Liquid Staking

Earn network staking rewards without losing liquidity

TLDR:

Liquid Staking allows users on a proof-of-stake network to stake their assets and earn staking rewards without losing their liquidity.

On Ethereum Lido is the most well known player and on Solana it is Jito. Both are incredibly simple to use as shown below.

There are risks involved though as you give up control of your coins, and can centralise the network’s consensus in a handful of staking platforms.

We recently saw a hefty airdrop from the liquid staking platform Jito on Solana. All in all they airdropped over $200m in their new $JTO token and made a lot of people rich.

Not many people had heard of Jito before, and even now many people probably don’t really understand what they do, which made me think it was a good opportunity to write about Liquid Staking.

Liquid Staking

To understand liquid staking we need to start with staking. The concept of staking is based around committing, and hence putting at risk, your own tokens in return for some vested “stake” in a network, protocol or project. Staking on a network relates to staking in proof-of-stake (POS) consensus - and if you’re not sure what this is then read my previous post on consensus algorithms.

In traditional POS you stake your assets for a chance to earn rewards from validating blocks. However, your assets are locked up and cannot be traded or used until they are unstaked or their staking period ends. This can be a significant drawback for people who want to keep liquidity.

This is where liquid staking comes in. In liquid staking a user is given a new token that represents the staked asset and its rights. This token can be bought, sold or used as collateral just as any other token and will still earn staking rewards, giving the user liquidity without having to unstake their underlying asset.

Ultimately though liquid staking requires an intermediary staking on your behalf and therefore has many risks involved that we’ll cover below. Also, the intermediary providing this service has to create and manage a lot of infrastructure for users so they rightfully take a fee on all POS rewards earned.

As POS has grown in popularity and become the most common consensus algorithm for blockhains, there has been a significant growth in liquid staking solutions.

Liquid Staking on Ethereum

On Ethereum the biggest and most well known liquid staking platform is Lido. They have over 9m ETH staked out of the total 120m or so ETH in circulation!

Staking on Lido is really simple. You just open stake.lido.fi, connect your wallet, type in how much ETH you want to stake, and submit the transaction.

On staking you’ll be given their stETH token where 1 stETH equals 1 ETH. Lido rebases the amount of stETH you own daily, automatically updating the rewards you’ve earned from staking.

Lido also offer the option to wrap stETH into wstETH, which doesn’t rebase so you keep a static quantity. Instead the price of wstETH has a moving exchange rate against stETH to accompany its rebasing. As of writing 1 stETH = 0.869 wstETH.

If you want to withdraw your stETH or wstETH for ETH then you first need to request a withdrawal. There’s a small period necessary for Lido to unlock ETH during which they mint you an NFT to represent this request. Once it’s ready you can burn the NFT and claim your ETH back.

Their rewards tab also shows you how much you have staked at any given time and how much you’ve earned from staking.

Liquid Staking on Solana

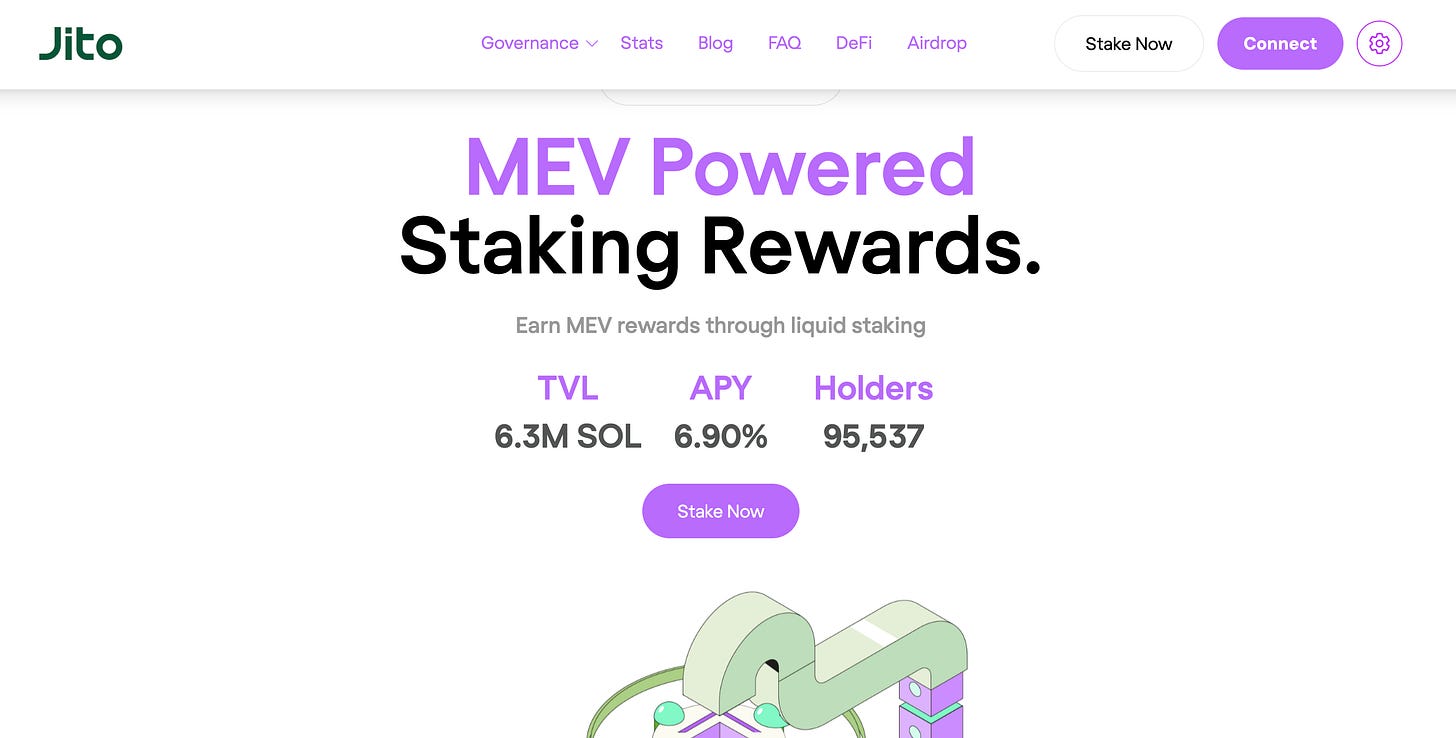

On Solana Jito has taken the top spot for liquid staking especially after their massive airdrop of the $JTO token.

To stake on Jito is simple too, you just click on jito.network/staking/ where you are given the option to stake your SOL for JitoSOL.

Liquid Staking from the user’s perspective is very similar here as on Ethereum. JitoSOL has no rebasing though, meaning the JitoSOL token has a constantly fluctuating value against SOL, similar to wstETH.

Unstaking can take up to two days, or you can sell the JitoSOL directly on an exchange like Pluto shown below.

Since Solana has such low cost gas fees it’s certainly worth trying out Jito for yourself to have a feel for how it works.

Risks

As mentioned at the start liquid staking is not without its risks.

From the perspective of the user, their primary risks come from the trust they place in a liquid staking platform. The platform could suffer a hack and lose their funds, or it could perhaps screw up the staking and have funds slashed, or they could even maliciously steal the funds and just disappear.

It’s the old saying “not your keys, not your coins”.

From the broader perspective of the network itself there are some pretty large centralisation risks involved too. If staking tokens are concentrated into a handful of actors on the network, they can have a disproportionate control of it, and their incentives may become skewed maliciously towards other network participants.

Lido today for example has over 32% of all ETH staked with them, whether liquid or not! This is a huge amount and gives them a lot of leverage over the Ethereum network. If they were to collude with some other major staking players, they could in principle go over the 66% mark needed to quite literally take over the network!

Liquid Staking amplifies the centralisation risk inherent in POS and is a serious point of contention. By comparison in a system like Bitcoin that uses proof-of-work, everyone is incentivised to keep hold of their own coins and individual miners have a clear incentive to not put too much power in the hands of a few.

With that in mind when you are liquid staking on Ethereum, you should probably be using alternative platforms like Rocket Pool, Frax, or ether.fi, to protect the network from these centralisation risks with Lido and reduce their over 75% market share of all Ethereum liquid staking.

Conclusion

Liquid staking on a proof-of-stake network allows you to have your cake and eat. You can get returns on your otherwise stationary assets without having to lock them up and lose liquidity.

However, it’s not without its risks, as a lot of power can be put in the hands of a few liquid staking platforms that could for example take your funds and simply disappear, or even worse, use them to maliciously take over the network given enough stake.

So liquid stake responsibly! Look after yourself and the health of the network!