they all have a Jupiter or Raydium interface in them. However, these Dex interfaces can often not work well. The best platform I’ve seen for ensuring you successfully buy is Photon:

Photon is very similar to the above tools but it also has the ability to create a new wallet and make trades directly from it! I’d usually avoid this sort of solution, as it seems unnecessary to want to have another wallet to track beyond your main wallets and to risk leaving your private key with them.

However, in this environment where you want transactions to go through fast and Raydium’s website just can’t keep up, Photon transactions go through almost every time so it’s a safer bet.

You can also use bots to automate your trading but I’ll cover that in a future post.

This is a Casino

There’s very little fundamentals with memecoins, it’s essentially a massive casino.

This means you should be very wary and responsible with what you are willing to risk on them. Just like in a real casino, make sure you don’t gamble away money you cannot afford to lose!

However, if you’re responsible with the amount you’re going to risk, it doesn’t mean you shouldn’t get involved and have some fun. People spend thousands of dollars in casinos in Las Vegas and other casinos around the world just to see if they can hit it big, and with memecoins you can do it all from the comfort of your own home.

A huge worldwide online casino is something pretty unique and it’ll be interesting to see how this aspect of crypto and Web3 continues to evolve over time.

Remember though that in a casino the house always wins, so be responsible, and know that as long as Solana is the house you can just play it safe by holding SOL.