Cascading Liquidations

Unpacking what happened on the Friday 10/10 crash

TLDR:

Cascading liquidations are where leveraged positions close one after another pushing the price further down and leading to even more liquidations.

The Friday 10/10 crash appears to have been due to several factors spiralling out from problems on Binance which led to cascading liquidations throughout crypto.

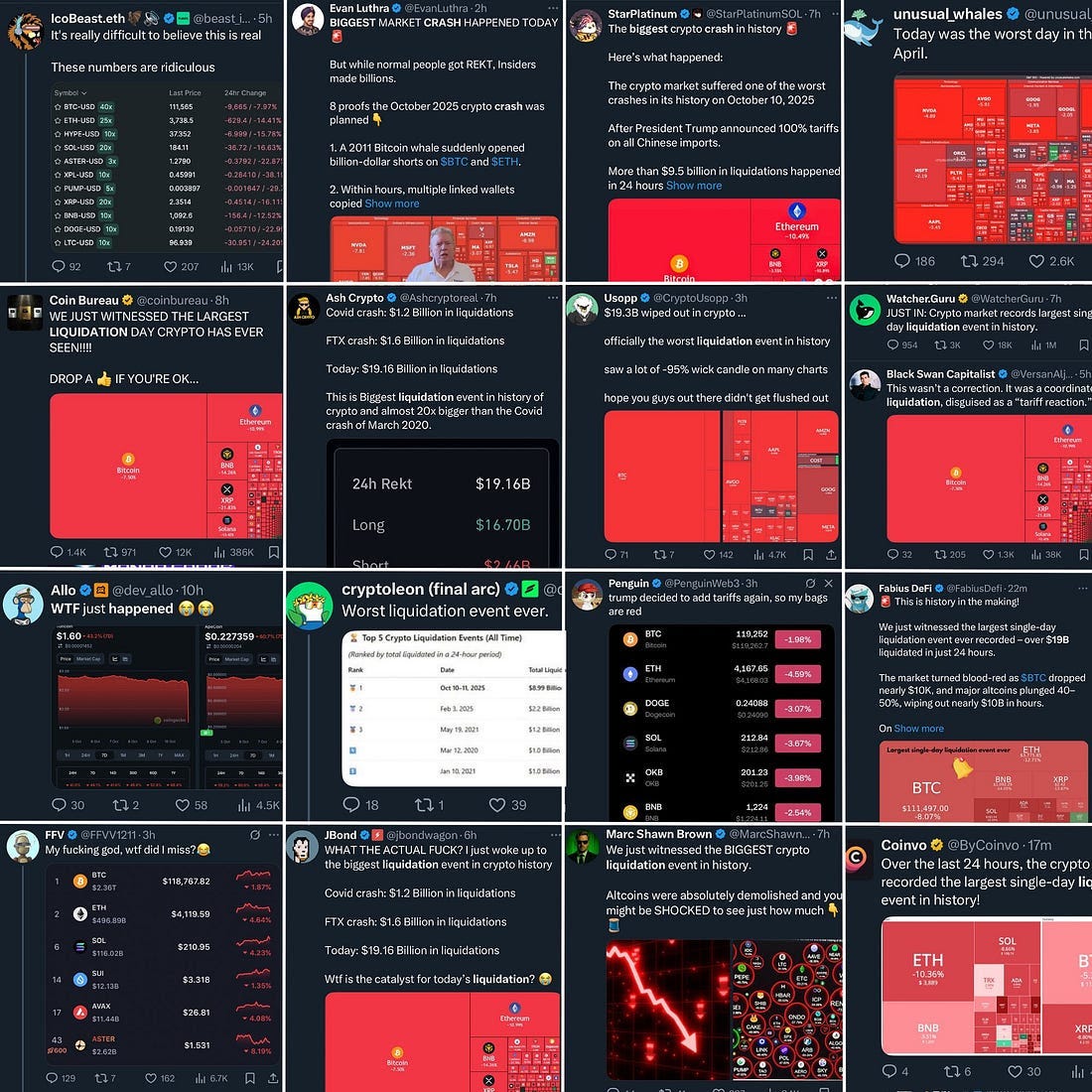

In 24 hours $19bn was liquidated from the market, nothing like this has ever happened before in crypto, even Covid and FTX crashes were $1.2bn and $1.6bn.

As crypto markets become more complex we can expect more black swan events like these to emerge, but also to be quickly fixed by this fast moving industry.

Last Friday on the 10th October ‘25 we witnessed a huge crash in the crypto market with over $19bn liquidated in 24 hours and prices crashing down, it was a complete bloodbath.

This was a unique moment in crypto history which appears to have been kickstarted by an error on Binance that led to cascading liquidations, there’s a lot to unpack from this event but the biggest concept to understand is cascading liquidations so I decided to cover it today.

If this post resonates with you and you enjoyed the content then please share it with friend and get rewarded for doing so!

This blog goes out weekly to almost 10,000 subscribers. Please message me if you’re interested in sponsorships or partnerships.

Liquidations

Last Friday on the 10/10 ‘25 we witnessed a huge crash in the crypto market with over $19bn liquidated in 24 hours, with major tokens like BTC dropping over 10% in minutes and some Altcoins falling betweeen 30%-80%!

There’s a lot to unpack in what happened during the crash with factors including Binance, oracles, market-makers, CEXs, leverage and liquidations. For the sake of keeping this post from becoming unreadably long I chose to focus on the key topic of cascading liquidations as that’s ultimately how all the money was lost.

So to start we need to understand what liquidations are. I’ve already discussed perpetuals and leverage in the previous post below, but for completeness sake leverage is essentially the use of borrowing money to amplify potential returns (and consequently also losses) on an investment or trade.

Importantly, when you use perpetual exchanges you are essentially betting on the direction that an asset’s price will go in. If a price goes enough in the opposite direction then you can be forced out of your leveraged position (which is known as being margin called) and will lose all your money (which is known as being liquidated).

When a forced liquidation like this occurs in practice you’re made to buy or sell to cover the losses you would incur so the platform that is lending you money for the trade doesn’t lose money themselves.

So a liquidation is essentially being forced out of your position, now that we understand liquidations we can begin to discuss cascading liquidations.

Cascading liquidations

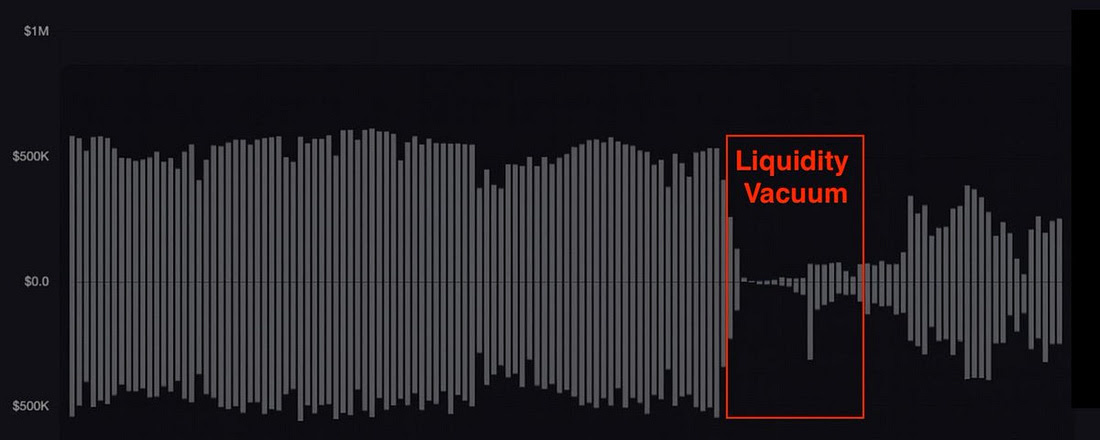

With a single liquidation a user is forced to buy or sell to cover their losses as we discussed above. This act of selling though will in turn push the price down itself.

Now imagine that the price goes down further since other leveraged traders also get margin called, and any other non-leveraged traders watching the charts get spooked and decide to sell too.

Well all of this can continuously push price down even further and force more and more people to be liquidated creating a downward spiral!

This is what’s known as “Cascading Liquidations”. You can picture a waterfall of liquidations cascading the price further and further down.

10/10 Friday Crash

With this info we can now get back to discussing what happened last Friday. The best analysis I’ve found online about the crash is from yq_acc on X who gave a really deep overview of everything that transpired.

I’ll personally try to keep it brief and high level. But essentially it started at 8pm UTC when Trump put out this social media post saying that he was not happy with what China were doing with their rare earths monopoly, and he seemed to suggest big tariffs were coming.

Now we’ve seen Trump’s off the cuff social media posts affect markets several times this year and unsurprisingly this spooked both the traditional market and the crypto market with prices dipping a little. However this was only a catalyst, it was obviously not enough to cause the massive liquidations we saw.

According to yq_acc’s analysis someone may have taken advantage of the market drawdown and dumped $60m of USDe on Binance, forcing its $1 peg down to $0.6567 (-34.33%) within Binance, and massively bringing down its trading pairs wBETH to $430 (88.7% below ETH value) and BNSOL to $34.9!

Now due to bad internal software architecture with Binance’s perpetuals, their price oracle looked at these low USDe, ETH, and SOL prices as the true price rather than looking out at the wider market, which very quickly set off liquidations!

Market makers (I’ll make a post about them in the future) who usually prop up CEXs exited en masse as they saw what was happening and didn’t want to get burned themselves, plus they saw the opportunity to make money in the chaos.

Once Market Makers pulled out the prices on other tokens dropped massively. Now since Binance is the single largest centralised exchange in the world and many other perpetual exchanges also mirror their price oracles, it sent shockwaves throughout the entire crypto system, and cascading liquidations rippled outwards.

All in all, these cascading liquidations led to over $19bn being liquidated over the next 24 hours, with traders making huge losses.

Assuming this information online is correct then its important to note that Binance had a serious bug in their implementation here, because if this were implemented correctly Binance would have checked the price from an external oracle and this situation could possibly not have spiralled out of control.

Although Binance claim no responsibility, it seems that they are somewhat aware of their involvement as they are offering $400m in compensation!

But this is a drop in the ocean compared to the damage that was done.

Markets are complex

Markets are complex and often all tangled up, as soon as the price of tokens tumbled on Binance the ripple effects were felt throughout other exchanges and we saw many other tokens on other exchanges tumble too.

Once the onslaught had started it wasn’t quick to stop, with many cascading liquidations across all sorts of tokens, and literally $19bn being liquidated!

For context that’s a very big number, by comparison the COVID crash in 2020 had $1.2bn liquidated and FTX in 2022 saw $1.6bn liquidated. However, since 2022 perpetuals have grown a lot and so has the amount of leverage in the crypto market so the impacts this time were much larger.

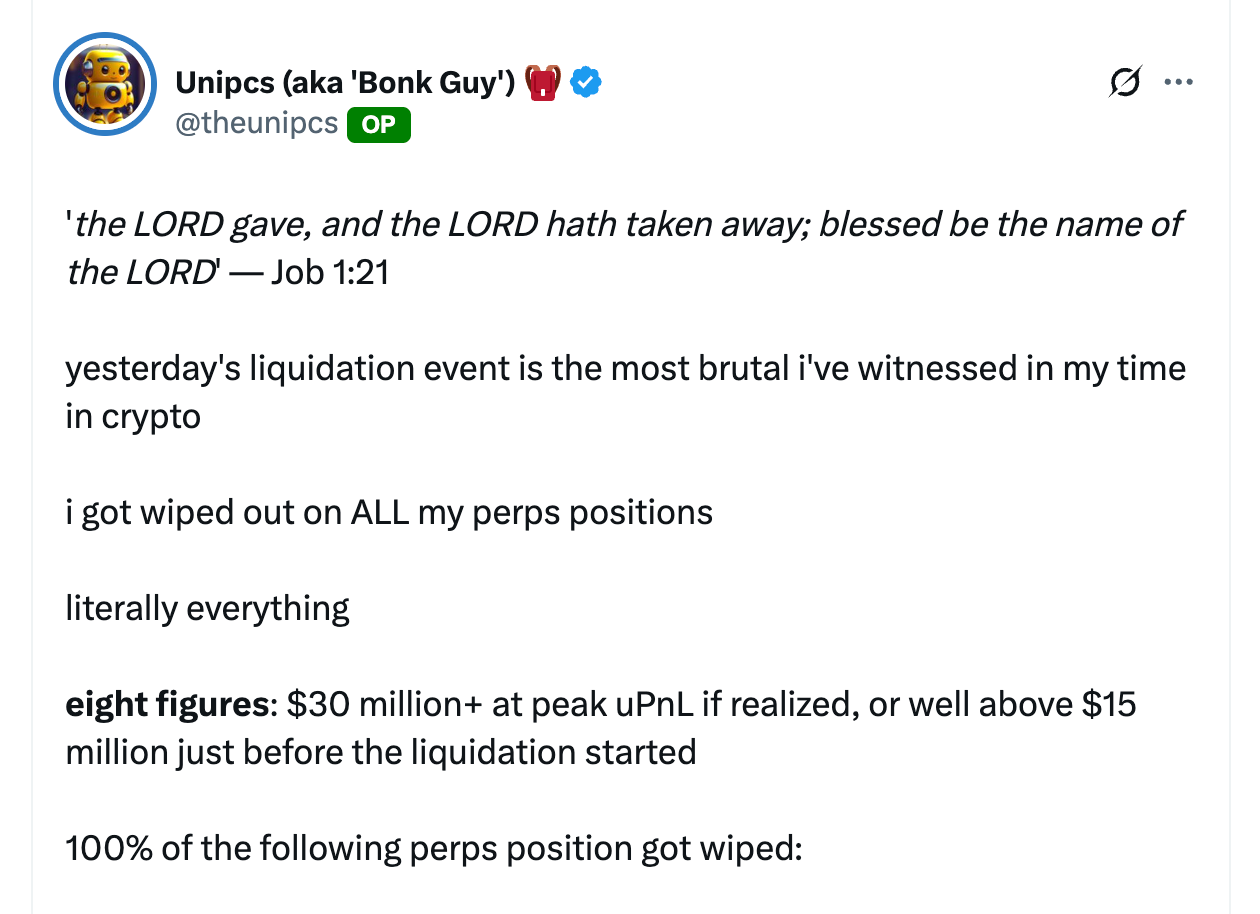

We saw crypto personalities on CT like BonkGuy claim he lost over $30m and Machi Brother supposedly losing over $40 million!

Meanwhile we also saw some mysterious trader on Hyperliquid supposedly make $192m having placed a trade just 30 minutes before the Trump post. Perhaps he had some insider information, or perhaps not, who knows.

And since last week’s drop crypto prices are much lower, even though they bounced back temporarily they haven’t held up much.

What’s interesting is that this was largely kicked off by a problem on a CEX, and even with all the financial stress there were no reports of any major DeFi platforms having any problems.

This was more of a show of how fragile the current market structure can be and how much we still rely on CEXs, but the crypto market is fast moving and no doubt market participants (especially Binance) will learn from their mistakes and implement better systems.

Some people may ask what’ll come next after this? Well my personal guess is that this was just a freak moment that flushed out all the leverage and we’ll see the generally bullish market continue.

There’s a lot of reasons to be bullish in general in crypto and even traditional markets right now, and black swan moments like this don’t necessarily define what’s set to come.

However, I also don’t have a crystal ball and could be wrong, markets are inherently unpredictable. Two things we can be certain about though: (1) large scale cascading liquidations will happen again; (2) looking back 10 years from now this will have been just a small blip as Bitcoin & Crypto market continue their upward climb.

Whenever you’re ready, these are the main ways I can help you:

Want high returns? Earn up to 14% APY with Yield Seeker!

Love Web3 insights? Follow @afoxinweb3 on X!

New to crypto? Join our beginners community to master crypto fast!

Building a Web3 app? Get our expert product development support!