Liquidity Land

Connecting Liquidity Providers with DeFi Protocols

TLDR:

Liquidity Land is an example of a Liquidity Distrubution Protocol (LDP), with other examples being Turtle.xyz and OneClick.fi.

LDPs act as a way for LPs to find DeFi protocols to park their cash, and provide protocol specific bonuses to the LPs who decide to use them.

Liquidity Land purposefully has no smart contracts to remove intermediary risk, so LPs just need to register their deposit transactions there to be rewarded.

As DeFi continues to grow the need for LDPs will undoubtedly grow too and there’ll likely be more and more DeFi protocols listed on them.

I’ve been looking at different liquidity distribution protocols recently for Yield Seeker and working specifically on getting it added to Liquidity Land this week.

So for this post I decided to write about Liquidity Land as an example of how this growing segment of liquidity distribution protocols work.

If this post resonates with you and you enjoyed the content then please share it with friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Liquidity Distribution Protocols

DeFi’s growing and the number of projects available in DeFi are growing with it. With this growth in the space there’s growing demand for liquidity providers (LPs) to find DeFi projects to park their cash.

Historically LPs have had to hear about a DeFi project through word of mouth or a marketing campaign to then go and check it out and park their cash to earn the appropriate rewards.

However, there’s a growing trend in companies that try to bridge the gap between LPs and DeFi protocols so users can find them more easily. Some people call these “Liquidity Distribution Protocols” (LDP) although there’s still not a very strongly defined name for this category.

A few example projects in this category include Turtle.xyz, OneClick.fi, and Liquidity.land. Today I’m going to run through Liquidity Land, but all three are quite similar so by seeing how Liquidity Land works you’ll understand how the rest work.

The basic idea is that instead of an LP having to roam around finding DeFi protocols, they just check out an LDP site and see all the opportunites available there. Most LDPs then provide incentives for LPs by striking deals with the DeFi protocols to give their clients specific bonus incentives.

Everyone’s a winner here because LPs find opportunities to allocate their liquidity more easily, DeFi projects get found more readily too due to the additional distribution channel, and LDPs get rewarded for faciliating this exchange.

Liquidity Land

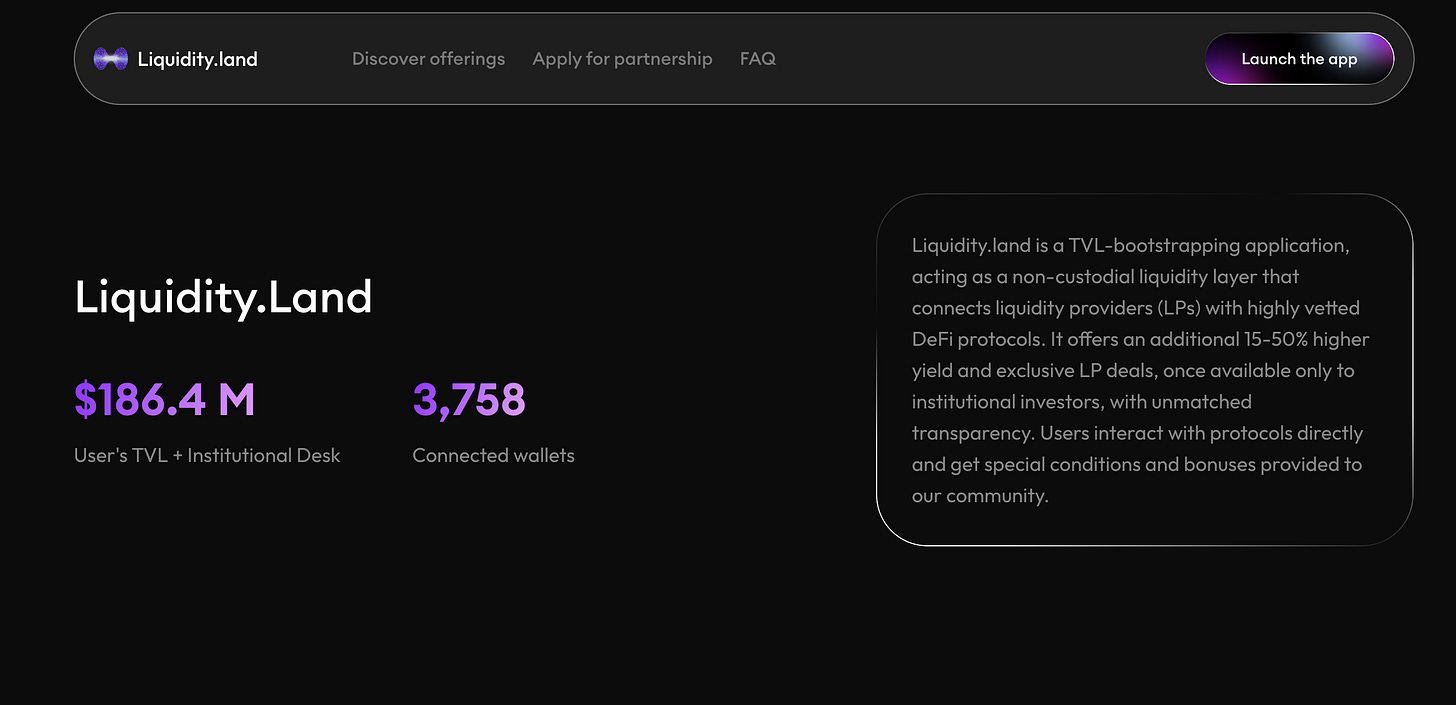

Liquidity Land is an example of an LDP that allows LPs to discover DeFi protocols more easily. They describe themselves as a “TVL-bootstrapping application ... that connects liquidity providers (LPs) with highly vetted DeFi protocols”.

Liquidity Land claims to have already helped distribute over $186M to DeFi protocols listed on their platform, and has over 3700 connected wallets.

Curiously they purposefully don’t have a smart contract as they don’t want to act as an intermediary and introduce additional risk, so you can make use of their platform without ever needing to send any money to them. Plus they are entirely free for the end user as they get paid through the DeFi protocols that list with them.

LPs are usually given an additional reward from depositing into LDP listed protocols and generally incentivised to hold for lengthy periods of times, which is ideal for the protocol.

Using Liquidity Land

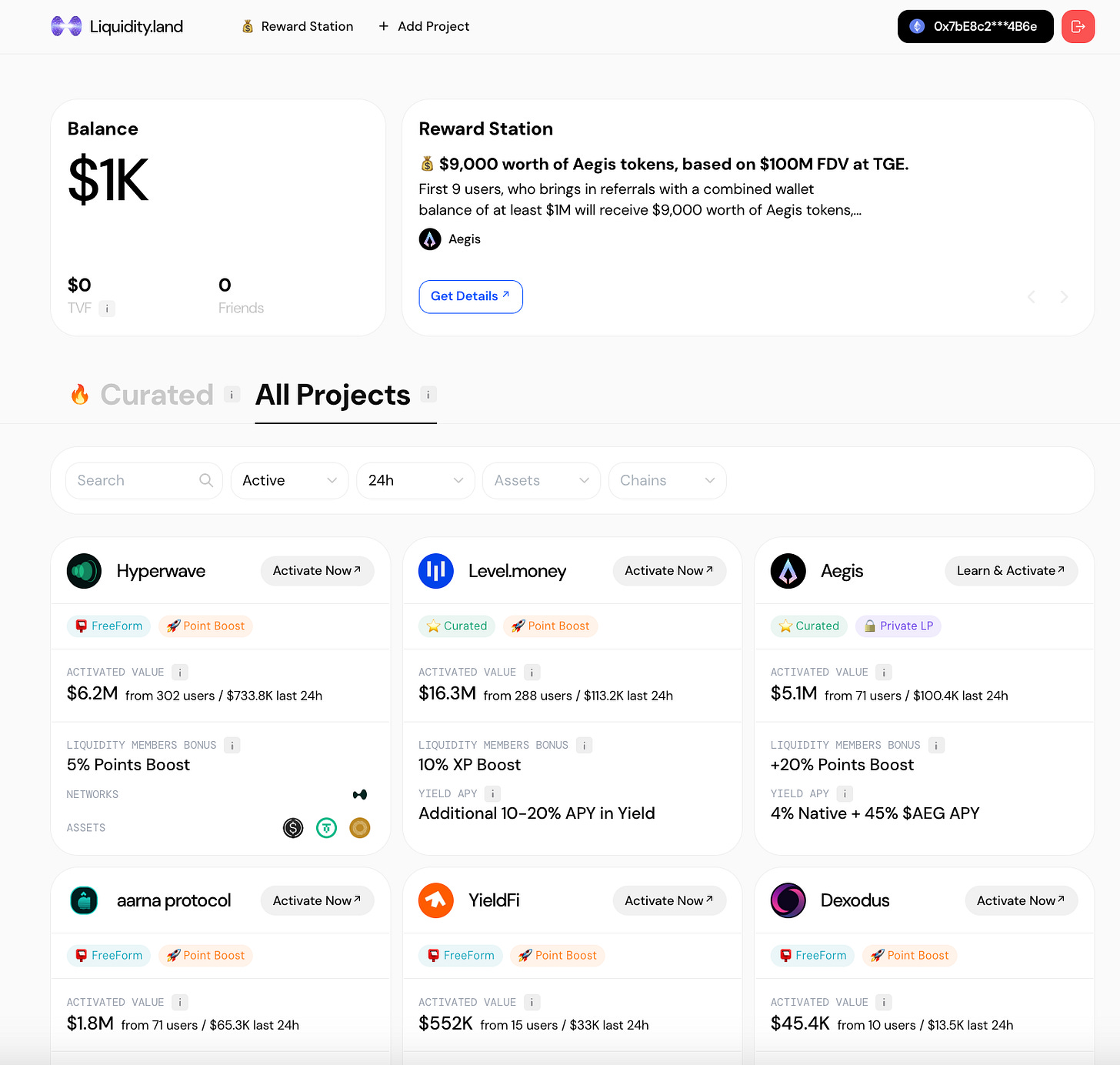

Using the Liquidity Land app itself is very simple, you just connect and sign with your wallet and then you’re able to browse around all the DeFi protocols listed with them as shown below.

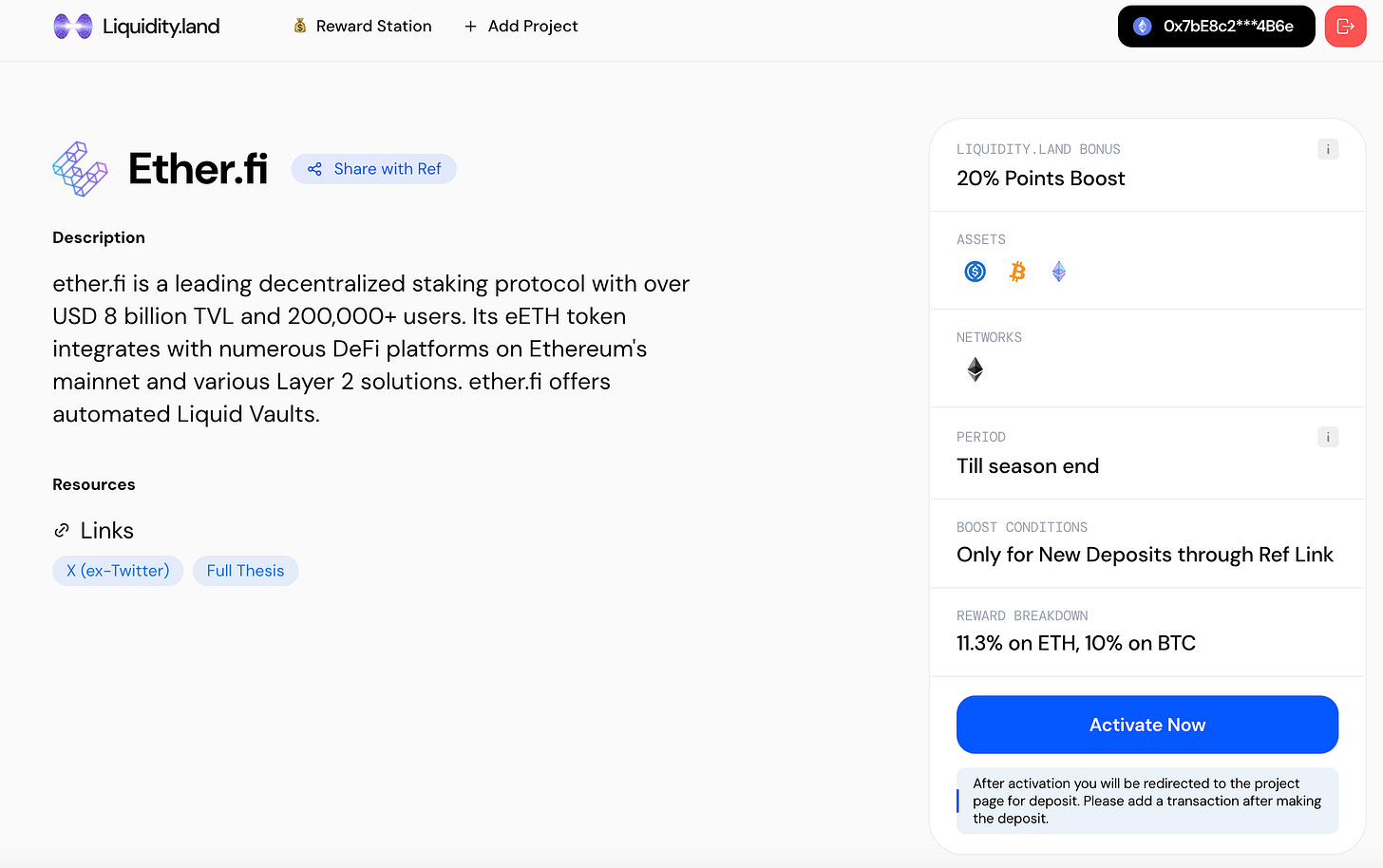

When you select a project you’re interested in you can then view a description of the project and also see the rewards associated with using it.

So for example with Ether.fi shown below you can see that there’s a 20% points boost for being referred by Liquidity Land. You can also see that it supports USDC, wBTC and ETH on the Ethereum network, giving APYs of approximately 11.3% on ETH, and 10% on BTC.

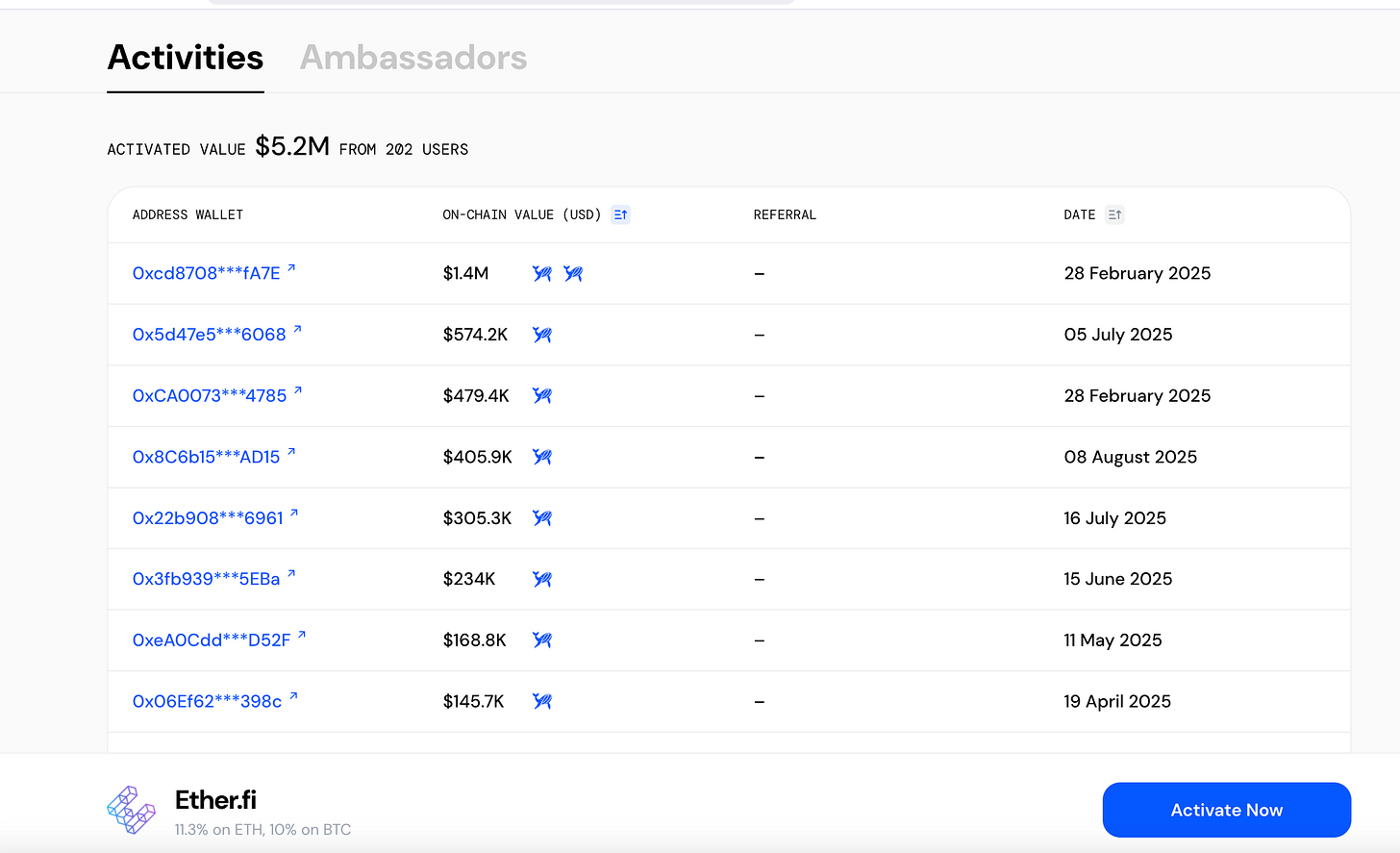

Below this it shows all the users that have provided liquidity over to the given DeFi protocol. In this case we see 202 Liquidity Land users have deposited over $5.2m into Ether.fi, and we can see specific dates and values too with the top wallet depositing $1.4m in February of this year.

This is a simple yet powerful interface as users can learn about a protocol, get a feel for how much money is getting put in, and also make sure they are rewarded appropriately for parking their own cash in there too.

Rewards

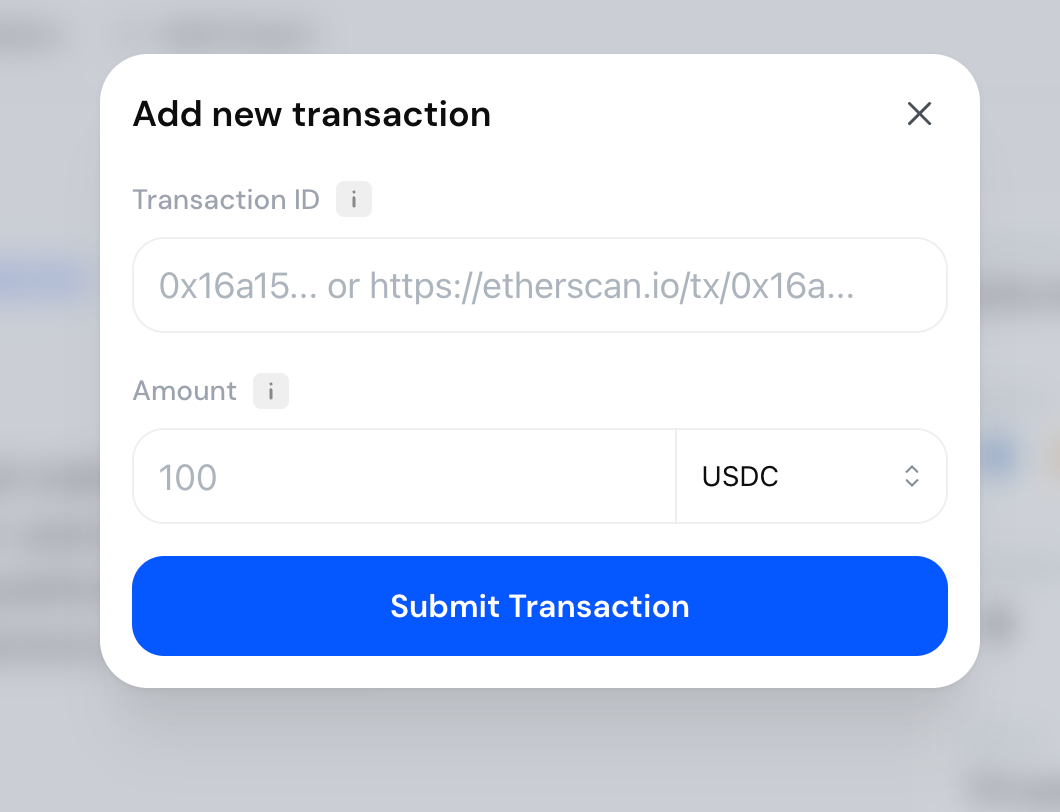

Since Liquidity Land purposefully doesn’t have any smart contracts in order to reduce the intermediary risks, they instead have a really simple way to check that users are indeed eligible for a reward.

First a user must select the “activate protocol” button on the protocol’s page, and then after providing liquidity they require user to select “submit transaction” and provide the transaction ID from their deposit transaction - its that simple!

This essentially turns Liquidity Land into an accounting layer that tracks all the deposits that users have done into all the protocols listed on their site.

The rewards are then given based on specified criteria. In the previous example with Ether.fi, rewards were given for new deposits who use the referral link with the points boost running until the end of Ether.fi’s points season.

However, Liquidity Land allows for pretty much any variant of this that a protocol might like. There are examples of campaigns that run for 30-90 days and of others that don’t even have an end.

Rewards can then be given out on the fly by projects as is the case with Ether.fi, or at the end of a given campaign where a user is rewarded all their bonuses in a single go. .

Growing Segment

Overall DeFi TVL is growing fast and accordingly so are the number of LPs and DeFi protocols, so there’s clearly a growing demand for LDPs like Liquidity Land. Their competitor Turtle.xyz recently raised a $6.2m seed round highlighting the growth in this space.

LDPs are therefore a nascent but interesting type of project in the world of crypto and Web3 that have a lot of room to grow over time. These could become product directories of sorts for DeFi protocols, however with this twist as they route millions of dollars worth of liquidity into projects.

Most importantly, from the end users perspective its a great place to just come and check on what’s the latest projects out there and find some great opportunities to park their cash and earn great rewards.

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!