Echo.xyz

Early stage investing in crypto and web3

TLDR:

Echo is a platform for “early-stage investing in startups and tokens” primarily in crypto and Web3 projects, it aims to democratise private investments.

Echo straddles the line between Web3 and Web2 as it uses smart contracts and USDC for investments, but requires sharing a lot of personal information to use.

It is structured through groups where each group has a lead investor who brings deals to its members. Users can request to join as many groups as they like.

Echo already has 70+ groups, with 10s of thousands of users, and has created 100s of deals with $100m+ of dealflow, yet its still in its infancy and poised to grow.

Right now we’re looking to raise more funds for Yield Seeker to keep our current momentum going, with that in mind I started looking at all the options available, including echo which is a platform for early stage investments in crypto. Therefore this week I decided to make my post about it as I explored the platform further.

If by chance you’re reading this and interested in learning more about potentially investing in Yield Seeker then just shoot me a message on our Discord.

If this post resonates with you and you enjoyed the content then please share it with friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Echo

Echo.xyz is a platform, that in its own words, is for “early-stage investing in startups and tokens” primarily in crypto and web3 projects. It allows for community-led funding, as users can join groups led by experienced investors and participate in deals on the same terms, essentially democratising private investments.

Echo was founded in 2024 by Cobie, one of crypto’s most prolific influencers and a well known thought leader over on crypto-twitter.

Cobie originally bought his first Bitcoin back in 2012, and later created one of the first altcoins in 2014 called Maxcoin. He then spent some time away from the space working in other companies including holding a senior role at the UK neobank Monzo, before coming back into crypto full time in 2020 with his podcast UpOnly.

In 2024 he decided to launch Echo and since then they’ve already faciliated over $100m in deals for early-stage crypto projects. Today they have 70+ groups and 10s of thousands of members, although it still feels like a rather small and upcoming platform.

Echo straddles the line between Web3 and Web2 companies. On the one hand it works through smart contracts with USDC and people are able to keep their identities private behind pseudonyms and X/Farcaster handles, yet on the other hand they require users to input a lot of personal information to begin investing.

Getting Started

Unlike most apps in crypto and Web3, getting started on Echo requires a lot of steps and sharing a lot of personal information.

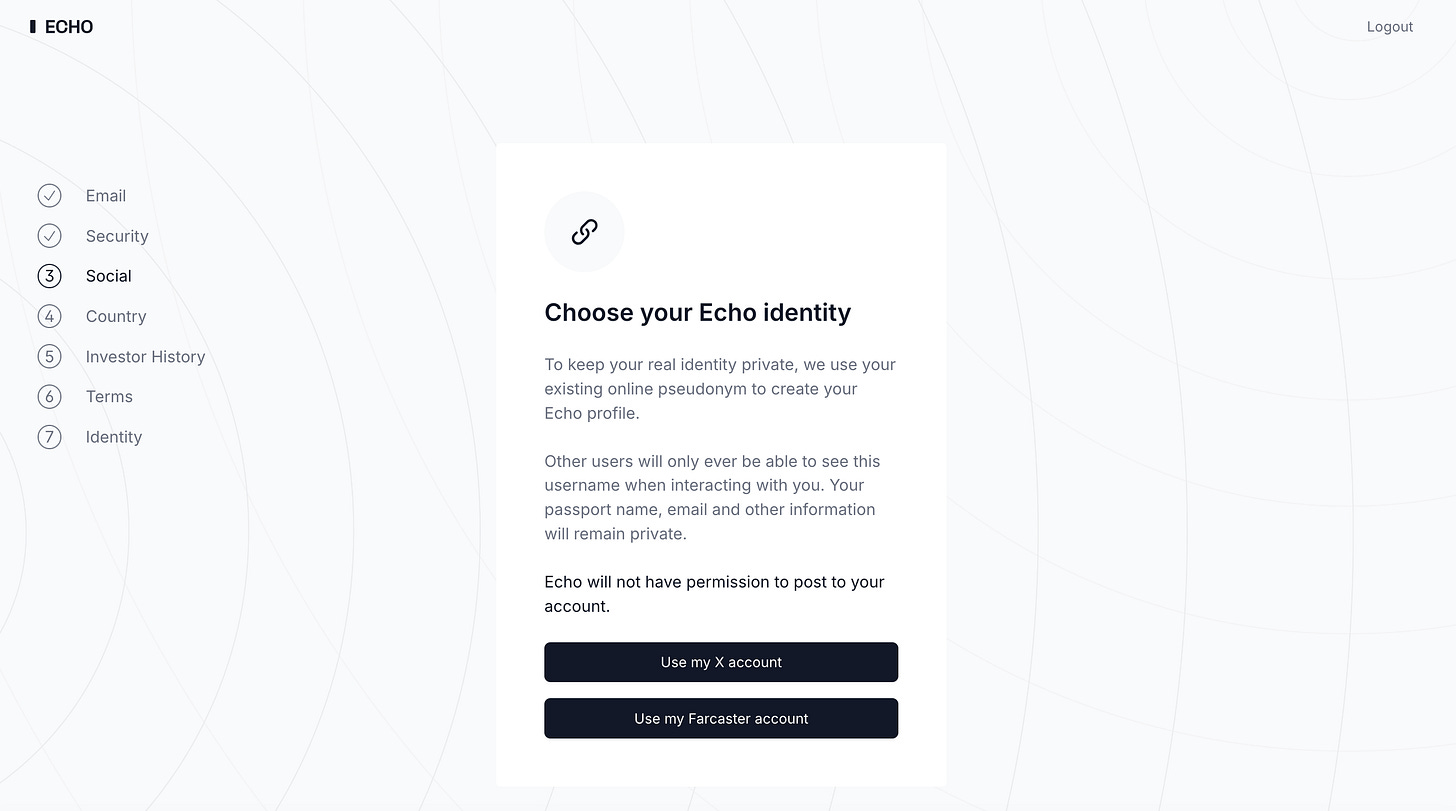

When you first sign up you’ll be taken through a series of setup steps that may actually put off many Web3-natives.

You’ll be required to enable 2-factor authentication, connect your X/Farcaster account, select your country and share personal information related to your investment history, then finally fill in a KYC form and upload your ID to a third-party provider that checks and validates who you are.

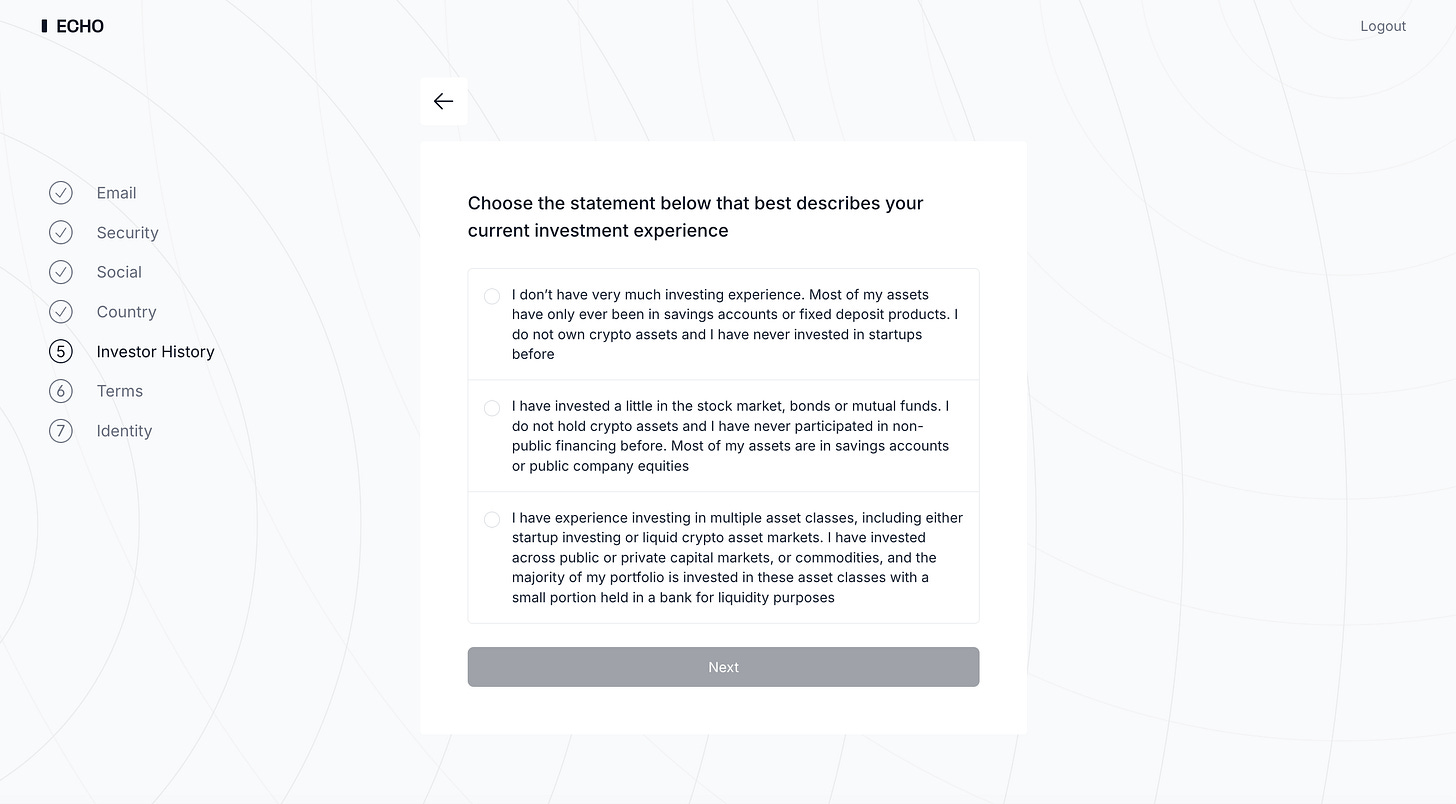

In the middle of it all you’ll see screens like the one below asking very personal questions about your investor history.

As I say, this isn’t as common in most of crypto, but it’s quite common in traditional investing platforms and so ultimately Echo decided to go down this route to protect themselves from getting sued.

Once you’ve gone through all these steps though you’ll be marked as verified and be ready to explore the platform further!

Groups

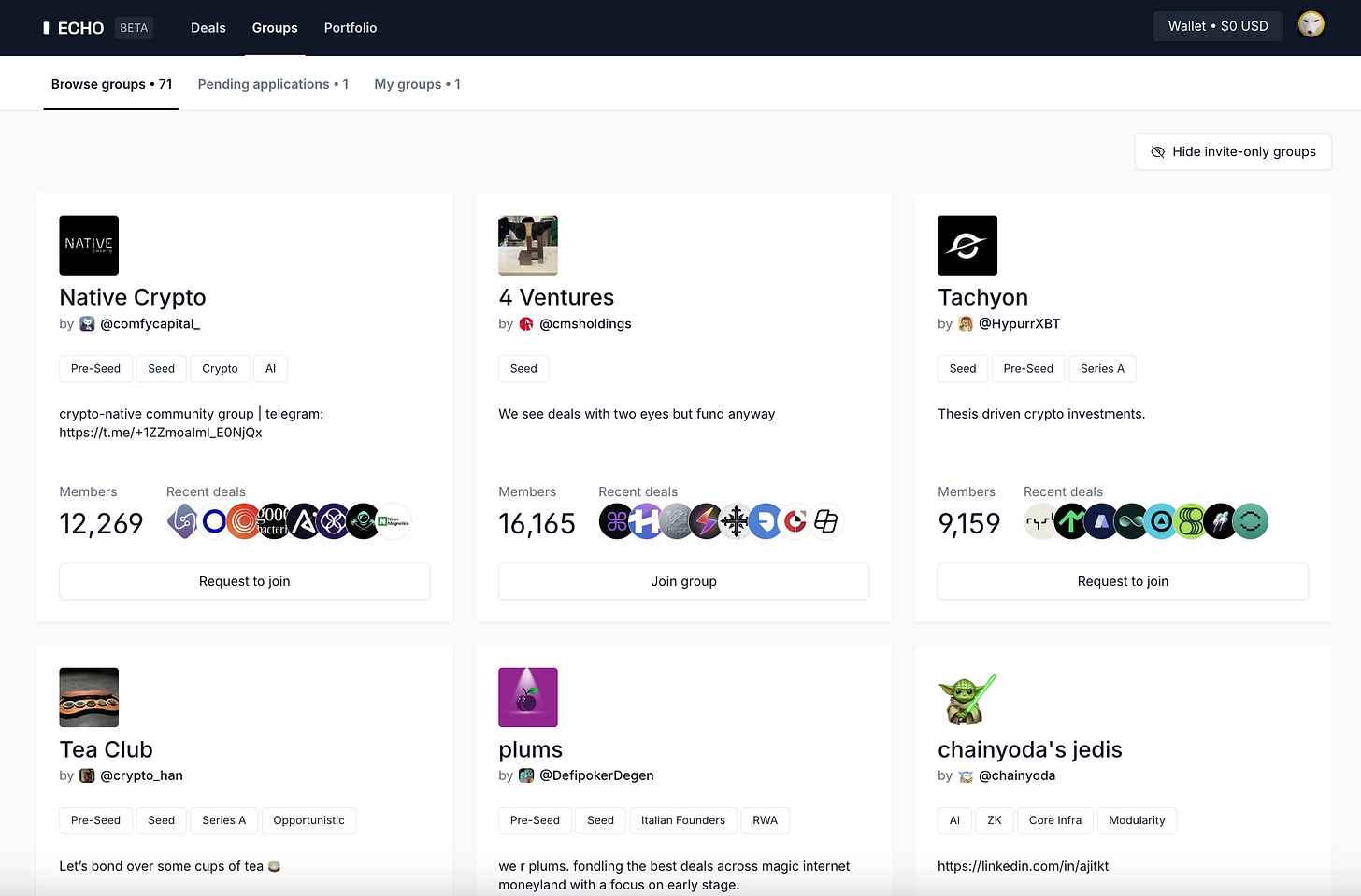

Echo is primarily split up into investment groups with each group having a lead investor who runs it. There are 71 groups and you can see a few examples below, such as the 4 Ventures group ran by cmsholdings and Tachyon ran by HypurrXBT.

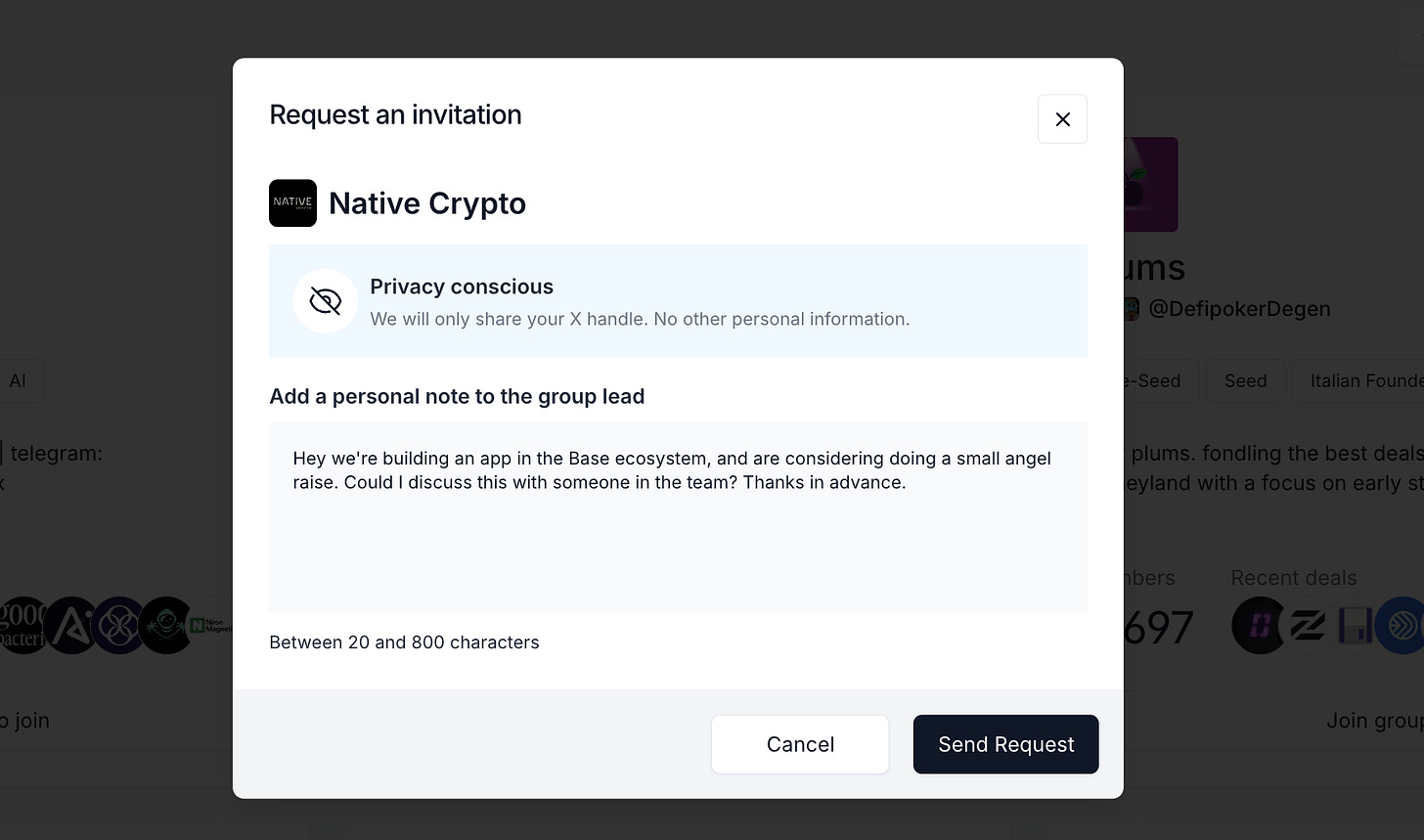

Since you’re required to be in a group to see any deal flow the first real thing to do is to join a bunch of groups. Joining is as simple as clicking the “Request to Join” button on any of the groups and then describing why you’d like to join, as shown below.

With some groups you can simply click “Join Group” and it’ll join automatically, so in these you won’t even need to send a request.

Depending on who runs the group it might take a while to get a reply and get let in, but once you’re in you can start getting in on their deals.

Deals

Deals are the main point of Echo, people are ultimately on the platform to invest in different deals for different projects.

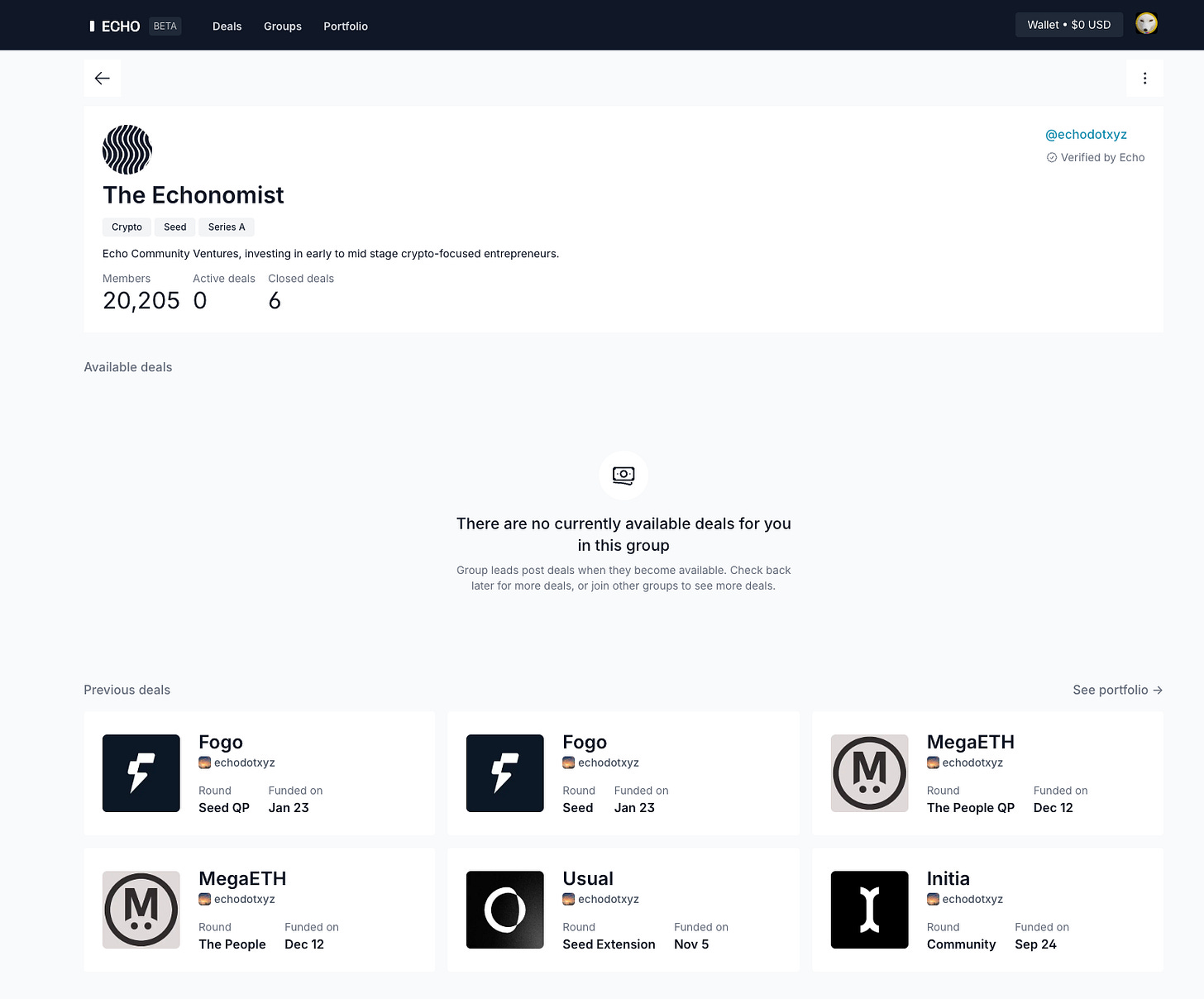

Within a group you can see all the deals that have happened in the past and any upcoming deal. For example below you can see what the “echonomist” group looks like with its previous deals.

However, unless you’ve participated in the deal itself you cannot actually see any further details about a deal, even those that have already finished.

Since I’ve only just started navigating the platform I can’t see any deals. Therefore for the sake of properly showing how Echo works, I went online and found a video on Youtube that shows how deals look when they are available and in your portfolio!

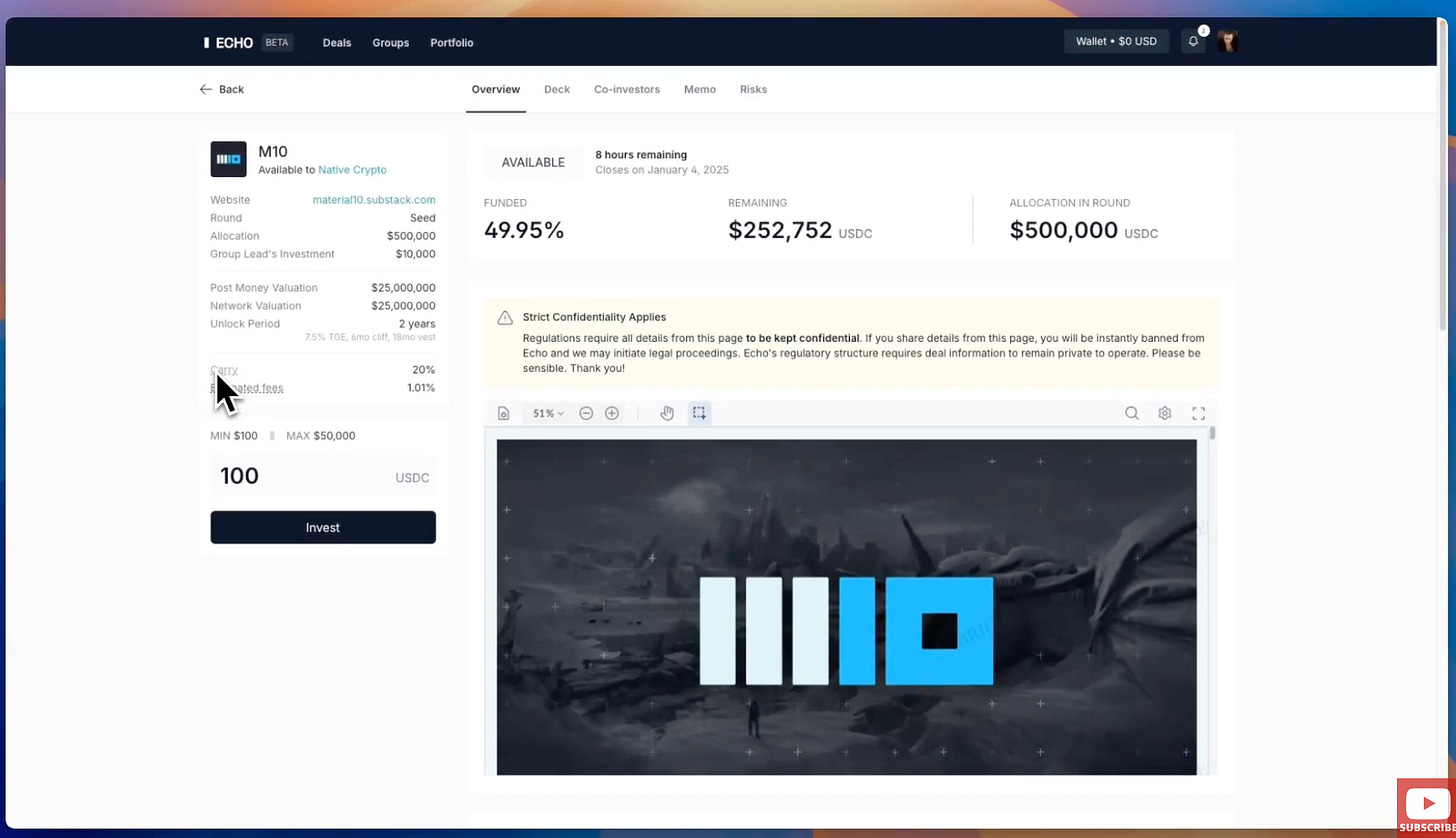

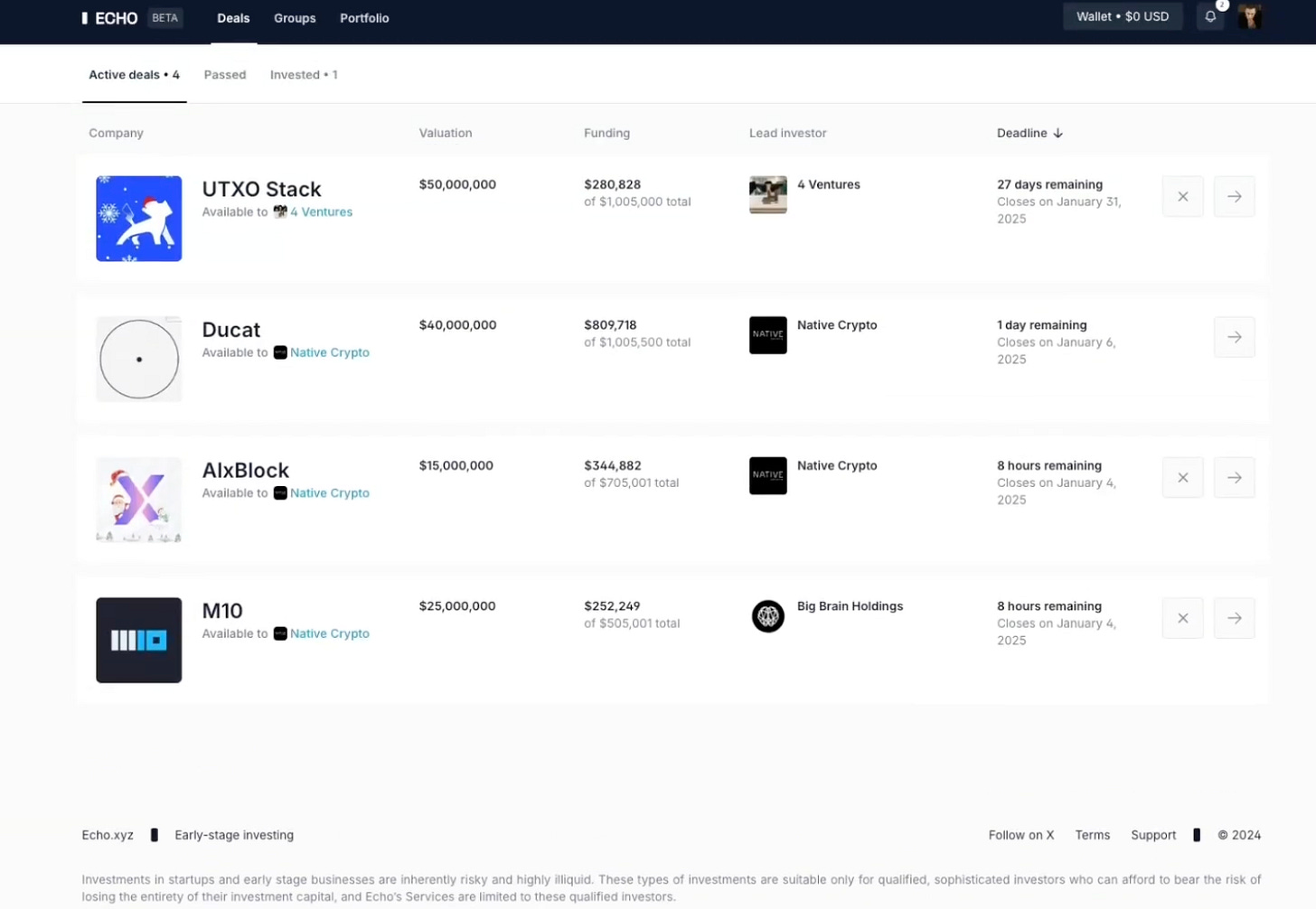

Below you can see an example of what an available deal looks like.

On the deal page you can see how much has been funded, the remaining amount, and the total desired allocation for the round. As well as more specific details like the post-money valuation and unlock period, plus the minimum and maximum amounts individuals can put into a round, along with the pitch deck right in the middle.

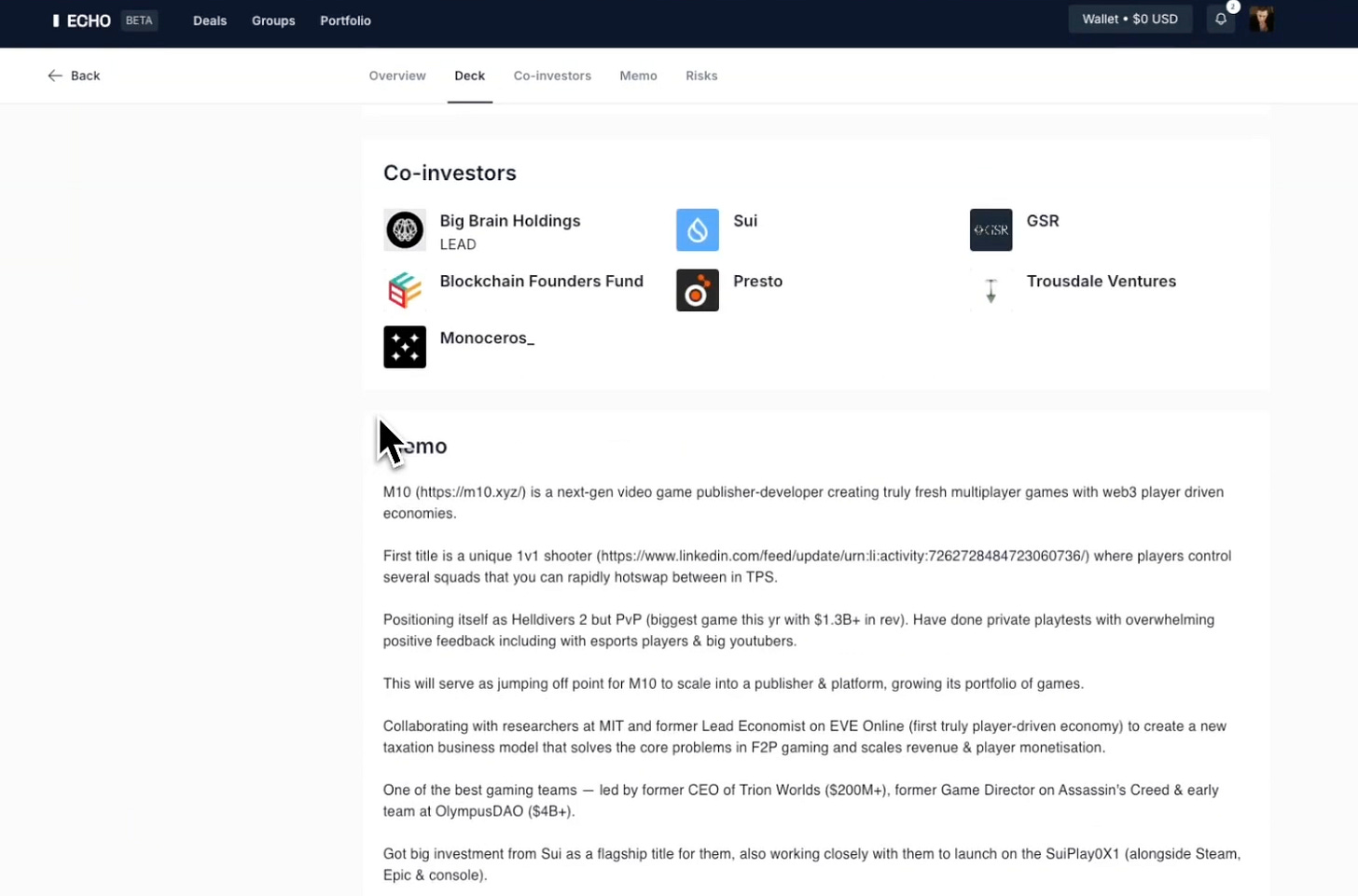

Below the pitch deck there’s a section showing known co-investors, followed by a short pitch in the memo section, and finally a risks section that ultimately says the legal fine print such as that there’s no guarantee you’ll make money.

Then when you have any active deals they’ll be shown in the active deals tab and you’ll be able to see an overview of all the deals you’re in and how much has already been invested, plus how much time is remaining for that deal.

And when deals complete they’ll pass into the invested tab where you can click into see the same view as above for a deal and see how much you invested in them.

Portfolio

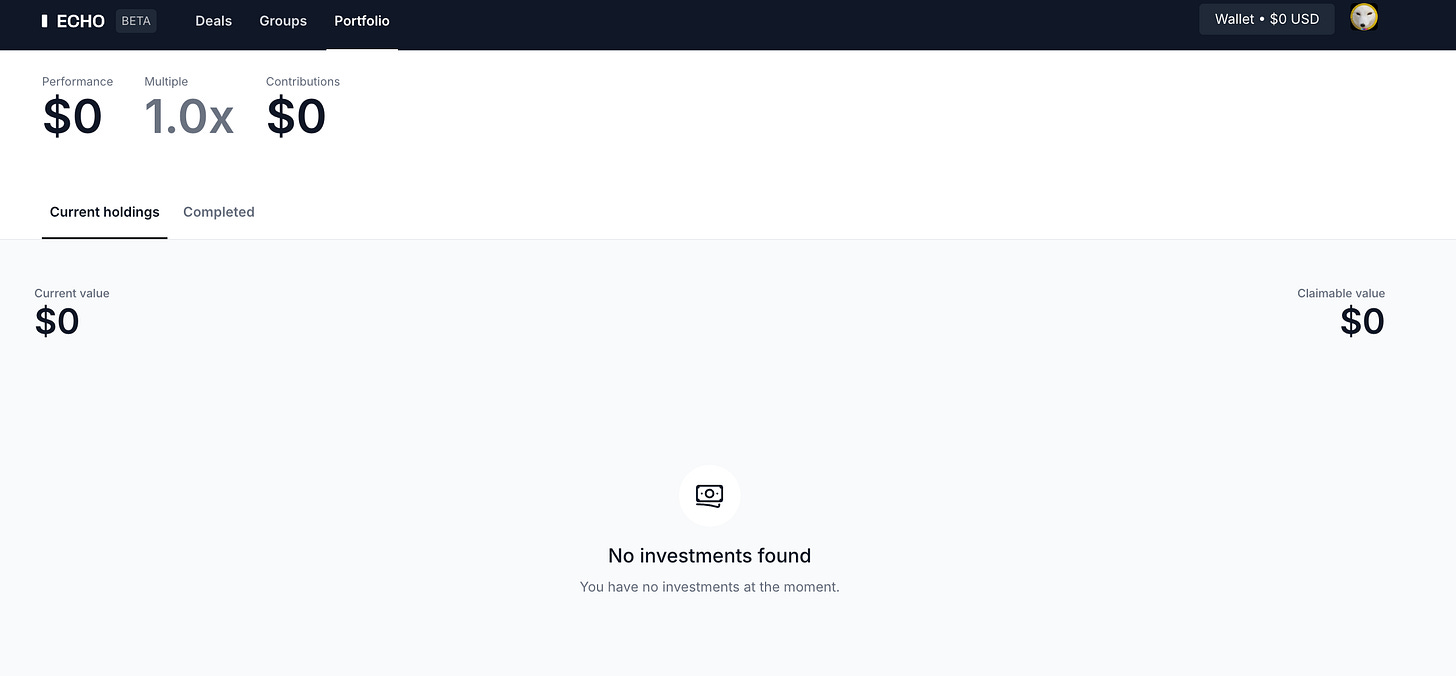

Finally, your portfolio will show you all the past deals that you’ve gotten through the platform and the return you’ve gotten on them. Once again, since I’ve just started using this platform this section is entirely empty for me.

I couldn’t find an example online to highlight what this would look like, but I’m pretty sure we can fill in the blanks as it would likely show the multiple you’ve made on your completed investments and your overall return.

And that’s pretty much it for the platform!

As you can see Echo is a relatively simple platform, but considering there’s already 10s of thousands of people on it, with 70+ groups, and 100s of deals with over $100m in dealflow already successfully raised, there’s obviously a lot of solid opportunities as a user here and a lot of potential for this platform to grow much further.

So if you’re interested in making some early stage investments on projects in the crypto and web3 space, and you’re comfortable with sharing your personal information and going through their KYC, then Echo may just be the right platform for you to join!

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!