ICOs, Bonding Curves and CCAs

The evolution of fungible token funding mechanisms

TLDR:

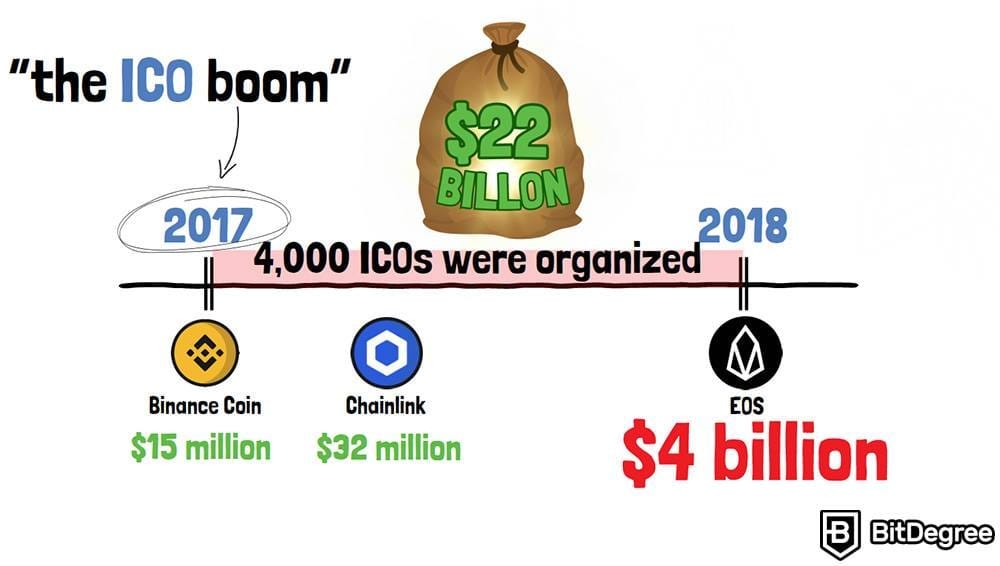

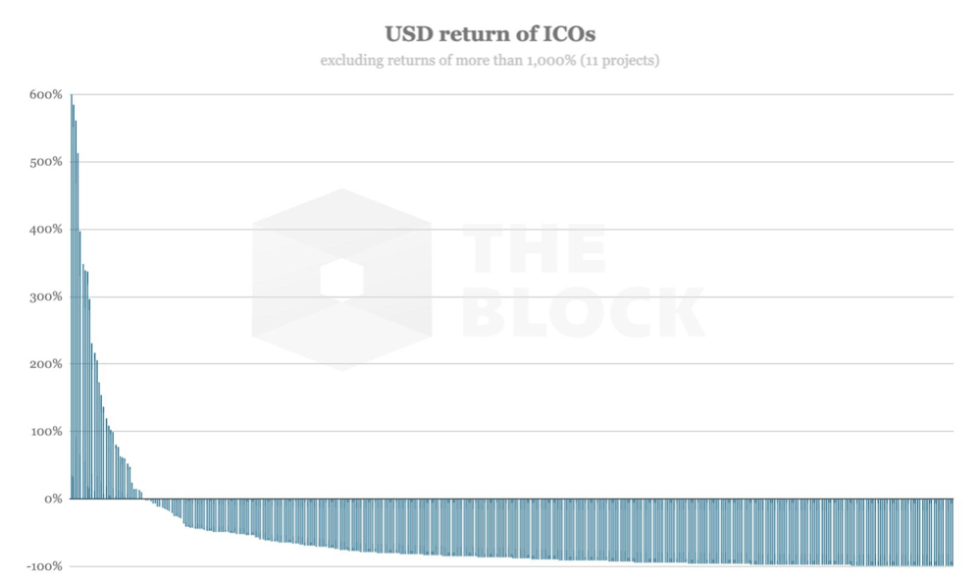

ICOs (Initial Coin Offerings) are a token funding mechanism that were highly popular in 2017-18, but their off-chain nature led to many scams and they died off.

Bonding Curves are another mechanism that’s become incredibly popular with the rise of memecoins, but they tend to incentivise short-term holders.

CCAs (Continuous Clearing Auctions) are a new mechanism created by Uniswap where a floor price is set and tokens are continuously auctioned each block.

CCAs were recently tested successfully with the Aztec token and have the potential to solve many of the shortcomings of ICOs and Bonding Curves.

Uniswap has recently launched CCAs, a novel fungible token funding mechanism that’s already getting a lot of love and has great potential to grow in popularity.

Given the recent buzz around CCAs I decided to compare them with ICOs and Bonding Curves which are a couple of other historically important funding mechanisms in crypto that laid the foundation for the creation of CCAs.

If this post resonates with you and you enjoy the content then please share it with a friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Token Funding Mechanisms in Crypto

Since the very beginning of crypto there’s always been new and innovative ways in which new coins and tokens have been funded and released.

In the early days many coins were simply premined, but soon enough came ICOs (initial coin offerings) which blew up in popularity around 2017-18, then in 2021-22 we saw NFT mints take over, and more recently bonding curves have had their time in the limelight.

Yet these funding mechanisms above are just a few of the more memorable ones, there’s been a lot of others over the years that were also important but not as market defining such as IDOs (Initial Dex Offerings) and IEOs (Initial Exchange Offerings).

And in the last month or so we’ve seen the emergence of an all new funding mechanism created by Uniswap called Continuous Clearing Auctions (CCAs) that may stand to become as popular as some of the more popular ones mentioned above.

For the sake of keeping this post from becoming too large we’ll discuss just ICOs, bonding curves and these new CCAs today, as all 3 are focused on fungible tokens and sort of led to the creation of one another - in the future I may cover some of the other ones.

Initial Coin Offerings (ICOs)

Initial Coin Offerings are an incredibly innovative method for funding projects that emerged in the early days of crypto. Ethereum itself was funded as an ICO back in 2014 through the receipt of around $18.6m in BTC at the time.

The Ethereum network was then released a couple of years later in 2016 and gave rise to the ERC20 token standard in 2017 making it super easy for people to create new tokens, which allowed ICOs to really take off and explode in popularity between 2017-18.

The name ICO (Initial Coin Offering) is a play on IPO (Initial Public Offering) in TradFi, which is where a company’s stock gets listed on an exchange. In IPOs people bid on a stock with a price that’s been pre-set by the company, similarly in ICOs people buy a coin or token at a price that’s been pre-set by the project.

However the similarity ends there because IPOs are incredibly bureaucratic and regulated while ICOs were always a free-for-all and each done in their own way.

At its core ICOs are crowdfunding opportunities where people send crypto money in and are promised tokens out. During the ICO mania most ICOs would set clear prices and funding limits on how much they were looking to raise, however some others like EOS and Tezos were uncapped with more complex dynamic price setting mechanisms.

This period was a time of great trial and error, with lots of different approaches to ICOs being taken. However, it was a period that also saw a lot of scammers taking the opportunity to scam, and eventually ICOs died with the SEC coming in hard on many projects.

Projects like EOS in particular managed to raise over $4bn of dollars worth of funding! However, their blockchain never really built out a meaningful ecosystem, which makes you wonder where those billions ended up going.

Bonding Curves

Bonding Curves like ICOs appeared pretty early on before they surged in popularity, in particular they were famously used as a pricing mechanism for Uniswap’s experiment Unisocks back in 2019 where they minted 500 $SOCKS NFTs and added them to a liquidity pool with a bonding curve used for price discovery.

However, they began to get real mainstream use with ERC20 tokens through the creation of projects like Friend.Tech, which allowed influencers to create their own fungible tokens that followed a bonding curve for price discovery.

If you want to learn more about friend.tech I wrote this post about them back in 2023.

But Bonding Curves’ true rise to popularity came through memecoins with the help of Pump.fun, which made creating a memecoin cheap and trivial as the entire funding mechanism was based on the curve.

If you want to learn more about pump.fun I wrote this post about them back in 2024.

Pump.fun were able to glue together a lot of different crypto primitives that just worked and its why they still rule the memecoin scene and make millions in revenue daily. Their smart use of bonding curves was a key factor in their growth, as they were able to allow creators to generate new tokens with near to no costs.

New tokens are funded by following the curve such that as new people buy or sell the token its price travels along the curve up until it reaches the end and then the token gets added into a separate liquidity pool where a classic AMM process takes over.

The fact you don’t need to put much money in to create a new token means that bonding curves are a pretty great way to bootstrap something from nothing.

However, they tend to be generally bad for legitimate projects as early buyers and snipers will get an unreasonably large amount of the token supply and as soon as it grows in value they will generally dump these tokens for a quick flip with no regards for the project.

Platforms like Virtuals tried to make use of bonding curves to spwan legitimate projects in the crypto agent space, but the method failed to really take hold because as projects were ending up with a small percentage of their token supply and investors weren’t aligned with the project’s long-term success.

Genuine crypto projects need to own a meaningful amount of the token supply, need their token markets to have deep liquidity and for their to be alignment from investors for the medium to long-term too, and this is where CCAs may be able to solve some of the shortcomings of ICOs and bonding curves.

Continuous Clearing Auctions (CCAs)

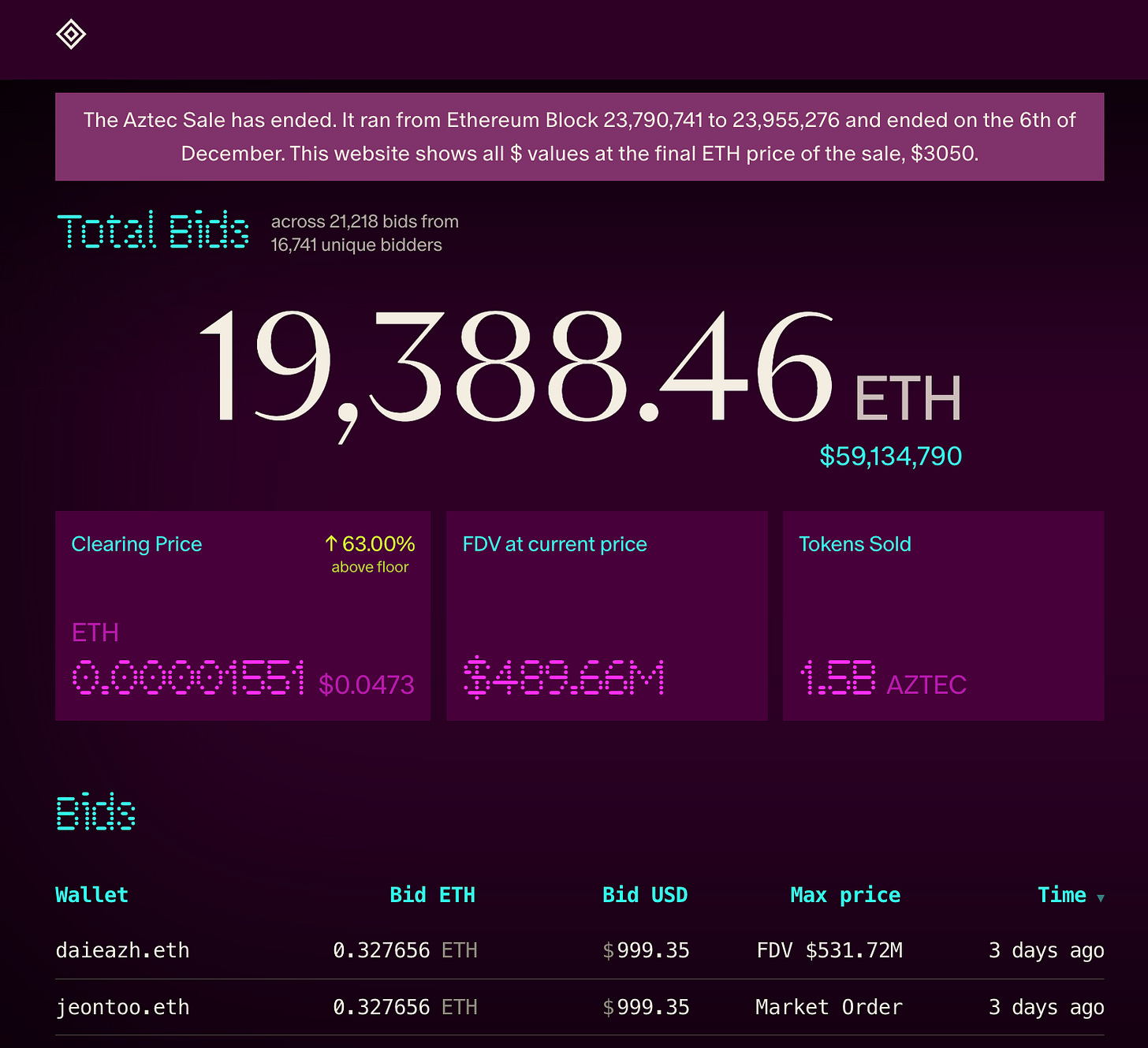

Uniswap’s Continuous Clearing Auctions have generated a bit of a buzz recently with the successful raise for $AZTEC, the first project to make use of this innovative new token funding mechanism.

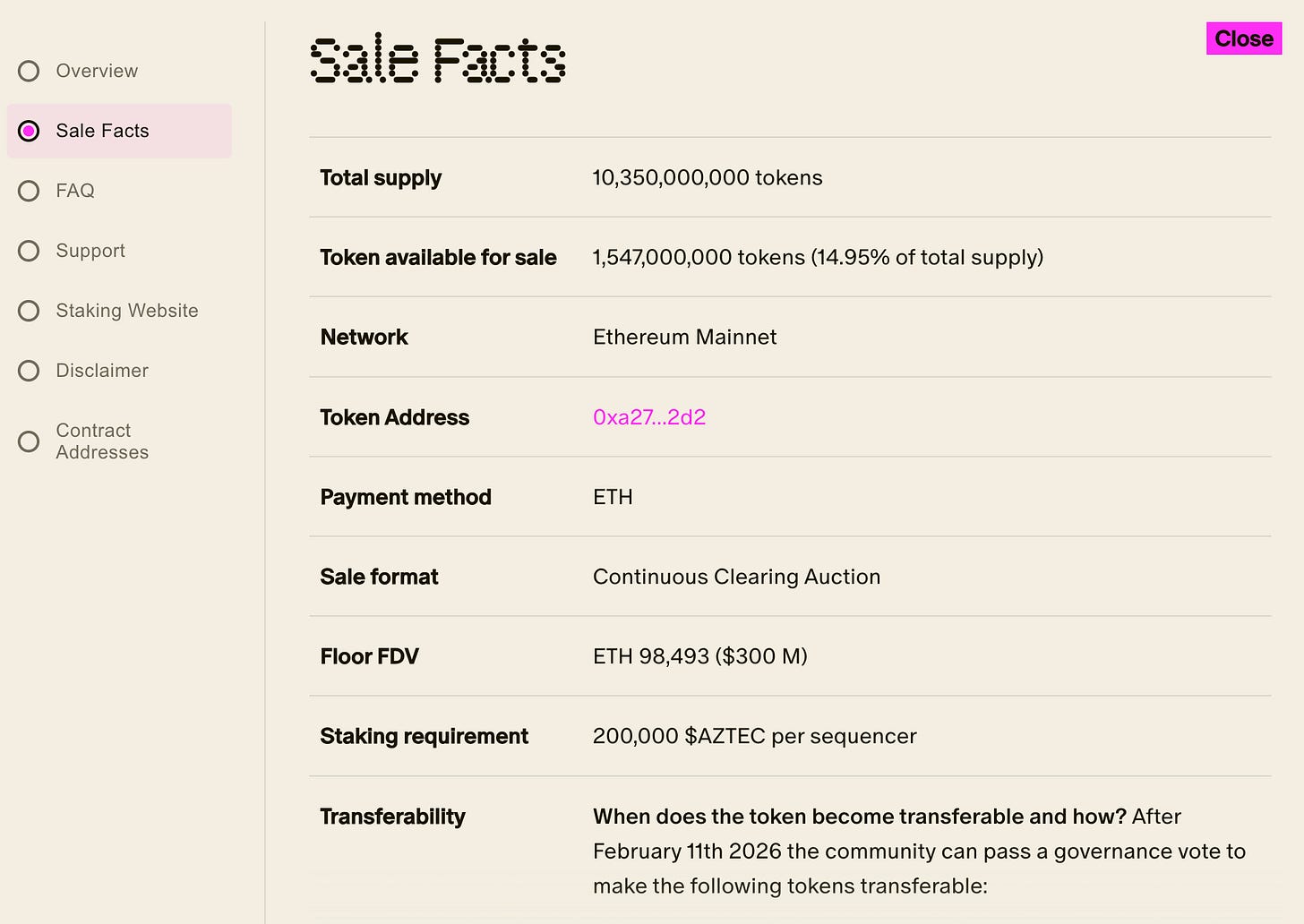

Essentially in a CCA a project sets an amount of tokens that they plan to sell and a floor price, then in every single Ethereum block (approximately every ~12 seconds) a mini auction happens where people bid up or down the price of the tokens and the price keeps adjusting according to the demand.

In the case of Aztec they made around 1.5bn tokens available to be sold in their CCA, around 14.95% of their total supply, and set a minimum floor FDV of $300m by setting a floor price of ~$0.03 per $AZTEC token.

The end result of their CCA was that the 1.5bn tokens were successfully sold for almost $60m worth of ETH, meaning that their FDV ended up at $489m, which was 63% higher than their anticipated $300m floor.

The $AZTEC token price ended up being higher than anticipated simply because the demand was higher than anticipated and the CCA’s clever auctioning mechanism pushed up the price along with that demand.

These $AZTEC tokens are now ready to be put into a liquidity pool in Uniswap, however the actual TGE date is yet to be decided on so the tokens are locked up for now within the CCA contracts until then.

CCAs have effectively learned from the flaws of ICOs and Bonding Curves, as they are far more flexible than curves which force a specific price discovery method, yet they are also more predictable and transparent than ICOs that were historically done mostly off-chain allowing for scammy behaviour.

In CCAs early bidders may still get a price advantage but they don’t walk away with a massive share of the overall tokens as they do with bonding curves, and the project can still keep something like 85% of the tokens as was the case with Aztec.

So now you know a little bit more about the history of some of the most market defining fungible token funding mechanisms and how they’ve impacted the creation of CCAs.

Although CCAs are certainly not perfect they appear to be an all round fairer system, and historically these new funding mechanisms have created new hype and driven bull markets in crypto.

Could we be seeing the birth of a new key funding mechanism? Might CCAs drive a whole new crypto meta? Only time will tell!

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!