Polymarket

The Top Web3 Prediction Market

TLDR:

Polymarket has transcended Web3 as a consumer oriented app with mass market appeal and as such is one of the biggest successes of the space so far this year.

The app has been smartly built to take advantage of Web3 tech through Polygon smart contracts without having this limit Web2 consumers’ usage.

Growth really took off after the US Presidential debate between Biden and Trump, and it’s just recently surpassed $1bn of USDC volume!

Using it is super simple, you can add money with fiat or crypto, and place bets trivially. Its main limitation today is that usage is blocked in some countries.

Polymarket stands as a great example of a Web3 app with mass appeal done properly, it’ll be interesting to see what other new apps it will inspire.

Polymarket has been one of the biggest winners in the Web3 space this year, emerging in the last few months as one of the most significant prediction markets in the world.

We’re still not at the point where Web3 apps are commonplace in the lives of mainstream consumers. However, Polymarket is an example of an app that’s almost there as it’s become one of the best sources to gauge the sentiment of who’ll win this year’s US presidential race.

Polymarket

Prediction markets like Polymarket are open markets that allow people to predict the outcome of an event through financial incentives. The prices of a prediction market indicate what the crowd thinks the probability of an event is, with events going from 0% to 100% chance of happening at any given moment and ending when they reach either extreme.

Prediction markets make use of what’s called the “the wisdom of crowds”, which those in Web3 are no stranger to with DAOs and the like being similar. Since people are putting their own money on the line, when you have enough users you’ll generally get a pretty accurate gauge of future events through this “collective wisdom”.

For example, participants have been betting on the chance of Nadal winning a gold medal in the Paris Olympics on Polymarket, and as of today they are betting with only a 36% chance of it happening.

If you bet on him winning and he does then you’ll make a notable gain since the odds are stacked against you, but if he doesn’t then you’ll lose what you put down and others will take your money as their winnings.

What makes Polymarket truly unique though is that it’s been built using Web3 tech! The “Poly” in its name even comes from the fact it’s built on the Polygon network.

The idea of prediction markets that use blockchain tech have been around for a long time with Augur being the first major player to try them out as far back as 2014. Yet neither the technology nor the market were quite ready for it back then.

Polymarket entered into the scene almost 2 years ago now, created in late 2022. With it’s simple UX and underlying EVM smart contracts the platform’s been slowly bubbling along for a while now. However, it really hit an inflection point last month when Biden and Trump had their presidential debate and Trump came out on top.

This was a critical moment for the platform and led to their “US Election Forecast for 2024” market to rocket up in interest. Since then we’ve seen $440m+ of liquidity go into the election prediction market alone!

The US elections have been so significant for the platform’s growth that they’ve even made a specific page for it namely polymarket.com/elections. Plus they’ve created lot’s of other related prediction markets such as an individual market for each of the American states, with a state map showing their current predicted outcomes.

The platform’s taken this heightened interest to work on several partnerships including with Substack which I write this blog on, as Substack have added Polymarket embeds as such:

People will often speak louder with their money than words, which is what makes Polymarket so interesting to follow. For example, mainstream polls have been showing that Republicans and Democrats are a lot more tied together than Polymarket does. Due to this even some news outlets have even began to regularly mention Polymarket’s predictions in their posts (example with Bay Area Times).

Web3 done properly

Polymarket is a glimpse into the future of Web3 apps. Firstly, it allows people to log in with either a Web3 wallet like Metamask or with Web2 methods like an email and password. This flexibility is often described as Web2.5 as it allows them to make use of Web3 tech without excluding those who aren’t Web3-native.

Secondly, users can send funds into the platform with either crypto or with fiat through an integration with MoonPay. So although your money is stored in crypto in the underlying Polygon smart contracts, as a user you don’t need to have any crypto.

The smart contracts are then hidden away but still manage the creation, resolution, and settlement of markets, and guarantee that the platform remains secure, transparent, and immune to manipulation, unlike in many traditional betting markets.

Meaning that we find ourselves in a situation where Web3 tech is used to provide powerful infrastructure and solve generally interesting problems but without users having to know they even exist.

This is exactly how Web3 should be!

The Tech

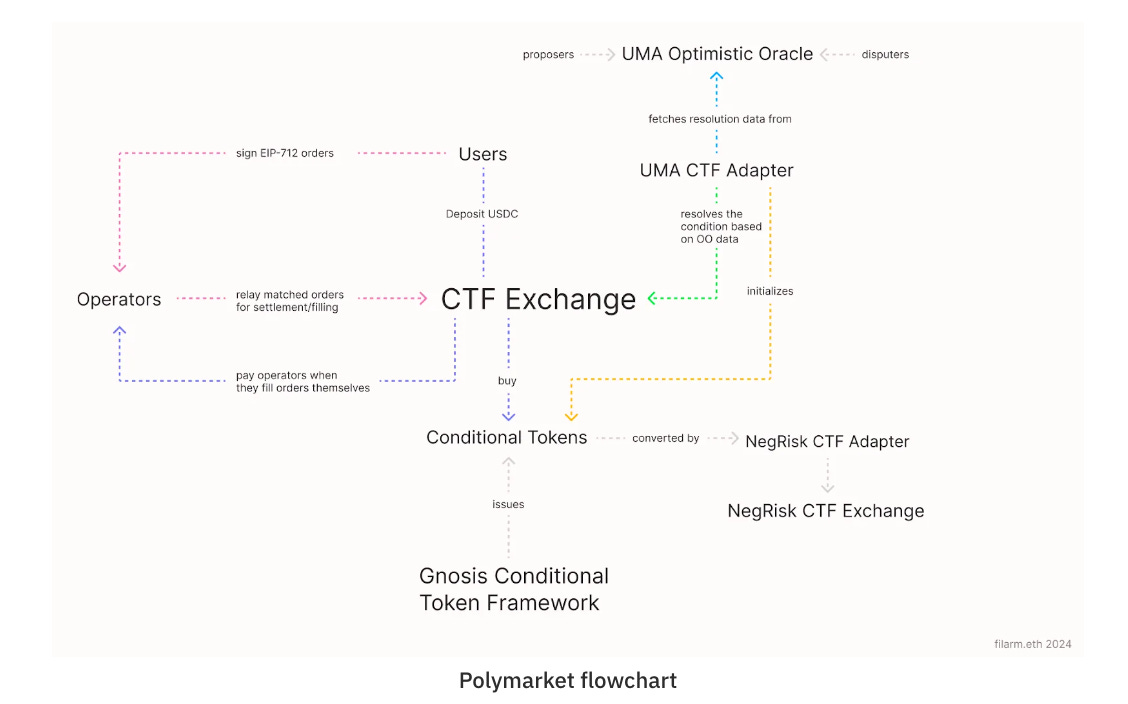

For those more technically minded the core pieces of Polymarket’s architecture are detailed below:

Some interesting points to note here are that firstly Polymarket does have some off-chain components with all it’s order matching been done off chain.

Yet importantly all bets and liquidity are stored and settled onchain on the Polygon blockchain, meaning they don’t have to deal with banks, can spin up infinite bets inexpensively, and can still provide an immutable record of all market activities.

Moreover, they use AMMs to ensure liquidity, allowing users to buy or sell shares without waiting for a counterparty. The prices of these shares adjust automatically based on supply and demand, reflecting the dynamic probabilities of outcomes.

It’s also worth noting that to validate if an outcome is truthful they use the UMA oracle, which is well regarded decentralised oracle in itself.

Plus Polymarket’s underlying markets are all built using Gnosis “Conditional tokens contracts” (CTFs) that essentially allow for their core Yes/No bets. “NegRisk” markets then essentially combine a set of these individual CTF bets and create the multi-variant bets we see in the example of the US presidential race.

Below you can see how all these pieces tie together:

As you can see it’s quite a complex system, for a deeper look at how Polymarket works I recommend checking this article out.

Growth

Polymarket’s growth this year has been monumental. As mentioned above it was created in late 2022 but really took off this June after the presidential debate. Over one-third of the platform's total lifetime volume was traded this past month July ‘24 and the majority of bets have been focus on U.S. politics and the Paris 2024 Olympics.

This Dune Analytics page shows very specific data to highlight this growth. For example we can see Polymarket just recently surpassed $1 billion in lifetime trading volume! With over $440 million wagered on the U.S. 2024 presidential election alone.

You can see this staggering hockey-stick growth in the platform’s usage in the chart below:

The newer “NegRisk” markets introduced in December 2023, seem to have been a key part of the growth with these more complex types of prediction markets being where the majority of transactions growth has occured.

As we’ve already mentioned, most of the growth in USDC volume negotiated has been due to the US presidential race in July ‘24. The graph below shows this very clearly as the biggest spike in came in the past month on NegRisk USDC volume:

Curiously we can also see that users tend to have higher average bets on NegRisk markets than their binary CTF counterpart.

Since Polymarket is essentially a futures platform, there are heavy regulations in place and they’ve already seen regulatory action by the Commodity Futures Trading Commission in the US. This means that Polymarket is currently restricted from operating in certain regions. But even that’s not slowed down their growth!

If you are interested in an even deeper look at the platform’s growth then check out this analysis here.

Making a prediction

Getting involved in the fun yourself is easy. Start by opening up Polymarket and you’ll see a lot of different prediction markets, with political ones being the current dominating theme. Although there are plenty of others categories too such as sports, business and science.

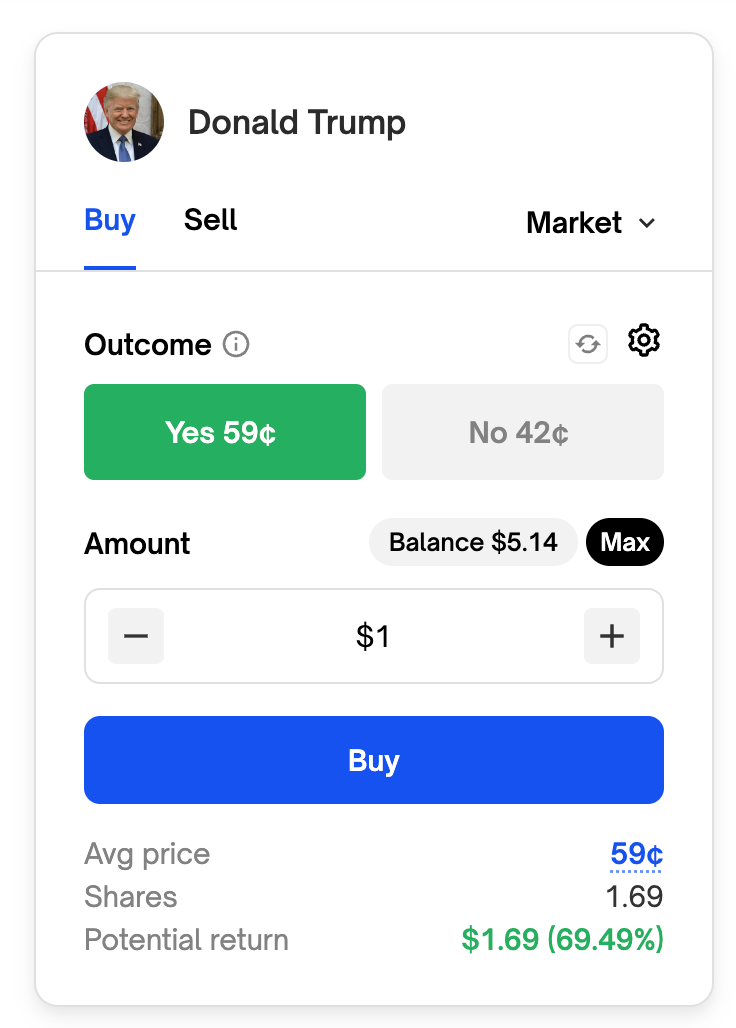

You can sign up and log with either an email and password or Web3 wallet, and then deposit money. Your portofolio will then show up on the top-right, and as you can see in the image below I’ve got $5.14 on the platform.

Note that you cannot deposit money nor bet if you’re in the USA and certain other territoires due to regulations as these options will be marked as “unavailable”. However, you can easily bypass these restrictions with a VPN.

As shown above the CTF bets have a single Yes/No bet, such as in the example of whether Biden will finish his term, which has got $14m+ worth of bets tied up in it.

Meanwhile NegRisk markets show several options and percentages for each one. They are most dominant and frequent on the platform, as the growth numbers in the previous section also show.

Select the “Presidential Election Winner 2024” market to get a peak into the biggest market of all on the platform, which today has $440m+ worth of bets in it.

Having opened a market it’s now pretty trivial to add your own bet. Just select on the outcome you want to bet on the right side, type in the amount, and hit “buy”. This will require a signature from your wallet assuming you’ve signed up with your Web3 wallet.

You will now watch your estimated reward fluctuate as other people make their own predictions too. Selling can be done whenever you want giving you the win/loss you’ve incurred so far, or you can wait until the end for the market to run to completion.

If you select the “Portfolio” button at the top you can view your open orders and compare how much you have in your overall portfolio versus how much cash you have available, where portfolio = cash + money in bets.

As you can likely tell I’ve just scratched the surface on what’s possible with Polymarket’s prediction markets as it’s an app with way too many features to mention in a single post. Have a play yourself to learn what it’s capable of!

Conclusion

Polymarket is a Web3 internet native prediction market. So, unlike traditional prediction markets, it transcends geographical barriers and gives a great snapshot of global public opinion across multiple areas of interest.

Additionally, by building on the blockchain, Polymarket integrates the dynamics of prediction markets with a native financial infrastructure. As DeFi and blockchain technology continue to grow and evolve, Polymarket is well-positioned to expand its offerings and user base.

The platform's ability to provide accurate, real-time forecasts makes it a very valuable tool in a world where information is increasingly decentralized and democratized.

Polymarket’s biggest boom came from the US elections and it’s not entirely clear if it will survive beyond the elections, but it’s already become a great show-case for a Web3 consumer app that transcends the technology into the mass market.

If the platform continues to mature and surpasses its regulatory hurdles, then it is likely to play an increasingly significant role in how we predict and prepare for future events, and serve as inspiration for more consumer oriented Web3 apps to grow and reach broad market appeal.