Ethereum Layer 2s

Learn about Ethereum L2 types and how to compare them

TLDR:

L2s are scaling solutions that sit on top of L1s, as L1s often struggle with the “Blockchain Trilemma” of acheiving all 3 of: security, decentralisation, and scale.

The main Ethereum Virtual Machine (EVM) L2 types are: rollups, validiums, state channels, plasma and sidechains.

Rollups come in two forms, either using optimistic or zero-knowledge proofs, and are considered to be in one of 3 stages.

L2 Beat is the best site to learn about L2s and keep up to date on all metrics related to different EVM L2 solutions.

The largest NFT exchange Blur recently announced they are releasing a new EVM L2 called Blast.

Blur created some very convincing “ponzinomics” promising a *redacted* reward for pre-emptively bridging over to Blast, and managed to secure over $500m in liquidity in a week without even having shown a working version of their new L2!

As we move into a new crypto-cycle it’s becoming increasingly likely that L2s are going to be a big narrative so I thought it would be good to discuss L2s today.

Layer 2s

First a brief reminder of what a Layer 2 (L2) is. Blockchain networks like Bitcoin, Ethereum, Solana and hundreds of others are what we call Layer 1 networks because they stand on their own as full blockchain solutions.

However, many L1s especially the most used ones like Bitcoin and Ethereum, offer great decentralisation and security properties but sacrifice scalability in doing so (this is known as the Blockchain Trilemma). In other words when there’s a lot of transactions going on they become exceedingly expensive and slow to use.

This is where L2s come in. These are separate scaling solutions that essentially provide extra transaction capacity for the L1 they are supporting, and allow the network as a whole to handle more transactions per second (TPS).

You can visualise an L1 a bit like a high-road with a bunch of transaction traffic on it and L2s provide alternative slip-roads to offload traffic from the L1 and reduce congestion and then funnel it all back into the L1 later.

Right now Ethereum is scaling through the help of several EVM (Ethereum Virtual Machine) based L2 solutions, however not all L2s are born equal.

L2 Types

Layer 2s come in different shapes and forms. There are 5 main groups that the Ethereum foundation themselves recognise:

Rollups

Rollups execute transactions on a seperate chain and then post a summarised version back onto the L1. Since data is included in L1 blocks, rollups are secured by Ethereum’s native security. They come in two flavours that I’ll discuss later, either optimistic or zero-knowledge (ZK). Well known examples are Optimism and Arbitrum.

Validium

A Validium chain uses validity proofs like ZK rollups but data is not stored on the L1. Not needing to sync data to the L1 allows 10,000+ TPS chains and multiple chains can be run in parallel. Celo is the best example of an Ethereum validium.

State channels

State channels utilize contracts to enable participants to transact quickly and freely off-chain, then settle back onto the L1. Bitcoin’s Lightning network is an example of this type of scaling solution with its use of payment channels.

Plasma

A plasma chain is a separate blockchain that is anchored to the main Ethereum L1, and uses fraud proofs (like optimistic rollups) to arbitrate disputes. They are like child chains benefiting from the L1s security but processing transactions on their own.

Sidechains

A sidechain is an independent EVM blockchain which runs in parallel to Ethereum mainnet. These are compatible with Ethereum via two-way bridges and run under their own chosen rules of consensus. The best EVM example of this is Polygon.

For a deeper understanding of L2 solutions you can look at Ethereums docs. Vitalik Buterin also recently wrote a great piece going deeper into the nuances between some of these. For example some blockchain use-cases may require a solution in the spectrum between a rollup and a validium due to their trade-offs in security and scale:

Rollups

Rollups make up the biggest EVM L2 category. They have this name because they essentially “roll-up” multiple transactions into a singular one by processing each individual transaction on a separate L2 chain and then later submit a single summarized transaction onto the Ethereum L1 chain.

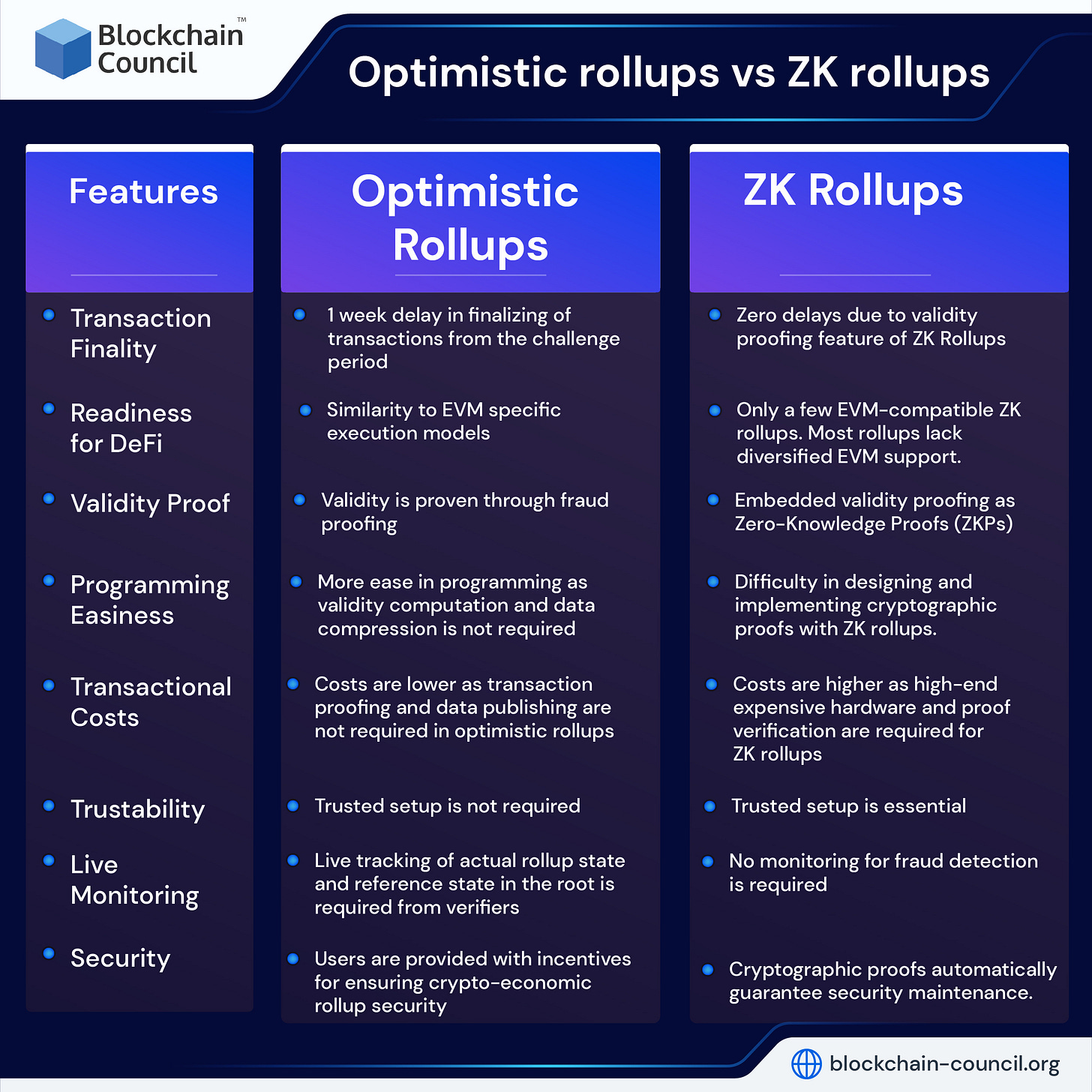

Roll ups can either be optimistic or use zero-knowledge (ZK) proofs. With optimistic rollups when transactions are summarised onto the Ethereum L1 there is a period of time where a “dispute” can arise to say if some sort of “fraud” occurred (ie. some transactions were invalid), then a dispute resolution happens to fix the fault.

While with ZK rollups, there’s a ZK-proof embedded together with the summarized transactions on the L1 chain proving its validity and that there’s no potential for fraud, also removing the need for a dispute period.

ZK rollups are generally viewed as better than optimistic ones, however zk-proofs are intensely slow and complex to generate, hence why optimistic rollup chains are currently still more common and more successful.

Rollup Stages

Vitalik discussed in a previous post how each rollup is in 1 of 3 possible distinct stages of development at any given time.

Stage 0 : full training wheels

At this stage the rollup is effectively run by its operators (ie. its creator). The rollup posts summarised transaction data onto the L1 and there’s software openly available to allow for the reconstruction of the L2s entire state from that data.

Stage 1: limited training wheels

In this stage, the rollup transitions to being governed by smart contracts. However, a “Security Council” might remain in place to address potential bugs. This council provides a safety net but its power also poses a potential risk.

Rollups at this stage have a fully functional proof system, decentralization of fraud proof submission, and allow users to exit with their liquidity independently without the need or possibility of interference from operators.

Stage 2: no training wheels

This is the final stage where the rollup becomes fully managed by smart contracts. At this point, the fraud proof system is permissionless, and users are given ample time to exit in the event of unwanted upgrades.

The Security Council’s role is strictly limited to addressing critical errors that appear on-chain, and users are protected from governance attacks.

L2 Beat

EVM L2s are a vibrant ecosystem in themselves and there’s a lot to keep up with. The best site to keep up with them right now is L2 Beat. A quick look will show you that there’s a lot of information here.

On the front page you can see there are metrics like total value locked and market share, both of which Arbitrum and Optimism are really ahead of the competition.

The site also gives great risk analysis. For example with Optimism there’s still some significant risks as it’s yet unifinished, risks like the fact it can be upgraded without any prior notice and that it’s able to save invalid state data to the L1.

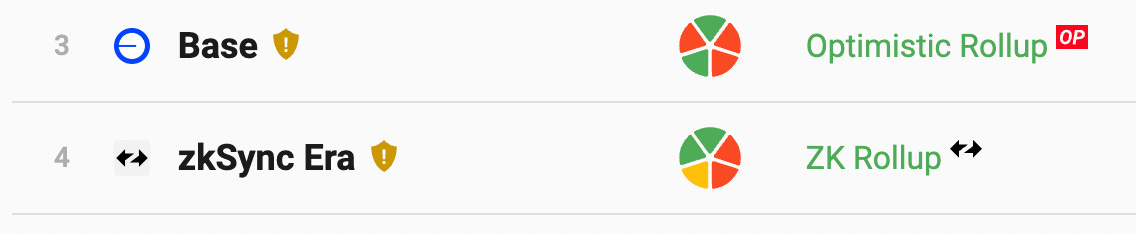

Looking at the technology column you can compare the stack an L2 is built on and what type of L2 it is. For example when comparing Base and zkSync Era, you can see the former is an Optimistic Rollup that’s built on the Optimism stack (hence has the same risks as Optimism above), while the latter is a ZK Rollup using its own ZK stack.

The Stage of a rollup is also shown. For example when comparing Arbitrum and Optimism it’s possible to see that Arbitrum is already considered to be a “stage 1” rollup while Optimsm with the risks we’ve already detailed falls into “stage 0”.

As you can tell L2 Beat offers all the ins and outs of any information you could possibly want to learn, it really is the go to place for L2 data right now.

Summary

Ethereum L2s are still a nascent technology in their early and exploratory stages. There are several different types yet none have really reached a point where you can feel 100% confident with their capabilities. Rollups have become the biggest category in the EVM L2 space although some are further along development than others.

When looking at L2 Beat one particularly interesting point that stands out is that Blur’s recently announced L2 “Blast”, which hasn’t even been released, has already amassed enough liquidity to put itself into the 3rd place in terms of liquidity market share, above Base and below only Optimism and Arbitrum!

This is really impressive and shows just how *ponzinomics* work well as a customer/liquidity acquisition strategy in today’s market, which is still fuelled predominantly by speculators (aka degens).

As the Ethereum ecosystem grows and grows and we head into another crypto summer there’s no doubt interest in L2s and scaling technologies will develop further.

Hold your hats and get ready for blast off (pun intended) as we see Ethereum scale further with L2s and beyond!