Microstrategy's Bitcoin Strategy

Michael Saylor's company has outperfomed the market with this innovative strategy

TLDR:

Michael Saylor created his company Microstrategy back in the early 90s. Him and his company had lost relevance until 2020 when he began advocating for Bitcoin.

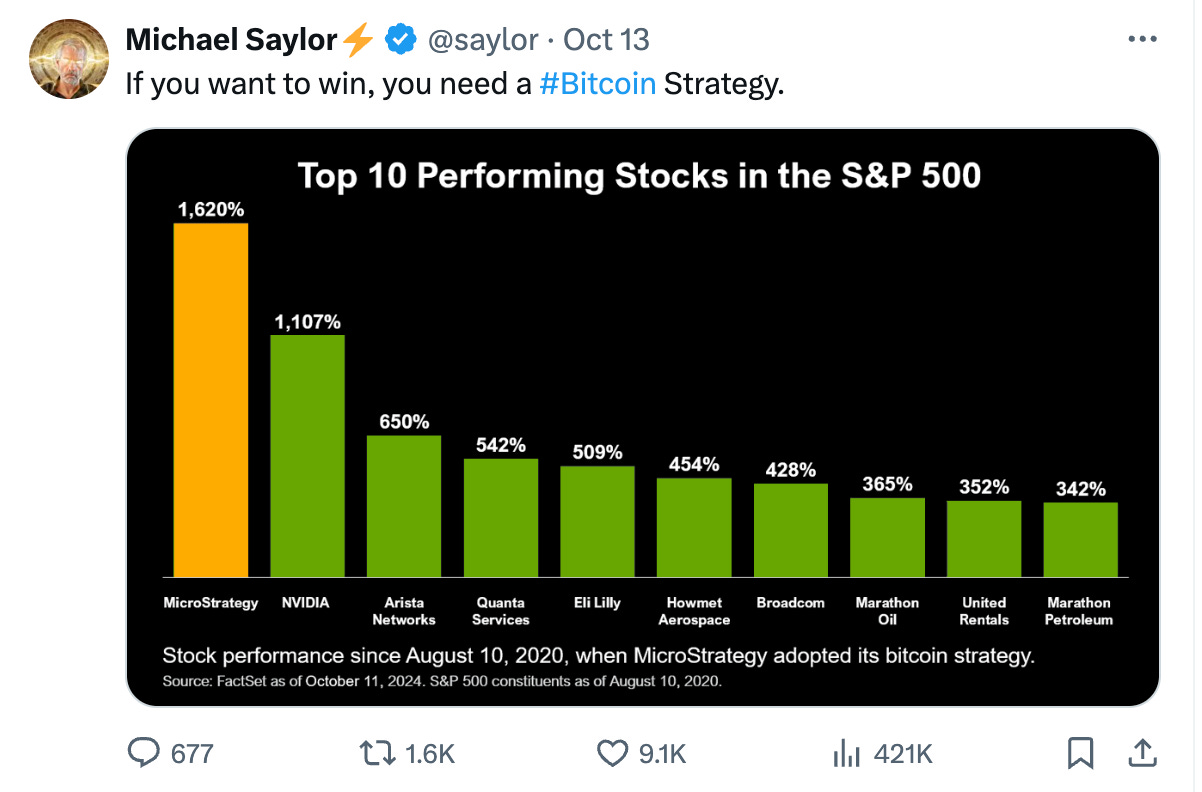

Saylor’s innovative Bitcoin strategy has helped made him make 1,500% returns on Microstrategy’s stock price in just 4 years, outperforming all major companies.

The strategy involves repeatedly selling convertible notes, a form of company debt, and using the cash they receive to stockpile more and more Bitcoin.

This strategy depends on Bitcoin price continuing its upward trend, but everything suggests that it will, and others have began to copy him.

As Bitcoin approaches its all-time-high (ATH) price of $73,700 set earlier this year, I wanted to cover one of the most bullish people on Bitcoin and his company’s strategy.

So this week we’re looking at how Michael Saylor and his company Microstrategy has been able to outperform all companies in the S&P 500 in the past 4 years. For the first time I’ve also made a video version of the post, let me know your thoughts if I should continue with this.

Remember also that we’ve got an up to $1,000 giveaway going on for joining our free community ending this Friday:

Watch the Video of this Post

Michael Saylor and Microstrategy

In just a short 4 years since 2020, Michael Saylor’s gone from being a forgotten entrepreneur from the dot-com period, to one of the most well known Bitcoin advocates in the world.

Saylor founded his company Microstrategy in the early 90s and took it public in 1998, reaching billionaire status with over $7bn net worth way back then. However, his company, net worth and relevance collapsed after the dot-com bubble burst.

Nonetheless, Microstrategy survived and continued developing its business intelligence software, keeping steady growth and profits but never reaching the significant heights of other tech companies we see today.

However, in 2020 things began to change when he came across Bitcoin as an alternative store-of-value to ever inflating government backed currencies. And in August 2020 he announced that Microstrategy would buy $250m worth of BTC to store part of their company treasury.

Since then Saylor’s advocacy around Bitcoin has grown and grown, and his name has become pretty synonymous with Bitcoin. His X posts are incredibly bullish on Bitcoin and he’s done hundreds of podcasts and interviews discussing its merits.

Saylor’s put his money where his mouth is, both with Microstrategy and on a personal level, as he’s continued to build up Microstrategy’s Bitcoin reserves. He’s said to own over $1bn in Bitcoin personally, and Microstrategy itself owns over 250,000 BTC, around $18bn, which is over 1.2% of the total maximum 21m BTC supply!

This makes Microstrategy the single largest holder of BTC as a public company in the world. Microstrategy are beaten only by Blackrock’s ETF, which holds over 1.9% of all BTC, yet importantly, Blackrock’s ETF is a vehicle for external holders, while Microstrategy’s BTC holding belong to them alone!

Microstrategy is up 1500% in 4 years

Now what’s most interesting is that Microstrategy’s unconvential Bitcoin strategy has paid off - in the past 4 years their stock price has gone up over 1,500%!

By comparison the S&P 500 is up around 90% in the same amount of time, gold is up just over 110%, and even Bitcoin is only up over 650%.

Microstrategy have in fact outperformed every single individual stock in the S&P 500 over the past 4 years. Even Nvidia, which has been the biggest darling of the US stock market in recent years, having ridden the huge successes of the recent growth in AI, is only up around 1,200% since August 2020.

So how has Microstrategy outperformed the market, gold, Bitcoin and even Nvidia?

Well it’s definitely not been through increased revenue, which has stayed roughly the same over the past 4 years.

No, it’s all down to the bizarre Bitcoin strategy that Saylor’s employed.

Some jokingly say he’s found the “infinite money glitch”. Let’s look at how it works.

Infite Money Glitch

We all know money doesn’t grow on trees, so how’s Saylor been able to keep growing the value of Microstrategy without growing its revenue?

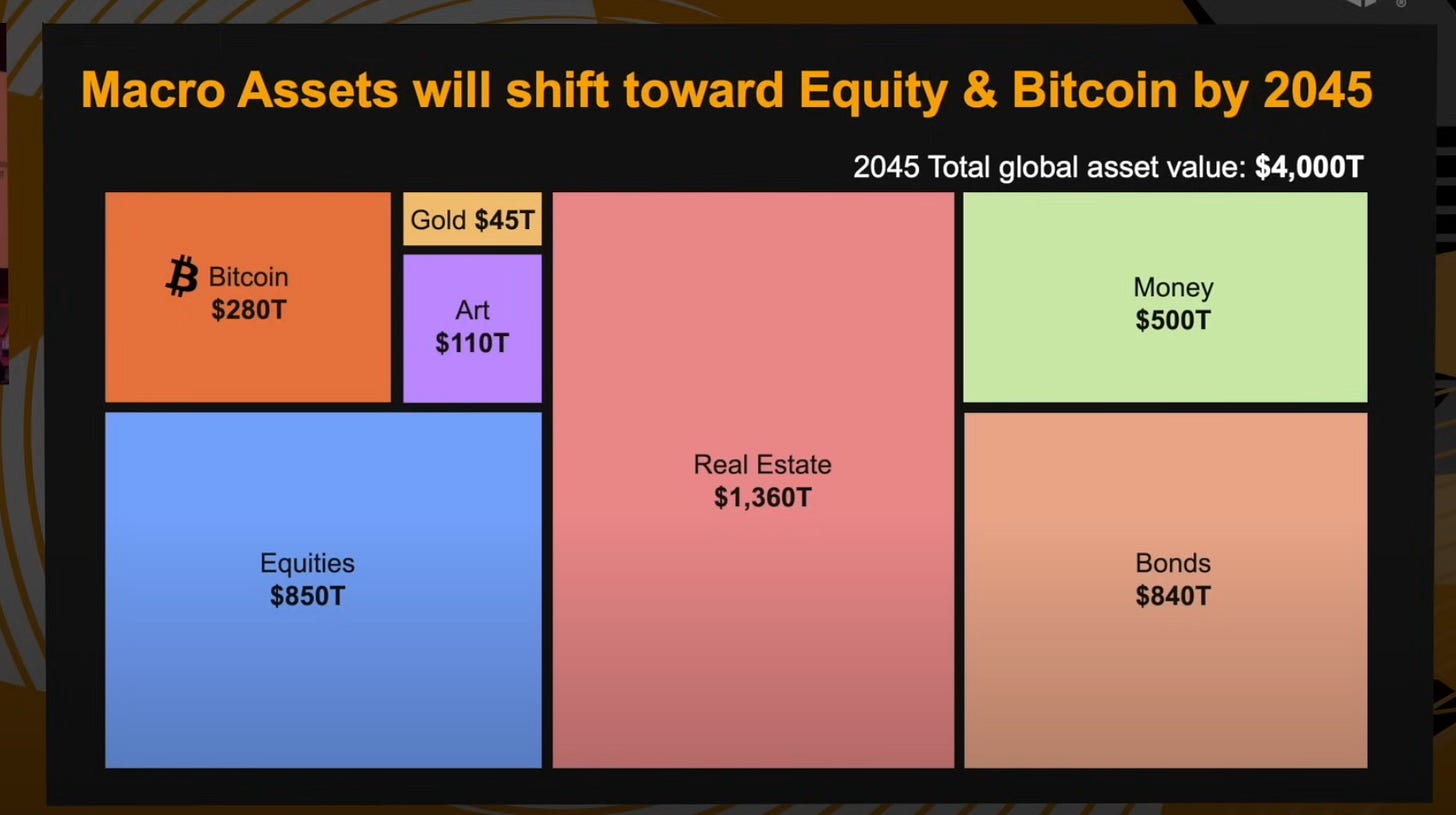

Well Saylor believes that Bitcoin is the best store-of-value in the world and will one day become the world’s most valuable asset, in fact he predicts 1 BTC will be worth as much as $1m by 2030, and he sees the entirety of the Bitcoin market cap to be worth $280 trillion by 2045!

Saylor’s strategy is therefore to stockpile as much BTC as he possibly can, and he does this through selling convertible notes.

Convertible notes are a form of company debt where lenders are given an low-interest baring IOU that they can convert into shares of the company at some point in the future for a discounted price.

Microstrategy therefore sells these IOUs to get cash, which they then use to buy more BTC and push their overall company treasury holdings up.

Since the company’s treasury has now grown, the market realises that Microstrategy’s overall assets are worth more, making the company more attractive to investors who buy more of its stock and raise its share price further up.

From the perspective of the investor the convertible notes are a good deal because they have the option to convert them to more valuable shares further down the line at a discount, and they get downside protection because company debt is the first thing to be paid off if a company goes under.

Meanwhile, Microstrategy is able to keep selling more and more debt, while buying up more and more Bitcoin, and growing their share price further and further up.

Infinite Money Glitch!

How is this possible?

Well first of all, this all depends on the price of Bitcoin.

If BTC’s price drops then the overall value of Microstrategy’s assets also drop, and people see that their assets aren’t worth what the shares suggest they are, right?

Well since Microstrategy have a profitable cash generating business, a drop in their company treasury does not impact their ability to continue running their operations at all. Sure some shareholders may sell but that doesn’t impact Microstrategy much in the short-term.

In fact the lower BTC prices offers Microstrategy a lower entry point to buy even more BTC. So although BTC fluctuates in price, since Microstrategy is a profitable company, they can just use it as an opportunity to stockpile more BTC and grow their treasury further.

Is this entirely risk free then?

Well it’s not entirely of course, if Bitcoin were to trend down to 0 then this would all unwind itself and Microstrategy’s shares would plummet down to what they were before they employed their Bitcoin strategy.

Remember that they have a profitable business that doesn’t depend on the Bitcoin, so BTC trending to 0 wouldn’t necessarily kill the company, just kill their share value.

However, Saylor’s pretty convinced that’ll never happen, he thinks Bitcoin is going to be worth over $1m per coin remember. And it’s been working well for him so far.

You might be asking yourself, if it’s this simple why isn’t everyone doing it?

Well, very recently a Japanese company called Metaplanet began employing exactly the same strategy, led by Dylan Leclair, buying up over 1,000 BTC as they have begin to store their company treasury as Bitcoin too.

Meanwhile, Elon Musk’s Tesla has almost 10,000 Bitcoin in their company treasury, and even Microsoft have said they will put up a vote to shareholders on whether they should be holding Bitcoin.

Saylor has certainly shown that this strategy is possible and we will likely see more and more companies adopt it over time. For most companies though it’s not a very viable idea since this strategy can be a distraction from their main focus, and introduces lot of volatility to their treasury and share price since BTC’s a volatile asset.

Not that Saylor cares anyway, his company stock has outperformed every stock in the S&P500, and he still sees huge potential upside in Bitcoin. He’s even began speaking about making Microstrategy into a Bitcoin bank of sorts and raising another $42 billion to buy more Bitcoin!

Saylor’s already a billionaire from his Bitcoin strategy, but it’s all still very early. If BTC continues marching upwards and his strategy continues to pay off, then he may just become one of the single richest men in the world.

Whenever you’re ready, these are the main ways I can help you:

FREE courses at beginners.tokenpage.xyz - Get a free video guide to set up your first wallet and buy your first crypto. Plus a bonus 1-on-1 call with me for free, and over $1,990 worth of bonus material.

VIP access beginners-vip.tokenpage.xyz - Get VIP access with me as I show you how you can get a 1,300% return over the next 5 years, on average a 20% monthly return. Includes weekly Q&A calls where you can ask me anything.

Web3 software development at tokenpage.xyz - Get your Web3 products and ideas built out by us, we’ve built for the likes of Zeneca, Seedphrase, Creepz and more.